- Home

- »

- Clinical Diagnostics

- »

-

North America Bloodstream Infection Testing Market Report 2030GVR Report cover

![North America Bloodstream Infection Testing Market Size, Share & Trends Report]()

North America Bloodstream Infection Testing Market Size, Share & Trends Analysis Report By Product (Instruments, Reagents & Consumables), By Sample Type, By Technology, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-114-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

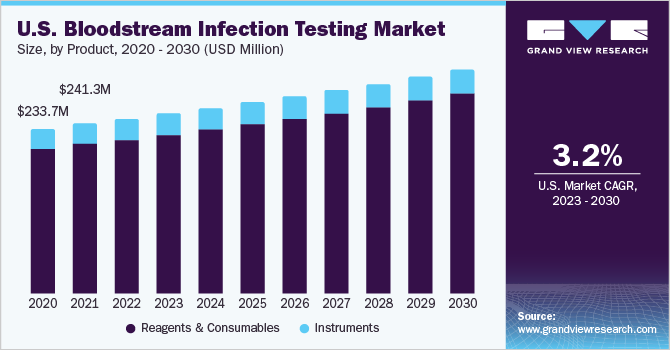

The North America bloodstream infection testing market size was valued at USD 307.88 million in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 3.6% from 2023 to 2030. Increasing demand for advanced bloodstream infection testing methods and a rising number of CROs and forensic and research laboratories are among the major factors expected to drive growth in the bloodstream infection testing market. Moreover, the introduction of culture-independent tests holds significant promise in improving patient management with bloodstream infections (BSI) as these methods can reduce the time required for test results and enhance their accuracy. Furthermore, the high prevalence of STIs and tuberculosis in the region is also anticipated to propel the bloodstream infection testing market growth.

According to CDC data, reported cases of STIs such as chlamydia, syphilis, and gonorrhea increased between 2020 and 2021. According to the survey, more than 2.5 million cases were reported during this period and gonorrhea rates rose by over 4%, while syphilis rates surged, increasing by nearly 32% for combined stages of the infection. Congenital syphilis cases also saw a significant 32% increase, leading to 220 stillbirths and infant deaths. Chlamydia rates increased by approximately 4%, as per the report.

The U.S. bacterial infection testing market has witnessed significant trends in recent years. With increasing awareness about healthcare-associated infections and the rise in drug-resistant bacteria, there has been a growing demand for accurate and rapid diagnostic tests. Molecular diagnostic techniques, such as polymerase chain reaction (PCR) and nucleic acid amplification tests (NAATs), have gained prominence due to their high sensitivity and specificity.

Additionally, there is a shift towards point-of-care testing, allowing for faster diagnosis and treatment decisions. The market also is seeing a rising adoption of automated systems and integrated platforms, streamlining the testing process and improving efficiency. Overall, the U.S. bacterial infection testing market is expected to continue its growth trajectory fueled by technological advancements and the need for prompt and accurate diagnostics.

Another significant trend in the U.S. bacterial infection testing market is the increasing adoption of MALDI-TOF mass spectrometry. MALDI-TOF (Matrix-Assisted Laser Desorption/Ionization Time-of-Flight) is a powerful technology that enables rapid identification of bacteria and their antibiotic resistance profiles. It offers advantages such as high accuracy, speed, and cost-effectiveness compared to traditional culture-based methods. With its ability to identify a wide range of bacterial species within minutes, MALDI-TOF has become an essential tool in clinical laboratories for diagnosing bacterial infections. Its widespread implementation is driven by the need for timely and targeted treatment decisions, especially in sepsis and antibiotic-resistant infections.

As a result, the U.S. bacterial infection testing market is witnessing a growing demand for MALDI-TOF mass spectrometry platforms. For instance, in February 2022, Bruker Corporation introduced the timsTOF MALDI PharmaPulse system, an advanced high-end solution designed for unbiased and efficient high-throughput screening (HTS) and ultra-high-throughput screening (uHTS) utilizing label-free mass spectrometry. This innovative system enables complete and rapid analysis, revolutionizing the screening process in the pharmaceutical industry. With the timsTOF MALDI PharmaPulse system, researchers and scientists have access to a powerful tool that enhances productivity and accuracy, ultimately driving drug discovery and development advancements.

Product Insights

The reagents and consumables segment accounted for the largest revenue share of 88.12% in 2022. The segment is also expected to expand at the fastest growth rate over the forecast period. The segment's growth is driven by the easy availability and frequent purchase of screening products for donors and recipients. Moreover, the market is propelled by the wide range of blood grouping, typing, and donor screening reagents, kits, and assays offered by North American and local manufacturers.

Additionally, the expanding product portfolio caters to the diverse needs of healthcare facilities, further fueling the growth of the segment in the regional bloodstream infection testing market. For instance, in March 2022, Accelerate Diagnostics, Inc., an in-vitro diagnostics company, launched the Accelerate Arc system. It comprises the Accelerated Arc Module and blood culture (BC) kit, an automated path for the accurate and rapid microbial recognition of positive blood cultures.

Sample Type Insights

The blood culture segment accounted for the largest revenue share of 74.81% in 2022 and is expected to witness the fastest CAGR over the forecast period. Blood culture testing has continued to evolve with technological advancements. The introduction of automated blood culture systems and faster detection methods have enhanced result efficiency and turnaround time, further cementing the segment’s dominance.

For instance, in October 2022, BD, a global medical technology company, and Magnolia Medical Technologies, Inc. entered a commercial agreement. The collaboration aims to assist U.S. hospitals in reducing blood culture contamination, enhancing testing accuracy, and ultimately improving clinical outcomes. Therefore, such initiatives with effective tools and technologies enhance the reliability and efficiency of blood culture testing, thereby boosting the demand for such methods.

Moreover, the blood culture segment is expected to experience growth due to the increasing number of cancer cases, bloodstream infections (BSIs), and sepsis. For instance, in June 2021, Accelerate Diagnostics, a biotech company based in Tucson, Arizona, USA, was granted funding of USD 578,000 by CARB-X. The funds are specifically allocated for developing innovative fiber optic technology aimed at diagnosing sepsis or assessing the risk of sepsis. This financial support signifies a significant opportunity for the company to advance its sepsis diagnostic capabilities and contribute to improving patient outcomes.

Technology Insights

The PCR segment held the largest revenue share of 59.7% in 2022 in the North America bloodstream infection testing market and is expected to expand at the fastest CAGR over the forecast period. The introduction of technologically advanced PCR tests, government initiatives, increasing prevalence of targeted diseases, and application expansion of existing technologies are expected to drive segment growth over the forecast period.

For instance, PLEX-ID (Abbott Molecular) is an advanced multiplex real-time automated PCR system with amplicon product detection using ESI MS technology. This innovative solution enables rapid and accurate genotypic characterization of various pathogens, including bacteria, fungi, viruses, and parasites within a given sample, such as cultures or whole blood. By utilizing broad-range primers targeting pathogen groups instead of specific species, PLEX-ID provides comprehensive and efficient identification capabilities. This advanced technology strengthens diagnostic capabilities in infectious disease management, offering businesses a valuable tool to enhance patient care and streamline laboratory workflows, thereby fueling segment growth.

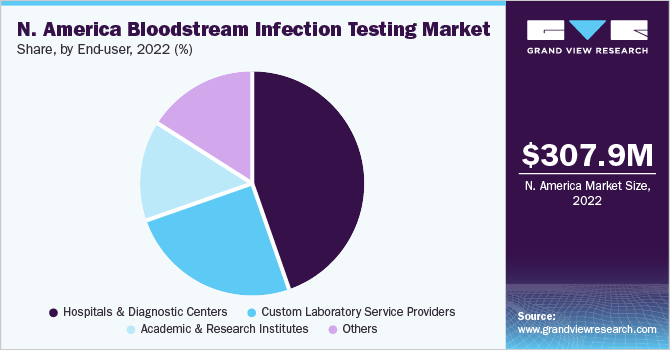

End-user Insights

The hospital and diagnostic centers segment accounted for the largest revenue share of 44.85% in 2022 and is expected to witness the fastest CAGR from 2023 to 2030. Hospitals often have R&D departments dedicated to studying bloodstream infections and developing new diagnostic tools, therapies, and preventive strategies. Their expertise and resources contribute to advancements in the field, further solidifying their position in the bloodstream infection testing market. Hospitals also possess advanced healthcare infrastructure, including well-equipped laboratories, diagnostic facilities, and skilled healthcare professionals. This allows for efficient diagnosis, monitoring, and treatment of bloodstream infections, leading to better patient outcomes.

Moreover, hospitals frequently collaborate with medical device manufacturers, pharmaceutical companies, and diagnostic companies to develop and test innovative solutions for bloodstream infection management. These collaborations ensure the availability of advanced products and technologies within the hospital setting, strengthening their dominance in the market. In addition, advanced infrastructure, infection control measures, research capabilities, and collaborations with industry contribute to their dominant position in the bloodstream infection testing market in the region.

Regional Insights

The U.S. dominated the regional market for bloodstream infection testing and accounted for the largest revenue share of 80.71% in 2022. This is due to the increasing awareness, favorable reimbursement policies, and increasing strategic initiatives and product launches by the major companies operating in the country. In October 2022, BD, a global medical technology company, and Magnolia Medical Technologies, Inc. entered a commercial agreement. The collaboration aims to assist U.S. hospitals in reducing blood culture contamination, enhancing testing accuracy, and ultimately improving clinical outcomes.

Therefore, such initiatives with effective tools and technologies enhance the reliability and efficiency of blood culture testing, thereby boosting the demand for such testing methods in the region. Canada is expected to witness the fastest CAGR over the forecast period, owing to the increasing demand for early detection of infections and new product launches. Additionally, increasing cases of health-associated infections, including bloodstream infections, are anticipated to drive the country's growth over the coming years.

Key Companies & Market Share Insights

The key companies operating in the North American market for bloodstream infection testing are attempting to enhance their product portfolio by upgrading their products and exploring acquisitions and government authorizations to increase their client base and obtain a larger market share. Furthermore, major players offering bloodstream infection testing services are implementing strategies such as partnerships, mergers and acquisitions, product and service launches, joint ventures, agreements, expansions, and collaborations, to strengthen their position in the market.

For instance, in March 2022, bioMérieux, a global leader in in-vitro diagnostics, announced that it had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its VITEK MS PRIME. This advanced MALDI-TOF mass spectrometry identification system is designed to provide rapid microbial identification within minutes. This development reinforces the company's commitment to delivering technologically advanced solutions for routine microbial identifications, offering businesses in the diagnostic industry an invaluable tool to streamline workflows and enhance patient care. Some of the major players in the North America bloodstream infection testing market include:

-

bioMérieux SA

-

BD

-

Cepheid

-

Seegene Inc.

-

Abbott

-

F. Hoffmann-La Roche Ltd

-

Siemens Healthcare Limited

-

Luminex Corporation

-

Bruker

-

Accelerate Diagnostics, Inc.

North America Bloodstream Infection Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 318.16 million

Revenue forecast in 2030

USD 408.53 million

Growth rate

CAGR of 3.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sample type, technology, end-user, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

bioMérieux SA; BD; Cepheid; Seegene Inc.; Abbott; F. Hoffmann-La Roche Ltd.; Siemens Healthcare Limited; Luminex Corporation; Bruker; Accelerate Diagnostics, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Bloodstream Infection Testing Market Report Segmentation

This report forecasts regional and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the North America bloodstream infection testing market report based on product, sample type, technology, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Consumables

-

Instruments

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Blood

-

Blood Culture

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

Mass Spectroscopy

-

In Situ Hybridization

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Centers

-

Custom Laboratory Service Providers

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America bloodstream infection testing market size was estimated at USD 307.88 million in 2022 and is expected to reach USD 318.16 million in 2023.

b. The North America bloodstream infection testing market is expected to grow at a compound annual growth rate of 3.6% from 2023 to 2030 to reach USD 408.53 million by 2030.

b. The U.S. dominated the North America bloodstream infection testing market with a share of 80.71% in 2022. This is attributable to increasing awareness of BSI testing and the implementation of government programs to prevent the incidence of BSI.

b. Some key players operating in the North America bloodstream infection testing market include Life technologies, Diatherix laboratories, Qiagen GmbH, Meridian Biosciences, Nordion, Roche, Cantel Medical Corporation, BD, and Danaher.

b. Key factors that are driving the market growth include increasing incidence of BSI, growing hospitalizations, and rising number of government programs to control the overall incidence rate of BSI.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."