- Home

- »

- Pharmaceuticals

- »

-

North America, Europe & Asia Pacific Legal Cannabis Market Report, 2030GVR Report cover

![North America, Europe & Asia Pacific Legal Cannabis Market Size, Share & Trends Report]()

North America, Europe & Asia Pacific Legal Cannabis Market Size, Share & Trends Analysis Report By Source Type, By Derivatives, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-768-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

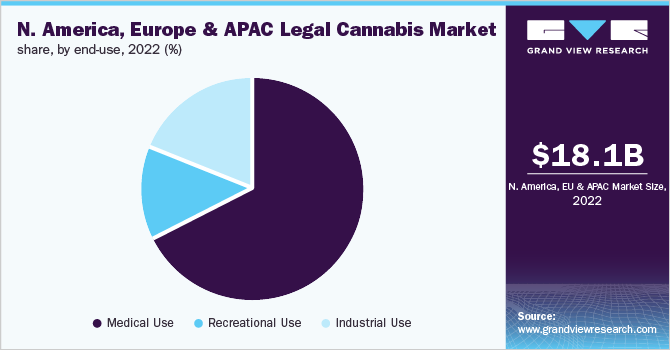

The North America, Europe, and Asia Pacific legal cannabis market size was valued at USD 18.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 22.3% from 2023 to 2030. On the economic front, recreational-use marijuana legalization will help create new job possibilities and add significantly to the economy. Tourism, real estate, finance, food, and transportation are just a few of the industries that will benefit from legalization. Many banks, for example, have begun to accept loans for marijuana businesses, which will gain traction following the legalization of marijuana for adult use. As a result, the upcoming recreational-use legalization is likely to increase the demand for legal cannabis and shrink the criminal market.

The presence of strict laws, on the other hand, makes it more difficult for manufacturers to establish a workable and legal route for the production and distribution of cannabis-derived goods like cannabidiol. Because different governments allow different activities in terms of hemp processing, extraction, and cultivation, several firms are obliged to operate in different countries. This makes determining the origin of the cannabidiol product and who is accountable for the end product's quality challenging. As a result, the legal cannabis market is expected to be hampered by the varying restrictions for these goods in different countries.

The growing number of states that have legalized medical marijuana and the rising demand from both medical and recreational applications are expected to drive the demand for medical marijuana in the coming years. Over the projected period, the drug's demand is expected to be driven by increasing research and development activities. The global pandemic has slowed market expansion dramatically. Trade restrictions, the implementation of a lockdown in major countries, and supply chain disruptions are just a few of the primary issues that have impacted the market.

During the pandemic, lockdowns and transportation interruptions disrupted product supply, resulting in a worsening of the supply-demand gap. As a result, not only the localized but also the global market was damaged. Increased use of marijuana, mostly for therapeutic purposes, is boosting total market growth as customers migrate away from traditional treatment methods and move toward cannabis-based treatment. Furthermore, the COVID-19 pandemic has had a severe influence on the market since a state-wide lockdown has disrupted product manufacturing and imposed import/export restrictions, reducing overall revenues.

The use of marijuana and hemp in a variety of businesses, including personal care and cosmetics, pharmaceuticals, nutraceuticals, and food and drinks, has aided expansion. Furthermore, the market is expected to be driven by the increasing use of cannabis and its variants as a raw material by enterprises to manufacture their products over the projected period.

Source Type Insights

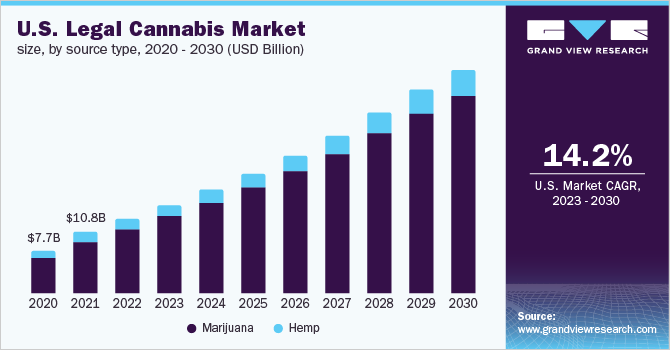

Marijuana captured the largest revenue share of over 74.5% in 2022 and it is expected to expand at the fastest rate during the projected period. Compared to oils or tinctures, smoking marijuana is low-priced and has a quicker medicinal onset, mainly a choice for flowers. They are also famous for recreational purposes, and this segment is predicted to grow lucratively as soon as the state government authorities complete their legalizing process.

Hemp is anticipated to register the fastest growth rate of 26.8%. Over the projection period, growing expertise on the consequences of smoking buds, instead of the usage of oils or tinctures, is projected to hamper this marketplace. The majority of the share in this category comes from the North American region where legalization is high as compared to other regions in consideration. This is a primary factor for the growth of this segment.

Derivatives Insights

CBD accounted for the largest revenue share of over 65.9% in 2022. The majority of the products that are being used for medicinal purposes have CBD and the use of medical cannabis has seen a significant surge in use since legalization. Furthermore, the increasing use of hemp-derived cannabidiol (CBD) in skincare and cosmetics, gummies, beverages, pet food, capsules, and dog treats is expected to boost demand throughout the projected period.

For example, Advanced Pain and Rehab Specialists, in partnership with Hemp Synergistics, performed a phase I clinical research in March 2021 to evaluate the efficacy of CBD for the treatment of pain, anxiety, sleeplessness, and opiate use reduction. In Asian countries where legalization is highly regulated and only products meeting the guidelines strictly are being sold in the market. In Japan, Hemp Foods Japan is one of the most successful hemp-based products companies since it meets the strict guidelines of this highly regulated plant.

The others is anticipated to register the fastest growth rate of 24.8% over the forecast period. The segment consists of minor cannabinoids, CBG, CBC, CBDa, etc. These products are also being recognized for their health benefits and are in high demand across the regions. One of the primary factors fostering the growth of these substances is the continuous research on trace substances derived from the cannabis plant. The above-listed factors all contribute significantly to the growth of the market.

End-use Insights

The medical use segment held the largest revenue share of over 65.0% in 2021. With more and more regions legalizing cannabis, its use has grown significantly, especially in North America, where the majority of states have legalized the use for medical purposes. This can be linked to the product's growing use in the management of chronic pain, mental illnesses such as anxiety, and sleep disturbances. Furthermore, growing practitioner knowledge is assisting segment expansion. According to the Australian Institute of Health and Welfare, in 2019, 41.0 percent of Australians supported cannabis legalization in July 2020. Because of the expanding body of clinical evidence, doctors are now recommending cannabis to their patients to treat a variety of medical ailments.

The recreational use segment is expected to witness a significant jump in the Asia Pacific region owing to the liberalization of laws regarding the use of cannabis. In May 2022, Thailand announced its plan to distribute one million cannabis plants across the nation that will allow residents to use it for personal medicinal use or small-scale commercial enterprise.

Regional Insights

North America held the largest revenue share of over 84.3% in 2022, and it is expected to expand at a rapid rate throughout the projected period. This can be linked to the product's growing use in the treatment of chronic pain and mental illnesses, such as anxiety and sleep disturbances. Furthermore, growing practitioner knowledge is assisting segment expansion. For example, since its legalization, the usage of cannabis for medical purposes has surged. Because of the expanding body of clinical evidence, doctors are now recommending cannabis to their patients to treat a variety of medical ailments.

The growing legalization of medical marijuana and the government's liberalism on the subject are boosting the growth of the regional market. Furthermore, the introduction of the 2018 Farm Bill to legalize hemp and hemp-based products in the U.S. is a major factor boosting product consumption and adoption in the U.S. An increase in the priority for CBD-based products such as wellness products, cosmetics and skincare, and food and beverages is also acting as a driver. The business is being fuelled by increased demand and positive consumer perceptions of cannabis and its derivatives in the country.

Asia is anticipated to register the fastest growth rate of 50.3% over the projected period. The increasing legalization and encouraging rules for the use of cannabis and its derivative products in countries are expected to boost growth. Thailand, for example, removed cannabis from its list of controlled narcotics in 2020. The consumption of hemp and marijuana in the country is projected to rise as a result of this.

Furthermore, the Australian government established a new cannabis law in 2019 that allows the Australian Capital Territory (ACT) to cultivate and possess marijuana for recreational use in Canberra. Residents of Canberra are able to possess up to 50 grams of cannabis and grow two plants per user or four plants per home at any given time, under this rule, which is likely to increase the demand for cannabis in the region. The Australian government, at the state and territorial levels, has approved rules allowing for simple access to medicinal cannabis products.

Key Companies & Market Share Insights

In the future years, rising demand is projected to encourage the arrival of several new players. Strategic initiatives like mergers and acquisitions, partnerships, product launches, and collaborations are also projected to increase market rivalry. Cultivators now have the tools and information they need to produce the strongest, most potent, and purest marijuana possible thanks to newly created equipment. For instance, Canopy Growth Corporation launched SurityPro, a new line of CBD-infused products for dogs, in 2021, to improve joint health and flexibility, healthy aging, quiet demeanor, and general physical and mental well-being. Some prominent players in the North America, Europe, and Asia Pacific legal cannabis market include:

-

Aurora Cannabis

-

Tilray

-

GW Pharmaceuticals

-

Canopy Growth Corporation

-

Lexaria Bioscience Corp.

-

Organigram Holdings Inc.

-

VIVO Cannabis Inc.

-

The Cronos Group

-

AusCann Group Holdings Ltd.

-

Cann Group Limited

-

Bod Australia

-

Zelira Therapeutics

-

Althea Group

-

THC Global Group Limited

-

MGC Pharma

-

ECOFIBRE

North America, Europe & Asia Pacific Legal Cannabis Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 18.1 billion

The revenue forecast in 2030

USD 89.8 billion

Growth rate

CAGR of 22.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source type, derivatives, end-use, region

Regional scope

North America, Europe, Asia Pacific

Country scope

U.S.; Canada; Germany; Italy; Poland; Czech Republic; Switzerland; Netherlands; Australia; New Zealand; South Korea; Thailand; Japan

Key companies profiled

CANOPY GROWTH CORPORATION; Aurora Cannabis; Tilray; GW Pharmaceuticals, plc; Organigram Holdings Inc.; Lexaria Bioscience Corp.; VIVO Cannabis Inc.; The Cronos Group; AusCann Group Holdings Ltd.; Cann Group Limited; Bod Australia; Zelira Therapeutics; Althea Group; THC Global Group Limited; MGC Pharma; ECOFIBRE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America, Europe & Asia Pacific Legal Cannabis Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research, Inc. has segmented the North America, Europe, and Asia Pacific legal cannabis market report based on source type, derivatives, end-use, and region:

-

Source Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Marijuana

-

Flower

-

Oil & Tinctures

-

-

Hemp

-

Hemp CBD

-

Supplements

-

Industrial Hemp

-

-

-

Derivatives Outlook (Revenue, USD Million, 2017 - 2030)

-

CBD

-

THC

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Medical Use

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Recreational Use

-

Industrial Use

-

Textile

-

Non-textile

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Italy

-

Netherlands

-

Poland

-

Czech Republic

-

Switzerland

-

-

Asia Pacific

-

Australia

-

New Zealand

-

Thailand

-

Japan

-

South Korea

-

-

Frequently Asked Questions About This Report

b. North America, Europe & Asia Pacific legal cannabis market size was estimated at USD 18.1 billion in 2022 and is expected to reach USD 22.0 billion in 2023.

b. North America, Europe & Asia Pacific legal cannabis market is expected to grow at a compound annual growth rate of 22.3% from 2023 to 2030 to reach USD 89.8 billion by 2030.

b. Marijuana dominated North America, Europe & Asia Pacific legal cannabis market with a share of 74.5% in 2022. This is attributable to the increasing adoption of marijuana coupled with the growing legalization of marijuana for medical and adult-use.

b. Some key players operating in North America, Europe & Asia Pacific legal cannabis market include Aphria, Inc.; Canopy Growth Corporation, Aurora Cannabis, Maricann Group, Inc.; ABcann Medicinals, Inc.; Tilray, The Cronos Group, GW Pharmaceuticals, plc., Organigram Holding, Inc.; and Lexaria Bioscience Corp.

b. Key factors that are driving the market growth include increasing the acceptance of hemp & marijuana and its derivatives, growing awareness about its medical benefits, and the easy availability of these products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."