- Home

- »

- Advanced Interior Materials

- »

-

North America And Europe Metal Powder Market Report, 2030GVR Report cover

![North America And Europe Metal Powder Market Size, Share & Trends Report]()

North America And Europe Metal Powder Market Size, Share & Trends Analysis Report By Material (Iron, Nickel, Stainless Steel), By Process, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-023-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

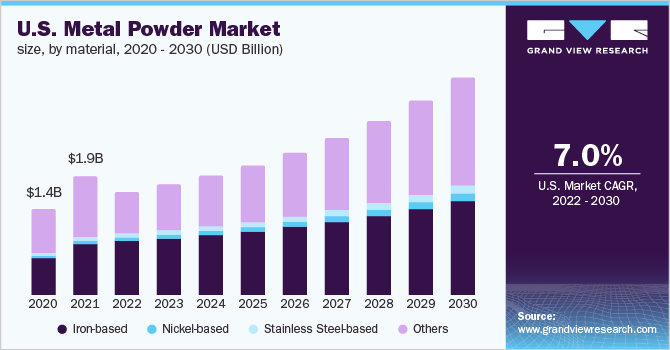

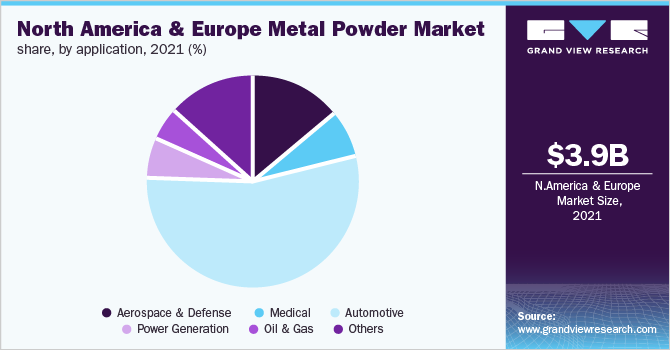

The North America and Europe metal powder market size was valued at USD 3.93 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2022 to 2030. The market is anticipated to be driven by the growing demand for additive manufacturing (AM) parts from the aerospace & defense industry. Metal powder-based components are witnessing high demand from this sector owing to increased emphasis on weight reduction to improve efficiency.

The ability of the AM process to produce low-cost and complex equipment in less time is expected to propel product demand over the forecast period. The U.S. holds the largest share of the North American metal powder market. Growing technological advancements, rising emphasis on the incorporation of AM technology, and growing investments in the automotive and aerospace & defense industries are propelling the product demand in the country. The country has a widespread presence of metal powder manufacturers as well as end-users.

The aerospace & defense sector continues to witness high investments in AM. For example, Senvol, an AM data specialist, received a new round of funding in March 2021 from the Department of Defense to optimize aerospace & defense components. Also, in August 2021, the Marine Corps got a headcap 3D printed for a rocket motor.

New purchasing orders for U.S. defense aircraft from major countries are anticipated to boost the demand for metal powders. For instance, in December 2021, the Israeli government signed a USD 3 billion deal to buy U.S. military aircraft. Similarly, in March 2022, the German government announced that it is planning to purchase 35 Lockheed F-35 fighter jets from the U.S.

As the demand for sustainability is increasing, key players in the industry are investing to enhance their products. For instance, in March 2022, IperionX Ltd. scaled its titanium metal powder production, which is manufactured by using 100% recycled titanium as feedstock in Salt Lake City, Utah. The company is planning to build a new Titanium Demonstration Facility (TDF) with a capacity of 125 tons per year in Halifax County, Virginia.

Material Insights

The iron-based material segment dominated the market with a revenue share of nearly 50.0% in 2021. Iron and steel are extensively used in the powder metallurgy processes, especially in press & sinter, on account of their abundant availability, low cost, and efficient characteristics. Iron powder is used in the production of steel and magnetic alloys. A growing preference toward the usage of low-cost metal through press & sinter is likely to augment segment growth over the forecast period.

In the past few years, the demand for AM has increased. For instance, in 2019, the Germany-based Fraunhofer Institute for Manufacturing Technology and Advanced Materials successfully processed and tested a new type of iron powder, which the institute believed to open up new opportunities in metal AM. Iron powders for AM are tailor-made with high-purity iron, good flow ability, high green density, and minimal cost.

Nickel enhances the properties of low alloy steel components by giving the exact particle size, shape, and density to the powder. It also provides corrosion resistance benefits. It is used to produce smooth coatings along with nickel flakes that can be used in metallic paints. Nickel powder is combined with other metals, such as iron and steel, to impart corrosion resistance, high strength, and excellent toughness at a higher temperature, especially in marine and power generation applications.

Process Insights

Press & sinter was the largest process segment in 2021, with a revenue share of over 47.0%. The process is a conventional technology used to produce metal powder components. Pressing involves mixing metal powders with additives or lubricants to produce a homogenous mixture, which is then compacted using dies at pressures varying from 138 MPa to 965 MPa. This provides hardness and strength to the metal components.

Metal injection molding (MIM) is a lucrative segment of the market. It has vital significance in the automotive industry, as the process enables the cost-effective production of geometrically sophisticated components in bulk. Another major advantage of MIM is minimal material loss during production, as approximately 98% of the feedstock ends up in the final product.

AM is anticipated to register the fastest growth rate across the forecast period. The process works through CAD, enabling the production of components using a layer-by-layer, or additive method of construction, therefore aiding in the manufacturing of complex structures without adding machining and manual labor. The final products can be produced without the need for expensive molds like in the casting processes. Metal powders are extensively used in the AM process.

Application Insights

Based on application, the automotive segment held the largest revenue share of over 54.0% in 2021. In the automotive industry, various parts and components of engines, chassis, and transmission are manufactured using metal powder. Furthermore, the introduction of AM in the automotive industry is propelling market growth. For instance, in December 2021, Porsche invested in a 3D printing company named INTAMSYS. Porsche is looking into exploring AM technology to manufacture and develop small series parts and components.

The medical segment is anticipated to register the fastest growth rate over the forecast period. The rise in demand for advanced medical components has pushed key players to partner with other companies to gain a competitive edge. For instance, in January 2022, Uniformity Labs signed an MOU with PrinterPrezz, Inc. to produce medical device parts. The partnership focuses on reducing the production cost of advanced medical devices by utilizing binder jetting and laser powder bed fusion technology.

Oil & gas is another lucrative segment in the market. NiCr superalloy powders such as Ni 718 and Ni 625 produce components that are corrosion resistant and have high strength and tensile, fatigue, and creep resistance. Growing investments in the oil & gas industry are anticipated to propel the demand for metal powder-based components and aid market growth over the forecast period.

Regional Insights

Based on region, Europe held a revenue share of over 47.0% of the overall market in 2021. High volume production of automotive components supported by vehicle parts production is likely to boost the demand for metal powder in the region over the coming years. The rising prominence of EVs is projected to provide numerous opportunities to the European automotive industry.

With the requirement to reduce its dependence on oil & gas supply from Russia, investments in offshore oil & gas projects in Europe are anticipated to surge over the forecast period. For instance, in April 2022, the Turkish government announced an investment of approximately USD 111 million to construct a subsea gas facility in the Black Sea. The first phase of the project is expected to start in 2023. Growing investments in the European oil & gas industry are further expected to aid in the market growth.

The North America metal powder market is likely to expand at a revenue-based CAGR of 6.9% from 2022 to 2030. The market growth is attributed to the large-scale production in the automotive and aerospace industries, along with the growth of the AM industry. For instance, in May 2022, the U.S. government launched Additive Manufacturing Forward (AM Forward), which is a voluntary agreement between major manufacturers to support smaller U.S.-based suppliers in using AM more frequently. The government will support this effort with numerous proposed and current Federal initiatives.

Key Companies & Market Share Insights

The North America and Europe metal powder market is characterized by the presence of established players including GKN PLC, Sandvik AB, Rio Tinto, and Höganäs AB. These companies use an established distribution and sales network to connect with their customers across different regions. New product development and competitive pricing are some of the key focus areas of the manufacturers to strengthen their position in the market.

The growth of lightweight vehicles, technological advancements, and raw material costs influence the price of metal powder products, along with macroeconomic factors. Market players formulate strategies in line with the above factors, along with the performance of the key application industries of metal powder, namely automotive, oil & gas, aerospace & defense, and medical. Some of the prominent players in the North America and Europe metal powder market include:

-

Lineage Metallurgical LLC

-

OC Oerlikon Management AG

-

Powder Alloy Corporation

-

SMP Metal Powder

-

Steward Advanced Materials LLC

North America And Europe Metal Powder Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.52 billion

Revenue forecast in 2030

USD 7.30 billion

Growth rate

CAGR of 7.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, Volume in tons, CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume, forecast, competitive landscape, growth factors, and trends

Segments covered

Material, process, application, region

Country scope

U.S.; Germany; U.K.; France

Key companies profiled

Lineage Metallurgical LLC; OC Oerlikon Management AG; Powder Alloy Corporation; SMP Metal Powder; Steward Advanced Materials LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

North America And Europe Metal Powder Market Segmentation

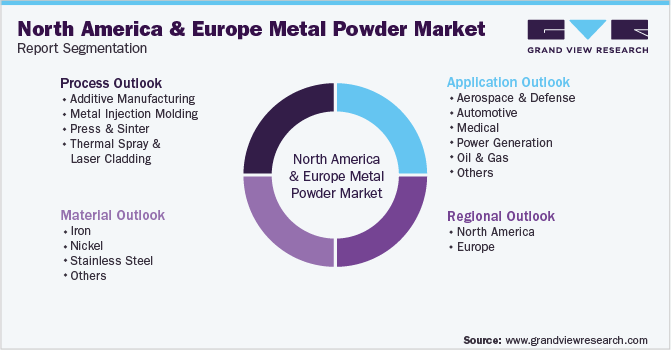

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America and Europe metal powder market report based on material, process, application, and region:

-

Material Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Iron

-

Nickel

-

Stainless Steel

-

Others

-

-

Process Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Additive Manufacturing

-

Metal Injection Molding

-

Press & Sinter

-

Thermal Spray and Laser Cladding

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

Automotive

-

Medical

-

Power Generation

-

Oil & Gas

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Frequently Asked Questions About This Report

b. The North America and Europe metal powder market size was estimated at USD 3.93 billion in 2021 and is expected to drop down to USD 3.52 billion in 2022.

b. The North America and Europe metal powder market is expected to grow at a compound annual growth rate of 7.1% from 2022 to 2030 to reach USD 7.30 billion by 2030.

b. Based on application, automotive accounted for largest revenue share of more than 50.0% in 2021 of the overall market. The share is attributed to the large-scale production of vehicles along with rising penetration of lightweight metal components in the automotive industry.

b. The key players operating in the North America and Europe metal powder market include, Lineage Metallurgical LLC, OC Oerlikon Management AG, Powder Alloy Corporation, SMP Metal Powder, Steward Advanced Materials LLC

b. Growing demand for additive manufacturing in aerospace & defense is one of the key growth drivers, which is expected to drive the North America and Europe metal powder market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."