- Home

- »

- Homecare & Decor

- »

-

North America Home Fragrance Diffuser Market Report, 2033GVR Report cover

![North America Home Fragrance Diffuser Market Size, Share & Trends Report]()

North America Home Fragrance Diffuser Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Reed Diffusers, Ultrasonic Diffusers, Nebulizing Diffusers), By Distribution Channel (Specialty Retail Stores), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-723-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

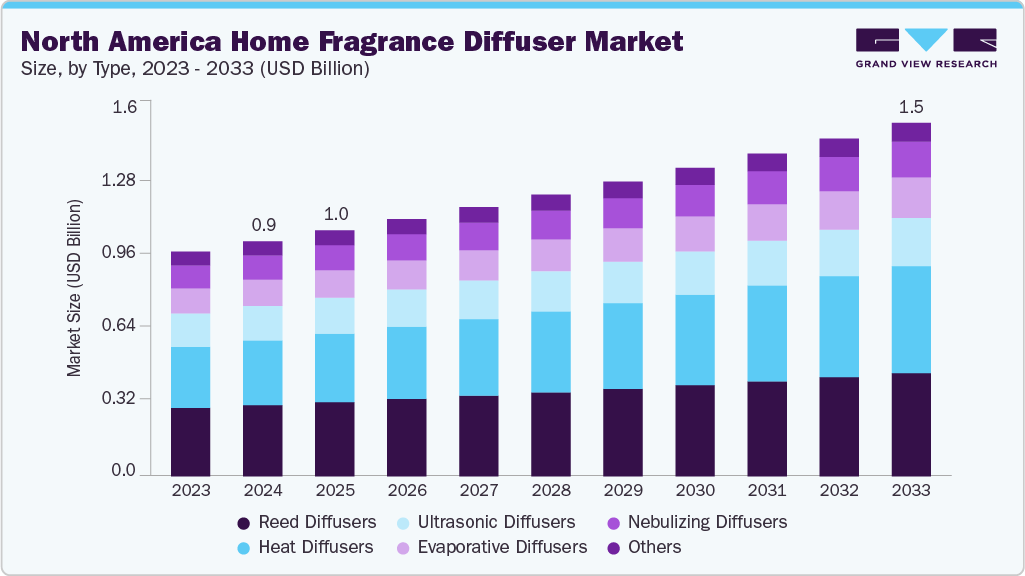

The North America home fragrance diffuser market size was estimated at USD 980.3 million in 2024 and is projected to reach USD 1474.6 million by 2033, growing at a CAGR of 4.6% from 2025 to 2033. The market has experienced notable expansion, driven by a combination of synergistic factors that have increased both consumer demand and product innovation. A considerable driver is the growing interest in creating comfortable and welcoming living environments, with diffusers providing a versatile and straightforward means to enhance the home ambiance. As consumers increasingly seek to personalize their living spaces, fragrance diffusers offer a practical solution for infusing pleasant scents and fostering a calming atmosphere. This emphasis on lifestyle enhancement bridges diverse demographics and domestic preferences, allowing for products with varying aesthetics, functionalities, and longevity.

The rising popularity of aromatherapy and wellness practices represents another pillar of market growth. Health-conscious individuals are drawn to the therapeutic benefits associated with essential oils, using diffusers to relieve stress, elevate mood, and improve sleep. This trend has expanded usage from mere scenting to holistic well-being, embedding fragrance diffusers as staples in homes, offices, and even wellness centers. The wellness focus dovetails with a shift toward natural and sustainable living, steering consumer choice toward plant-based oils, non-toxic ingredients, and eco-friendly product designs. Manufacturers have aligned their offerings to these expectations, resulting in more biodegradable and organic options on the market.

Technological advancements have played a significant role, as smart diffusers equipped with Wi-Fi or Bluetooth connectivity enable remote control via mobile apps, programmable schedules, and customizable scent combinations. These tech innovations appeal to convenience-oriented users and those integrating home automation systems for a seamless sensory experience. Moreover, improvements in ultrasonic and nebulizing technologies further enhance scent dispersal efficiency and minimize waste, demonstrating responsiveness to both consumer and environmental sensibilities.

The market’s growth is also fueled by North America's premium lifestyle orientation and established retail infrastructure. American consumers, in particular, demonstrate a willingness to invest in premium products that combine function, design, and wellness. This is bolstered by broad access to diffusers through both brick-and-mortar outlets and robust e-commerce platforms, which cater to varying price points and enable high market penetration. The combination of strong brand marketing and digital-first sales strategies drives awareness and adoption, crossing age and income boundaries.

Competition and innovation go hand in hand within the North America fragrance diffuser sector. Numerous global and niche brands vie for market share, prioritizing product differentiation through exclusive blends, artisanal craftsmanship, and multifunctional capabilities. This dynamic ecosystem ensures that consumers are presented with evolving choices-ranging from luxury boutique items to affordable mass-market solutions-maintaining the sector’s vibrancy. Strategic partnerships, collaborations, and acquisitions further stimulate product portfolio expansion and brand presence.

Consumer skepticism regarding synthetic fragrances and regulatory scrutiny over chemicals in home products have prompted producers to adopt safer, more natural alternatives. Addressing these challenges requires ongoing investment in research and development, but it also serves as a springboard for future growth by emphasizing health, safety, and transparency. As North America continues to embrace mindful consumption and innovation, these intertwined drivers and responses ensure that the fragrance diffuser market will remain dynamic and resilient in the years to come.

Consumer skepticism regarding synthetic fragrances and product safety is a growing obstacle. With increasing awareness of allergies, respiratory issues, and safety concerns tied to chemicals and diffuser components, buyers are demanding greater transparency and more rigorous safety standards. Regulatory agencies in North America are responding with tighter guidelines, prompting manufacturers to invest in research for reformulated, non-toxic, and natural alternatives-often at increased development and production costs.

Product Insights

Reed home fragrance diffusers were the most sold product type and accounted for over 40% market revenue in 2024. Their dominance is primarily due to their safety, ease of use, and continual fragrance release without the need for electricity, fire, or batteries, making them highly suitable for homes with children and pets, as well as commercial spaces such as hotels and offices. Reed diffusers appeal to consumers who prioritize a low-maintenance, flame-free option that blends functionality with home décor, providing a pleasant ambiance continuously. The rise in wellness and aromatherapy trends, alongside the expansion of online retail channels offering diverse product options, further fuels demand for reed diffusers in North America.

In addition to their functional benefits, reed diffusers have gained traction due to their aesthetic appeal, providing consumers with decorative home fragrance solutions that align with contemporary interior design preferences. Popular brands emphasize natural, eco-friendly materials and essential oil blends that cater to the growing demand for sustainable products. Their ability to offer a long-lasting scent experience without constant attention or replenishment makes them a convenient choice for consumers across diverse demographics. The mature market infrastructure in North America, combined with strong consumer awareness and marketing efforts, keeps reed diffusers as the largest and most established segment in the regional fragrance diffuser market.

Heat diffusers represent the fastest-growing product type in the North America market, growing at a CAGR of 5.7% from 2025 to 2033, due to their technological innovation and enhanced functionality. These diffusers use heat to effectively disperse fragrance oils, offering quicker and often stronger scent diffusion than reed diffusers. Their design innovations-such as energy-efficient heating elements, safety features, and stylish, compact forms-have attracted consumers looking for modern, tech-integrated home fragrance solutions. Heat diffusers align well with the rising consumer interest in smart home products and personalized wellness devices, contributing to their rapid adoption.

Moreover, heat diffusers provide users with customizable scent experiences, often allowing adjustable intensity and timing settings that enhance user control over the home environment. Their compatibility with a variety of essential oils and fragrance blends appeals to consumers who value quick mood enhancement and versatile scenting options. The growing demand for multi-functional self-care and relaxation products, along with increasing urbanization and lifestyle changes, positions heat diffusers as a dynamic growth segment that resonates with younger, tech-savvy demographics and wellness enthusiasts alike. This innovation-driven growth explains why heat diffusers are outpacing more traditional diffuser types in market expansion, despite reed diffusers holding the largest market share.

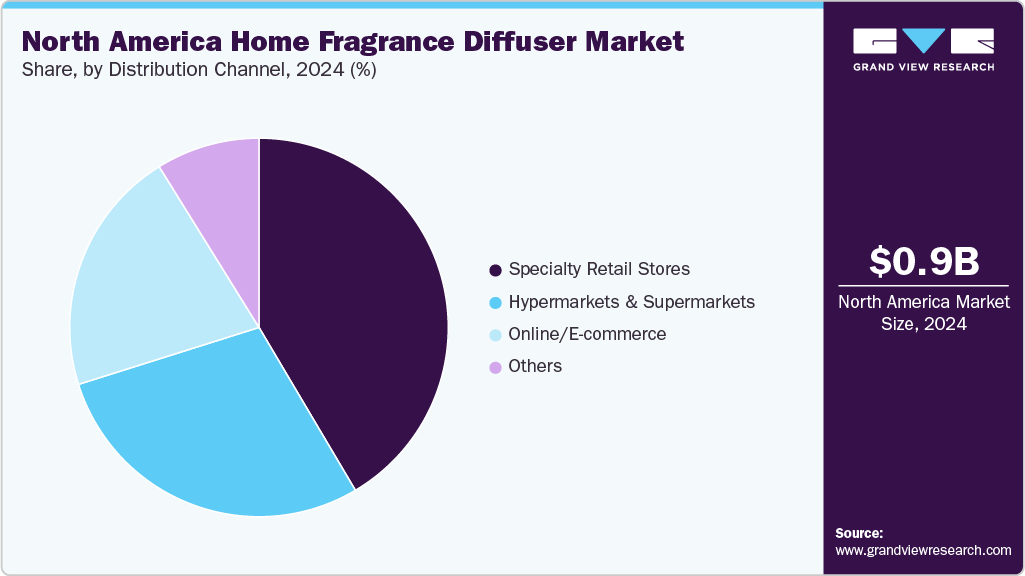

Distribution Channel Insights

Specialty retail stores were the largest distribution channel, accounting for a market revenue of over USD 400 million in 2024. This dominance stems from consumers’ preference for in-store experiences, where they can physically examine products, sample different fragrances, and receive expert guidance on selection. Specialty stores often curate exclusive or premium collections that appeal to discerning buyers, combining a wide variety of products with knowledgeable service. The tactile and sensory experience offered by these outlets is essential in building brand loyalty and trust, particularly for luxury and wellness-focused products. This makes specialty stores a popular choice for consumers looking to improve their home ambiance or find personalized aromatherapy options.

In addition, supermarkets and hypermarkets, while smaller in market share, cater to the broad base of consumers seeking convenience and accessibility at affordable prices. These channels significantly contribute to sales volume by offering widespread availability of entry-level fragrance diffusers and seasonal promotions that attract price-sensitive buyers. Although not as experiential as specialty stores, their significant foot traffic and multiservice nature allow easy exposure to fragrance products, supporting brand awareness among general consumers. Other offline channels like pop-up shops, boutiques, and direct sales contribute minor shares but address niche or impulse purchasing segments.

The online distribution channel is the fastest-growing segment in North America’s fragrance diffuser market, driven by shifting consumer buying behaviors and technological advancements. Online retail offers unparalleled convenience, allowing consumers to shop at any time and compare a vast range of products, including artisanal, niche, and customizable blends that may not be available in brick-and-mortar stores. The pandemic accelerated e-commerce adoption, and many consumers continue to appreciate the convenience of home delivery and hassle-free returns. Furthermore, rich online content, such as customer reviews, influencer endorsements, and detailed product information, supports confident purchase decisions, thereby enhancing consumer trust in digital shopping.

E-commerce also enables subscription-based models and personalized fragrance experiences, fostering long-term customer engagement and higher lifetime value. Brands leverage digital marketing, social media, and targeted advertising to reach broader audiences, capturing younger, tech-savvy demographics prioritizing sustainability and wellness. The ability of direct-to-consumer brands to innovate rapidly and respond to online trends strengthens the channel’s growth momentum. As a result, online channels are expected to continue gaining share over traditional outlets, driving significant market expansion.

Country Insights

U.S. Home Fragrance Diffuser Market Trends

The U.S. home fragrance diffuser market is the largest market within North America, accounting for approximately 80% of the region's total market share in 2024. The dominance of the U.S. market is underpinned by a large and affluent consumer base that prioritizes wellness, home ambiance, and lifestyle enhancement products. The country boasts advanced retail infrastructure with a strong presence of specialty stores, supermarkets, and an increasingly robust e-commerce ecosystem, facilitating broad product availability. American consumers demonstrate high demand for innovative products such as smart diffusers integrated with IoT and customizable scent experiences, further cementing the US market's leadership. The well-established essential oils industry and strong domestic manufacturing capabilities add to the competitive edge of the US market within the region.

Mexico Home Fragrance Diffuser Market Trends

Home fragrance diffuser market in Mexico represents the fastest-growing country market in North America with a projected CAGR of 5.2% from 2025 to 2033. This accelerated growth is driven by rising consumer awareness of aromatherapy benefits, alongside an increasing focus on anxiety and stress relief solutions amid changing lifestyle patterns. Mexican consumers are exhibiting strong interest in indigenous aromatic plants and traditional home fragrance methods, creating unique product demand opportunities. The country's market is also boosted by expanding distribution channels, competitive pricing strategies, and an emerging preference for handcrafted and locally designed diffusers. These factors combine to position Mexico as a dynamic growth market that complements the stability offered by the larger US market within North America.

Key North America Home Fragrance Diffuser Company Insights

The competitive landscape of the North America fragrance diffuser market is characterized by a combination of large multinational corporations and specialized local brands competing across different segments. Market leaders such as doTERRA, Young Living Essential Oils, Newell Brands, Organic Aromas, Bath & Body Works, Diptyque, and The Estée Lauder Companies dominate the industry with extensive product portfolios and well-established distribution networks. These companies leverage continuous product innovation, including smart diffusers with IoT capabilities, advanced ultrasonic and nebulizing technologies, and eco-friendly formulations to cater to evolving consumer preferences. Brand reputation and the ability to offer premium, personalized, and wellness-oriented products are key differentiators in this highly fragmented market.

In addition to product innovation, companies are actively expanding their reach through omnichannel strategies that blend specialty stores, online retail platforms, and major chains to maximize market penetration. Smaller and niche players focus on artisanal designs, natural ingredients, and targeted marketing to capture specialized consumer segments drawn to sustainability, exclusivity, and handcrafted quality. The competitive environment also features frequent mergers and acquisitions as larger players seek to consolidate market share and integrate vertically to control quality and supply chains.

Key North America Home Fragrance Diffuser Companies:

- doTERRA

- Young Living Essential Oils

- Newell Brands

- Organic Aromas

- Bath & Body Works

- Diptyque

- The Estée Lauder Companies

- Saje Natural Wellness

- Muji

- Yankee Candle Company

North America Home Fragrance Diffuser Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1025.7 million

Revenue forecast in 2033

USD 1474.6 million

Growth rate

CAGR of 4.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

doTERRA; Young Living Essential Oils; Newell Brands; Organic Aromas; Bath & Body Works; Diptyque; The Estée Lauder Companies; Saje Natural Wellness; Muji; Yankee Candle Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options North America Home Fragrance Diffuser Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America home fragrance diffuser market based on product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Reed Diffusers

-

Ultrasonic Diffusers

-

Nebulizing Diffusers

-

Heat Diffusers

-

Evaporative Diffusers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarkets and Supermarkets

-

Specialty Retail Stores

-

Online/E-commerce

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.