- Home

- »

- Smart Textiles

- »

-

North America Disposable Gowns Market Size, Report, 2030GVR Report cover

![North America Disposable Gowns Market Size, Share & Trends Report]()

North America Disposable Gowns Market Size, Share & Trends Analysis Report By Material (Polyethylene, Polypropylene), By End-use (Food Processing), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-193-3

- Number of Report Pages: 112

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

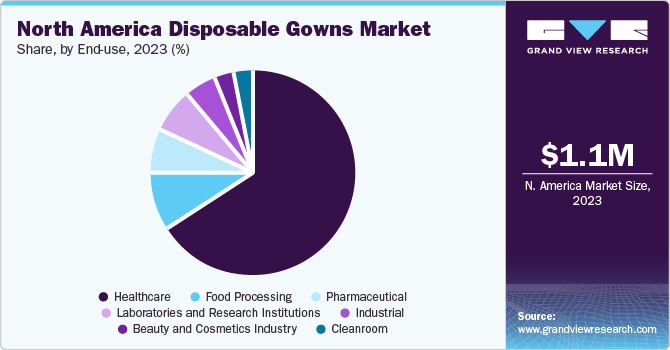

The North America disposable gowns market size was estimated at USD 1,143.1 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030. The growing population in the region and rising demand for processed food products owing to the convenience and ease are likely to boost the growth of the market over the forecast period.

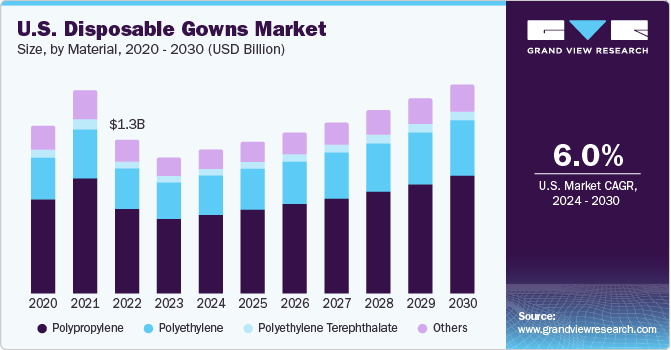

The U.S. disposable gowns market is expected to witness lucrative growth owing to the expansion of the end-use industries such as pharmaceutical, food processing, cosmetic, industrial, and research laboratories. North America's food and beverage processing industry is growing owing to the increasing per capita consumption and rising demand from the expanding population. According to World Bank data, the U.S. population increased by 1.2 million in 2022 compared to 2021. This growth trend is expected to positively impact the demand for food products.

The demand for plant-based food products is rapidly increasing in the U.S. on account of growing awareness regarding health among consumers. The increasing demand for plant based food products is further boosted by the shift in the diet habits due to the impact of the COVID-19 pandemic. As per the Plant-Based Food Association data, the total plant-based food products consumption exhibited a value-basis year on year growth of 6.6% in 2022. The increasing plant based food product demand is expected to positively impact the disposable gowns market growth over the forecast period.

The market has also surged due to the increasing compliance with the regulations in various end-use industries such as pharmaceutical, healthcare, food processing, industrial manufacturing, semiconductor fabrication, cleanroom activities, and others. The storage, product handling, processing/manufacturing, packaging, and other end products, chemicals, raw ingredients, and intermediaries in these various industries require proper safety gears such as disposable gowns. The regulations such as OSHA, U.S. FDA, FSMA, and ISO outlines the rules and guidelines for the use of disposable gowns in the end-use industries.

Various key manufactures are increasingly investing in the ensuring proper safety measures are followed in the workplace to prevent the risk of life and loss of money. The rising adoption of disposable gowns to comply with the regulations is expected to boost the growth of the market over the forecast period.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. North America disposable gowns industry is characterized by a high degree of competition owing to the large number of manufacturers and providers of the disposable gowns in the market. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product innovation, geographical expansions, and collaborations, to strengthen their position in the regional market.

The market is also characterized by a high level of research and development activities, expansions, collaboration, and product innovation. The use of polypropylene material for the production of disposable income also leads to the production of huge amounts of waste, which takes over 600 years to completely degrade in the landfill. Thus, manufacturers and researchers are collaborating on sustainable and biodegradable materials for manufacturing of disposable gowns. Key market players adopting this inorganic growth strategy include DuPont, Flavorseal, MEDTECS GROUP, PETOSKY PLASTICS, and others.

Safety regulations and standards help reduce the contamination of end products and the risks associated with it. The use of proper personal protective equipment, such as disposable gowns, in the food processing, healthcare, pharmaceutical, beauty & cosmetic industries, and others, can enhance the quality of products and ensure the safety of workers. Further, cleanrooms, research laboratories, and industrial manufacturing require a high level of worker protection as well as enhanced hygienic conditions.

With a proper barrier between products and workers, end products are less likely to be contaminated with biological, physical, or chemical substances. Commonly found contaminants on the human body and clothing are bacteria, dust, parasites, mold spores, cosmetic products, and other debris. Therefore, strict compliance with safety regulations and standards to prevent contamination is expected to significantly impact the penetration of disposable gowns.

Various companies are investing in developing highly efficient recycling techniques for all types of gowns. For instance, Go Zero Recycle is a startup that focuses on the recycling of disposable personal protective equipment, including protective clothing. The recycling service offered by the company includes disposable gowns, medical isolation gowns, food preparation aprons, coverall suits, bouffants, and cleanroom disposable clothing.

Material Insights

The polypropylene material segment dominated the market and accounted for a revenue share of 64.1% in 2023. Polypropylene is a lightweight material, which makes it easy to handle and comfortable for extended use in the various end-use industries including food & beverage, pharmaceutical, industrial, and cleanroom. Moreover, polypropylene is known for its durability and strength, providing resilience against wear and tear. This makes it suitable for applications that require robust and long-lasting materials, such as packaging in the food industry.

The polypropylene segment is expected to grow at the fastest CAGR over the forecast period. The polyethylene segment is likely to register second-fastest CAGR over the forecast period. Polyethylene disposable gowns have extensive applications in the food industry, providing a crucial layer of protection for workers involved in food processing, handling, and preparation. These gowns offer a lightweight and breathable solution, ensuring comfort for extended wear in demanding work environments.

End-use Insights

The healthcare segment led the market in 2023, owing to significant growth of the segment can be attributed to increasing expenditure on healthcare services. Owing to manufacturing advancements and technological developments, as the emergence of new treatments and medical procedures the healthcare spending is continuously increasing. Moreover, various government initiatives to improve the healthcare systems are expected to drive the growth of the market over the forecast period. For instance, Ayushman Bhava initiative was launched in September 2023 by the Indian government to provide healthcare schemes at the village level.

The pharmaceutical segment is expected to grow at the fastest CAGR over the forecast period. The prevalence of chronic diseases in North America is creating a new surplus demand for pharmaceutical products. According to the National Institute of Health, the number of people with at least one chronic disease among people aged over 50 is estimated to increase to 142.6 million in 2050 from 71.5 million in 2020. This in turn is expected to boost the domestic production of pharmaceuticals production with ongoing initiatives to revive domestic manufacturing in the U.S. The growing pharmaceutical production is anticipated to drive market growth over the forecast period.

Country Insights

U.S. led the market and accounted for a revenue share of 68.6% in 2023. The well-established end-user industries in the country and high adoption of safety gears as per regulatory compliance are attributed to the dominance in the North America disposable gowns industry. The growing population in the country is driving the demand for various commodities and goods & services, which are likely to catapult the demand for disposable gowns.

Canada Disposable Gowns Market

The disposable gowns market in Canada is expected to be driven by the growing end-use segments and rising demand for personal protective equipment such as disposable gowns. In the food processing industry, disposable gowns are used to reduce the risk of cross-contamination. According to Farm Credit Canada, food and beverage manufacturing revenue sales increased by 10.6% in 2022. This growth was mainly attributed to the grains and oilseed milling industry development.

Further, increasing healthcare spending in Canada is likely to facilitate the growth of the Canada disposable gowns market. According to the Canadian Institute for Health Information, total spending on health in Canada in 2023 increased by 2.8% compared to 2022. The lingering effect of the COVID-19 pandemic is expected to have contributed to the growth of spending on hospitals and physicians.

Mexico Disposable Gowns Market

The disposable gown market in Mexico is expected to grow at the highest CAGR over the forecast period owing to the increasing expansion of the end-use industries such as food manufacturing, pharmaceutical, cosmetic industries, industrial, and others, owing to the favorable macroeconomic conditions. Pharmaceutical production in the country is witnessing an upward trajectory.

For instance, according to the International Trade Administration, the production of pharmaceutical products including medical devices, equipment, and instruments, has surged from USD 20.80 billion in 2020 to USD 17.31 billion in 2023 in Mexico. This growth in the pharmaceutical sector serves as a pivotal driver for the escalating demand in the disposable gowns market.

Key Companies & Market Share Insights

The North America disposable gowns market is characterized by intense competition facilitating various key strategies adopted by key companies such as product development, facility launch, and technological innovations. Key manufacturers are collaborating with solution providers to build sustainable and biodegradable materials to solve the waste problems related to disposable gowns.

In December 2022, Team Rubicon and DuPont entered an expanded cooperation. This relationship includes Tyvek protective clothing donations, PPE application training and instructional support, safety-related website material, access to safety personnel, potential volunteers, and awareness-raising both inside and outside of DuPont.

Key North America Disposable Gowns Companies:

The following are the leading companies in the North America disposable gowns market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these North America disposable gowns companies are analyzed to map the supply network.

- DuPont

- ALPHAPROTECH

- Union Jack

- UltraSource LLC

- Flavorseal

- PolyConversions, Inc.

- Cellucap Manufacturing

- STRONG Manufacturers

- RONCO

- Tronex International, Inc.

- Kimberley-Clark Worldwide, Inc.

- O&M Halyard

Recent Developments:

-

In May 2023, the PETOSKEY PLASTICS opened a new manufacturing facility in the U.S. The new facility will produce disposable gowns for healthcare industry; the primary production capacity of the facility will be producing 2 million gowns per month.

-

In December 2022, Team Rubicon and DuPont entered an expanded cooperation. This relationship includes Tyvek protective clothing donations, PPE application training and instructional support, safety-related website material, access to safety personnel, potential volunteers, and awareness-raising both inside and outside of DuPont.

North America Disposable Gowns Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,205.9 million

Revenue forecast in 2030

USD 1,756.4 million

Growth rate

CAGR of 6.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

DuPont; ALPHAPROTECH; Union Jack; UltraSource LLC; Flavorseal; PolyConversions, Inc.; Cellucap Manufacturing; STRONG Manufacturers; RONCO; Tronex International, Inc.; Kimberly-Clark Worldwide, Inc.; O&M Halyard

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Disposable Gowns Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America disposable gowns market report based on material, end-use, and country:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polypropylene

-

Polyethylene Terephthalate

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Processing

-

By Application

-

Meat, Poultry, & Seafood

-

Bakery & Confectioneries

-

Dairy

-

Beverage

-

Grains

-

Others

-

-

By Material

-

Polyethylene

-

Polypropylene

-

Polyethylene Terephthalate

-

Others

-

-

-

Pharmaceutical, By Material

-

Polyethylene

-

Polypropylene

-

Polyethylene Terephthalate

-

Others

-

-

Laboratories and Research Institutions, By Material

-

Polyethylene

-

Polypropylene

-

Polyethylene Terephthalate

-

Others

-

-

Industrial, By Material

-

Polyethylene

-

Polypropylene

-

Polyethylene Terephthalate

-

Others

-

-

Beauty and Cosmetics Industry, By Material

-

Polyethylene

-

Polypropylene

-

Polyethylene Terephthalate

-

Others

-

-

Cleanroom, By Material

-

Polyethylene

-

Polypropylene

-

Polyethylene Terephthalate

-

Others

-

-

Healthcare, By Material

-

Polyethylene

-

Polypropylene

-

Polyethylene Terephthalate

-

Others

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America disposable gowns market size was estimated at USD 1,143.1 million in 2023 and is expected to be USD 1,205.9 million in 2024.

b. The North America disposable gowns market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 1,756.4 million by 2030

b. U.S. dominated the market in 2023 by accounting for a share of 68.6% of the market. The well-established end use companies in the country and strict compliance of the regulations drives the demand for disposable gowns in the country.

b. Some of the key players operating in the North America disposable gowns market include DuPont, ALPHAPROTECH, Union Jack, UltraSource, LLC, FLavroseal, PolyConversions, Inc., Cellucap Manufacturing, STRONG Manufacturers, RONCO, Tronex International, Inc., Kimberly-Clark Worldwide, Inc., and O&M Halyard.

b. The increasing focus on strengthening the regulatory framework for employee safety and enhance product quality is likely to boost the adoption of disposable gowns in various end use industries. Further, growing expansion of the end use industries across the regions expected to drive the growth of the market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."