- Home

- »

- Medical Devices

- »

-

North America Durable Medical Equipment Market Report 2030GVR Report cover

![North America Durable Medical Equipment Market Size, Share & Trends Report]()

North America Durable Medical Equipment Market Size, Share & Trends Analysis Report By Product, By End-use (Hospitals, Nursing Homes), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-943-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

The North America durable medical equipment market size was valued at USD 68.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030. The COVID-19 pandemic has affected the logistics and supply chain of the Durable Medical Equipment (DME). The market is majorly driven by the rising product demand due to the rising need for the product and the growing geriatric population that is prone to various chronic diseases, such as cancer, cardiovascular disorders, neurological disorders, and mobility disorders.

Durable medical equipment plays a major part in long-term remote care after surgery at home or any other healthcare setting. This is also estimated to propel market growth. Additionally, the stringent regulatory guidelines in developed countries and the lack of skilled professionals for this equipment are said to hinder the industry growth.

The rising chronic diseases and need for healthcare services have affected U.S. healthcare expenditure from USD 3.5 trillion in 2017 to USD 6.2 trillion in 2028 and account for 20% of the GDP. The anticipated growth in the annual spending for Medicare (7.9%) is projected to contribute significantly to the increase in the national health expenditure over the forecast period.

The COVID-19 pandemic negatively impacted the durable medical equipment market initially due to the lack of accessibility of the products to the customers. The pandemic has affected the operations and financial condition of various market players. The DME suppliers have faced interruptions in the logistics, such as significant delays and order cancellations, as a result of public health and economic emergencies related to the COVID-19 pandemic.

The rising chronic diseases have directed resulted in an increasing demand for DME. Cancer is one of the leading causes of death in the region. An estimated 608,570 Americans will die from cancer in 2021. As per the National Cancer Institute Report 2018, approximately 1.7 million people in the U.S. were diagnosed with cancer. Diabetes is another serious chronic disease that is responsible for market growth. In the U.S., 1 out of 10 people have diabetes and 11.3% of the U.S. population is living with diabetes.

The durable medical equipment users can avail reimbursement and coverage for the products are also likely to boost the growth of the market. Durable medical equipment is covered under Medicare. Medicare Part-B beneficiaries pay 20% of the approved cost of the product and the remaining 80% is paid by Medicare.

Product Insights

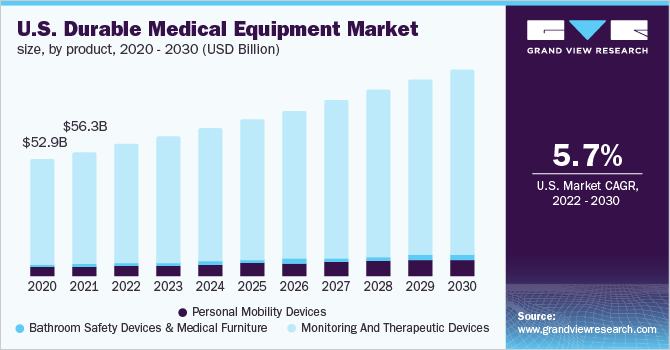

The monitoring and therapeutic devices held the largest market share of 89.4% in 2021 due to the increasing demand for health monitoring devices such as wristwatches or fitness bands. Increasing patient preference for at-home medical treatment or remote medical services over an in-patient setting is contributing to the segment growth. The other product segments include bathroom safety devices, personal mobility devices, and medical furniture.

The bathroom safety devices and medical furniture segment is anticipated to witness the fastest CAGR of over 6.8% during the forecast period. The increasing geriatric population, chronic illness, and the requirement for the medical furniture such as medical beds, transport chairs, etc. are likely to create more need & demand for mobility products over the forecast period as these factors generally reduce the ability to move and perform physical tasks to maintain independent functioning.

End-use Insights

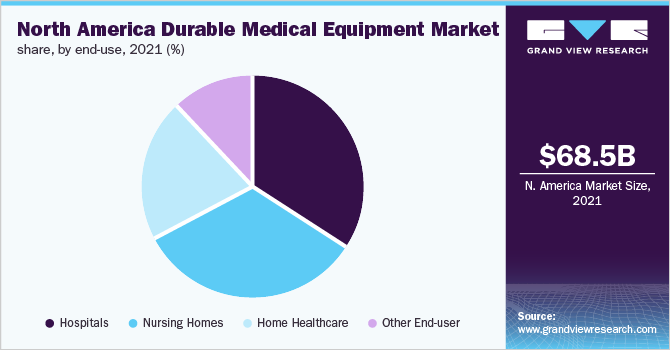

The end-use segment consists of hospitals, nursing homes, home healthcare, and other end-users. Hospitals led the end-use segment with 34.2% in 2021 on account of the rising number of patient admission due to the increasing chronic diseases and healthcare needs. There is a rise in the hospital’s financing and services capabilities to provide better care to the patients.

Nursing homes are considered to provide the most extensive care that can be offered in a non-hospital setting. Nursing homes also provide custodial care, which includes skilled care like providing food, dressing, etc. Factors, such as the increasing number of these establishments across the region are expected to boost the market over the forecast period.

Home healthcare is expected to witness the highest growth rate of 6.4% over the forecast period due to the cost-saving approach for the patient to get remote healthcare services and the rising demand for remote equipment for homecare use.

Regional Insights

The U.S. accounted highest market share of 82.2% in 2021. The rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. The presence of leading manufacturers and quick adoption of advanced products are projected to boost the region’s growth further.

The country is continuously developing cost-efficient and advanced devices for patients to capture a huge share of the market. In addition, the rise in the number of hospitals and the growing geriatric population are factors responsible for the regional market growth.

Canada is expected to be the fastest-growing country during the forecast period as a result of the rapid development of advanced DME products, rising target population base with increasing chronic diseases, the need for medical equipment by the patients, and supportive reimbursement policies.

Key Companies & Market Share Insights

Some of the major market players include Invacare Corp., Sunrise Medical, Arjo, Medline Industries, Inc., GF Healthcare Products, Inc., Carex Health Brands, Inc., Cardinal Health, Drive DeVilbiss Healthcare, NOVA Medical Products, Kaye Products, Inc. These companies are continuously focusing on initiatives such as mergers & acquisitions, regional expansion, and novel product development. For instance, in August 2020, Sunrise Medical completed the acquisition of Leckey and Firefly which is likely to extend the company’s existing pediatric mobility portfolio. Some prominent players in the North America durable medical equipment market include:

-

Invacare Corp.

-

Sunrise Medical

-

Arjo

-

Medline Industries, Inc.

-

GF Healthcare Products, Inc.

-

Carex Health Brands, Inc.

-

Cardinal Health

-

Drive DeVilbiss Healthcare

-

NOVA Medical Products

-

Kaye Products, Inc.

North America Durable Medical Equipment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 72.7 billion

Revenue forecast in 2030

USD 114.4 billion

Growth rate

CAGR of 5.8% from 2022 to 2030

Base year for estimation

2021

Historic data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Invacare Corp.; Sunrise Medical; Arjo; Medline Industries, Inc.; GF Healthcare Products, Inc.; Carex Health Brands, Inc.; Cardinal Health; Drive DeVilbiss Healthcare; NOVA Medical Products; Kaye Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America durable medical equipment market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Mobility Devices

-

Wheelchairs

-

Scooters

-

Walker and Rollators

-

Canes and Crutches

-

Door Openers

-

Other Devices

-

-

Bathroom Safety Devices And Medical Furniture

-

Commodes And Toilets

-

Mattress & Bedding Devices

-

-

Monitoring And Therapeutic Devices

-

Blood Sugar Monitors

-

Continuous Passive Motion (CPM)

-

Infusion Pumps

-

Nebulizers

-

Oxygen Equipment

-

Continuous Positive Airway Pressure (CPAP)

-

Suction Pumps

-

Traction Equipment

-

Others Equipment

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Nursing Homes

-

Home Healthcare

-

Other End-user

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America durable medical equipment market size was estimated at USD 68.5 billion in 2021 and is expected to reach USD 72.7 billion in 2022.

b. The North America durable medical equipment market is expected to grow at a compound annual growth rate of 5.8% from 2022 to 2030 to reach USD 114.4 billion by 2030.

b. U.S. dominated the North America DME market with a share of 82.3% in 2021. This is attributable to their ease of use, convenience, and patient preference for the equipment.

b. Some key players operating in the North America DME market include include Invacare Corporation; Sunrise Medical; ArjoHuntleigh; Hill-Rom; Stryker; Medline Industries, Inc.; Medical Device Depot, Inc.; GF Health Products Inc.; Carex Health Brands; Baxter International, Inc.; Becton, Dickinson and Company; and Joerns Healthcare LLC.

b. Key factors that are driving the U.S. durable medical equipment market growth include an increase in the prevalence of chronic disease, rapid technological advancements, and a rising aging population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."