- Home

- »

- Nutraceuticals & Functional Foods

- »

-

North America Gummy Market Size & Share Report, 2030GVR Report cover

![North America Gummy Market Size, Share & Trends Report]()

North America Gummy Market Size, Share & Trends Analysis Report By Product (Vitamins, Minerals), By Ingredient (Gelatin, Plant-based Gelatin Substitute), By End-use (Adult, Kids), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-183-6

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America gummy market size was estimated at USD 3.07 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.9% from 2024 to 2030. The increasing demand for functional and fortified gummy, availability of gummy supplements in different flavors, rising preference for natural products, and a growing interest in vegan gummy, are projected to propel market growth of gummy in the North America region over the forecast period. Gummies are a convenient and easy-to-use format for delivering a wide range of active ingredients, including vitamins, minerals, and supplements. The growing popularity of gummies as a delivery format is one of the major factors driving the growth of the gummy industry in the North American region.

The consumer preferences for food and nutritional supplements are changing. Consumer demand for nutritional products have increased significantly in recent years due to increased health awareness and concerns about the negative effects of processed foods and artificial ingredients. Consumers are looking for products that taste good and offer health benefits. This trend is particularly noticeable in the market, where consumers seek chews that work and are fortified with vitamins, minerals, and other nutrients. The growing demand for this type of chewing gum is due to the increasing awareness of the importance of maintaining good health through proper nutrition. People are increasingly aware of the nutrients their bodies need and are looking for convenient and enjoyable ways to supplement their food.

Moreover, the market is witnessing a surge in diverse gummy formats. Beyond the conventional gummy bear shape, manufacturers are introducing innovative designs and novel formats to enhance consumer appeal. This includes gummies in the form of slices, cubes, and even intricate shapes corresponding to specific health themes. The variety in format not only caters to aesthetic preferences but also allows for creative product differentiation. This diversification resonates well with consumers, offering them a broader array of choices that align with their tastes and preferences and thereby, contributing to the growth of market in the region.

In addition, the increasing demand for vegan and vegetarian options is significantly shaping the market in the North America region. This trend is driven by a growing consumer preference for plant-based alternatives, reflecting not only dietary choices but also ethical and environmental considerations. In the U.S., the adoption of vegan and vegetarian lifestyles has gained substantial momentum, influencing purchasing behaviors across various product categories, including dietary supplements. Gummy supplements, traditionally formulated with gelatin, are now undergoing a transformation to cater to the preferences of a more plant-centric consumer base. Manufacturers are increasingly opting for plant-derived alternatives such as pectin, agar-agar, and other plant-based gelling agents to replace traditional animal-derived gelatin, this is expected to augment the growth of the market during the forecast period.

Market Concentration & Characteristics

In North America, the market for gummy shows a medium to high degree of innovation. Companies are continuously introducing new flavors, formulations, and functional ingredients to meet the evolving consumer preferences. Furthermore, the innovations include the incorporation of vitamins, minerals, and supplements, along with the introduction of vegan and natural gummy options. Manufacturers are targeting various age groups by introducing gummies designed specifically for adults and children.

The mergers and acquisitions are in the range of low to medium in the market. Companies undergoing the mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage on each other’s strengths. Moreover, the competitive nature of the market has led to further encouraging the players to explore synergies, leading to occasional mergers and acquisitions aiming to gain a competitive edge and achieving economies of scale in the market.

Regulatory requirements, particularly those set by authorities such as the FDA in the U.S. and relevant agencies in Mexico, influence product development, manufacturing processes, labeling, and marketing practices. Compliance with these regulations is mandatory for the market participants to ensure safety and quality of gummy products.

The market faces competition from traditional supplement formats such as pills and capsules. However, the unique characteristics of gummies, including enjoyable taste, ease of consumption, and diverse formulations, position them as distinct products. Gummies are considered a preferred option, especially among consumers who find traditional supplement formats less appealing. The continual innovation in gummy formulations acts as a restraint to easy substitution.

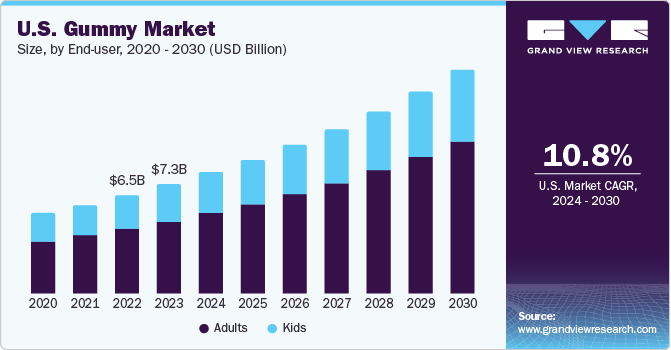

Gummies, available in a variety of formulations, address the preferences of various consumer segments, including the adults, children, and seniors. The market's wide product range prevents it from being excessively dependent on any particular demographic. However, the consumption pattern of gummies is highly skewed towards adults, accounting for more than 70% of the total gummy consumption. This results in a medium to high concentration for the North America gummy market.

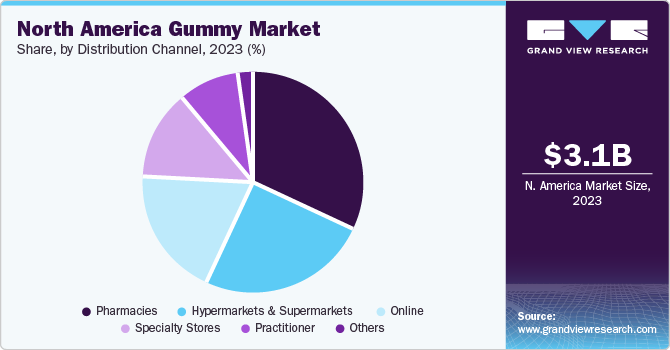

Distribution Channel Insights

The sales of gummy through pharmacies held a share of 31.7% in 2023. Pharmacies are considered the most convenient and trusted channel by consumers seeking health-related products. In addition, many pharmacists provide personal recommendations, encouraging consumers to try specific products. Furthermore, several pharmacies are expanding their product offerings by introducing gummy supplements to cater to a broader customer base. For example, the U.S.-based CVS Health pharmacy offers a range of supplements under its Live Better brand, including gummies, drops, and drink packets, for consumers who may have difficulty swallowing pills. As a result, pharmacies will continue to be the dominant sales platform for the market in the North America region during the forecast period.

The sales of gummies through online channels are expected to grow at the fastest CAGR from 2024 to 2030.The demand for gummy supplements through e-commerce or online channels is high due to the wide availability of multiple gummy supplement brands. These channels allow market players to display their products and gain global traction from consumers, which is impossible in other offline channels. In addition, these channels frequently implement dynamic pricing strategies and discounts to drive sales. These factors are considered highly favorable among consumers, encouraging them to purchase gummy supplements through online channels.

Product Insights

The vitamin gummy segment held the largest market share of 25.9% in 2023. The popularity of vitamin gummies is on the rise due to their similarity to gummy candies, which makes them an appealing choice for consumers who prefer a pleasant taste experience when taking their supplements. Several manufacturers are broadening their product range by providing gummy vitamins in different colors, shapes, and innovative flavors. In addition, the rising awareness of health among consumers positively contributes to the demand for vitamin gummies.

The CBD/ CBN gummy segment is expected to grow at the fastest CAGR during the forecast period. These gummies are gaining popularity among consumers as they help alleviate the symptoms of anxiety and depression and help relieve pain. Increased stress levels due to a hectic lifestyle drive the demand for gummy.In addition, the regulations over CBD and CBN make it difficult to diversify product offerings by manufacturers. However, the manufacturers in the U.S. are increasingly introducing minor cannabinoids, such as cannabigerol, to diversify their product portfolio. For example, U.S.-based Wyld offers hemp-derived gummies fortified with CBN, CBG, and CBD in elderberry flavor. All these factors are expected to augment the growth of CBD/ CBN gummies during the forecast period in the North American region.

Ingredient Insights

The gelatin gummy segment held a share of 73.7% in 2023. These gummies are the most common supplements provided by manufacturers. They offer ideal texture, cost-effectiveness, and compatibility with other ingredients driving its demand among the consumers. Furthermore, gelatin-based gummy offer a chewy texture that appeals to consumers. For instance, in October 2023, Cargill, an American global food corporation shared its consumer research at a trade show in Las Vegas, U.S. As per the research, 50% of respondents prefer the harder texture of gummy, which is produced due to gelatin. The preference and wide availability of the gelatin based gummy is likely to contribute to its demand during the forecast period.

Plant-based gelatin substitute gummy is expected to grow at the fastest CAGR during the forecast period. The rise in awareness of clean-label products among consumers and an increasing vegan population in the U.S. and Mexico have generated the demand for plant-based gelatin substitutes for use in gummy. Moreover, several manufacturers are launching vegan or plant-based gummy to cater to the growing demand for these gummy. For instance, U.S.-based AbsoluteXtracts, a provider of cannabis products, offers cannabis-infused gummy in three flavors. Gummies are made of vegan and all-natural ingredients and THC oil.

End-use Insights

The adults end-use segment held a share of 79.3% in 2023 in the market. A major factor driving the demand for gummies among adults is the enjoyable taste and texture of these supplements. The wide availability of gummies in different flavors makes them more appealing than traditional supplements such as pills or capsules among the adults. Furthermore, gummies are also easier to consume, especially for consumers who have difficulty swallowing pills or capsules. As documented by the National Library of Medicine, many studies have shown that pill-swallowing problems affect around 10% to 40% of the adult population in the U.S. Therefore, the sweet taste and chewy texture of gummies make them more appealing to consumers who avoid supplements due to texture or flavor.

Gummies for the kids is expected to grow at a stellar CAGR during the forecast period. The sweet taste of gummies and their availability in different flavors, shapes, and colors are among the key factors driving the demand for gummies among kids. Several players have launched innovative and unique gummy products to cater to the growing demand for gummies among the kids and parents. In February 2023, the iconic Smurfs brand collaborated with Florida-based leader in nutritional products Growve LLC for the launch of Smurfs Kids Gummies. These gummies are made with real fruit juices and purees, making them attractive to parents and kids. The collection includes gummies supporting immune health, digestive health, sleep, and multivitamins.

Regional Insights

The U.S. held market share of 98.7% in 2023. According to an article published by Glanbia Nutritionals, a leading innovator and solutions partner in the global food and nutrition industry, dated August 2021, stated that more than three in four consumers in the U.S. typically take vitamin, mineral, or supplement products. Among the various formats available in the market, gummies continue to be the preferred choice, particularly among younger consumers, appealing to 67% of individuals aged 18 to 34 years who either currently take or plan to take vitamins, minerals, or supplements in gummy format. Furthermore, the article revealed that the gummy format holds a significant market share in the U.S., reaching 17% in 2021, up from 13% in 2020. The popularity and the increase in consumption of the gummy in the U.S. is expected to contribute significantly to its demand and market growth during the forecast period.

The Mexico market is projected to grow at the fastest CAGR over the forecast period (2024 - 2030). In Mexico there has been a surge in product launches by manufacturers introducing a wide variety of gummy supplements to cater to diverse consumer needs. This includes gummies specifically tailored for men, women, various age groups, and specific health concerns, contributing to an extensive product offering. Moreover, in Mexico, there is a noticeable shift in consumer preferences towards the gummy format over traditional supplement formats. Gummies offer enjoyable taste, chewy texture, and wide range of flavors making gummies more appealing and convenient for consumption. All these factors are expected to contribute significantly to the growth of the market in the Mexico during the forecast period.

Key Companies & Market Share Insights

In the North America market, gummy manufacturers have been actively engaging in strategic initiatives, including product launches and partnerships. The manufacturers are focusing on innovation and meeting evolving consumer preferences. Many manufacturers have introduced functional gummies, incorporating vitamins, minerals, and supplements to cater to the growing demand for health-conscious products. In addition, there has been a notable trend towards the introduction of CBD-infused gummies in these countries as their regulatory framework permits its consumptions.

Furthermore, manufacturers in the market are strategically partnering with actresses and health advocates to introduce and launch innovative products that resonate with a health-conscious audience. This approach aims to leverage the growing market demand by increasing their presence and visibility among consumers.

-

In October 2023, Garden of Life expanded its well-received Vitamin Code line with a new range of gummy supplements. Consisting of seven products tailored to various needs, these gummies, like the rest of the Vitamin Code line, provide vitamins and minerals within a whole food base derived from raw fruits and vegetables. Moreover, they contain probiotics and enzymes, key elements noted throughout the Vitamin Code collection.

-

In June 2023, Nature's Bounty launched Sleep3 Gummies that incorporate L-theanine, time-release melatonin, and quick-release melatonin, all conveniently packaged in a gummy format. This innovative product is designed to prepare the body for a restful night's sleep and encourages sustained sleep for adults with occasional sleeplessness. Nature's Bounty Sleep3 Gummies are available at Target, CVS, and Amazon.com across the U.S.

-

In May 2023, SmartyPants Vitamins introduced a new range of gelatin-free multivitamin gummies at Walmart. The new multivitamins come in adult, children's, and toddler formulations, and are crafted without the use of gelatin, focusing on reduced sugar content.

-

In June 2022, Vitafusion, a subsidiary brand of Church & Dwight Co., Inc., collaborated with American actress Tiffany Haddish to release 2-in-1 gummies—Multi + Immune Support and Multi + Beauty—targeting immune health and beauty. These gummies feature biotin and retinol (or vitamin A RAE) to support hair, skin, and nails. They are available across the U.S., in CVS Pharmacy, Wakefern, Rite Aid, Publix, Target, and Walmart.

Key North America Gummy Companies:

- SCN BestCo

- Herbaland Gummy

- Boscogen, Inc.

- Pharmavite, LLC

- Church & Dwight Co., Inc.

- SMP Nutra

- Nature’s Bounty

- SmartyPants Vitamins

- Garden of Life

- Haleon plc

- Bayer AG

North America Gummy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.50 billion

Revenue forecast in 2030

USD 8.02 billion

Growth rate

CAGR of 14.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, end-use, distribution channel, country

Country scope

U.S.; Mexico

Key companies profiled

SCN BestCo; Herbaland Gummies; Boscogen, Inc.; Pharmavite, LLC; Church & Dwight Co., Inc.; SMP Nutra; Bayer AG; Nature’s Bounty; SmartyPants Vitamins; Garden of Life; Haleon plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Gummy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America gummy market report based on product, ingredient, end-use, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Minerals

-

Carbohydrates

-

Omega Fatty Acids

-

Proteins & Amino Acids

-

Probiotics & Prebiotics

-

Dietary Fibers

-

CBD/CBN

-

Psilocybin/Psychedelic Mushroom

-

Melatonin

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Plant-based Gelatin Substitute

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Men

-

Women

-

Pregnant Women

-

Geriatric

-

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies

-

Practitioner

-

Online

-

Others

-

-

CountryOutlook (Revenue, Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America gummy market size was estimated at USD 3.07 billion in 2023 and is expected to reach USD 3.50 billion in 2024.

b. The North America gummy market is expected to grow at a compounded growth rate of 14.9% from 2024 to 2030 to reach USD 8.02 billion by 2030.

b. Vitamin gummies accounted for a share of 25.9% in 2023 and is expected to hold a market size of USD 1.89 billion by 2030. The popularity of vitamin gummies is on the rise due to their similarity to gummy candies, which makes them an appealing choice for consumers who prefer a pleasant taste experience when taking their supplements.

b. Some key players operating in North America gummy market include SCN BestCo; Herbaland Gummies; Boscogen, Inc.; Pharmavite, LLC; Church & Dwight Co., Inc.; SMP Nutra; Bayer AG; Nature’s Bounty; SmartyPants Vitamins; Garden of Life; Haleon plc

b. The increasing demand for functional and fortified gummies, the availability of gummy supplements in different flavors, rising preference for natural products, and a growing interest in vegan gummies, are projected to propel market growth of gummies in the North America region over the forecast period. Gummies are a convenient and easy-to-use format for delivering a wide range of active ingredients, including vitamins, minerals, and supplements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."