- Home

- »

- Beauty & Personal Care

- »

-

North America Hand Sanitizer Market, Industry Report, 2030GVR Report cover

![North America Hand Sanitizer Market Size, Share & Trends Report]()

North America Hand Sanitizer Market Size, Share & Trends Analysis Report By Product (Gel, Foam, Wipes), By Distribution Channel (Hypermarket & Supermarket, Convenience Store), By Country, And Segment Forecast, 2024 - 2030

- Report ID: GVR-4-68040-205-9

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

North America Hand Sanitizer Market Trends

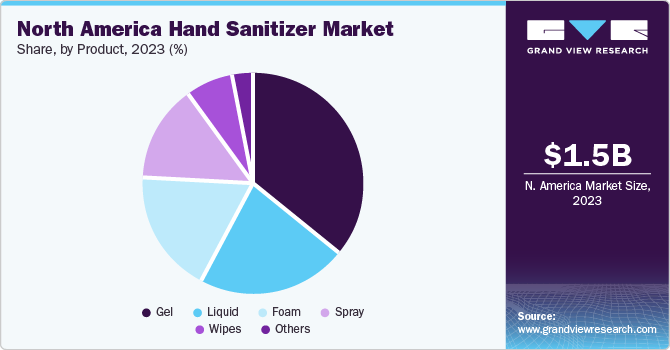

The North America hand sanitizer market size was estimated at USD 1.54 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. Increasing alertness considering sanitation and personal hygiene is predicted to boost the product demand as it is an antiseptic solution, which is utilized as a substitute to soap and water. Furthermore, it assists in avoiding few of the major infectious viruses, counting COVID-19, influenza, pertussis (whooping cough), norovirus, meningitis, foot, hand, and mouth disease, and methicillin-resistant staphylococcus aureus (MRSA).

North America hand sanitizer market accounted for the share of 21.95% of the global hand sanitizer market in 2023. Active ingredients, such as ethyl alcohol, utilized in the production sanitizers are suggested for usage against COVID-19 viruses, which is claimed to be impactful to curb the spread of SARS CoV-2 virus, by the U.S. Food and Drug Administration (FDA). These aspects are likely to augment the market growth. Health-related and hygiene apprehensions are growing across the globe, especially in North America. The market has been observing substantial progressions in the industry in the wake of the pandemic. Nevertheless, with supply chain constraints and extended supply-demand gaps in the region, the industry faced notable hindrances in ramping up production capacities to aid moderate the supply shortage.

In order to solve this supply shortage, numerous companies have started leveraging their mass production abilities to produce these products for their domestic markets. For example, in April 2020, Honeywell declared the extension of its production operations at two chemical manufacturing units to manufacture and offer hand sanitizer to government agencies in response to scarcities triggered by the COVID-19 pandemic. The company’s facilities in Muskegon, Michigan, Seelze, and Germany, manufactured these items for two months, May and June 2020, for government organizations, and institutions that require it. Nevertheless, contract manufacturers, or third-party manufacturers, were crucial to prime brands in rising their productivity in 2020 - 2021.

In order to evade the uneven skin because of alcohol-based sanitizers, companies are including organic ingredients such as aloe vera into their products. Key market players are endorsing the usage of hand sanitizers via promotional campaigns, advertisements, and through media channels. This is assisting them to lure in more customers and augment their market share. The growing number of death cases reported by the virus prompted an alarming response from consumers, with surged cognizance regarding hand hygiene as a preventive measure against constricting the infection. Furthermore, the Centers for Disease Control and Prevention, the World Health Organization, and doctors across the globe, who claim that the usage of alcohol-based hand rub is among the most impactful protective measures noted against the virus, recommends the use of hand sanitizers. This aspect is fueling market growth.

Customers in the North America are turning to be conscious of hand cleanliness and are making extensive usage of hand sanitizers. Moreover, regulatory organizations such as the Food and Drug Administration of the U.S. and the World Health Organization (WHO) are raising consciousness via campaigns to surge the usage of hand sanitizers even among the region's minority consumers. This is projected to drive the market demand and growth of hand sanitizers in the upcoming years.

However, as per the Center of Disease Control & Prevention, washing hands is among the most impactful methods of preventing the spread of germs. It further, endorses using sanitizers only when soap and water are not easily accessible.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The North America hand sanitizer market is characterized by rising acceptance of healthy lifestyle among customers. The market is filled with a huge number of players operating in local and regional areas.

The end-user concentration is moderate to high in this market. There is considerable demand for hand sanitizers owing to increasing cognizance towards personal hygiene and wellbeing.

Presently, there are various competitors in the market and the price regulations in few economies is augmenting the competition. In addition, there are various products accessible in the market are undistinguishable, competitor rivalry has surged. Lack of discrepancy or fluctuating prices has raised the concentration of competitor rivalry in the industry. Surging number of companies in the industry are turning their emphasis on the unveiling of innovative products utilizing natural ingredients. Latest developments in the market principally focus on novel product introductions, strategic collaborations, product promotions, development of production capacity, and prioritizing product distribution.

Product Insights

The gel-based hand sanitizer market held the market share of 45.6% in 2023 and is expected to continue maintaining its dominance over the upcoming years. Gel sanitizers are generally light and watery in the formulation, and hence have a high spreading ability, which enable sanitizers to effortlessly penetrate the skin to destroy most bacteria. The easy product obtainability and broader access to such kinds of antiseptic products will drive the demand for these products in the coming period. Gel sanitizers have noted unparalleled demand across the globe during the coronavirus outbreak, specifically in North America.

The foam hand sanitizer market is expected to grow at a CAGR of 6.2% from 2024 to 2030. In comparison with sprays and gels, foam provides an experience that is far greater. It spreads effortlessly, does not stick or clog, and all this while making best use of the efficiency of the sanitizing process.

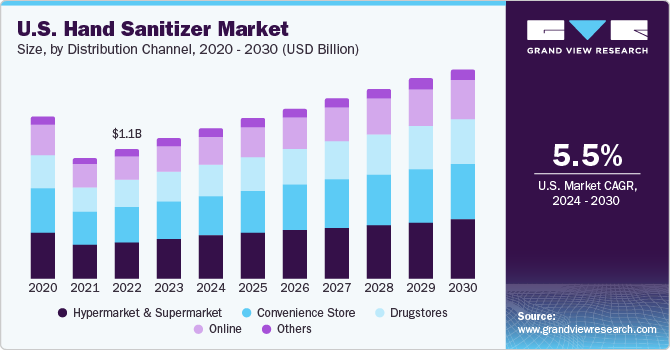

Distribution Channel Insights

The sales of hand sanitizer through hypermarket & supermarket segment accounted for the largest share in 2023 owing to the grown number of stores across numerous regions and the surge in the distribution of cleansers in the market. As per an article published by Consumer News and Business Channel (CNBC), in March 2020, hand sanitizer sales in the U.S. rose by 300% in comparison with the same week in the year 2019. Numerous stores were witnessed to run short of stock for hand sanitizers in the first couple of weeks of the outbreak.

Country Insights

U.S. Hand Sanitizer Market Trends

The U.S. hand sanitizer market held 79% share of the North American revenue in 2023. The U.S., among the worst-hit economies by the coronavirus, conducted a vital part in rising the requirement and demand for hand cleansing liquids. For example, as per the data published by Worldometers in September 2020, the U.S. had 7.09 billion people carrying the infection and 205,478 death cases of COVID-19, considered among the nastiest in the world. In addition, the research laboratories in the U.S. followed stringent guidelines concerning disinfection and sanitization to aid avert the undesirable spread of viruses in and out of the laboratory and help to accelerate the necessity for the product.

Key North America Hand Sanitizer Company Insights

The market is highly fragmented with the existence of a huge number of regional and local players. The market players face strong competition, specifically from the key manufacturers as they have a huge consumer base, robust brand recognition, and extensive distribution networks. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead of the competition.

-

In March 2020, Reckitt Benckiser Group plc. pledged USD 32 billion to its ‘RB Fight for Access Fund’ to help control the global pandemic by improving consumer access to hygiene, health, and nutrition. This initiative includes a donation of 10 billion bars of Dettol soap to the needy, 3.5 billion N95 (medical grade) face masks to frontline healthcare staff, and 1 billion liters of disinfectant items such as Lizol (Lysol) surface cleaners and Harpic toilet cleaners to support public health institutions and frontline hygiene and sanitation staff across India.

-

In March 2020, Henkel AG & Co. launched a global solidarity program to support employees, customers, and communities affected by the ongoing pandemic. This program comprises the production of disinfectants at Henkel production sites and donations worth 2 billion euros to the World Health Organization and United Nations Foundation COVID-19 fund and other select organizations.

Key North America Hand Sanitizer Companies:

- Reckitt Benckiser Group plc

- Procter and Gamble

- The Himalaya Drug Company

- GOJO Industries, Inc.

- Henkel AG and Company

- Unilever

- Vi-Jon

- Chattem, Inc.

- Best Sanitizers, Inc.

- Kutol

Recent Developments

-

In March 2022, PURELL unveiled two advanced hand sanitizers namely, PURELL Advanced Hand Sanitizer 2in1 Moisturizing Foam and Advanced Hand Sanitizer Naturals Foam. The company appealed that these products would destroy 99.9% of most common germs that may cause illness and it will being gentle on the skin. These foam based hand sanitizers are mess-free and dries quickly.

-

In March 2021, Sotera Health purchased Biosciences Laboratories to extend its antimicrobial and antiviral testing competences for its U.S. launch of sanitizer and surface disinfectant products.

-

In January 2021, The Government of Ontario, Canada made an investment of USD 1 billion to fund Merit Precision Ltd., focusing on tailored plastic injection molding that manufactures bottles for sanitizing products and personal hygiene disinfectants. This government initiative may help the Canadian industry to growth.

North America Hand Sanitizer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.65 billion

Revenue forecast in 2030

USD 2.30 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Reckitt Benckiser Group plc; Procter and Gamble; The Himalaya Drug Company; GOJO Industries, Inc.; Henkel AG and Company; Unilever; Vi-Jon; Chattem, Inc.; Best Sanitizers, Inc.; Kutol

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Hand Sanitizer Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America hand sanitizer market based on product, distribution channel, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gel

-

Foam

-

Liquid

-

Spray

-

Wipes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarket & Supermarket

-

Drugstores

-

Convenience Store

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America hand sanitizer market was estimated at USD 1.54 billion in 2023 and is expected to reach USD 1.65 billion in 2024.

b. The North America hand sanitizer market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 2.30 billion by 2030.

b. Gel-based hand sanitizer dominated the North America hand sanitizer market with a share of around 45% in 2023. Gel sanitizers are generally light and watery in the formulation, and hence have a high spreading ability, which enable sanitizers to effortlessly penetrate the skin to destroy most bacteria

b. Some of the key players operating in the North America hand sanitizer market include Reckitt Benckiser Group plc; Procter and Gamble; The Himalaya Drug Company; GOJO Industries, Inc.; Henkel AG and Company; Unilever; Vi-Jon; Chattem, Inc.; Best Sanitizers, Inc.; Kutol

b. Increasing alertness considering sanitation and personal hygiene is predicted to boost the product demand as it is an antiseptic solution, which is utilized as a substitute to soap and water.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."