- Home

- »

- Medical Devices

- »

-

Breast Reconstruction Market Size And Share Report, 2030GVR Report cover

![Breast Reconstruction Market Size, Share & Trends Report]()

Breast Reconstruction Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Implants, Tissue Expander), By Shape (Round, Anatomical), By End-use (Hospitals, ASCs), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-129-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Breast Reconstruction Market Summary

The global breast reconstruction market size was estimated at USD 2.16 billion in 2024 and is projected to reach USD 3.15 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. This growth is being aided by the rising breast cancer cases along with the presence of favorable reimbursement policies.

Key Market Trends & Insights

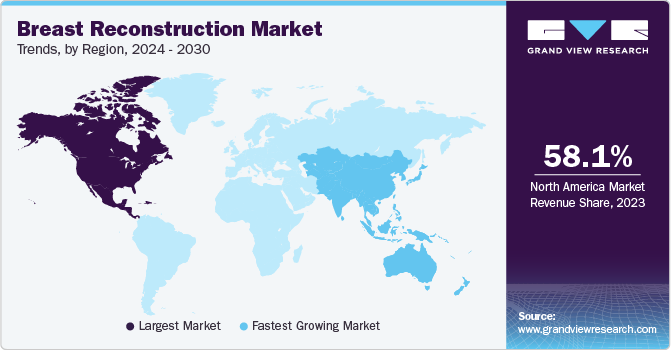

- North America accounted for the largest revenue share of 58.09% in 2023.

- By product, the implants segment held the largest revenue share of 60.39% in 2023.

- By shape, the round-shaped segment held the largest revenue share of 55.19% in 2023

Market Size & Forecast

- 2024 Market Size: USD 2.16 Billion

- 2030 Projected Market Size: USD 3.15 Million

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2023

Additionally, a rise in the number of breast reconstruction procedures, as well as technological developments, is anticipated to drive market expansion. As per Medicare, breast reconstruction can be reimbursed provided the patient has undergone breast mastectomy owing to breast cancer. Moreover, as per Services Australia, the external breast prosthesis reimbursement program can reimburse breast prostheses after breast cancer. Such factors are expected to propel industry growth.

Moreover, to meet the increasing demand for breast reconstruction, key players are undertaking various strategic initiatives, such as product launches, awareness campaigns, and geographic expansions. For instance, the American Society of Plastic Surgeons and The Plastic Surgery Foundation organized the Breast Reconstruction Awareness Day program on October 18, 2023. The main purpose of this program was to create awareness about breast reconstruction among women when diagnosed with breast cancer. Similarly, in October 2021, Sientra, Inc. along with Mission Plasticos launched a philanthropic initiative, ‘Reshaping Lives: Full Circle’. This was aimed at providing women living in poverty with breast reconstruction post-mastectomy.

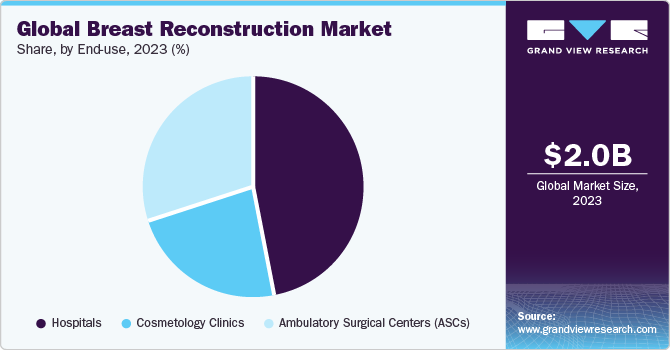

End-use Insights

The hospital segment dominated the market with a share of 46.79% in 2023 due to a rise in the number of hospitals worldwide. For instance, according to the Athar Institute of Health Management & Studies, hospitals in India make up 80% of the total healthcare market. Moreover, as per The Canadian Encyclopedia, there are 706 public & 193 private hospitals in Canada. In addition, there has been an increase in medical tourism globally. A rise in medical tourism is expected to increase the quality of healthcare facilities provided by hospitals.

The ambulatory surgical centers (ASCs) segment is projected to witness the fastest CAGR of 6.64% from 2024 to 2030. This growth rate can be attributed to a global increase in the number of breast reconstruction surgeries performed in ASCs. For instance, as per the Plastic Surgery Statistics Report, approximately 1,692,717 breast reconstruction surgeries were performed in the ASCs. Also, a similar report stated that there was an around 7% increase from 2019 to 2020. Such factors are anticipated to drive significant segment growth in the near future.

Regional Insights

Based on region, North America accounted for the largest revenue share of 58.09% in 2023. This was owing to the rising number of breast cancer cases in North America. For example, according to the Canadian Cancer Society, around 78 women are diagnosed with breast cancer daily in Canada, while 15 women die per day due to this condition. Moreover, a similar source states that 28,600 women in Canada were expected to be diagnosed with breast cancer in 2022.

This number represents 25% of the new cases of cancer overall. Therefore, above mentioned factors are expected to boost market growth in this region. Asia Pacific is projected to register a CAGR of 6.91% from 2024 to 2030. This strong growth rate is owing to the rapidly rising number of breast cancer cases along with growing awareness about breast reconstruction surgeries. For instance, as per a report by NIH, in 2022, around 4,820,000 new breast cancer cases were reported in China, with 3,210,000 deaths in the same year.

Market Dynamics

The rising prevalence of breast cancer globally is expected to drive market growth. For instance, the World Health Organization (WHO) reports that globally, around 2.3 million women were diagnosed with breast cancer in 2020. As per statistics published by breastcancer.org, breast cancer accounts for an estimated 30% of all cancer cases diagnosed among women in the United States annually. In 2023, as per the American Cancer Society, approximately 297,790 new cases of invasive breast cancer are expected to be registered among women in the country, as well as 55,720 new cases of Ductal Carcinoma In Situ (DCIS). Also, according to Breast Cancer Now, one out of seven women in the UK is anticipated to be diagnosed with breast cancer. Thus, a visible growth in the number of people suffering from breast cancer is expected to boost the demand for breast reconstruction procedures. These factors are expected to propel industry growth.

Product Insights

On the basis of product, the market is segmented into implants, tissue expanders, and acellular dermal matrix. The implants segment held the largest revenue share of 60.39% in 2023. This growth is aided by the rising use of breast implants in breast augmentation surgeries. For example, as per the NCBI, around 8.08 women per 1,000 in the United States have any type of breast implant. Moreover, the University of Utah Health states that an estimated 35 million women have textured breast implants; a similar source says that it is believed that over 1.5 million women have breast implants annually. However, the tissue expander segment is projected to witness the fastest CAGR of 6.69% from 2024 to 2030.

This is attributed to the increasing use of tissue expanders for breast reconstruction. For instance, according to a report by Science Direct, tissue expander reconstruction contributed to 65% of the total breast reconstruction procedures performed. As per Medscape, with 137,808 breast reconstruction surgeries performed in the U.S. in 2020, 60.6% included tissue expanders and implants. In addition, breast reconstruction with the use of a tissue expander has several advantages as it is faster, simpler, and relatively cheaper. Furthermore, key players are focusing on launching a wide range of tissue expanders to increase their industry share. For instance, in June 2023, Sientra, Inc. received U.S. FDA approval for its AlloX2 Pro Tissue Expander.

Shape Insights

On the basis of shape, the market has been sub-segmented into round and anatomical. The round-shaped segment held the largest revenue share of 55.19% in 2023 due to an increasing number of product launches, regular FDA updates on breast implant safety, and the conduction of various clinical trials. For instance, in May 2021, GC Aesthetics launched its next-generation round silicone breast implant PERLE. In October 2021, the U.S. FDA updated its safety requirements for breast implants, and restricted the sales & distribution of breast implants, to ensure patients undergoing breast implant surgery have adequate information.

However, the anatomical shape segment is projected to grow at a CAGR of 6.67% from 2024 to 2030. The growth rate can be attributed to several advantages of anatomically shaped breast implants. For instance, according to the Sayah Institute, these implants provide a natural shape and textured surface, therefore, it does not shift after placement. Moreover, their texture makes them ideal for breast augmentation in women with little natural breast tissue. Thus, propelling the segment growth.

Key Companies & Market Share Insights

Key players are adopting various strategies, such as geographic expansions, mergers & acquisitions, partnerships, new product launches, and seeking government approvals, to strengthen their foothold in the industry. For instance, in March 2023, Establishment Labs announced entering into a collaborative agreement with companies in Europe and a secondary partner network in Japan, to launch Mia Femtech, a minimally invasive breast aesthetics solution. Similarly, in October 2023, ExxonMobil merged with Pioneer Natural Resources. Key players are investing heavily in research and development to manufacture technologically advanced products.

Key Breast Reconstruction Companies:

- Mentor Medical Systems B.V. (Johnson & Johnson)

- Allergan, Inc. (AbbVie)

- Sientra, Inc.

- Ideal Implant Incorporated

- Establishment Labs

- POLYTECH Health & Aesthetics GmbH

- RTI Surgical

- Sebbin

- Integra LifeSciences

- GC Aesthetics

Breast Reconstruction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.28 billion

Revenue forecast in 2030

USD 3.15 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, shape, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Mentor Medical Systems B.V.; Allergan Inc.; Sientra Inc.; Ideal Implant Inc.; Establishment Labs S.A.; POLYTECH Health & Aesthetics GmbH; RTI Surgical Holdings; Sebbin; Integra LifeSciences; GC Aesthetics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

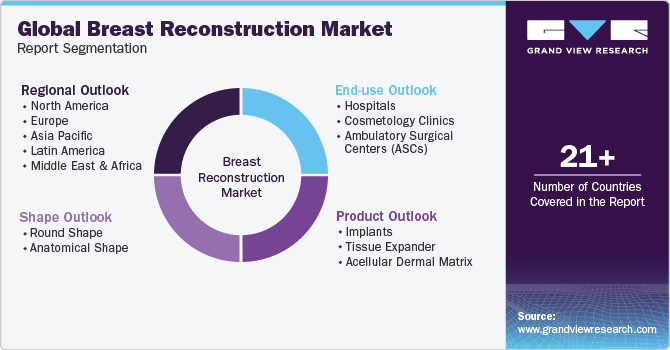

Global Breast Reconstruction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the breast reconstruction market report based on product, shape, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Silicone Breast Implants

-

Saline Breast Implants

-

-

Tissue Expander

-

Saline Expander

-

Air Tissue Expander

-

-

Acellular Dermal Matrix

-

-

Shape Outlook (Revenue, USD Million, 2018 - 2030)

-

Round Shape

-

Anatomical Shape

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cosmetology Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast reconstruction market size was estimated at USD 2.0 billion in 2023 and is expected to reach USD 2.1 billion in 2024.

b. The global breast reconstruction market is expected to witness a compound annual growth rate of 6.54% from 2024 to 2030 to reach USD 3.1 billion by 2030.

b. North America dominated the breast reconstruction market with a share of 58.1% in 2023. This is attributable to rising healthcare awareness and constant research and development initiatives.

b. Some key players operating in the breast reconstruction market include Mentor Worldwide LLC, Allergan Inc., Sientra, Inc., Deal Implant Incorporated, Establishment Labs S.A, POLYTECH Health & Aesthetics GmbH, RTI Surgical Holdings, Inc., and GROUPE SEBBIN SAS.

b. Key factors that are driving the breast reconstruction market growth include the rising number of breast reconstruction procedures, the increasing incidence of breast cancer, and the introduction of technologically advanced products across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.