- Home

- »

- Advanced Interior Materials

- »

-

Industrial Boiler Market Size & Share, Industry Report, 2033GVR Report cover

![Industrial Boiler Market Size, Share & Trends Report]()

Industrial Boiler Market (2025 - 2033) Size, Share & Trends Analysis Report By Capacity (10-150 BHP, 151-300 BHP), By Boiler Type (Fire Tube, Water Tube), By Type, By Fuel, By Application, By Region And Segment Forecasts

- Report ID: GVR-3-68038-819-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Boiler Market Summary

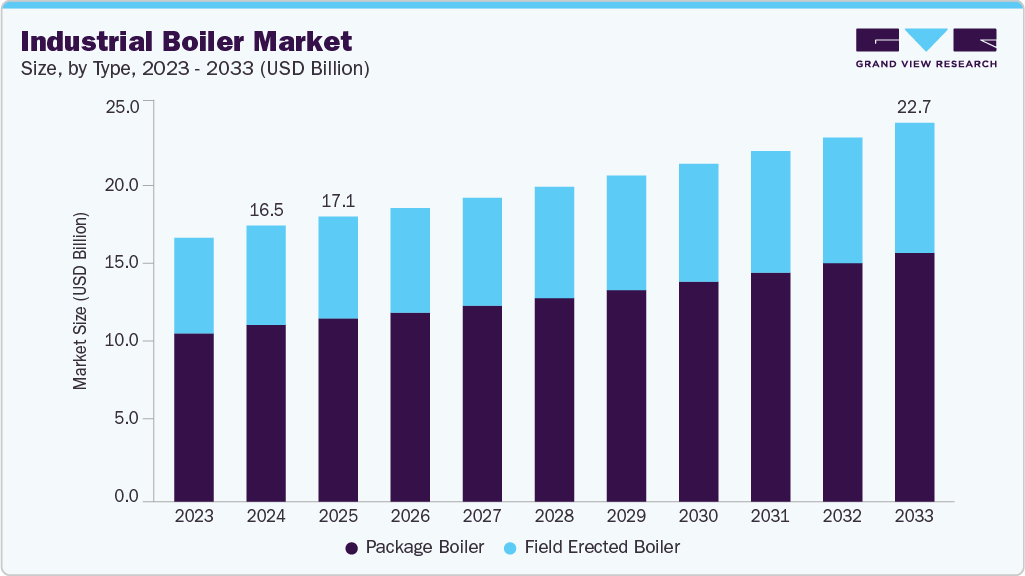

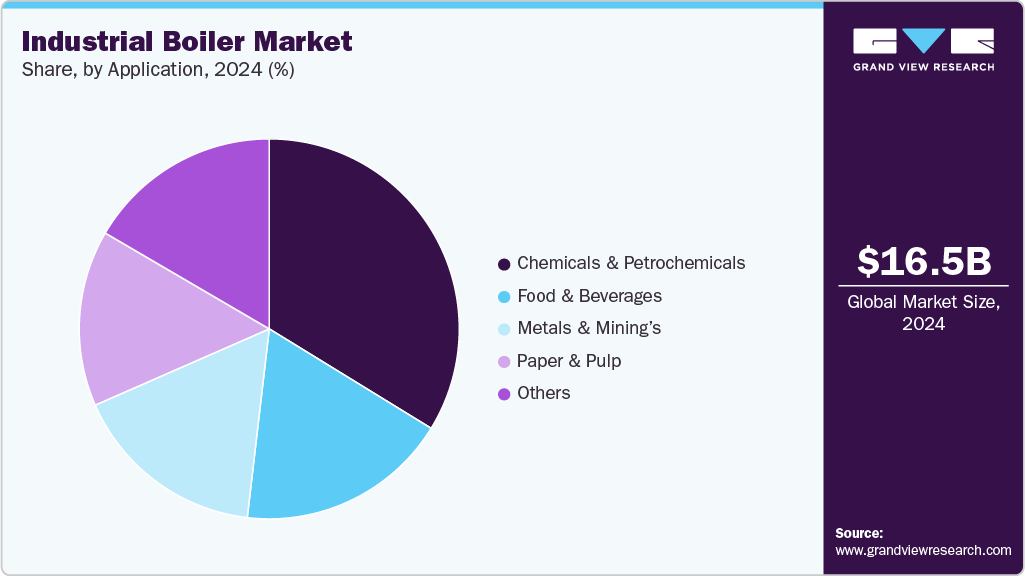

The global industrial boiler market size was estimated at USD 16,551.7 million in 2024 and is projected to reach USD 22,714.6 million by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The growth is primarily attributed to accelerating industrial output in developing economies, where infrastructure expansion and energy demand drive investment in steam-intensive operations.

Key Market Trends & Insights

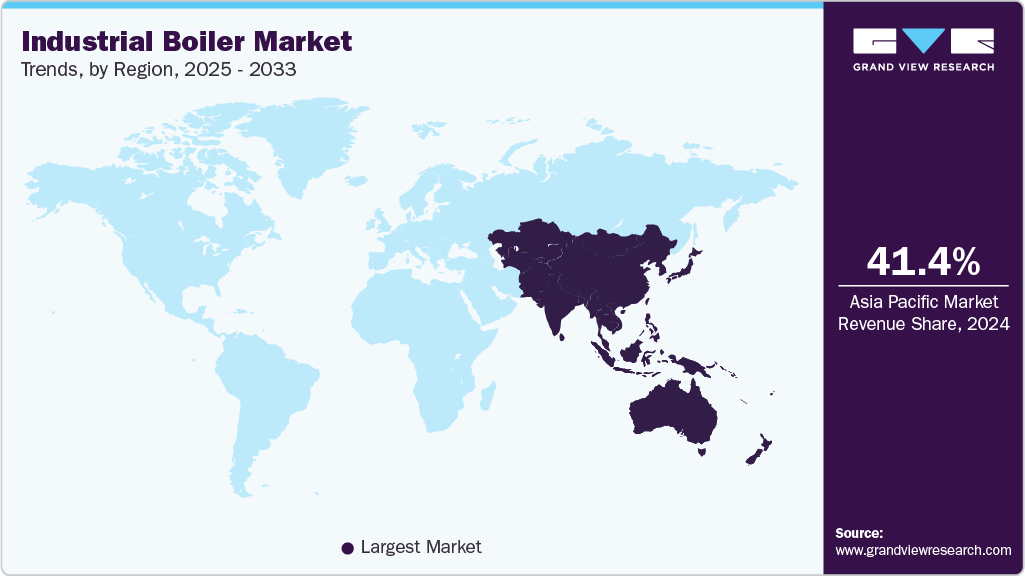

- Asia Pacific dominated the industrial boiler market with the largest revenue share of 41.4% in 2024.

- The industrial boiler market in the U.S. dominated North America due to its advanced industrial base and widespread use of high-capacity boilers across sectors.

- By type, package boiler segment is expected to grow at a considerable CAGR of 3.9% from 2025 to 2033 in terms of revenue.

- By fuel, electric is expected to grow at a considerable CAGR of 4.9% from 2025 to 2033 in terms of revenue.

- By application, the paper & pulp segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 16,551.7 Million

- 2033 Projected Market Size: USD 22,714.6 Million

- CAGR (2025 - 2033): 3.6%

- Asia Pacific: Largest market in 2024

Industries such as chemicals, food and beverage processing, and metal production continue to scale operations, requiring efficient and high-capacity steam generation solutions. In addition, the need for energy efficiency and stricter emissions regulations is pushing industries to adopt modern, cleaner boiler technologies.

The growing emphasis on energy efficiency and emission control propels the adoption of modern, high-efficiency industrial boilers. Regulatory pressures to minimize carbon emissions encourage industries to upgrade older systems with cleaner, more efficient alternatives. Technological advancements such as condensing boilers and integration with smart controls are gaining traction. This shift supports both sustainability goals and operational cost savings.

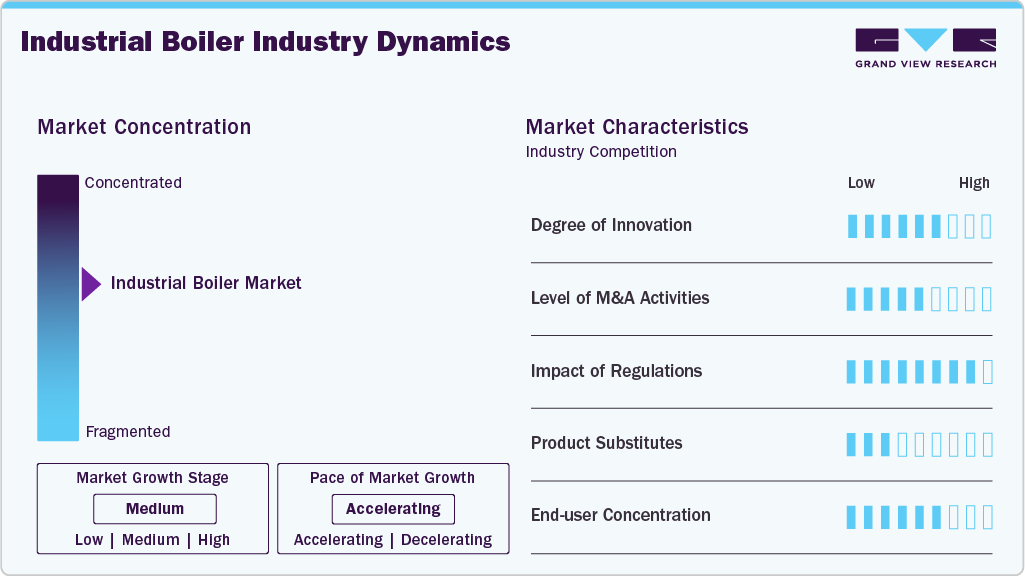

Market Concentration & Characteristics

The industrial boiler industry is moderately concentrated, with a few key players holding a significant market share. These companies compete based on technology, product efficiency, and service offerings. However, regional players also maintain a strong presence, especially in emerging markets. This blend of global and local competition drives the market dynamic and innovation.

The industrial boiler industry is witnessing steady innovation, particularly in energy efficiency and emission reduction technologies. Manufacturers focus on integrating smart controls, automation, and hybrid fuel capabilities. Innovation is also driven by the need for flexible designs suitable for diverse industrial applications. These advancements are essential to meet evolving environmental and performance standards.

The market has seen a moderate level of mergers and acquisitions as companies aim to expand their geographical presence and technological capabilities. Strategic partnerships and acquisitions help firms access new customer bases and strengthen product portfolios. Global players often acquire regional manufacturers to enhance competitiveness. The growing demand for customized and sustainable boiler solutions also influences M&A activity.

Regulations are crucial in shaping the industrial boiler industry, especially regarding emissions and energy efficiency standards. Governments enforce stricter environmental policies, prompting industries to invest in compliant boiler systems. Non-compliance can result in penalties, pushing companies toward timely upgrades. These regulations ultimately drive market demand for cleaner and smarter technologies.

Drivers, Opportunities & Restraints

Rising industrialization and expansion of food processing, chemicals, and manufacturing sectors are key market drivers. Growing demand for steam and hot water in industrial processes boosts equipment adoption. In addition, emphasis on energy efficiency and modernization of existing systems fuels market growth. Government initiatives supporting industrial development further strengthen demand.

A significant opportunity exists to develop high-efficiency and low-emission boiler systems to meet environmental standards. Due to rapid industrial expansion, emerging Asian and African markets present untapped potential. Integrating Internet of Things (IoT) and smart controls into boiler systems offers new avenues for innovation. Furthermore, retrofitting and upgrading aging infrastructure provides consistent aftermarket growth.

High initial investment and installation costs can hinder adoption, especially among small and medium enterprises. Stringent regulatory approvals and compliance requirements may delay project timelines. Volatility in fuel prices impacts operating costs and affects purchasing decisions. Technical challenges related to maintenance and operation can also limit market expansion.

Type Insights

Package boilers dominated the market and accounted for 64.0% share, due to their compact design, pre-assembled construction, and ease of installation. They are ideal for small to mid-sized industrial applications requiring quick setup and reliable performance. These boilers offer lower installation costs and minimal on-site labor, making them highly cost-effective. Their consistent efficiency and ease of maintenance drive strong demand across various sectors.

Field erected boilers are growing significantly, especially in large-scale industries such as power generation, petrochemicals, and pulp and paper. These systems are customized on-site to meet high-capacity and pressure requirements, making them suitable for complex industrial operations. As industrial infrastructure expands globally, demand for these large, tailor-made systems continues to rise. Their ability to handle diverse fuels and challenging operating conditions supports their accelerated adoption.

Boiler Type Insights

Fire tube dominated the market and accounted for 49.2% share in 2024, due to their simple design, lower initial cost, and ease of operation. They are ideal for low to medium steam demands, making them popular in food processing, laundry, and small manufacturing units. Maintenance requirements are generally lower, contributing to their widespread adoption. Their reliability and efficiency in smaller-scale operations sustain their leading market position.

Water tube boilers are the fastest-growing segment, driven by rising demand in high-pressure and high-capacity industrial applications. They are preferred in power generation, petrochemicals, and large-scale manufacturing because they can handle greater steam output and efficiency. These boilers support advanced automation and cleaner combustion technologies. Stricter emission norms and the need for energy-efficient solutions fuel their rapid adoption.

Capacity Insights

Boilers with a capacity of 10-150 BHP dominated the market and accounted for 31.7% share in 2024, due to their suitability for small to mid-sized industrial operations. They are commonly used in food processing, pharmaceuticals, and textiles, where moderate steam output is sufficient. These boilers are easier to install, operate, and maintain, making them cost-effective for everyday industrial needs. Their flexibility and wide applicability contribute to their strong market presence.

The 301-600 BHP segment is experiencing significant growth as demand rises in larger facilities requiring higher steam generation. These boilers are typically used in heavy-duty applications such as petrochemicals, paper, and large-scale manufacturing. Growth is supported by the replacement of aging units with more efficient models. However, their adoption is somewhat restrained by higher capital and operational costs compared to lower-capacity systems.

Fuel Insights

Natural gas is the dominant fuel in 2024 and accounted for a 39.7% share, due to its cleaner combustion and lower emissions compared to coal and oil. Its widespread availability and relatively stable pricing make it a preferred choice for industries aiming to meet regulatory standards. Natural gas boilers also offer high efficiency and quicker start-up times. These advantages make them suitable for a wide range of industrial applications, from food processing to chemicals.

Oil-fired boilers are witnessing moderate growth, particularly in regions lacking reliable gas infrastructure. They are often used as backup systems or in remote industrial operations where fuel flexibility is important. Although they have higher emissions than natural gas, advancements in burner technology have improved their performance. Their growth remains steady but limited by environmental regulations and the global shift toward cleaner fuels.

Application Insights

The chemicals & petrochemicals segment accounted for a share of 33.8% in 2024 due to its continuous and high-volume demand for steam and heat in complex processing operations. These industries require precise temperature and pressure control, making high-capacity boilers essential. Boiler systems are integral for distillation, cracking, and refining operations. The sector’s scale and energy intensity drive consistent investment in advanced and efficient boiler technologies.

The paper & pulp industry is the fastest-growing segment in the market, driven by rising global demand for packaging and hygiene products. Boilers are critical for key processes such as pulping, drying, and bleaching, which require large amounts of steam. The industry's move toward sustainable practices has led to increased adoption of biomass boilers. Expansion in developing markets and modernization of older facilities are further fueling growth.

Regional Insights

North America's well-established industrial infrastructure is driving the industrial boiler market, which is growing at a significant CAGR of 3.1%. The region emphasizes energy efficiency and modernizing aging boiler systems. Technological advancements and the adoption of low-emission boilers are prominent trends. Regulatory pressure to reduce carbon footprint further drives the replacement and upgrading of existing equipment.

U.S. Industrial Boiler Market Trends

The industrial boiler market in the U.S. dominated North America due to its advanced industrial base and widespread use of high-capacity boilers across sectors. Strict emissions regulations have accelerated the adoption of energy-efficient and low-emission boiler systems. The presence of leading boiler manufacturers and continuous technological advancements supports market growth. Furthermore, investments in upgrading aging infrastructure further boost demand.

Canada industrial boiler marketis growing steadily, driven by rising demand in the food processing, pulp and paper, and chemical industries. Government support for clean energy and sustainable technologies encourages the adoption of biomass and high-efficiency boilers. The country also focuses on reducing industrial emissions and promoting boiler upgrades. Regional expansion of manufacturing and energy sectors adds to market momentum.

Europe Industrial Boiler Market Trends

The industrial boiler market in Europe remains a key market due to stringent environmental regulations and a focus on sustainable energy use. Countries like Germany, France, and the UK invest in cleaner technologies and high-efficiency systems. The presence of major manufacturing industries and the transition to low-carbon energy sources support market growth. Boiler manufacturers in the region prioritize innovation and compliance with EU standards.

Germany industrial boiler market is growing due to its strong manufacturing and chemical sectors, which require reliable steam and heat generation. The country’s focus on energy efficiency and strict environmental regulations encourages the adoption of low-emission and modern boiler systems. Technological innovation and support for renewable energy sources further drive demand. In addition, the replacement of aging infrastructure contributes to market expansion.

The industrial boiler market in the UKis growing due to increasing demand across the food processing and pharmaceutical industries. Government initiatives promoting carbon reduction and energy-efficient technologies are boosting the installation of modern boilers. The push for cleaner energy and transitioning from fossil fuels to renewable sources is also shaping market trends. Investment in upgrading outdated systems is another key growth factor.

Asia Pacific Industrial Boiler Market Trends

The industrial boiler market in Asia Pacific dominated and accounted for 41.4% of the global market, driven by rapid industrialization and urban development in countries like China, India, and Southeast Asia. The region hosts a strong manufacturing base across chemicals, food processing, and textiles. Rising energy demands and supportive government policies encourage large-scale boiler installations. Furthermore, ongoing infrastructure investments and expansion of power and utility sectors continue to fuel market dominance.

China industrial boiler market is growing rapidly due to its expansive manufacturing base and high energy demands across industries such as chemicals, textiles, and steel. Government efforts to reduce emissions encourage shifting from coal-fired to cleaner, high-efficiency boilers. The country’s focus on industrial automation and modernization further supports market growth. Moreover, strong domestic production capabilities drive competitive pricing and widespread adoption.

The industrial boiler market in India is expanding steadily, driven by growth in sectors like food processing, pharmaceuticals, and power generation. Rising demand for process heat and steam in small to mid-sized industries fuels boiler installations. Government initiatives like “Make in India” and increasing investment in infrastructure and energy projects boost industrial activity. In addition, adopting biomass and other cleaner fuels supports sustainable market growth.

Middle East & Africa Industrial Boiler Market Trends

The industrial boiler market in the Middle East and Africa region is emerging as a growing market for industrial boilers, supported by rising investments in petrochemicals, energy, and desalination industries. Countries like Saudi Arabia, the UAE, and South Africa are expanding their industrial bases, boosting boiler demand. The focus on diversifying economies beyond oil is driving infrastructure and industrial development. However, market growth is somewhat restrained by political and economic uncertainties in certain areas.

Saudi Arabia industrial boiler market is growing due to expanding activities in the oil and gas, petrochemical, and desalination sectors. The country’s focus on industrial diversification under Vision 2030 drives infrastructure and manufacturing growth. Increasing investments in clean energy and modern industrial equipment encourage the adoption of efficient boiler systems. Furthermore, rising demand for process steam in energy and utility projects supports market expansion.

Latin America Industrial Boiler Market Trends

The industrial boiler market in Latin America is witnessing steady growth due to expanding food and beverage, mining, and manufacturing sectors. Countries like Brazil and Argentina are investing in industrial modernization and energy infrastructure. Growing demand for process heat and steam creates new opportunities for boiler suppliers. However, economic fluctuations and limited regulatory frameworks can pose short-term challenges.

Brazil industrial boiler marketis growing due to the expansion of its food and beverage, pulp and paper, and chemical industries. The country’s focus on industrial modernization increases demand for efficient and reliable steam generation systems. Government incentives promoting renewable energy are encouraging the use of biomass boilers. Moreover, rising investments in manufacturing and energy infrastructure support continued market growth.

Key Industrial Boiler Company Insights

Some key players operating in the market include Thermax Ltd., Siemens AG, and Bharat Heavy Oilals Ltd.

-

Thermax Ltd. is a leading market player, known for its focus on energy-efficient and environment-friendly boiler systems. The company specializes in biomass-fired and waste heat recovery boilers, catering to industries seeking sustainable energy solutions. It has a strong presence in emerging markets, particularly Asia and Africa. Thermax actively invests in R&D to develop low-emission and high-efficiency boiler technologies. Its turnkey project capabilities strengthen its position in customized industrial applications.

-

Siemens AG plays a significant role in the industrial boiler space through its advanced automation, control systems, and digitalization solutions. The company provides integrated energy management and boiler optimization technologies that enhance efficiency and reduce emissions. Siemens is known for retrofitting existing boilers with smart controls to improve operational performance. Its solutions cater primarily to power, chemical, and manufacturing sectors with high energy demands. The company’s global network and digital expertise give it a strong competitive edge.

Key Industrial Boiler Companies:

The following are the leading companies in the industrial boiler market. These companies collectively hold the largest market share and dictate industry trends.

- Thermax Ltd.

- Siemens AG

- Bharat Heavy Electricals Ltd.

- Forbes Marshall

- Mitsubishi Heavy Industries Ltd.

- Harbin Oil Corporation

- Cheema Boilers Limited

- IHI Corporation

- AC Boilers

- Dongfang Oil Corporation Ltd.

- Cleaver-Brooks.

- Babcock and Wilcox

- Clayton Industries

- Cochran

- Doosan Heavy Industries and Construction

Recent Developments

-

In February 2025, Cleaver-Brooks launched myBoilerRoom, a digital platform that simplifies boiler room operations by offering centralized access to critical tools and information. The platform provides features such as equipment documentation, parts tracking, and user training resources in one place. The system also includes real-time monitoring and analytics to improve performance and maintenance planning. This platform aims to enhance efficiency, reduce downtime, and support smarter boiler management.

-

In March 2024, Nationwide Boiler Inc. was named Hurst Boiler's exclusive representative in California and Greater Houston. This collaboration expands access to Hurst’s boiler systems and engineered solutions across major industrial sectors and enhances service reach by combining Hurst’s product range with Nationwide’s regional expertise.

-

In January 2023, BHEL signed a technology license agreement with Sumitomo SHI FW of Finland to produce CFBC boilers in India and global markets. The deal enhances BHEL’s ability to offer advanced, emission-compliant boiler systems. It supports fuel flexibility and aligns with clean energy initiatives, including biomass co-firing.

-

In August 2022, Thermax, anenergy and environmental solutions provider, developed a unique multi-fuel boiler solution for industrial users wishing to transition from a traditional portfolio to a green one with the flexibility of switching inputs.

Industrial Boiler Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17,097.9 million

Revenue forecast in 2033

USD 22,714.6 million

Growth rate

CAGR of 3.6% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, boiler type, type, fuel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Russia; Japan; India; Thailand; Malaysia; Thailand; Indonesia; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Thermax Ltd.; Siemens AG; Bharat Heavy Electricals Ltd.; Forbes Marshall; Mitsubishi Heavy Industries, Ltd.; Harbin Oil Corporation; Cheema Boilers Limited; IHI Corporation; AC Boilers; Dongfang Oil Corporation Ltd.; Cleaver-Brooks; Babcock and Wilcox; Clayton Industries; Cochran; Doosan Heavy Industries and Construction

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Boiler Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial boiler market report based on capacity, type, boiler type, fuel, application, and region:

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

10-150 BHP

-

151-300 BHP

-

301-600 BHP

-

Above 600 BHP

-

-

Type (Revenue, USD Million, 2021 - 2033)

-

Package Boiler

-

Field Erected Boiler

-

-

Boiler Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Fire Tube

-

Water Tube

-

Others

-

-

Fuel Outlook (Revenue, USD Million; 2021 - 2033)

-

Natural Gas

-

Coal

-

Oil

-

Others

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Chemicals & Petrochemicals

-

Paper & Pulp

-

Food & Beverages

-

Metals & Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Malaysia

-

Australia

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial boiler market size was estimated at USD 16,551.7 million in 2024 and is expected to be USD 17,097.9 million in 2025.

b. The global industrial boiler market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach USD 22,714.6 million by 2033.

b. Rapid industrialization and the growing food & beverage industry are expected to drive the global market over the forecast period. Moreover, stringent laws to regulate harmful emissions in the environment will boost the adoption of these systems boosting the demand for industrial boilers over the coming years.

b. Package boilers dominate the industrial boiler market and accounted for 64.0% share, due to their compact design, pre-assembled construction, and ease of installation. They are ideal for small to mid-sized industrial applications requiring quick setup and reliable performance.

b. Some of the key players operating in the global industrial boiler market include Thermax Ltd., Siemens AG, Bharat Heavy Electricals Ltd., Forbes Marshall., Mitsubishi Heavy Industries, Ltd., Harbin Oil Corporation, Cheema Boilers Limited, IHI Corporation, AC Boilers, Dongfang Oil Corporation Ltd., Cleaver-Brooks., Babcock and Wilcox, Clayton Industries, Cochran, Doosan Heavy Industries and Construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.