- Home

- »

- Advanced Interior Materials

- »

-

North America Electrical Steel Market Size Report, 2030GVR Report cover

![North America Electrical Steel Market Size, Share & Trends Report]()

North America Electrical Steel Market Size, Share & Trends Analysis Report By Product (Grain Oriented Electrical Steel, Non-Oriented Electrical Steel), By Application (Transformers, Motors, Inductors), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-077-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

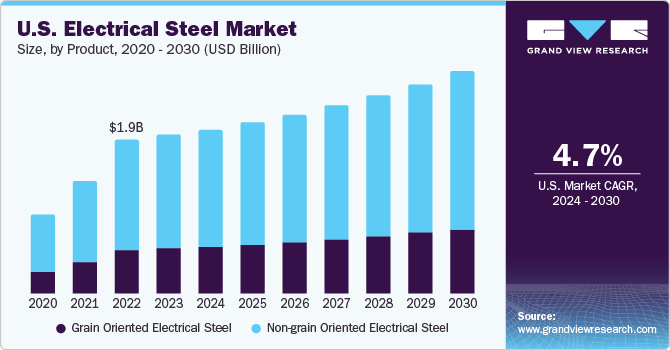

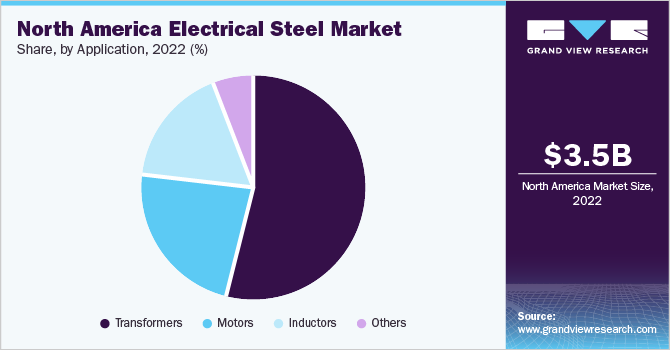

The North America electrical steel market size was valued at USD 3.50 billion in 2022 and is estimated to grow at a compounded annual growth rate (CAGR) of 5.0% from 2023 to 2030.Increasing electricity generation worldwide, awareness toward green energy, and rising demand for EVs are attributed to driving the market growth across the forecast period. Electrical steel finds application in transformers and inductors, which are further used in electricity generation and distribution. Growth in electricity production and developments in their distribution infrastructure, especially in developing economies are propelling their demand and thus, benefiting market growth. Further, motors are extensively used in EVs, and the shifting inclination towards electrification of vehicles is boosting demand for motors and propelling the consumption of electrical steel.

The U.S. dominates the overall market owing to rising investments in the energy industry and EV sector. The growing demand for electrical energy requires huge investments in power generation and equipment. Motors, generators, and transformers are the prominent equipment used in the industry. Thus, an increase in power output augments the use of electrical steel for manufacturing generators and motors.

Further, a positive government attitude toward EVs is anticipated to boost market growth. For instance, the U.S. president issued an executive order in August 2021 with the goal of having 50% of all new car sales be electric by 2030. As a result, several automakers are turning their attention towards EVs. For example, Bentley Motors in October 2021, announced that all of its vehicles are likely to be electric by 2030.

Also, in May 2022, Hyundai Motor Company announced to build an EV production facility in Georgia, U.S. The company is planning to construct the plant near its existing facilities dedicated to Kia and Hyundai brands. Thus, rising EV production is anticipated to aid market growth over the forecast period.

The market, however, witnesses restrictions with volatility in raw material prices. Coal, iron ore, and ferrosilicon are among the key raw materials for electrical steel, which face fluctuations in prices due to factors such as trade relations and the demand-supply gap.For instance, in May 2021, iron ore prices reached USD 237.5 per ton owing to the strong demand from China. This was a new record; however, prices eventually stabilized by the end of 2021.

Product Insights

Based on the product, Non-grain oriented electrical steel (NGOES) held more than 71.0% revenue share in 2022. It is an iron-silicon alloy with nearly the same magnetic properties in any direction. It contains medium to high alloy content depending on core loss requirement. It is utilized to provide exceptional magnetic characteristics, for applications such as electric home appliances, office equipment, and stabilizers.

The grain-oriented (GOES) segment is anticipated to register a growth rate of 5.5% in terms of revenue across the forecast period. GOES is produced from cold-rolled strips, providing an insulated coating with a thickness of less than 2 mm. It also helps to mitigate the eddy current losses. These strips are cut in lamination shapes, which are stacked on each other to form laminated cores of transformers, rotors, and stators of electric motors. GOES is an essential material in the production of energy-efficient transformers and generators.

Application Insights

Based on application, transformers dominated the market with a revenue share of over 53.0% in 2022. Cold rolled grain oriented (CRGO) core, also known as laminations, is used in transformers as core material to provide high permeability and mitigate eddy current losses. Increasing investment in expanding the grid increases the rate of deployment of transformers, which is anticipated to drive the market in the projected timeline.

The motors segment is expected to register the fastest CAGR of 5.5% in terms of revenue across the forecast period. The product manufacturers are focused on developing soft magnetic materials with high flux density and minimal core losses at high frequencies such as high-speed motors for EVs, power tools, and traction motors.

Increased demand for HVAC systems for residential, commercial, and industrial purposes drives the use of motors which is estimated to propel the market growth during the projected period. For instance, in June 2022, Daikin Comfort Technologies North America, Inc. announced to invest USD 230 million to set up a new plant by 2024.

The inductor segment is expected to register a growth rate of 5.1% in terms of revenue over the forecast period. The inductor is mostly used in power and electronic devices for blocking, choking, attenuating, or filtering/smoothing high-frequency noise in electrical circuits, transferring and storing energy in power converters, impedance matching, and other applications.

Regional Insights

The U.S. held a revenue share of over 73.0% in 2022, of the North America market. Increasing investment in green energy is anticipated to prove beneficial for market growth over the forecast period. For instance, a USD 550 billion clean energy investment package was passed by the US government in September 2021, and it is anticipated to modernize everything from power generation to transit networks. This is expected to propel the demand for electrical steel over the forecast period.

Canada is expected to register a CAGR of 5.4% in terms of revenue across the forecast period. The growth of the market in the country is attributed to rising investment in green energy and EVs.For instance, the Canadian government is focusing on new light-duty vehicle sales to be electric to 100% by 2035.

Mexico is facing inadequate infrastructure for transmission and distribution networks which has led to limited access to electricity in certain parts of the country. Thus, growing investment in increasing and upgrading the power generation capacity is propelling the demand for transformers, which in turn is anticipated to boost the usage of electrical steel. Some of the projects under the pipeline for upgrading the network are Mexico–Clark 69 transmission line in Pampanga by April 2028 and Liberty–Cabanatuan–San Rafael–Mexico 230 kV for upgrading the transmission line in Bulacan by April 2030.

Key Companies & Market Share Insights

The North America electrical steel market is highly competitive due to the presence of several major as well as small players. These companies, in order to have a competitive edge, are engaged in implementing different strategies such as development in significant research activities, technology, and presence in the regional market. For instance, in March 2023, United States Steel Corporation announced that it is going to start production of its new product InduX at its Big River Facility along with the commissioning of an NGO electric steel line. Some prominent players in the North America electrical steel market include:

-

ArcelorMittal

-

ATI

-

Cleveland-Cliffs Inc.

-

LIBERTY Steel Group

-

Steel Dynamics

-

Sumitomo Canada Limited

-

Union Electric Steel Corporation

-

United States Steel Corporation

North America Electrical Steel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.62 billion

Revenue forecast in 2030

USD 5.17 billion

Growth Rate

CAGR of 5.0% from 2023 to 2030

Market size volume in 2023

1,682.3 kilotons

Volume forecast in 2030

2,224.6 kilotons

Growth Rate

CAGR of 4.0 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2022

Forecast period

2023-2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

ArcelorMittal; United States Steel Corporation; Steel Dynamics; BRS;LIBERTY Steel Group; Sumitomo Canada Limited; Union Electric Steel Corporation; Cleveland-Cliffs Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Electrical Steel Market Report Segmentation

This report forecasts revenue and volume growth at country & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America electrical steel market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Non-Oriented Electrical Steel

-

Grain Oriented Electrical Steel

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transformers

-

Motors

-

Inductors

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America electrical steel market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 5.17 billion by 2030.

b. The transformer was the key application segment of the market with a revenue share of above 53.0% in 2022.

b. Some of the key vendors of the North America electrical steel market are ArcelorMittal, Union Electric Steel Corporation, United States Electric Steel, and Cleveland-Cliffs.

b. The key factor that is driving the growth of the North America electrical steel market is the rising investment by countries in green energy and EVs.

b. The North America electrical steel market size was estimated at USD 3.50 billion in 2022 and is expected to reach USD 3.62 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."