- Home

- »

- Medical Devices

- »

-

North America Clinical Trials Market Size, Trends, Report, 2030GVR Report cover

![North America Clinical Trials Market Size, Share & Trends Report]()

North America Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design, By Indication, By Service Type, By Sponsor, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-202-2

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Market Size & Trends

The North America clinical trials market size was estimated at USD 40.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.99% from 2024 to 2030. This is attributed to increasing clinical trial cycles, the need for novel therapies, a surge in chronic diseases such as cancer, diabetes, and infectious diseases such as COVID-19, along with favorable government investments R&D activities.

Availability of well-established CROs and escalating R&D activities are facilitating market growth. Moreover, the healthcare per capita share offered by government of the U.S. plays a significant role in the overall uplift of the industry. North America-based companies such as Parexel International Corporation and Charles River Laboratory engage in technological and data advancement aspects for clinical trials processing and monitoring, thereby attributing to increased demand in the market.

Moreover, well-known pharmaceutical & biopharmaceutical and medical device firms are investing in R&D operations of clinical trials due to increasing product-manufacturing practices in the market. For example, Paraxel came up with the Community Alliance Network, a novel concept that helps incorporate clinical research into the healthcare centers, aimed to boost patient services and support more opportunities for diversity in clinical trials in June 2022.

Furthermore, the COVID-19 pandemic affected the industry on a larger scale. During the pandemic, the government authorities as well as healthcare settings shifted their focus on the prevention, diagnosis, and treatment aspects of COVID-19. In addition, the prevalence of chronic diseases in the U.S. fuels the clinical trials market in the region.

Cancer is one of the most predominant diseases resulting in a higher necessity for medication and devices, thereby leveraging the clinical trial market. As per the article published by the American Society of Clinical Oncology Journal, the US Food and Drug Administration (FDA) released 161 new approvals for cancer therapeutics across a range of solid tumor malignancies and indications from 2017 to 2022. This is attributed to higher demand for medication and devices, thereby raising demand of the clinical trial market.

Market Concentration & Characteristics

The industry growth stage is high, and the pace of market growth is accelerating. North America's clinical trial market is characterized by a high degree of innovation due to emerging infectious diseases such as COVID-19 and the constant need for novel therapies for chronic diseases such as cancer, diabetes, heart disease, and stroke, cancer, or diabetes. Also, companies are expanding their business geographically to provide and improve healthcare services. For instance, in November 2023, Syneos Health collaborated with P3 Research Ltd Network to expand its clinical trial capabilities across therapeutic areas in New Zealand.

-

Key players in the industry are offering new solutions that focus on patient engagement and fast-tracking clinical trials. In April 2023, U.S.-based Athena-health launched an innovative tool, the Patient Digital Engagement Index to keep track of patients and their engagement using cloud-based electronic health records systems

-

Industry growth is also encouraged by high merger and acquisition activities. For instance, in March 2022 OptumHealth collaborated with LHC to serve advanced home-based patient care

-

The regulatory authorities support the overall market growth. For instance, In January 2024, the U.S. FDA’s Center for Devices and Radiological Health (CDRH) declared reclassification for highly threatening IVDs to allow healthcare producers to avail marketing clearance. These efforts of regulatory bodies to get promising therapeutic results attract more multinational pharmaceutical companies to perform their clinical trials, in turn leveraging the industry growth

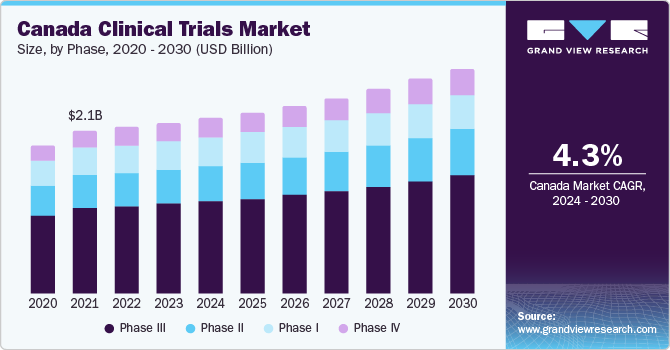

Phase Insights

Based on the phase type, phase III dominated the market with a revenue share of 53.5% in 2023. Phase III trial is an essential stage for vaccine approval. Despite no or lesser incidences of COVID-19, manufacturers are still focusing on the new generation vaccine-manufacturing practices to prevent serious consequences of the disease in the near future.

As per clinicaltrial.gov, around 550 novel vaccines were in the development stage in 2022. This is further anticipated to increase the number of trials that are most likely to contribute towards the market's substantial growth.

Indication Insights

Based on indication, oncology segment accounted for the largest revenue share of 36.4% in 2023. This is due to a high prevalence of cancer in the U.S. and associated clinical trials for the same. Predominance of cancer is resulting in more demand for medication and devices, thereby leveraging the clinical trial market. As per the article published by the American Society of Clinical Oncology Journal, between 2017 and 2022, the U.S. Food and Drug Administration (FDA) released 161 new approvals for cancer therapeutics across a range of solid tumor malignancies and indications. These are attributed to higher demand for medication and devices, thereby leveraging the clinical trial market.

The cardiovascular segment is expected to grow faster at a CAGR of about 5% from 2024 to 2030. As per the Heart and Stroke Foundation of Canada, about 750,000 Canadians are likely to have heart conditions, demanding the development of accurate medications and treatment. This will increase the industry growth substantially in the near future. The need for affordable medicine in developing nations is expected to attract government R&D funding, potentially leading to new cost-effective treatments, and propelling clinical trial market growth.

Service Type Insights

Based on service type, the laboratory services segment dominated the market with a revenue share of 34.71% in 2023. Considering the increasing outbreaks of infectious diseases, many U.S.-based companies are seeking to provide accurate laboratory services with better outcomes through acquisition. For instance, Bio-Reference Labs, a U.S. based company, provides a wide variety of clinical laboratory testing services to detect, diagnose, evaluate, and treat diseases.

Patient recruitment is anticipated to grow at a faster CAGR from 2024 to 2030 due to the increasing number of trials performed in the U.S. As per the report from National Library of Medicine, 20,465 clinical studies are actively seeking participants in the United States as of January 2024.

Sponsor Insights

Based on the sponsor, the pharmaceutical & biopharmaceutical companies segment dominated the market with a revenue share of 70.24 % in 2023. This is due to the local presence of pharmaceutical and biopharmaceutical companies in the U.S. In addition, stringent and accurate regulatory authorities of the U.S. and Canada are attracting more clinical trial projects across the world, which escalates the industry growth.

Medical device companies are expected to register a lucrative growth rate from 2024 to 2030 owing to increased need of diagnostics and treatment facilities. Moreover, key players of this market voluntarily invest in the R&D services of clinical trials. For instance, in June 2022, Paraxel started an innovative program combining clinical research into a healthcare setting for patients.

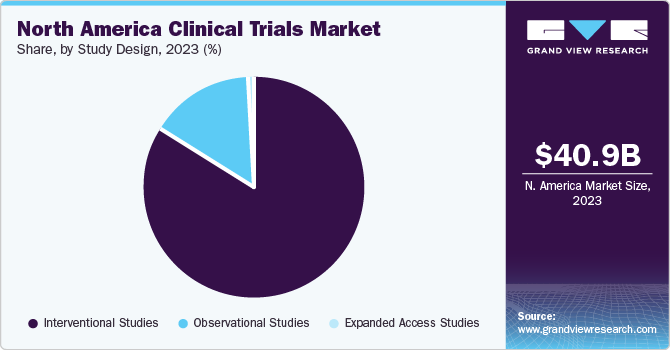

Study Design Insights

Based on the study design, the interventional studies segment accounted for the largest share of 83.5% in 2023. This is due to many interventional studies on ophthalmic, metabolic, respiratory, and infectious conditions across the globe. For instance, in June 2022, an international study titled as “Evaluating Community Interest in Virtual Reality Vision Screening Technology” was performed in the U.S.

The observational segment is expected to attain growth with a CAGR of 6.13% from 2024 to 2030. According to the clinicaltrials.gov data, a high number of observational studies are being performed, accelerating the market growth. For instance, in December 2023, the observational study on the “Preventing Obesity in the Worksite: A Multi-Message, Multi-"Step" Approach” was performed in the U.S.

Regional Insights

Based on the region, the U.S. accounted for the largest share of the market about 95% in 2023. Factors attributing to regional growth include higher per capita healthcare spending, and the prevalence of infectious as well as chronic diseases. In addition, the U.S. is a hub for several contrast research organizations (CROs) such as IQVIA; ICON plc; Parexel International Corporation; Syneos Health, Inc.; and Charles River Laboratory, contributing to the market. As per the Clinicaltrial.gov report, in December 2023, there were 145,218 studies listed for clinical trials in the U.S., which accounted for approximately 31% of total clinical trials globally. This surge sets a record for the highest number of clinical trials across the U.S.

Canada is the second largest market and is projected to expand at a CAGR of 4.7% from 2024 to 2030. This is due to the steady investment of the government in clinical trials, accelerating market growth. Moreover, Canada has a well-established infrastructure for performing trials and is authorized as G7 leader in clinical trial efficiency making it a significant contributor within a country.

Key North America Clinical Trials Company Insights

Some of the prominent players operating in the North America clinical trials market include IQVIA, PAREXEL International Corporation, and Charles River Laboratories International, Inc. These companies provide services companies in clinical trials, personalize patient engagement, and navigate regulatory hurdles, ultimately aiming to bring lifesaving treatments to improve patient outcomes.

Key North America Clinical Trials Companies:

- Covance

- IQVIA

- Syenos Health

- Paraxel International

- PRA Healthcare Science

- Pharmaceutical Product Development

- Icon

- Charles River Laboratories International, Inc.

- WuXi AppTec

- Medpace Holdings

- Pharmaceutical Product Development (Thermo Fisher Scientific)

Recent Developments

-

Susan R. Salka, a retired chief executive officer and president of AMN Healthcare Services, Inc., is named to the board of directors of Paraxel in February 2024. Ms. Salka’s appointment is effective Feb. 1. Salka's prior experience is expected to improve Paraxel's overall services and innovation.

-

In October 2022, Thermo Fisher expanded its clinical research operation by investing USD 59 million in the laboratory. This step supported Thermo Fisher's worldwide aimed to serve central laboratory and biomarker services for clinical research initiatives

-

In July 2022, WuXi AppTec came up with a crucial plan to establish a new R&D and manufacturing plant in Singapore. The company committed USD 1.43 billion to build and operate a site that would accelerate healthcare innovation for its global partners.

-

In July, Icon

announced its acquisition with PRA Health sciences for revenue of about 12 billion. This will increase consulting, clinical, and commercial services, geographical expansion, and the company’s therapeutic capabilities.

North America Clinical Trials Market Scope

Report Attribute

Details

Revenue forecast in 2030

USD 60.64 billion

Growth rate

CAGR of 5.99% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Phase, study design, indication, service type, sponsor, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Covance; IQVIA; Syenos Health; Paraxel International; PRA Healthcare Science; Pharmaceutical Product Development; Charles River Laboratories; Icon; WuXi AppTec; Medpace Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America clinical trials market report based on phase, design, indication, service type, sponsor, and region.

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional Studies

-

Observational Studies

-

Expanded Access Studies

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Autoimmune/ Inflammation

-

Pain Management

-

Oncology

-

CNS Conditions

-

Diabetes

-

Obesity

-

Cardiovascular

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Protocol Designing

-

Site Identification

-

Patient Recruitment

-

Laboratory Services

-

Bioanalytical Testing Services

-

Clinical Trial Data Management Services

-

Others

-

-

Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America clinical trials market is estimated at USD 40.9 billion in 2023 and is expected to reach USD 42.7 billion in 2024.

b. The North America clinical trials market is expected to grow at a CAGR of 5.99% from 2024 to 2030 to reach USD 60.64 billion in 2030.

b. Phase III dominated the market with a revenue share of 53.5% in 2023. Phase III trial is an essential stage for vaccine approval.

b. Some of the prominent players operating in the market include IQVIA, PAREXEL International Corporation, and Charles River Laboratories International, Inc.

b. Key factors driving the market growth include increasing clinical trial cycles, need for novel therapies, a surge in chronic diseases such as cancer, diabetes, and infectious diseases such as COVID-19, along with favorable government investments R&D activities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."