- Home

- »

- Medical Devices

- »

-

Aesthetic Surgery Procedures Market Size Report, 2030GVR Report cover

![Aesthetic Surgery Procedures Market Size, Share & Trends Report]()

Aesthetic Surgery Procedures Market (2024 - 2030) Size, Share & Trends Analysis Report By Procedure Type (Face & Head, Body & Extremities), By End-use (Cosmetic Surgery Clinics, Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-099-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

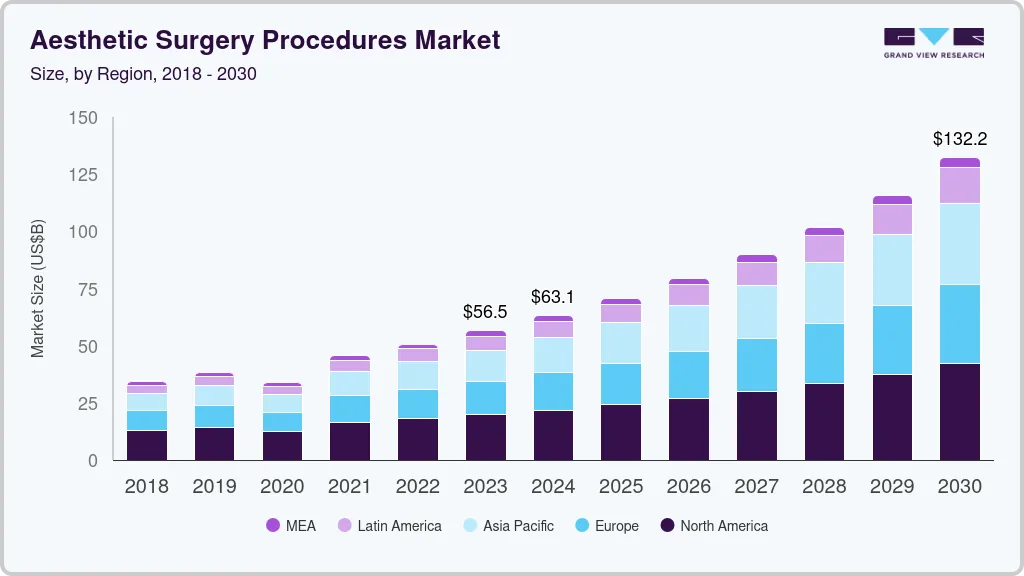

The global aesthetic surgery procedures market size was estimated at USD 56.472 billion in 2023 and is projected to reach USD 132.2 billion by 2030, growing at a CAGR of 12.9% from 2024 to 2030. The market has experienced significant growth in recent years due to several factors, including increasing consumer demand for cosmetic enhancements, advancements in surgical techniques and technology, and a growing acceptance of aesthetic procedures in society. The market includes a wide range of surgical procedures targeting various areas of the body, such as breast augmentation/reduction, liposuction, eyelid surgery, abdominoplasty, and rhinoplasty. The market has witnessed tremendous growth as the number of experienced professionals and success rate for surgical procedures have increased.

Factors, such as high disposable income and willingness to undergo aesthetic treatments, are boosting market growth. Moreover, minimally invasive procedures have gained popularity due to their numerous benefits, including reduced scarring, shorter recovery times, and decreased risk of complications. Non-surgical options, such as injectables (e.g., Botox, dermal fillers), laser treatments, and non-invasive body contouring procedures have expanded the options available to patients, attracting those who prefer less invasive approaches. For instance, according to the Aesthetic Society (U.S.), non-invasive body fat reduction was among the top 5 non-invasive procedures in the U.S. in 2020 with 140,314 procedures performed.

Furthermore, aesthetic surgery procedures are often elective and typically not covered by insurance. As disposable incomes increase globally, more people can afford these procedures. Thus, growing disposable income has expanded the potential customer base for aesthetic surgery procedures. Adding to it, the proliferation of social media platforms has significantly impacted the market. The constant exposure to images of celebrities, influencers, and peers showcasing their cosmetic enhancements has increased awareness and acceptance of aesthetic procedures. People increasingly seek to emulate the idealized beauty standards they encounter on social media. The COVID-19 pandemic had significantly affected the aesthetic medicine market.

Initially, social distancing and a sudden sharp cut in consumers' income levels had negatively impacted the aesthetic medicine market. The market had witnessed a phase of short-term negative growth owing to factors, such as a decline in service demand, limited operations, temporary closures of beauty centers, and disruption in the manufacturing & supply chain. However, remote working has increased the time spent on Zoom calls. People are paying attention to their physical appearance closely. This has increased the demand for cosmetic surgeries, with Botox being one of the most preferred procedures. Interest in non-invasive procedures has increased during the past few months while interest in invasive procedures has declined.

Procedure Type Insights

On the basis of procedure type, the market has been segmented into breast, face & head, and body & extremities. The body and extremities segment dominated the market with the highest share of 50.4% in 2022. The segment will expand further at a lucrative CAGR from 2023 to 2030 on account of the growing emphasis on body contouring and sculpting, driven by societal beauty standards and the desire for a more proportionate and aesthetically pleasing physique.Furthermore, the increasing focus on physical fitness and the influence of social media platforms showcasing idealized body shapes have fueled the demand for procedures that enhance body aesthetics.

On the other hand, the face & head segment is expected to register the fastest growth rate during the forecast period. This growth can be attributed to the high demand for facial rejuvenation, an aging population seeking to address signs of aging, cultural & societal influences that emphasize facial aesthetics, the popularity of non-invasive & minimally invasive procedures, psychological & emotional impact of enhancing facial features, and advancements in surgical techniques & technology.

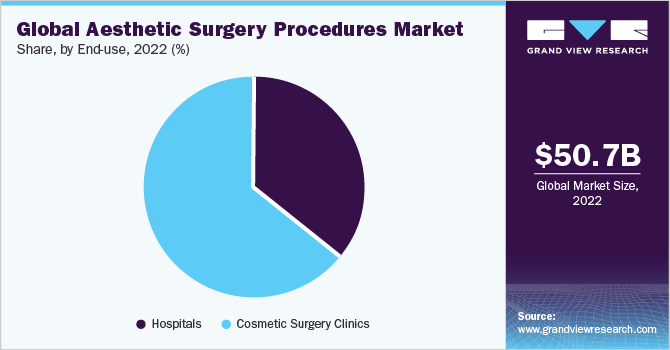

End-use Insights

On the basis of end-uses, the market has been segmented into cosmetic surgery clinics and hospitals. The cosmetic surgery clinics segment dominated the market in 2022 and accounted for the largest share of over 61.2% of the overall revenue due to their specialization in various aesthetic procedures, including those related to body contouring and breast surgery. Surgeons in these centers often have extensive experience and expertise in performing aesthetic surgery procedures, ensuring optimal outcomes and patient satisfaction. Moreover, cosmetic surgery clinics are more focused on aesthetic outcomes as they understand the impact of aesthetic surgery procedures on a patient's self-confidence and body image and strive to provide a natural look, balanced results, thereby contributing to the demand for cosmetic surgery centers.

On the other hand, the hospitals segment is anticipated to register a lucrative growth rate during the forecast period. Hospitals provide comprehensive healthcare facilities, including specialized departments and equipment for various medical conditions. With the growing recognition of aesthetic surgery procedures as a medical concern, hospitals have expanded their services to include these treatment options, ensuring that patients can access specialized care in a hospital setting.

Regional Insights

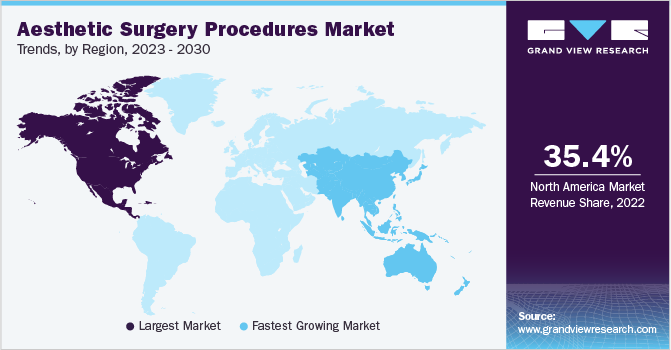

North America held the largest revenue share of over 35.4% in 2022 on account of the advanced healthcare infrastructure, stringent regulatory environment, emphasis on patient safety & quality of care, and the presence of key market players in this region. Moreover, the greater affordability of healthcare services and relatively higher disposable income levels enable individuals to pursue aesthetic surgery treatments more readily. Furthermore, the regional market of North America is highly competitive, with the presence of various specialized clinics, hospitals, and healthcare providers offering a wide range of treatment options.

This competition drives innovation and ensures a high standard of care, further solidifying the region's dominance in the global market. Asia Pacific is expected to register the fastest growth rate during the forecast period. The awareness about aesthetic surgery and its treatment options is increasing in the Asia Pacific region, therefore the stigma associated with aesthetic surgery procedures is gradually diminishing, leading to greater acceptance and a higher demand for treatments. Moreover, Asia Pacific has witnessed significant economic growth in recent years, resulting in an increase in disposable income levels, further boosting the market growth in the region.

Key Companies & Market Share Insights

The global market is highly fragmented with many local players competing with international players. Leading market players are involved in service launches, expansions, collaborations, and acquisitions to sustain the competition. Some of the prominent players operating in the global aesthetic surgery procedures market include:

-

Long Island Plastic Surgical Group

-

Westlake Dermatology

-

Piedmont Plastic Surgery & Dermatology

-

SKINovative of Gilbert-Medical Spa

-

Toronto Cosmetic Clinic (TCC)

-

Laser Clinic United Kingdom

-

VIVA Skin Clinic

-

Therapie Clinic

-

Nova Aesthetic Clinic

-

Renovo Skin Clinic

-

SILK Laser Clinics

-

Laser Clinic Australia

Aesthetic Surgery Procedures Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.09 billion

Revenue forecast in 2030

USD 132.2 billion

Growth rate

CAGR of 12.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Long Island Plastic Surgical Group; Westlake Dermatology; Piedmont Plastic Surgery & Dermatology; SKINovative of Gilbert-Medical Spa; Toronto Cosmetic Clinic (TCC); Laser Clinic United Kingdom; VIVA Skin Clinic; Therapie Clinic; Nova Aesthetic Clinic; Renovo Skin Clinic; SILK Laser Clinics; Laser Clinic Australia

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

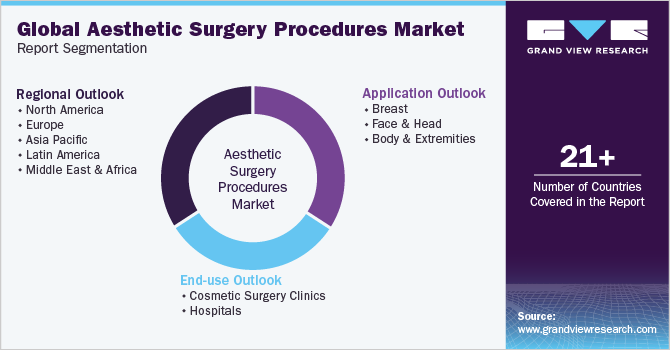

Global Aesthetic Surgery Procedures Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aesthetic surgery procedures market report based on procedure type, end-use, and region:

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast

-

Breast Augmentation

-

Breast Implant Removal

-

Breast Lift (Mastopexy)

-

Breast Reduction

-

Others

-

-

Face & Head

-

Eyelid Surgery

-

Rhinoplasty

-

Lip Enhancement

-

Fat Grafting-Face

-

Others

-

-

Body & Extremities

-

Abdominoplasty

-

Buttock Augmentation-Implants and Fat Transfer

-

Buttock Lift

-

Liposuction

-

Vaginal Rejuvenation

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cosmetic Surgery Clinics

-

Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aesthetic surgery procedures market size was estimated at USD 50.7 billion in 2022 and is expected to reach USD 56.4 billion in 2023

b. The global aesthetic surgery procedures market is expected to grow at a compound annual growth rate of 12.9% from 2023 to 2030 to reach USD 132.2 billion by 2030.

b. North America dominated the aesthetic surgery procedures market with a share of 35% in 2022. The market's growth in the region is increasing due to the greater affordability of healthcare services and relatively higher disposable incomes of individuals in the region

b. Some key players operating in the aesthetic surgery procedures market include Long Island Plastic Surgical Group; Westlake Dermatology; Piedmont Plastic Surgery & Dermatology; SKINovative of Gilbert-Medical Spa; Toronto Cosmetic Clinic (TCC); Laser Clinic United Kingdom; VIVA Skin Clinic; Therapie Clinic; Nova Aesthetic Clinic; Renovo Skin Clinic; SILK Laser Clinics; Laser Clinic Australia

b. Key factors that are driving the market growth include the primary factor driving the industry is escalating demand for aesthetic procedures, fueled by societal trends emphasizing beauty, self-improvement, and the pursuit of physical perfection

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.