- Home

- »

- Medical Devices

- »

-

North America IV Hydration Therapy Market Size Report 2030GVR Report cover

![North America IV Hydration Therapy Market Size, Share & Trends Report]()

North America IV Hydration Therapy Market Size, Share & Trends Analysis Report By Type (Immune Boosters, Energy Boosters), By Age (0-18, 18-60), By Gender, By End-use (Hospitals & Clinics, Home Healthcare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-161-3

- Number of Report Pages: 126

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Share

The North America IV hydration therapy market size was estimated at USD 1.15 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. The increasing focus on health and wellness is the major factor contributing to the market growth. As per a 2020 research study conducted by a digital health company Rally Health, Inc., majority of Americans (43%) stated that COVID-19 pandemic has driven them to focus on their health more than ever before. Rising foodborne illnesses in the region and increasing awareness of the benefits of intravenous (IV) hydration therapies are factors expected to drive market growth in the forecast period.

The North America intravenous hydration therapy industry is rising, owing to increasing prevalence of chronic diseases such as cancer and diabetes. According to the CDC estimates, 6 in 10 adults in the U.S. are dealing with these health issues, creating a strong demand for effective healthcare solutions. IV hydration therapy is a crucial player, offering a direct and quick way to address consequences and management of chronic diseases. It becomes a valuable tool in improving the well-being of individuals facing these conditions. As chronic diseases become more common, the market is stepping up to provide specialized care and support for those who need it.

The prevalence of foodborne illnesses in the North American region poses significant health challenges. According to CDC estimates, 1 in 6 Americans falls ill from contaminated food or beverages each year, resulting in 3,000 deaths. The financial toll, as estimated by the U.S. Department of Agriculture (USDA), surpasses USD 15.6 billion annually. Within this landscape, the market is crucial in addressing the aftermath of foodborne illnesses. Intravenous hydration therapy is a supportive measure in managing dehydration, a common consequence of such illnesses. Offering efficient and rapid fluid replenishment, IV hydration therapy becomes a valuable component of healthcare response to mitigate the impact of foodborne illnesses on individuals' well-being.

Increasing awareness of the benefits of IV hydration therapies among North America’s population is boosting the market growth. According to the National Institute of Health and Care Excellence, numerous adult patients require Intravenous (IV) fluid therapy to address to fluid and electrolyte balance. IV therapy serves as a therapeutic intervention, administering fluids directly into the bloodstream to restore hydration and revitalize the body. Remarkably, IV hydration offers a faster and more complete absorption of vitamins, electrolytes, and antioxidants than oral intake, as it avoids the digestive system.

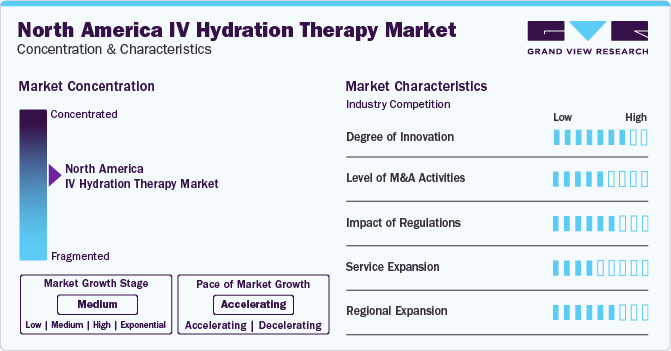

Market Concentration & Characteristics

The North America IV hydration therapy market is experiencing a surge in innovation, marked by a constant influx of novel concepts and advanced methodologies. IV hydration therapy has gained prominence for its minimally invasive nature and its ability to provide relief with reduced discomfort. Companies operating in this market are actively dedicating resources to inventive technologies and procedures, aligning with the rising demand and staying at the forefront of advancements in this domain.

Several market players, such as Drip Hydration, DriPros IV Hydration Wellness, wHydrate, and Renew Ketamine & Wellness Center, are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories.

Companies are actively investing substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline services. This may increase the cost of developing novel North America IV hydration therapy technologies.

North America intravenous hydration therapy services involve broadening the scope and offerings of intravenous fluid treatments. This extension caters to diverse healthcare needs, including hydration, nutrient replenishment, and wellness support. Companies are diversifying their service portfolios, introducing innovative therapies and personalized solutions to meet the growing demand for intravenous hydration. The expansion focuses on enhancing the overall patient experience by providing a range of targeted IV therapy options, leveraging advancements in medical science and technology.

Age Insights

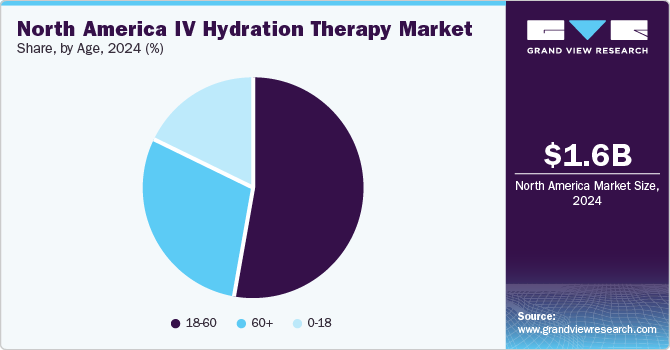

Based on age, the 18-60 segment accounted for the largest revenue share of 53.2% in 2023. The segment's dominance is due to this age group's increasing adoption of IV hydration therapy for various conditions. For instance, hydration therapy for skincare and rejuvenation is majorly adopted by females in this age group, as a major change in skin appearance and texture is witnessed during this stage of an individual’s life. Most athletes and sports personnel who require energy boosters regularly fall under this age group, further increasing the adoption of hydration therapies in these individuals.

The 60+ segment is anticipated to witness significant market growth over the forecast period, owing to an increasing prevalence of major disorders in the geriatric population. Minor cognitive disorders are thought to affect between 2% and 10% of 65-year-olds and up to 25% of 85-year-olds. The prevalence of major cognitive disorders is difficult to estimate, but they are estimated to affect between 2% and 10% of 65-year-olds and up to 25% of 85-year-olds. IV hydration therapy to boost memory and enhance brain health is widely adopted in individuals above the age of 60 years. IV hydration therapy serves as one of the most efficient methods of delivering critical fluids into the body. It avoids the digestive system, which slows absorption, by using an IV drip to administer the chemicals directly to the bloodstream. These aspects are boosting the market growth.

Type Insights

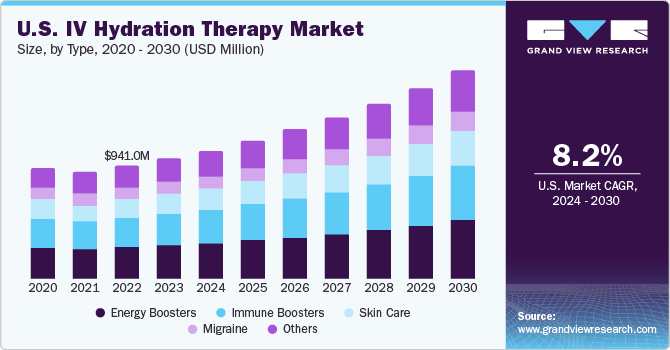

Based on type, the energy boosters segment accounted for the largest revenue share of 28.6% in 2023. Energy IV drip packets provide energy by infusing the body with a specifically prepared blend of electrolytes, vitamins, fluids, and antioxidants to battle sensations of exhaustion & low energy. There is a high adoption of energy supplements and drinks in the region, so demand for energy-boosting hydration therapy is increasing. For instance, according to the National Institute of Health, in the U.S., energy drinks are the most popular dietary drinks consumed by young adults & teens. Energy boost drips tend to increase energy levels, improve circulation & digestive issues, boost metabolism, and provide quick hydration. Energy IV hydration therapy is majorly adopted by athletes who require high energy due to high physical activity. IV therapy for sports was developed in response to the requirement for athletes to recover quickly.

Immune boosters segment anticipated to witness the significant market growth over the forecast period. Immune boost IV therapy is accepted as a safe and effective therapeutic option when delivered by a medical practitioner. Even though substantial scientific data do not support using vitamin IV drips, it produce good outcomes in restoring well-being and vitality. According to the CDC, about 6.2% of adults aged 18 to 64 in the U.S. have reduced immune function, as do approximately 2.6% of children. Immunosuppression seems to be growing as patients live longer with cancer, HIV, organ transplants, or chronic therapies, which leaves them more susceptible to infections. This further leads to increased demand for immune boosters among the population which boosts the market.

Gender Insights

Based on gender, the woman segment accounted for the largest revenue share of 52.7% in 2023, owing to the increasing adoption of IV therapies in skincare & beautification and for overall wellness by women. Skin rejuvenation treatment is any method or procedure of changing the appearance of skin. Skin rejuvenation treatments are most successful when delivered by IV therapy, as greater absorption enhances the treatment's effects. The treatment is widely adopted by women aged 24 to 54 years when signs of aging are predominantly observed. IV hydration therapy is a promising treatment for overall skin wellness by reducing wrinkles & spots and providing an improved skin appearance, making it highly suitable for any skin type. Moreover, there is an increase in the number of medical spas offering these treatments for women, which makes the treatment available to a large population, further increasing the adoption is significantly boosting the market progress.

Men segment is anticipated to witness a significant market growth over the forecast period, owing to increasing adoption of IV therapies for boosting immunity, energy, and metabolism. Over the years, it has been observed that the percentage of male athletes is increasing over the female athletes, which makes the use of intravenous hydration therapy for energy boosting more prominent in men compared to women. Moreover, men tend to have a weaker immune system than women. It was observed that even if the infection is similar in both genders, males tend to suffer more severe infections than females. During the pandemic, the adoption of IV hydration therapy was seen to be higher in males than in females, owing to the severity of the infection.

End-use Insights

Based on end-use, the hospitals & clinics segment accounted for the largest revenue share of 41.5% in 2023. This is attributed to the fact that most infusion therapies are carried out in hospitals and cosmetic centers/ clinics for treatment of a wide variety of conditions. The rising need for hospitalization among the population due to an increase in the number of people suffering from chronic disorders is another factor propelling market growth. On average, hospitalization lasts 4 to 5 days, which impels the need to supply patients with medications and nutrients through IV routes. Moreover, these services are offered in hospitals at a lower cost under a licensed physician's supervision, making it a prime location for IV hydration therapy.

The home healthcare segment is estimated to register the fastest CAGR over the forecast period. The segment's growth is due to the increasing geriatric population prone to various disorders. IV hydration therapy at home is a method of receiving IV treatment prescribed by a doctor without traveling to a hospital or clinic. This setting offers a safe and efficient alternative to hospitalization. The adoption of home healthcare services is increasing owing to the ease and comfort of obtaining treatments at home. These aspects are boosting the market growth.

Regional Insights

The U.S. dominated the overall market with a revenue share of 86.8% in 2023. High share of the market in the region is attributed to the unprecedented adoption of IV hydration therapy in the U.S. There is an increasing demand for immune boosters and energy in the region owing to rising prevalence of chronic diseases. The region shows a high disposable income and patient spending on overall wellness, hence, increasing market demand. Moreover, key regional players are focusing on introducing new technologies to capitalize on rising demand for IV hydration therapies. For instance, in April 2023, The DRIP Bar Vitamin Therapy partnered with Kevin Harrington for IV therapy franchise as a major investor. The franchise has been gaining immense acceptance across the region.

Canada is expected to grow at a significant rate during the forecast period. Adoption of IV hydration therapy is limited in the country owing to a lack of awareness and low healthcare spending. IV hydration therapy is a minimally invasive treatment that allows fluids to be delivered directly into the bloodstream, which is considerably more effective and faster than absorbing fluids through the digestive tract. It is also adopted for various applications, including immunity boosting, energy boosting, hangover management, and overall wellness. However, due to the lack of awareness across Canada, the demand for IV hydration therapy is moderate.

Key Companies & Market Share Insights

-

Drip Hydration, DriPros IV Hydration Wellness, wHydrate, and Renew Ketamine & Wellness Center are some dominant players operating in the North America IV hydration therapy industry.

-

Drip Hydration is a mobile IV therapy company that provides IV treatments directly to patients. The company also offers in-home IV infusions with essential fluids, vitamins, electrolytes, and antioxidants.

-

DriPros offers mobile IV hydration and vitamin therapy to the Upstate SC region. Its services include drips tailored to help with hangovers, migraine headaches, athletic pre/post workouts, beauty/skin issues, and boosting immunity.

-

wHydrate offers IV therapy for an intravenous drip to administer vital minerals, electrolytes, vitamins, and amino acids. The company is considered to be the best in the South East network of IV therapy clinics and lounges.

-

Hydration Room, Hydrate IV, and AliveDrip are some of the emerging market players functioning in North America IV hydration therapy industry.

-

Hydration Room was established by board-certified Anesthesiologist Dr. Brett Florie. Hydration Room integrates both allopathic and osteopathic medicine into customized vitamin injection and IV therapies.

-

AliveDrip is a mobile IV therapy company that offers comprehensive wellness, diagnostic, and IV vitamin infusion services. For IV vitamin infusions, the company provides more than 10 exclusive formulas.

Key North America IV Hydration Therapy Companies:

- Drip Hydration

- DriPros IV Hydration Wellness

- wHydrate

- Renew Ketamine & Wellness Center

- R2 Medical Clinic

- AliveDrip

- Hydrate IV

- Hydration Room

Recent Developments

-

In June 2022, DRIPBaR has partnered with entrepreneur and investor Kevin Harrington, who is set to become a significant investor in the IV therapy franchise. The franchise is rapidly gaining widespread acceptance in the region.

-

In March 2022, PAVmed Inc., a versatile medical technology company, successfully implanted its PortIO Intraosseous Infusion System in three patients at the Clinica Porto Azul in Barranquilla, Colombia.

North America IV Hydration Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.23 billion

Revenue forecast in 2030

USD 1.96 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type,age, gender, end-use, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Drip Hydration; DriPros IV Hydration Wellness; wHydrate; Renew Ketamine & Wellness Center; R2 Medical Clinic; AliveDrip; Hydrate IV; Hydration Room

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America IV Hydration Therapy Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America IV hydration therapy market report based on type, age, gender, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Immune Boosters

-

Energy Boosters

-

Skin Care

-

Migraine

-

Others

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

0-18

-

18-60

-

60+

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Wellness Centers & Spa

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America IV hydration therapy market size was estimated at USD 1.15 billion in 2023 and is expected to reach USD 1.23 billion in 2024.

b. The North America IV hydration therapy market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 1.96 billion by 2030.

b. Energy Boosters segment accounted for the largest revenue share of 28.6% in 2023. Energy IV drip packets provide energy by infusing the body with a specifically prepared blend of electrolytes, vitamins, fluids, and antioxidants to battle sensations of exhaustion & low energy.

b. Some of the players are Drip Hydration, DriPros IV Hydration Wellness, wHydrate, Renew Ketamine & Wellness Center, R2 Medical Clinic, AliveDrip, Hydrate IV, Hydration Room

b. Rising foodborne illnesses in the region and increasing awareness of the benefits of IV hydration therapies are factors expected to drive market growth in the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."