- Home

- »

- Consumer F&B

- »

-

North America Dairy Alternatives Market, Industry Report, 2030GVR Report cover

![North America Dairy Alternatives Market Size, Share & Trends Report]()

North America Dairy Alternatives Market Size, Share & Trends Analysis Report By Source (Soy, Almond, Coconut, Rice, Oats), By Product (Milk, Yogurt, Cheese, Ice-cream, Creamers), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-213-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

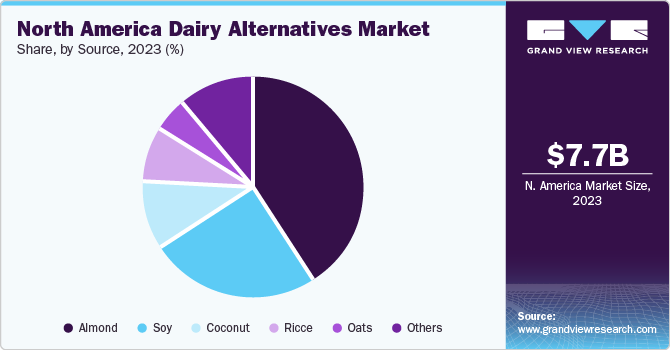

The North America dairy alternatives market size was estimated at USD 7.74 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.1% from 2024 to 2030. Due to changes in nutrition trends and customer eating habits, the industry is expanding and experiencing increasing demand. Throughout the projected period, it is anticipated that the rising number of cases of lactose intolerances and milk allergies would further fuel demand. Numerous food and beverage products are thus making use of the products to appeal to the growing consumer base that is opting for plant-based and other dairy alternatives.

The North America market accounted for a 26.5% share of the global dairy alternatives market in 2023.

The demand for dairy-free or non-dairy goods has increased recently, and this can be attributed to plant-based milk alternatives. Plant extracts that have been dissolved and degraded are suspended in water to create vegan milk. To enhance the suspension and stability of these plant-derived compounds, two processing procedures are applied homogenization and heat treatments.

In the non-dairy industry, vegan milk has taken center stage and is heavily promoted as a nutritious, environmentally beneficial, and animal welfare-friendly substitute. Legumes, nuts, or cereals are the main constituents of these substitute goods; most customers in developed and emerging nations are familiar with these ingredients. In addition, the demand for plant milk and related products is being driven by the innovation and evolution of dietary choices like flexitarianism and veganism.Growing knowledge of the numerous health advantages that plant-based food products provide has expanded this industry's customer base. Products made from plants help control blood pressure and reduce the risk of heart disease, stroke, colon cancer, prostate cancer, cholesterol, and early mortality. The market's manufacturers have released a number of high-quality food products in a variety of tastes with eye-catching packaging options, which should accelerate market expansion.

The main factor driving growth is the growing awareness of the benefits of switching to a vegan diet. People are switching from eating animal-derived food to plant-based food due to growing concerns about animal welfare and ethical treatment. As a result of this shift in customer preferences, there has been a noticeable rise in the consumption of plant-based foods.For example, in 2021, the delivery of plant-based meals increased by 17% on Grubhub, a well-known online meal delivery service. The food business was among the several sectors that experienced severe strain because to the COVID-19 outbreak. The worldwide shutdowns brought about significant changes to the food industry, including interruptions to food supply chains, modifications to product distribution networks, and associated consequences.

Market Concentration & Characteristics

This market is expected to increase as a result of consumers' growing inclination for high-quality skin care products and their increasing expenditure on them. However, in order to keep up with the ever-evolving expectations of consumers worldwide, manufacturers are encouraged to innovate, develop, and diversify their product offerings. This is because consumer tastes and wants are changing so quickly.

In the market for dairy substitutes, product releases are critical, especially for items that are high in ingredients and healthful. To remain competitive and satisfy the changing needs of consumers for natural and healthy ingredients, food companies in this industry depend on introducing new products.

Getting ingredient certifications is crucial for the dairy substitutes industry because it shows that manufacturers are dedicated to upholding high standards for sustainability, quality, and the environment. These certificates provide purchasers with peace of mind regarding the product's origin, production, and adherence to environmentally friendly standards by confirming its authenticity and dependability.

The market for dairy substitutes is heavily influenced by corporate social responsibility (CSR), which emphasizes the dedication to moral and sustainable business operations. Companies that participate in environmental and community-benefitting projects can cultivate enduring relationships with partners and customers as well as enhance their brand image.

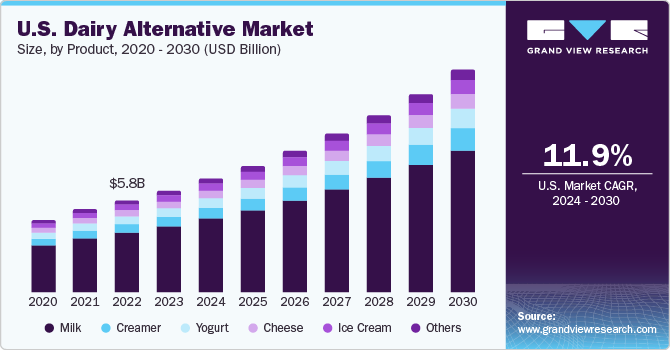

Product Insights

The non-dairy milk category accounted for a revenue share of 66.1% in 2023. includes various new and innovative beverage options with dairy alternatives as the base ingredient. The manufacturers of beverages are introducing new products for higher market capitalization. The increasing demand among consumers for varied beverage options has resulted in varied options of flavored beverages consisting of dairy alternatives. The flavored beverages also appeal to lactose-intolerant consumers who are looking for a variety of milk-based dairy alternative beverages.

The dairy-free ice cream market is projected to grow at a CAGR of 13.8% from 2024 to 2030. Shifting preference of consumers toward low-calorie soy and almond milk-based desserts is likely to propel the demand for plant-based ice cream products.

Source Insights

The market for almond-based dairy alternatives accounted for a revenue share of 41.2% in 2023. It is rich in Vitamin B, which helps raise the base metabolic rate of the body, enabling it to burn fats and calories more efficiently. Due to these nutritional benefits provided by almond milk, its demand is likely to contribute to the growth.

Almond milk has essential minerals such as iron, magnesium, phosphorous, zinc, and copper that help in controlling blood pressure, improving blood oxygenation, and providing body protection against diseases. In addition, almond milk is rich in Vitamin E and manganese, making it a more powerful drink for improving skin quality and for protecting against cancer.

Distribution Channel Insights

Supermarkets & hypermarkets dominated the North America dairy alternatives market with a revenue share of 41.2% in 2023. Some of the key factors driving the dominance of this segment include easy access and wide selection of brands or products.

Online sales of dairy alternatives are projected to grow at a CAGR of 13.0% from 2024 to 2030. Increased number of internet users, ease of access to number of brands, fast-paced lifestyle of the masses, 24/7 availability of products, convenience of shopping, and a wide range of products offered are factors driving the sales of dairy alternatives through online distribution channels in the region.

Country Insights

U.S. Dairy Alternatives Market Trends

The U.S. dairy alternatives market accounted for the largest revenue share of 84.1% in 2023. The key factors driving the growth of this market include the rising demand for healthy foods and beverages among millennials, coupled with the shift in preference toward organic foods and naturally-derived ingredients. Over the coming years, the country's concentration of important non-dairy product manufacturing enterprises is anticipated to fuel market expansion.

One of the leading producers of dairy substitutes worldwide is American-based Danone. The company sells a variety of lactose-free goods under the Silk brand. Over the course of the forecast period, the U.S. market is anticipated to rise due in large part to the growing popularity of lactose-free goods, growing consumer preferences for organic and healthful food products, and an increase in the number of cases of milk allergies.

In recent years, soymilk has been a key product segment of the dairy alternatives market in the U.S. The country is the among the largest producers of soybeans globally. Abundant availability of raw material and technology know-how are expected to have a positive impact on the growth of soymilk segment over the forecast period.

Canada Dairy Alternatives Market Trends

The growing use of lactose-free beverages as an alternative to cow's milk is slated to drive the growth of the Canada dairy alternatives market over the coming years. The country’s growing fast food consumption and shifting nutritional preferences will increase demand for cheese substitutes. Over the course of the forecast period, rising demand for lactose-free sweets in the nation is anticipated to positively affect market growth.

Mexico Dairy Alternatives Market Trends

The dairy alternatives market in Mexico is projected to grow at a CAGR of 13.7% from 2024 to 2030. The growth of this market is driven by the growing demand, particularly from non-Hispanic customers, for lactose-free beverages such soymilk, almond milk, rice milk, and others. Over the course of the forecast period, there is likely to be a rise in demand for dairy replacement products due to the growing prevalence of milk allergies among Mexican consumers. For the past few years, soymilk has dominated the Mexican market for dairy substitutes. It is projected that growing consumer demand for soy-based beverages due to its nutritional advantages-such as a decreased risk of obesity, cancer, and cholesterol-will propel market expansion.

Key North America Dairy Alternatives Company Insights

The dairy alternatives market in North America has been witnessing key developments in terms of product innovation and portfolio expansion among others. Both public and private companies have been proactive in initiating strategies to gain a competitive advantage in the market. In the near future, many new entrants are expected to follow suit. The presence of internationally renowned public players in the region is expected to augment the instances of mergers & acquisitions over the forecast period, given the inability of smaller and privately held players to compete with international market participants in terms of revenue generation, regional/global presence, and establishment of distribution channels.

-

In January 2022, Chobani LLC launched plant-based coffee creamers. These plant-based creamers are available in four flavors-Sweet & Creamy, Chocolate Hazelnut, French Vanilla, and Caramel Macchiato.

-

In October 2022, Danone North America announced a substantial USD 22 million investment in health and wellness initiatives. It also includes the reformulation of 70% of its plant-based milk alternatives with more wholesome ingredients. With the aim of positively impacting the dietary well-being of around 300 million Americans, Danone is dedicated to decreasing added sugars in its range of children's products. Furthermore, the company is set to enhance the nutritional value of a majority of its plant-based beverages as part of its commitment to fostering healthier choices.

Key North America Dairy Alternatives Companies:

- Danone North America Public Benefit Corporation

- Chobani LLC

- Eden Foods

- Melt Organic

- Earth’s Own

- Ripple Foods

- Living Harvest Foods, Inc.

- Daiya Foods Inc.

- Ecomil

- Hiland Dairy

Recent Developments

-

In July 2023, Daiya Foods introduced its latest offerings: Feta Cheeze Flavor Crumbles and Goat Cheeze Flavor Crumbles. These two new cheese alternatives were made available across Canada in June. The crumbled plant-based cheese products are crafted using oat flour, ensuring a creamy and indulgent texture that stands out from other plant-based alternatives.

-

In October 2022, SunOpta Inc. announced the sale of its sunflower business to Pacific Avenue Capital Partners for USD 16.0 million, with adjustments applied post-closing. The transaction was finalized on October 11, 2022. This move aligned with SunOpta's strategic focus on transformative portfolio enhancement, directing resources towards high-growth plant-based beverages like oat, soy, almond, rice, coconut, hemp, as well as nutritional beverages, broths, teas, and liquid and powder ingredients.

North America Dairy Alternatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.66 billion

Revenue forecast in 2030

USD 17.19 billion

Growth rate

CAGR of 12.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Danone North America Public Benefit Corporation; Chobani LLC; Eden Foods; Melt Organic; Earth’s Own; Ripple Foods; Living Harvest Foods, Inc.; Daiya Foods Inc.; Ecomil; Hiland Dairy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Dairy Alternatives Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America dairy alternatives market report on the basis of source, product, distribution channel, and country:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Almond

-

Coconut

-

Rice

-

Oats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Milk

-

Yogurt

-

Cheese

-

Ice Cream

-

Creamer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket & Hypermarkets

-

Convenience Stores

-

Online retail

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America dairy alternatives market size was estimated at USD 7.74 billion in 2023 and is expected to reach USD 8.66 billion in 2024.

b. The North America dairy alternatives market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 17.19 billion by 2030.

b. The U.S. dominated the North America dairy alternatives market with a share of 84.1% in 2023. This is attributable to the rising demand for healthy foods and beverages among millennials, coupled with the shift in preference toward organic foods and naturally-derived ingredients.

b. Some key players operating in the North America dairy alternatives market include Daiya Foods Inc., Eden Foods, Inc., Nutriops, S.L., Earth’s Own Food Company, SunOpta Inc., Freedom Foods Group Ltd., OATLY AB, Blue Diamond Growers, CP Kelco, Vitasoy International Holdings Limited, Organic Valley Family of Farms, and Living Harvest Foods Inc.

b. Key factors that are driving the market growth include rising incidences of lactose intolerance among consumers, coupled with the growing consumer knowledge about the benefits of plant-based dairy alternatives and other food products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."