- Home

- »

- Pharmaceuticals

- »

-

Non-opioid Pain Treatment Market, Industry Report, 2030GVR Report cover

![Non-opioid Pain Treatment Market Size, Share & Trends Report]()

Non-opioid Pain Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (NSAIDs, Local Anesthetics), By Pain (Chronic Pain, Post-operative Pain), By Route of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-983-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-opioid Pain Treatment Market Summary

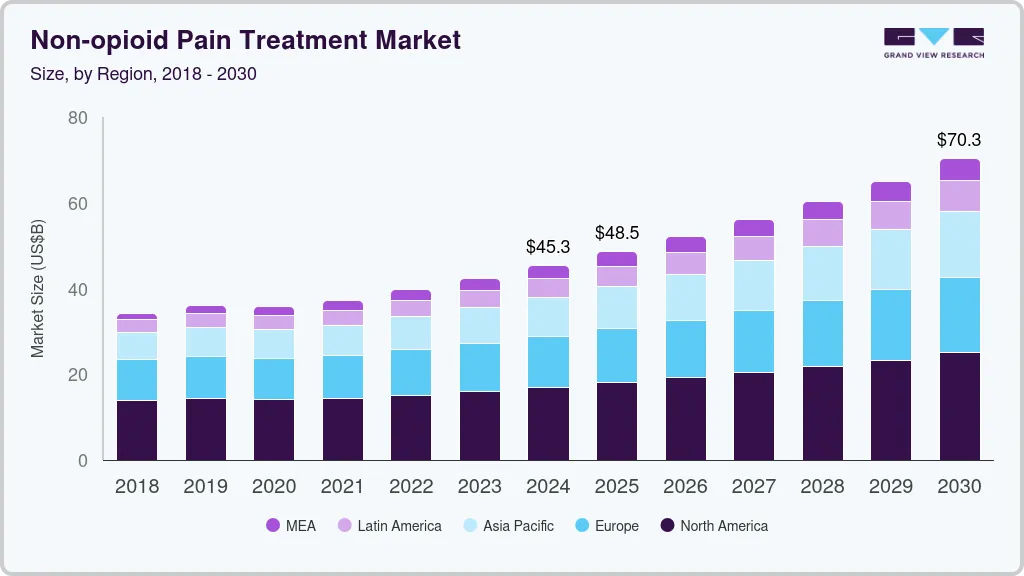

The global non-opioid pain treatment market size was estimated at USD 45,321.9 million in 2024 and is projected to reach USD 70,309.5 million by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The rise in R&D investments by leading companies to develop innovative non-opioid pain relief drugs, along with supportive initiatives and awareness campaigns from both government and private organizations.

Key Market Trends & Insights

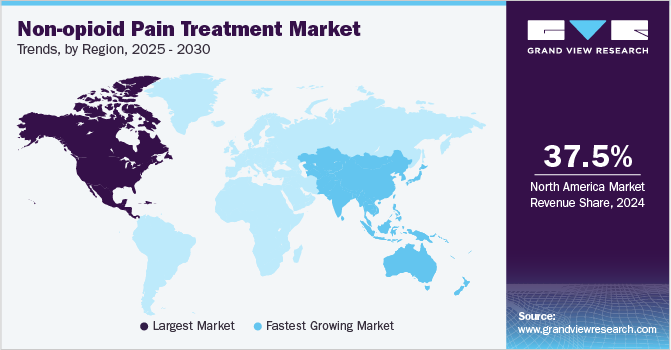

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, nsaids accounted for a revenue of USD 26,316.7 million in 2024.

- Local Anesthetics is the most lucrative drug class segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 45,321.9 Million

- 2030 Projected Market Size: USD 70,309.5 Million

- CAGR (2025-2030): 7.7%

- North America: Largest market in 2024

In addition, rising demand for drugs such as NSAIDs, Acetaminophen, and Local Anesthetics owing to high cases of chronic and post-operative ache as the they provide moderate relief, making them suitable for mild to moderate post-surgical conditions.

A 2020 study by the National Center for Biotechnology and Information (NCBI) estimates that approximately 310 million key operations are carried out worldwide each year, with about 40 to 50 million of these procedures occurring in the U.S. and 20 million in Europe. Over the years, the push towards non-opioid pain management is likely to gain momentum, especially in regions with high surgical volumes like the U.S. and Europe. This shift could lead to a more significant adoption of multimodal disease management strategies that combine different methods to optimize treatment while minimizing reliance on opioids.

Furthermore, the ongoing opioid crisis, particularly in the U.S., has led to a growing need for non-addictive ache management options. CDC and other health organizations have raised concerns about the widespread misuse of opioid prescriptions, leading to significant morbidity and mortality. According to provisional figures from the Centers for Disease Control and Prevention (CDC), over 108,000 people died from drug overdoses in the 12 months leading up to April 2022. Opioids, which were responsible for nearly 75% of drug overdose deaths in 2020, remain a significant contributor to this crisis. The heightened awareness around opioid risks is also fostering innovation in the development of new alternative therapies, potentially transforming chronic ache management practices.

Increasingly, insurance companies are expanding coverage for non-opioid pain management therapies, recognizing their long-term benefits and cost savings compared to opioids. In July 2024, Heron Therapeutics announced that ZYNRELEF (bupivacaine and meloxicam) is included in the proposed 2025 Non-Opioid Pain Relief Policy under Medicare's Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center (ASC) payment system. This inclusion, effective April 1, 2025, was outlined in the CMS Proposed Rule, recognizing ZYNRELEF for its potential to manage postoperative ache and reduce opioid use. Currently, ZYNRELEF benefits from CMS's pass-through payment status, set to expire on March 31, 2025. This initiative is anticipated to drive market growth over the forecast period.

Drug Class Insights

The Non-steroidal Anti-Inflammatory Drugs (NSAIDs) segment dominated the market and accounted for 54.94% of the global revenue in 2024. This can be attributed to high prescription rate owing to wide availability and easy accessibility to drug worldwide. A 2023 study from the University of Rochester Medical Center highlighted the widespread use of NSAIDs, with over 70 million prescriptions issued annually in the U.S. Including over-the-counter usage, Americans consume over 30 billion doses of NSAIDs each year. This widespread reliance suggests that NSAIDs are a key alternative for managing pain without the risks associated with opioids, helping to reduce opioid prescriptions and potentially lowering the risk of addiction and overdose. Thus, their accessibility and effectiveness make NSAIDs a cornerstone in the shift towards safer pain treatment options.

The other drug class segment is expected to witness lucrative market growth from 2025 to 2030. In addition to NSAIDs, acetaminophen, and local anesthetics, several other drug classes are commonly used for non-opioid pain management. Anticonvulsants like gabapentin and pregabalin are effective for neuropathic pain such as diabetic neuropathy and fibromyalgia. Antidepressants, particularly tricyclic antidepressants (e.g., amitriptyline) and SNRIs (e.g., duloxetine), also relieve neuropathic and chronic symptoms. Muscle relaxants like cyclobenzaprine are used for muscle spasms in musculoskeletal pain. Topical agents such as capsaicin cream and lidocaine patches provide localized conditions. Corticosteroids (e.g., prednisone) are potent anti-inflammatories for conditions like arthritis, while alpha-2 adrenergic agonists (e.g., clonidine) can manage chronic and neuropathy. The growing adoption of these drugs is anticipated to drive segment growth during the forecast period.

Pain Insights

Chronic pain segment dominated the market with a market share of 38.76% in 2024 and is expected to grow at the fastest CAGR over the forecast period. Chronic ache conditions, such as osteoarthritis, back cramp, and fibromyalgia, affect millions globally, leading to an increased demand for effective, long-term management solutions. In 2021, approximately 20.9% of U.S. adults-equating to 51.6 million individuals-reported experiencing chronic pain. In addition, 6.9% (17.1 million individuals) were high-impacted with conditions, which significantly limits daily activities. In addition, the prevalence of chronic ache was notably higher among non-Hispanic American Indian or Alaska Native adults, those identifying as bisexual, and individuals who were divorced or separated. Thus, the shift toward chronic symptom management with drugs such as, NSAIDs, anticonvulsants like gabapentin, and antidepressants like duloxetine, offer significant relief for those suffering from these persistent conditions, especially as healthcare systems and patients seek to minimize opioid use due to the associated risks of dependency and overdose.

The post-operative pain segment is projected to experience lucrative growth from 2025 to 2030. According to the CDC, around 51 million surgeries are performed each year for various indication across the U.S. In addition, according to the U.S. Institute of Medicine, approximately 80% of individuals who undergo surgery experience post-operative cramps, with 88% of these patients reporting moderate to severe or extreme discomfort levels. This significant incidence of post-surgical pain highlights the growing need for effective pain management strategies. As concerns over opioid use and its associated risks continue to rise, there is an increasing shift toward non-opioid ache treatments in post-operative care.

Route of Administration Insights

Oral segment dominated the market with a revenue share of 47.23% in 2024. The approval and introduction of new oral NSAIDs have significantly enhanced pain management options. Several crucial oral non-opioid analgesics commonly prescribed by physicians for ache relief include Celebrex (celecoxib), Dyloject, Zipsor, and Zorvolex (diclofenac potassium), along with Anaprox, Ec- Naprosyn, Treximet (naproxen sodium), and Naprelan. Other notable medications in this category include Nalfon (fenoprofen), Advil and Motrin (ibuprofen), Lodine (etodolac), and Daypro (oxaprozin), among others. These medications offer effective, non-opioid alternatives for managing cramps, contributing to a broader shift away from opioid use.

The injectable segment is projected to experience lucrative growth from 2025 to 2030. This growth can be attributed to rising approval and the launch of new non-opioid medication for pain treatment. In October 2024, B. Braun Canada Ltd. introduced Acetaminophen for Injection, available in Ready-to-Use Mini-Plasco and Ecoflac Plus containers, offered in three different sizes. This non-opioid analgesic and antipyretic is indicated for the short-term management and treatment of ache and fever in both adult and pediatric patients.

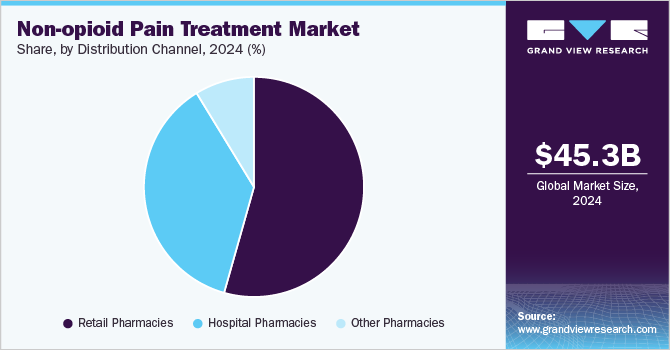

Distribution Channel Insights

The retail pharmacies segment dominated the market with a revenue share of 54.39% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This dominance attributed to widespread availability and easy access to non-opioid analgesic medications have made them more accessible to patients. Major retail pharmacies, such as CVS Health, Walgreens Boots Alliance, Inc., Ahold Delhaize, Albertsons Companies, Inc., and Rite Aid Corp., are key providers of these non-opioid analgesics. According to the Consumer Healthcare Products Association (CHPA), the estimated sales of over-the-counter (OTC) external and internal analgesics were USD 6.07 billion in 2021, USD 6.27 billion in 2022, and USD 6.29 billion in 2023. This steady increase in sales reflects the growing demand for non-opioid pain relief options, as more consumers seek accessible, over-the-counter alternatives to manage discomfort. The consistent rise in OTC analgesic sales underscores the shift towards non-opioid treatments, driven by concerns over opioid dependence and side effects.

The hospital pharmacies segment is projected to witness a lucrative growth from 2025 to 2030.The growing adoption of non-opioid ache injections in hospital settings is expected to significantly boost the hospital pharmacies segment over the forecast period. Non-opioid pain injections, such as acetaminophen, anticonvulsants, and other NSAIDs, provide hospitals with effective pain management solutions that avoid the risks associated with opioid use, such as addiction and overdose. As hospitals prioritize safer pain management protocols, these alternatives are being increasingly integrated into treatment regimens, especially in post-operative care, chronic pain management, and emergency settings.

Regional Insights

The North America non-opioid pain treatment market is seeing steady growth, driven by an increasing demand for safer alternatives to opioids, especially in chronic pain management. Among the various drug classes, NSAIDs, particularly Non-Selective NSAIDs and Selective COX-2 Inhibitors, dominate the market. These are commonly used for conditions such as osteoarthritis and chronic back pain. Acetaminophen and local anesthetics are frequently prescribed for post-operative pain and muscle sprains/strains. Moreover, antidepressants and anticonvulsants have carved a niche for managing neuropathic cramp, with a rise in conditions like diabetic neuropathy and fibromyalgia. However, healthcare costs and the availability of insurance coverage for pain management therapies remain significant barriers to broader market growth.

U.S. Non-opioid Pain Treatment Market Trends

The non-opioid pain treatment market in the U.S. leads the North American market, with a growing focus on innovative pain management options. In particular, Selective COX-2 Inhibitors and NSAIDs are extensively used in the treatment of conditions like chronic back pain and arthritis. Non-opioid treatments for neuropathic ache, including antidepressants like Duloxetine and anticonvulsants like Gabapentin, are gaining acceptance for their efficacy in managing diabetic neuropathy and post-herpetic neuralgia. With a shift toward oral and topical formulations, healthcare systems are emphasizing patient access through hospital and retail pharmacies. Despite this, challenges such as high out-of-pocket costs and insurance reimbursement limitations continue to hinder access for uninsured and underinsured populations.

Europe Non-opioid Pain Treatment Market Trends

The European non-opioid pain treatment market is expanding, spurred by a growing patient base and increasing awareness of the dangers associated with opioid use. In markets such as Germany, the UK, and France, NSAIDs and acetaminophen continue to be the most prescribed treatments for conditions like arthritis, muscle sprains, and chronic back ache. The use of topical treatments is also gaining traction, particularly for localized pain management in conditions like osteoarthritis and musculoskeletal cramp. Antidepressants and anticonvulsants are increasingly being prescribed for neuropathic pain management, and localized treatments are being integrated into patient care plans across various healthcare settings.

The non-opioid pain treatment market in the UK market is seeing growth driven by a shift towards multi-modal pain management approaches, especially for neuropathic pain and chronic conditions like arthritis. NSAIDs, particularly topical treatments, are commonly used in combination with other drug classes like antidepressants for more comprehensive pain relief. Acetaminophen remains a key treatment option for mild to moderate pain, and there is growing interest in non-opioid drugs for cancer pain and post-operative recovery. The increasing integration of digital health tools in the UK is improving patient access to non-opioid therapies, allowing easier access to prescription and OTC medications.

In Germany non-opioid pain treatment market, pain treatment options are widely available and are seeing increased uptake, particularly for chronic pain conditions such as arthritis and back pain. NSAIDs, both Non-Selective and Selective COX-2 Inhibitors, are commonly used in both oral and topical forms. The German healthcare system has been actively promoting the use of non-opioid alternatives to manage pain in outpatient clinics and pharmacies. Additionally, there is rising interest in using anticonvulsants and antidepressants for neuropathic pain, which is prevalent among the aging population. Increased attention to patient education and adherence to prescribed therapies is helping drive market growth.

In non-opioid pain treatment market in France, there is growing emphasis on reducing opioid use in favor of non-opioid alternatives. The use of NSAIDs and acetaminophen for conditions like arthritic ache and muscle sprains is widespread. Additionally, antidepressants and anticonvulsants are increasingly prescribed for managing chronic conditions, particularly neuropathic discomfort. The French healthcare system supports widespread distribution through both hospital pharmacies and retail outlets, with a focus on improving patient access and adherence to prescribed therapies. The government’s health initiatives to combat opioid misuse further support the market for non-opioid treatments.

Asia Pacific Non-opioid Pain Treatment Market Trends

The Asia-Pacific (APAC) region is witnessing rapid growth in the non-opioid pain treatment market, driven by increasing healthcare investments and a growing awareness of the harmful effects of opioid misuse. NSAIDs remain the most prescribed drug class in the region, used to treat a variety of conditions including osteoarthritis, chronic back ache, and migraine. The rise in conditions like diabetic neuropathy has led to a greater use of antidepressants and anticonvulsants for neuropathic ache management. Additionally, there is rising adoption of topical treatments as a more localized and less invasive option for ache relief.

Non-opioid pain treatment market in China is seeing a significant rise in demand for non-opioid pain treatments as healthcare access improves and awareness of chronic pain conditions increases. NSAIDs, especially in oral formulations, are commonly prescribed for osteoarthritis and back pain. Antidepressants like Amitriptyline and anticonvulsants like Gabapentin are increasingly used to manage neuropathic pain. The Chinese healthcare system has been focusing on expanding access to both prescription and OTC drug treatments, with a growing network of retail pharmacies providing easier access to therapies.

Japan non-opioid pain treatment market is expanding, driven by the country’s aging population and the increasing prevalence of age-related ache conditions such as arthritis and joints. NSAIDs and acetaminophen are commonly prescribed in both oral and topical forms. In addition, antidepressants and anticonvulsants are seeing growing use for neuropathic condition management. The rise of digital health solutions is enhancing patient access to non-opioid pain treatments, and the government’s focus on improving healthcare services for the elderly is likely to further drive market growth.

Latin America Non-opioid Pain Treatment Market

Non-opioid pain treatment market Latin America is gradually expanding as healthcare systems improve and there is greater awareness of the importance of non-opioid therapies in ache management. Brazil leads the region in the adoption of NSAIDs for arthritis and muscle strains. Acetaminophen continues to be widely used for mild cramps, while antidepressants and anticonvulsants are increasingly being prescribed for neuropathic ache management. The shift towards non-opioid alternatives is further supported by rising healthcare investments in the region.

Brazil non-opioid pain treatment market is at the forefront of the Latin American non-opioid pain treatment market. The rise in chronic conditions such as arthritis and back cramp is driving demand for NSAIDs, acetaminophen, and localized treatments. Additionally, there is growing interest in the use of antidepressants and anticonvulsants for the management of neuropathic ache, with increasing awareness about their efficacy. The government’s push to improve healthcare infrastructure and access to essential medications, along with rising disposable incomes, is expected to drive the growth of the market in Brazil.

Middle East & Africa Non-opioid Pain Treatment Market Trends

The non-opioid pain treatment market in MEA region is beginning to show notable growth in the non-opioid pain treatment market. Efforts to increase healthcare access and improve awareness of symptoms management alternatives are helping drive the demand for non-opioid therapies. NSAIDs and acetaminophen are commonly used for general ache management, particularly for conditions like arthritis and chronic back cramp. Antidepressants and anticonvulsants are gaining acceptance for managing more complex conditions, such as neuropathic condition.

Saudi Arabia non-opioid pain treatment market is expected to experience significant growth in the non-opioid pain treatment market, driven by increasing healthcare investments and a growing awareness of chronic conditions. NSAIDs and acetaminophen are frequently used in both hospital and retail pharmacy settings for treating common conditions like arthritis and muscle sprains. The Saudi Arabian healthcare system’s focus on improving access to affordable medications, including antidepressants and anticonvulsants, is expected to further accelerate market growth.

Key Non-opioid Pain Treatment Company Insights Key players in the non-opioid pain treatment industry include Teva Pharmaceutical Industries Limited, Dr. Reddy’s Laboratories Ltd, Pfizer Inc., and Sun Pharmaceutical Industries Ltd. These companies are prominent in the global healthcare sector, focusing on the development and manufacturing NSAIDs, acetaminophen, local anesthetics, and other alternative therapies. Their comprehensive product portfolios, along with their widespread market presence, enable them to meet the growing demand for safer, non-opioid ache relief options. By expanding access to affordable treatments and driving innovation, these companies play a vital role in improving patient care and outcomes in the non-opioid pain management space.

Key Non-opioid Pain Treatment Companies:

The following are the leading companies in the non-opioid pain treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- Teva Pharmaceutical Industries Limited

- Dr. Reddy’s Laboratories Ltd

- Sun Pharmaceutical Industries Ltd

- GSK plc.

- Pfizer Inc.

- Perrigo Company plc,

- LNK International, Inc.

- Cipla Inc.

- Johnson & Johnson Services, Inc.

- Pacira Pharmaceuticals, Inc.

- Pierrel

Recent Developments

-

In March 2024, Endo International plc announced that its subsidiary, Par Pharmaceutical, Inc., launched ibuprofen-famotidine 800 mg/26.6 mg tablets, a generic version of Amgen's (formerly Horizon Therapeutics) DUEXIS. This combination medication is designed to alleviate the symptoms of rheumatoid arthritis and osteoarthritis while reducing the risk of stomach and upper intestinal ulcers that can occur with ibuprofen use alone.

-

In July 2024, Camber Pharmaceuticals announced the launch of Acetaminophen Injection. This injectable formulation is indicated for the management of mild to moderate pain in adults and pediatric patients aged 2 years and older, as well as for moderate to severe ache when used alongside opioid analgesics in the same age group. In addition, it is approved for reducing fever in both adult and pediatric patients.

-

In July 2024, Hikma Pharmaceuticals PLC, through its subsidiary Hikma Pharmaceuticals USA, Inc., expanded its voluntary recall of one lot of Acetaminophen Injection, 1000mg/100mL (10mg/mL). The recall was initiated due to the potential presence of a mislabeled bag containing Dexmedetomidine HCL Injection (400mcg/100mL) inside the overwrap labeled as Acetaminophen Injection. The recall applies to the consumer and user level.

Non-opioid Pain Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 48.54 billion

Revenue forecast in 2030

USD 70.30 billion

Growth rate

CAGR of 7.69% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, pain, route of administration, distribution channels, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Novartis AG; Teva Pharmaceutical Industries Limited; Dr. Reddy’s Laboratories Ltd; Sun Pharmaceutical Industries Ltd; GSK plc.; Pfizer Inc.; Perrigo Company plc; LNK International, Inc.; Cipla Inc.; Johnson & Johnson Services, Inc.; Pacira Pharmaceuticals, Inc.; Pierrel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-opioid Pain Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-opioid pain treatment market report based on drug class, pain, route of administration, distribution channels, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

NSAIDs

-

Non Selective NSAIDs

-

Selective COX-2 Inhibitors

-

-

Acetaminophen

-

Local Anesthetics

-

Other Drug Class

-

-

Pain Outlook (Revenue, USD Million, 2018 - 2030)

-

Post-operative Pain

-

Cancer Pain

-

Chronic Pain

-

Other Pain

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Topical

-

Injectable

-

Other Route of Administration

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global non-opioid pain treatment market size was valued at USD 45.32 billion in 2024 and is anticipated to reach USD 48.54 billion in 2025.

b. The global non-opioid pain treatment market is expected to witness a compound annual growth rate of 7.69% from 2025 to 2030 to reach USD 70.30 billion by 2030.

b. The Non-steroidal Anti-Inflammatory Drugs (NSAIDs) segment dominated the market and accounted for 54.94% of the global revenue in 2024. This can be attributed to high prescription rate owing to wide availability and easy accessibility to drug worldwide.

b. Some of the key players in the non-opioid pain treatment market are Novartis AG; Teva Pharmaceutical Industries Limited; Dr. Reddy’s Laboratories Ltd; Sun Pharmaceutical Industries Ltd; GSK plc.; Pfizer Inc.; Perrigo Company plc; LNK International, Inc.; Cipla Inc.; Johnson & Johnson Services, Inc.; Pacira Pharmaceuticals, Inc.; Pierrel.

b. The major factors driving the market growth are the increasing prevalence of chronic & inflammatory diseases, increasing product approval and launches, and supportive regulatory and reimbursement policies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.