- Home

- »

- Advanced Interior Materials

- »

-

Electrical Steel Market Size & Share, Industry Report, 2033GVR Report cover

![Electrical Steel Market Size, Share & Trends Report]()

Electrical Steel Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Grain Oriented Electrical Steel, Non-Grain Oriented Electrical Steel), By Application (Motors, Inductors), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-029-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrical Steel Market Summary

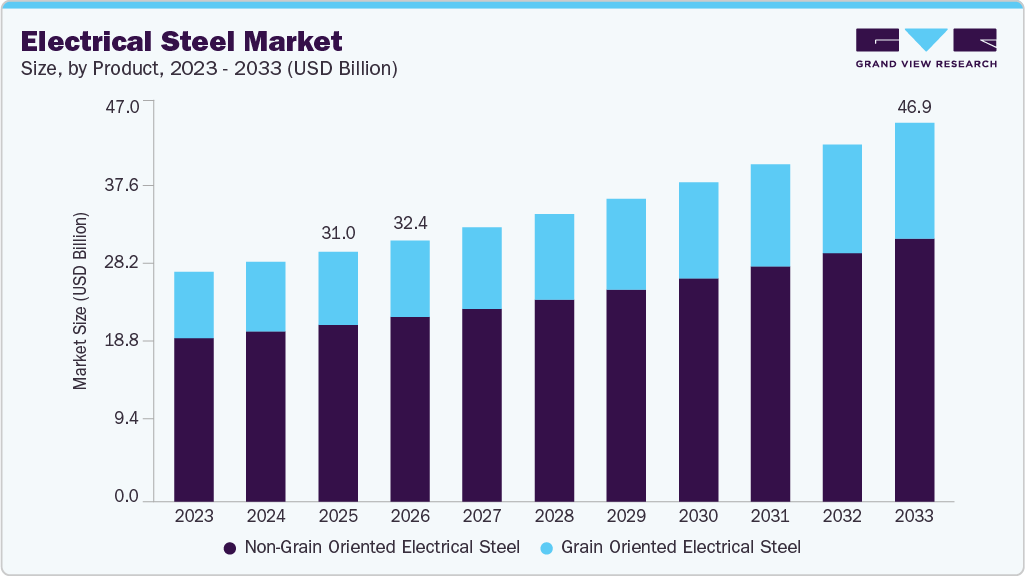

The global electrical steel market size was estimated at USD 31.00 billion in 2025 and is projected to reach USD 46.97 billion by 2033, at a CAGR of 5.5% from 2026 to 2033. Electrical steel continues to gain importance across generators, electric motors, relays, solenoids, and advanced electromagnetic devices that support modern power distribution and energy infrastructure.

Key Market Trends & Insights

- Asia Pacific dominated the electrical steel industry with the largest market revenue share of over 66.0%.

- By product, the grain oriented electrical steel segment is anticipated to register a CAGR of 6.1% from 2026 to 2033.

- By application, transformers accounted for the largest market revenue share of over 52% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 31.00 Billion

- 2033 Projected Market Size: USD 46.97 Billion

- CAGR (2026-2033): 5.5%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

These components form the backbone of grid systems, industrial machinery, and mobility technologies that rely on efficient magnetic performance. The U.S. remains the second-largest electricity generator globally. In 2024, the country produced nearly 4,300 TWh of electricity, reflecting steady grid expansion and rising consumption from electrified industries. This sustained generation activity strengthens demand for high-grade electrical steel used in transformers, distribution equipment, and power-handling machinery.The electric vehicle industry delivers an even stronger push. Electrical steel offers magnetic characteristics that are essential for the rotors and stators of EV motors, helping minimize core losses and extend driving range. As global EV adoption accelerates, automakers increasingly prioritize premium electrical steel grades to enhance performance. In 2024, global electric car sales exceeded 17 million units, marking an all-time high and confirming the transition toward large-scale electrification. This surge in EV output directly elevates the use of electric motors, intensifying the requirement for both grain-oriented and non-oriented electrical steel.

Growth in the EV sector also demonstrates resilience. Despite uneven trends in the broader automotive market, EV sales in 2024 continued to climb sharply, strengthening long-term expectations for global electrification. Increasing production volumes across major EV manufacturing hubs encourage higher consumption of high-efficiency motor components, pushing electrical steel demand from mobility applications to record levels. With automakers scaling dedicated EV platforms, the material’s importance across the automotive value chain becomes even more prominent.

Manufacturers of electrical steel are responding to this momentum with capacity expansion initiatives. Companies across Asia, Europe, and North America have invested in new cold-rolling, annealing, and coating lines to meet tightening efficiency standards and larger order volumes. In India, earlier moves toward capacity building have evolved into concrete project developments as demand from EVs, power transformers, and industrial machinery continues to grow. Strategic partnerships focused on technology transfer and production scaling highlight the sector’s shift toward regional self-sufficiency.

Drivers, Opportunities & Restraints

The electrical steel industry gains momentum from expanding renewable power installations, rising transformer demand, and continuous grid modernization across major economies. Growth in electric vehicles magnifies the requirement for high-efficiency motors, which strengthens the consumption of grain-oriented and non-oriented electrical steel. Industrial automation and appliance manufacturing add further support, as manufacturers seek materials that enhance energy performance and reduce operational losses.

Significant opportunities come from the rapid shift toward green infrastructure and smart grids. Utilities and governments are investing heavily in transmission upgrades, enabling producers of advanced electrical steel grades to capture value from premium efficiency categories. Emerging markets in Asia and the Middle East are scaling up their power networks, creating favorable conditions for new capacity additions, downstream partnerships, and technology-driven product differentiation.

The industry faces restraints involving volatile raw material prices, especially silicon and energy inputs, which pressure manufacturing margins. Production requires substantial technological precision, and supply limitations among leading producers can create bottlenecks. Environmental regulations on emissions from steelmaking facilities add cost burdens, and competition from alternative materials in certain applications can restrict market expansion.

Product Insights

Growth in the non-grain oriented electrical steel segment is shaped by rising demand for rotating machines that serve industrial and infrastructure activity worldwide. Motors used in manufacturing, HVAC systems, household appliances, and electric mobility require materials that deliver consistent magnetic performance in all directions, which strengthens the preference for this product. Urban expansion encourages higher consumption of compressors, pumps, and transformers used in residential and commercial buildings, lifting the requirement for non-grain oriented grades.

The grain oriented electrical steel segment is anticipated to register the fastest CAGR over the forecast period driven by expanding electricity demand and the continuous need for high-performance transformer cores in power distribution networks. Utilities worldwide are upgrading aging grids, installing new substations, and strengthening long-distance transmission lines, all of which require materials with superior magnetic permeability in a single preferred direction. This segment benefits from rising power consumption in emerging regions, where rapid industrialization and urban population growth call for reliable and efficient transformer capacity.

Application Insights

The transformers segment shows steady expansion due to rising electricity consumption and the broad upgrade cycle underway across global transmission and distribution networks. According to IEA, global energy investment is projected to reach around USD 3.3 trillion in 2025, a 2% real increase over 2024, with approximately USD 2.2 trillion flowing into clean energy areas such as renewables, nuclear grids, storage, low‑emissions fuels, efficiency, and electrification, roughly double the USD 1.1 trillion directed to oil, natural gas, and coal. Many regions are replacing aging transformers with modern energy efficient units that reduce core losses and improve overall grid stability.

Motors is anticipated to register the fastest CAGR over the forecast period. Growth in the motors segment is supported by broad industrial expansion and the rising shift toward energy efficient machinery across manufacturing, commercial buildings, and residential applications. Industries are investing in advanced motor-driven equipment to enhance productivity and reduce electricity consumption, which propels the adoption of premium electrical steel grades. The appliance sector adds further momentum as consumers increasingly prefer high-efficiency refrigerators, washing machines, and air conditioning systems that rely on motors with improved electromagnetic performance.

Regional Insights

The Asia Pacific electrical steel industry continues to experience strong expansion in demand, fueled by rapid industrialization across emerging economies. Manufacturing clusters in China, India, Vietnam, and Indonesia are scaling up production of motors, generators, compressors, and rotating machinery, which rely on electrical steel for improved magnetic performance and reduced core losses. This surge in industrial output has encouraged producers to upgrade equipment designs with premium non grain oriented and grain oriented grades that enhance efficiency across high load environments.

North America Electrical Steel Market Trends

The electrical steel industry in North America is expanding steadily as the region prioritizes energy efficiency, modernization of industrial assets, and the transition toward cleaner power systems. The manufacturing sector across the U.S. and Canada is upgrading machinery and production lines with high-efficiency motors and generators that depend on electrical steel for reduced losses and improved magnetic behavior, which directly enhances output quality and operational performance.

U.S. Electrical Steel Market Trends

The U.S. electrical steel industry is driven by a strong focus on energy efficiency and modernization across industrial operations. In December 2025, surging U.S. demand for grid transformers, up 274% for generator step-up units from 2019 levels, positions these equipment makers' investments as a primary driver for grain-oriented electrical steel, the essential core material comprising up to 70% of transformer weight.

Europe Electrical Steel Market Trends

The electrical steel industry in Europe is witnessing a growing demand, shaped by a strong push toward energy efficiency, industrial decarbonization, and greater electrification across multiple sectors. EU regulations require reduced energy consumption across machinery and appliances, which encourages widespread adoption of electrical steel that supports lower core losses and enhanced magnetic performance. This regulatory environment motivates manufacturers to redesign motors, compressors, and generators with premium grades that elevate operational efficiency.

Middle East & Africa Electrical Steel Market Trends

The electrical steel industry in the Middle East and Africa is witnessing rising demand, as governments invest heavily in expanding and modernizing power infrastructure. Many countries in the region are experiencing rapid growth in electricity consumption driven by population increases, industrial expansion, and new urban developments. This surge requires advanced transformers and distribution equipment that depend on high permeability electrical steel to minimize energy losses and improve overall grid stability.

Key Electrical Steel Company Insights

Some of the key players operating in the market include ArcelorMittal, Baosteel, and others.

-

ArcelorMittal operates as one of the world’s largest integrated steel producers with a broad presence across North America, Europe, South America, and Asia. The company focuses on high performance steel solutions for automotive, energy, construction, and industrial sectors. Its global manufacturing network enables a consistent supply of advanced ferrous materials supported by extensive R&D capabilities that emphasize efficiency, durability, and low environmental impact. ArcelorMittal continues to invest in technologies that enhance magnetic performance, energy efficiency, and sustainability across its electrical steel portfolio.

-

Baosteel stands as a leading steel producer in China with a strong global footprint supported by advanced production facilities and continuous innovation in specialty steels. The company serves automotive, energy, shipbuilding, machinery, and household appliance sectors through a diverse product range driven by high-quality standards and modern manufacturing technologies. Its significant investments in clean production, digital manufacturing, and high-end steelmaking have positioned it as a major supplier of premium electrical steel to domestic and international markets.

Key Electrical Steel Companies:

The following are the leading companies in the electrical steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Baosteel

- China Steel Corporation

- JFE Steel Corporation

- Nippon Steel Corporation

- POSCO

- Shougang Group

- Tata Steel

- Thyssenkrupp Steel Europe

- Voestalpine AG

Recent Developments

-

In December 2025, ArcelorMittal France plans to start up a new electrical steel production line at its Mardyck site in northern France, targeting high-grade electrical steels for electric vehicles, motors, generators, and industrial transformers. The USD 582 million project is the group's largest investment in Europe in the past decade and will lift ArcelorMittal's European electrical steel capacity to about 295,000 mt per year, with all such production in the region concentrated in France alongside the existing Saint-Chély-d'Apcher unit.

Electrical Steel Market Report Scope

Report Attribute

Details

Market definition

The market size represents the annual sales value of electrical steel sold for end use purposes.

Market size value in 2026

USD 32.39 billion

Revenue forecast in 2033

USD 46.97 billion

Growth rate

CAGR of 5.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; France; China; India; Japan; Brazil; Iran

Key companies profiled

Nippon Steel Corporation; POSCO; Voestalpine AG; ArcelorMittal; JFE Steel Corporation; Baosteel; Shougang Group; Thyssenkrupp Steel Europe; Tata Steel; China Steel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrical Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electrical steel market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Grain Oriented Electrical Steel

-

Non-Grain Oriented Electrical Steel

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Transformers

-

Motors

-

Inductors

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The key factor driving the growth of the global electrical steel market is the increasing demand for high efficiency transformers and motors across power generation, transmission, and industrial applications.

b. The global electrical steel market size was estimated at USD 31.00 billion in 2025 and is expected to reach USD 32.39 billion in 2026.

b. The global electrical steel market is expected to grow at a compound annual growth rate of 5.5% from 2026 to 2033 to reach USD 46.97 billion by 2033.

b. The non-grain oriented electrical steel segment dominated the market with a revenue share of 71.0% in 2025.

b. Some of the key players of the global electrical steel market are Nippon Steel Corporation, POSCO, Voestalpine AG, ArcelorMittal, JFE Steel Corporation, Baosteel, Shougang Group, Thyssenkrupp Steel Europe, Tata Steel, China Steel Corporation, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.