- Home

- »

- Medical Devices

- »

-

North America Extremity Tissue Expanders Market, Report 2030GVR Report cover

![North America Extremity Tissue Expanders Market Size, Share & Trends Report]()

North America Extremity Tissue Expanders Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Round, Anatomical, Rectangular, Crescent), By Type, By Application, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-2-68038-555-7

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

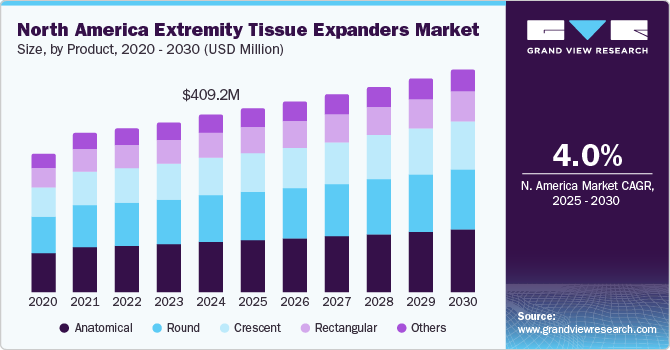

The North America extremity tissue expanders market size was valued at USD 409.2 million in 2024 and is projected to grow at a CAGR of 4.0% from 2025 to 2030. This growth is driven by technological advancements that have developed more effective and minimally invasive tissue expanders, making them a preferred choice for reconstructive surgeries. In addition, there is a growing awareness among healthcare professionals and patients about the benefits of tissue expander-based treatments, which has increased their adoption. Improvements in the quality of patient care and the rise in healthcare expenditure also contribute to the market growth.

The rising incidence of breast cancer, which is the most prevalent cancer among women in the region, is also driving the demand for extremity tissue expanders. Each year, millions of women undergo mastectomies, creating a substantial need for effective breast reconstruction options, with tissue expanders being a preferred choice for many. The demand for extremity tissue expanders is further amplified by a surge in trauma-related injuries and severe road accidents, which necessitate advanced reconstructive procedures to restore functionality and aesthetics to affected extremities.

Product Insights

Based on product, the anatomical extremity tissue expanders segment accounted for the largest revenue share of 28.3% in 2024. The anatomical tissue expanders are designed to mimic the natural shape and contour of the body part they are expanding, making them ideal for reconstructive surgeries that require a more natural appearance. Their ability to provide a more aesthetically pleasing outcome has made them a popular choice among surgeons and patients.

The round extremity tissue expanders segment is expected to grow at a CAGR of 4.4% over the forecast period. Round tissue expanders are commonly used in procedures that require uniform expansion, such as certain types of limb reconstruction. Their simplicity and effectiveness in providing consistent results make them a preferred option for many reconstructive surgeries.

Type Insights

The upper extremity segment dominated the North American extremity tissue expanders market in 2024. The high prevalence of trauma-related injuries, sports-related injuries, and congenital defects requiring reconstructive surgeries has driven the demand for upper extremity tissue expanders. The segment's dominance is also supported by advanced surgical techniques and the availability of specialized devices tailored for upper extremity reconstruction.

The lower extremity segment is expected to grow fastest from 2025 to 2030, attributed to the increasing number of reconstructive surgeries required for injuries and conditions affecting the legs, feet, and ankles, particularly given that younger patients are more prone to ankle sprains, foot contusions/abrasions, and foot strains/sprains, while older patients tend to experience lower trunk fractures and contusions/abrasions. Advances in medical technology and surgical procedures have improved the effectiveness of tissue expanders in lower extremity reconstruction, leading to greater adoption.

Application Insights

The breast reconstruction segment contributed the largest share of the total revenue in 2024, attributed to the increasing number of breast cancer survivors opting for reconstructive surgery and the rising awareness about the benefits of tissue expansion techniques. Breast reconstruction using tissue expanders allows for the creation of a natural-looking breast by gradually stretching the skin and muscle to accommodate an implant.

The oral and maxillofacial reconstruction segment is projected to grow fastest over the forecast period, driven by the increasing incidence of facial trauma and congenital defects and the rising demand for cosmetic enhancements. Tissue expanders are used in these procedures to create additional skin and soft tissue, essential for reconstructive facial and jaw surgeries.

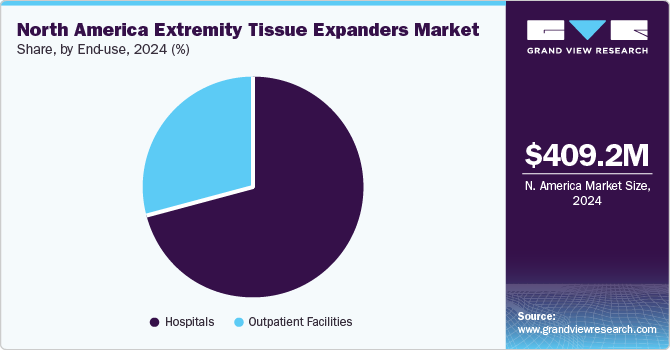

End-use Insights

The hospital segment was the largest revenue contributor in 2024. Hospitals are equipped with advanced medical infrastructure and experienced healthcare professionals, which makes them the preferred choice for complex reconstructive surgeries requiring tissue expanders. These institutions handle a high volume of trauma cases, congenital deformities, and oncological surgeries, all of which necessitate the use of tissue expanders. Hospitals often have multidisciplinary teams that can provide comprehensive pre and post-operative care, ensuring better patient outcomes and driving the demand for tissue expanders in this setting.

The outpatient facilities segment is anticipated to grow steadily over the forecast period. This growth can be attributed to the increasing shift towards minimally invasive procedures and the rising preference for same-day surgeries. Outpatient facilities offer the advantage of shorter hospital stays and lower overall healthcare costs, making them an attractive option for patients and healthcare providers alike. The advancements in surgical techniques and anesthesia have enabled tissue expansion procedures in these settings without compromising safety or efficacy. As a result, more patients are opting for outpatient facilities for their reconstructive needs, contributing to the steady growth of this segment.

Country Insights

U.S. Extremity Tissue Expanders Market Trends

The U.S. held the largest revenue share in the North American extremity tissue expanders market in 2024 attributed to the country's advanced healthcare infrastructure, high prevalence of trauma-related injuries, and a significant number of reconstructive surgeries performed annually. The U.S. market benefits from continuous technological advancements and the presence of leading medical device companies that offer innovative tissue expander solutions.

Canada Extremity Tissue Expanders Market Trends

Canada extremity tissue expanders market is expected to grow at a CAGR of 6.1% from 2025 to 2030, driven by the rising number of road accidents and trauma injuries, which necessitate reconstructive surgeries involving extremity tissue expanders. The Canadian healthcare system's focus on improving patient outcomes and the increasing adoption of advanced surgical techniques contribute to the market expansion.

Mexico Extremity Tissue Expanders Market Trends

Mexico extremity tissue expanders market is projected to grow steadily over the forecast period supported by the increasing demand for reconstructive surgeries due to trauma-related injuries and congenital defects. The Mexican healthcare system is gradually improving, with more facilities adopting advanced surgical techniques and offering tissue expander-based treatments. The rising middle-class population and their growing awareness of reconstructive options also contribute to the steady expansion of the market.

Key North America Extremity Tissue Expanders Company Insights

Some of the key companies in the North American extremity tissue expanders market include Mentor Worldwide LLC, PMT Corporation, Sientra, Inc., KOKEN CO., LTD., and GC Aesthetics.

-

Mentor Worldwide LLC, a subsidiary of Johnson & Johnson, offers a wide range of tissue expanders, including smooth, textured, and anatomical designs, catering to various reconstructive needs.

-

PMT Corporation specializes in manufacturing medical devices for plastic and reconstructive surgery, including extremity tissue expanders. Its product offerings include Integra and Accuspan tissue expanders.

Key North America Extremity Tissue Expanders Companies:

- Mentor Worldwide LLC

- PMT Corporation

- Sientra, Inc.

- KOKEN CO., LTD.

- GC Aesthetics

- ARION Laboratories

- Guangzhou Wanhe Plastic Material Co., Ltd

- Sebbin

- Eurosurgical Ltd.

- Specialty Surgical Products, Inc.

Recent Developments

-

In October 2023, Establishment Labs Holdings Inc. obtained FDA 510(k) clearance for its Motiva Flora SmoothSilk Tissue Expander. This advanced device integrates proprietary technology, including the company's patented SmoothSilk surface, to reduce inflammation and foreign body response. Furthermore, Flora incorporates a non-magnetic port with RFID capability and is categorized as MR Conditional by the FDA, ensuring compatibility with MRI procedures and potentially improving the precision of radiation oncology treatments.

North America Extremity Tissue Expanders Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 424.4 million

Revenue forecast in 2030

USD 516.3 million

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application end-use, region

Country scope

U.S., Canada, Mexico

Key companies profiled

Mentor Worldwide LLC, PMT Corporation, Sientra, Inc., KOKEN CO., LTD., GC Aesthetics, ARION Laboratories, Guangzhou Wanhe Plastic Material Co., Ltd, Sebbin, Eurosurgical Ltd., Specialty Surgical Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Extremity Tissue Expanders Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America Extremity tissue expanders market report based on product, type, application end-use, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Anatomical

-

Round

-

Rectangular

-

Crescent

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Extremity

-

Lower Extremity

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Reconstruction

-

Scalp Reconstruction

-

Oral And Maxillofacial Reconstruction

-

Pediatrics

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.