- Home

- »

- Petrochemicals

- »

-

North America Activated Carbon Market, Industry Report, 2030GVR Report cover

![North America Activated Carbon Market Size, Share & Trends Report]()

North America Activated Carbon Market Size, Share & Trends Analysis Report By Type (Granular, Powdered), By Form (Liquid, Gas), By End-use (Water Treatment, Air Purification), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-953-4

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

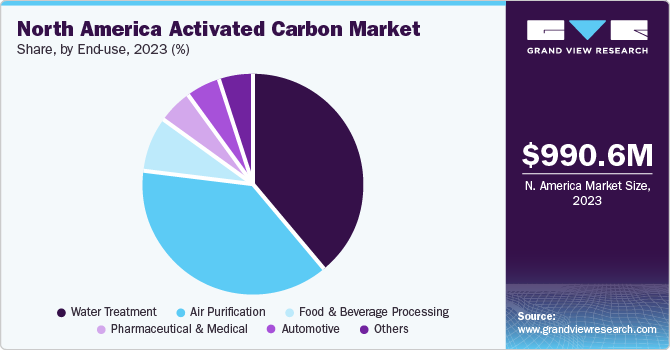

The North America activated carbon market size was estimated at USD 990.6 million in 2023 and is expected to grow at a CAGR of 3.6% from 2024 to 2030. The product has air-purifying properties and is widely used to reduce odor and control greenhouse emissions. Coconut and wood are the popular raw materials used to produce activated carbons for end use industries such as food and beverages. The coconut-based product contain 50% more pores, which enable them to efficiently adsorb volatile organic chemicals, and hence, they are also gaining popularity in water treatment plants.

Activated carbon-based materials are increasingly being considered as a viable option for carbon capture due to their low cost and sustainable sourcing from natural resources. Huge government funding for the research and development of carbon capture and storage (CSS) is aimed at fuelling the adoption of product. For instance, the Congressional Budget Office’s December 2023 data states that the Infrastructure Investment and Jobs Act (Public Law 117-58) provided USD 3.31 billion for developing appropriations for CCS, and the total investment is expected to be USD 8.17 billion between 2022 and 2026 to launch large scale pilot projects in the upcoming years.

The demand for granular product and its consumption is expected to surge in the coming years owing to rising environmental awareness worldwide to purify air and water, along with the formulation and implementation of regulations and standards requiring industries such as food & beverage processing, pharmaceuticals & medical, and automotive to adopt environment-friendly processes.

Activated carbon filters are well known for their use in controlling gaseous odor. They are generally used as a sponge to absorb gaseous odors as the air passes through them. However, they require frequent replacements. Another major application in air purification includes the removal of mercury emissions from power plants. They are used as filtration media in industrial boilers, cement kilns, coal-fired generators, waste incinerators, and steel mills. The rising demand from air purification applications worldwide is positively influencing the overall market growth.

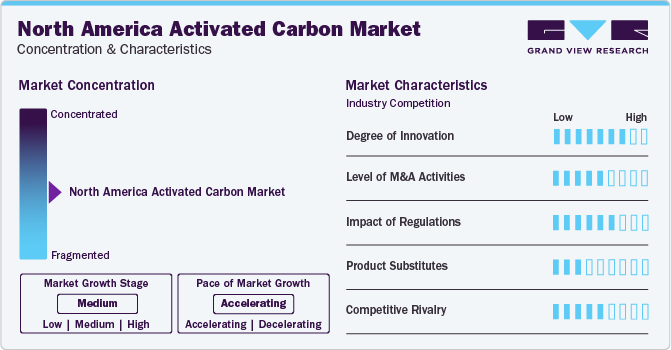

Market Concentration & Characteristics

Market growth stage is high, and the pace is accelerating owing to a moderately consolidated market. The companies provide onsite reactivation, datasheet usage, and customized production services to attract customers. The manufacturers in North America are actively implementing strategic initiatives such as new product launches, mergers & acquisitions, and production expansion, among others.

The degree of innovation is high owing to the influx of government investments and initiatives in optimizing water purification. According to the February 2024 White House fact sheet, the U.S. government announced an investment of USD 6.0 billion for clean water infrastructure under President Biden’s Investing in America agenda. The initiative will cater to providing access to clean and safe water. In line with this, the EPA announced on 24th February that the total clean water funding from the President's Bipartisan Infrastructure Law has reached USD 22.0 billion. The Infrastructure Law dedicates over USD 50.0 billion to the advancement of the water infrastructure in America, making it the largest investment in clean water in the country's history.

The threat of substitutes is moderate to low as there are no potential substitutes for product for water and purification, pharmaceutical, and food and beverage applications. Bentonite clay, wood vinegar, peat moss, and fuller earth are often used as a contaminant purifier and deodorizer but are not as effective as activated carbon.

Type Insights

Powdered type dominated the market with a largest revenue share of 55.6% in 2023 owing to its increasing use worldwide in water treatment applications. It has exceptional pore structure and adsorption properties. Powdered type is introduced in PAC contractors and rapidly mixed with water sources. It is followed by flocculation or sedimentation of water. The final step in the water treatment process involves the filtration of water to obtain treated water. Typically, PAC is made from organic materials such as coal, wood, and lignite, which are rich in carbon.

Granular type is projected to expand at the fastest CAGR during the forecast period. It is made from organic raw materials such as coconut shells or coal shells, which have high carbon content. The regenerative properties of granular type make it more popular than any other type of products, even though the iodine content of regenerated activated carbon reduces after its regeneration. It is widely used in municipal or environmental air and water treatment facilities, as well as in metal recovery, food & beverages, medical, industrial, and mercury recovery applications.

Form Insights

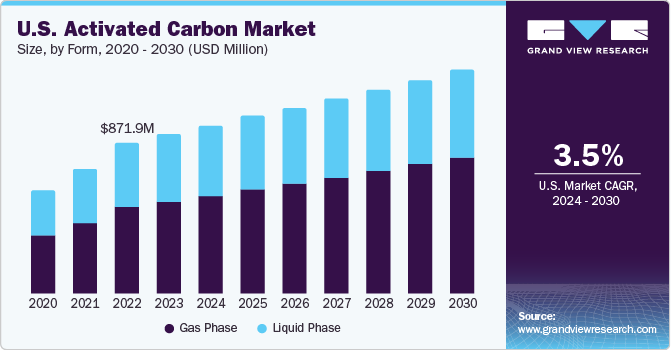

Gas phase accounted for the largest revenue share of 58.3% in 2023. The product in the form of small pellets, granules, or powder is used in gas-phase applications including cigarette filters, industrial gas masks, effluent gas purification, industrial off-gas purification (elimination of SO2, HS, CS2.), petroleum refineries, sewage and geothermal plants, solvent recovery in vinyl chloride monomer (VCM) plants, adsorption of radionuclides, natural gas storage and purification, and odor control.

Liquid phase is projected to expand at a significant CAGR from 2024 to 2030. The product is being increasingly used in liquid-phase applications to remove impurities or contaminants from liquids by attracting and retaining them on the surface of carbon material. It has a highly porous structure, which provides a large surface area to facilitate the adsorption process of liquids to take place. Some liquid-phase applications are water treatment, beverage purification, chemical processing, etc.

End use Insights

Water treatment dominated the market with a largest revenue share of 38.9% in 2023. The segment is driven by the growing government investment in regulating public water treatment processes. For instance, in October 2023, the governments of British Columbia and Canada announced an investment of over USD 10.0 million, along with the Government of British Columbia, for funding four projects supporting drinking water and wastewater treatment infrastructure in Fraser Lake, Burns Lake, and the District of Mackenzie. This is expected to fuel the demand in water treatment applications in Canada during the forecast period.

Food and beverage sector is expected to expand at the fastest CAGR from 2024 to 2030. The product caters to the growing purification challenge in the food and beverage processing industry. It is predominantly used to demineralize liquid streams, improve color stability, increase the crystallization yield, reduce odor, remove color, and remove toxic compounds including polycyclic aromatic hydrocarbons (PAH) and dioxins from fish and vegetable oils.

Country Insights

North America activated carbon market is characterized by stringent regulations on air and water pollution. This drives the demand for product in the region as it eliminates toxic contaminants from water & air. In addition, government regulatory agencies in North America have suggested the usage of product for impurity removal from water as well as air. For instance, the U.S. Environmental Protection Agency (EPA) has formulated mercury and air toxics standards (MATS) to limit the amount of mercury and other air pollutants emitted by oil and coal-fired power plants across the country. Activated carbon can remove mercury from the flue gas of coal-fired power plants. Thus, all these standards in North America have fuelled the usage of activated carbon in mercury removal applications in industrialized countries such as the U.S., Canada, and Mexico.

U.S. Activated Carbon Market Trends

Activated carbon market in the U.S. held the largest regional revenue share of 89.9% in 2023. The market is driven by the presence of stringent regulations regarding water and air pollution, coupled with high demand from medical applications such as removal of radio-opaque dyes, dressings and wound care, and anti-flatulence therapy.

Key North America Activated Carbon Company Insights

The market growth in North America is driven by the surging demand for air- and water-purifying products, particularly in the U.S. Some key players operating in the market in this region are Calgon Carbon Corporation, Carbon Activated Corporation, and ADA Carbon Solutions. These companies are investing in research and development activities to launch new and innovative products in the market. They are expanding their manufacturing and global distribution networks to reach a large base of customers. For instance, in March 2022, Cabot Corporation acquired TOKAI CARBON (TIANJIN) CO., LTD to support the manufacturing of battery materials and increase its global foothold. Such strategic initiatives by key players are fostering the market expansion.

Key North America Activated Carbon Companies:

- CarbPure Technologies

- Cabot Corporation

- Carbo Tech AC GmbH

- Evoqua Water Technologies LLC

- Oxbow Activated Carbon LLC

- Carbon Activated Corporation

- Datong Coal Jinding Activated Carbon Co.

- CarbUSA

- California Carbon Co., Inc.

- Reynolds Culligan

- Kleen Industrial Services

- Jaxon Filtration

- ADA Carbon Solutions

Recent Developments

-

In October 2023, Calgon Carbon expanded its virgin activated carbon annual manufacturing capacity with its new facility at Pearlington, Mississippi. This will increase the company’s activated carbon production by 55.0 million pounds and strengthen its commitment to environmental remediation

-

In October 2023, ADA Carbon Solutions announced a USD 251.0 million expansion of its production facility and introduced a novel proprietary process for converting purified coal waste into granular activated carbon in Red River Parish. It is aimed at catering to the demand for activated carbon used in municipal water purification, renewable energy sources, and groundwater and soil contaminant remediation

North America Activated Carbon Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.03 billion

Revenue forecast in 2030

USD 1.27 billion

Growth rate

CAGR of 3.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, form, end-use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

CarbPure Technologies; Cabot Corporation; CarboTech AC GmbH; Evoqua Water Technologies LLC; Oxbow Activated Carbon LLC; Carbon Activated Corporation; Datong Coal Jinding Activated Carbon Co.; CarbUSA; California Carbon Co., Inc.; Evoqua Water Technologies; Reynolds Culligan; Kleen Industrial Services; Jaxon Filtration; ADA Carbon Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Activated Carbon Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America activated carbon market report based on type, form, end-use, and country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powdered

-

Granular

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid Phase

-

Gas Phase

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water Treatment

-

Food & Beverage Processing

-

Pharmaceutical & Medical

-

Automotive

-

Air Purification

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America activated carbon market size was estimated at USD 990.6 million in 2023 and is expected to reach USD 1.03 billion in 2024.

b. The North America activated carbon market is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 1.27 billion by 2030.

b. The U.S. dominated the North America activated carbon market with a share of 77.81% in 2023. This is attributable to strong presence of product manufacturers along with regulatory mandates which are likely to push companies toward efficient methods of water treatment.

b. Some key players operating in the North America activated carbon Market include CarbPure Technologies, Cabot Corporation, Donau Chemie AG, Carbon Activated Corporation, Haycarb (Pvt) Ltd., Evoqua Water Technologies LLC, Jacobi Carbons Group, Osaka Gas Chemicals Co., Ltd., Oxbow Activated Carbon LLC, CarbUSA LLC, Calgon Carbon, and Ingevity among others

b. Key factors that are driving the North America activated carbon market growth include growing demand for water treatment processes, sewage water treatment and air purification.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."