- Home

- »

- Homecare & Decor

- »

-

North America LGBTQ Tourism Market Size, Report, 2030GVR Report cover

![North America LGBTQ Tourism Market Size, Share & Trends Report]()

North America LGBTQ Tourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Tour Type (Solo, Couple, Group), By Age Group, By Budget, By Destination, By Booking Mode, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-467-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

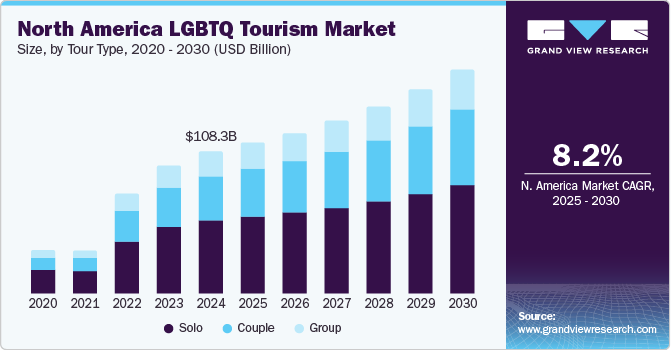

The North America LGBTQ tourism market size was estimated at USD 108.33 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. North America boasts many LGBTQ-friendly destinations that cater specifically to the community. San Francisco, New York, Toronto, and Vancouver offer a variety of LGBTQ-friendly accommodations, bars, clubs, and cultural events, creating an inviting atmosphere for LGBTQ travelers. The diversity of destinations ensures that LGBTQ tourists have a plethora of options to choose from, each offering unique experiences.

The abundance of pride events and LGBTQ festivals across North America significantly drives LGBTQ tourism. Events such as New York City Pride, Toronto Pride, and San Francisco Pride allow millions of people from worldwide to attend, encouraging LGBTQ travelers to visit and participate in these vibrant and inclusive events.

Moreover, North America has historical significance for the LGBTQ community, encouraging tourists to explore this heritage. Cities such as New York and San Francisco have played pivotal roles in the LGBTQ rights movement, with landmarks such as the Stonewall Inn and the Castro District symbolizing LGBTQ activism and history. LGBTQ travelers are drawn to these sites to pay homage to the community's struggles and achievements.

Furthermore, supportive local communities in various North American cities and towns drive the growth of the LGBTQ tourism market. Neighborhoods such as the Castro in San Francisco, West Hollywood in Los Angeles, and the Village in Montreal have strong LGBTQ presence and inclusive atmosphere. These communities offer a sense of camaraderie, making LGBTQ travelers feel at home. The support and acceptance from residents enhance the overall travel experience and contribute to the demand for these destinations.

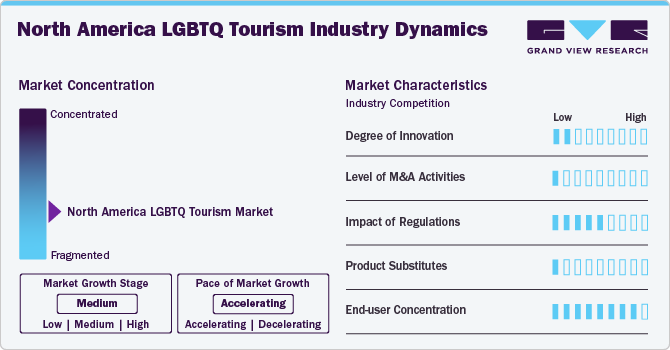

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. The hospitality industry in North America has made significant strides in adopting inclusive policies and practices for LGBTQ travelers. Major hotel chains, airlines, and travel companies have implemented diversity and inclusion training for their staff, ensuring that LGBTQ guests receive respectful and affirming service. These efforts by the hospitality industry create a welcoming environment and encourage LGBTQ tourists to choose North America as their travel destination.

Local government initiatives promoting LGBTQ tourism have a notable impact on the market. Cities such as Connecticut, San Francisco, Toronto, and New York have established tourism boards or offices dedicated to LGBTQ tourism, developing marketing campaigns, and supporting LGBTQ events and festivals. These initiatives often include grants, funding, and resources for local businesses to enhance their LGBTQ-friendly offerings. By actively promoting LGBTQ tourism and ensuring regulatory support at the regional level, these cities can boost their economies.

In June 2022, the Connecticut Office of Tourism partnered with the International LGBTQ+ Travel Association (IGLTA). The Connecticut Office of Tourism is among many brands that have committed support and are listed among the network of top global destinations that support the LGBTQ+ community. Connecticut is the first state to join IGLTA as a global partner, emphasizing LGBTQ+ travelers in the U.S. The LGBTQ+ community has always been integral to Connecticut's fiber and the state's tourism industry.

LGBTQ-themed cruises are a prominent substitute for traditional vacations. Cruise lines such as Atlantis Events and Olivia offer exclusive LGBTQ cruises that cater specifically to the community. These cruises provide a safe and inclusive environment where LGBTQ travelers can appreciate luxury accommodations, entertainment, and social activities while visiting multiple destinations. The all-inclusive cruises and the opportunity to meet other LGBTQ travelers are prominent alternatives for LGBTQ travelers to have unique and community-focused travel experiences.

Tour Type Insights

The solo tour segment led the market with the largest revenue share of 51.8% in 2024 and is expected to continue to dominate the industry over the forecast period. The availability of tailored travel services for solo LGBTQ travelers drives the segment's growth. Travel agencies and tour operators specializing in LGBTQ travel offer customized packages and itineraries catering to solo travelers' unique needs. These services often include personalized recommendations for LGBTQ-friendly accommodations, dining, and entertainment, as well as guided tours and activities designed for solo travelers. According to MMGY Global survey in 2022, Among U.S. LGBTQ+ travelers, solo travel is more common than traveling in pairs. According to survey responses, 50% of LGBTQ+ individuals travel solo, while only 33% travel with a partner.

The couple tour segment is anticipated to witness the fastest CAGR during the forecast period. The legalization of same-sex marriage and the implementation of anti-discrimination laws are driving the segment's growth. These legal and social changes have created a more inclusive environment for LGBTQ couples, encouraging them to travel more freely and confidently. This progress has also led to the emergence of destinations that actively celebrate LGBTQ travelers, providing a sense of safety and acceptance that is crucial for couples to enjoy their vacations without fear of discrimination.

Age Group Insights

The 25 - 45 years segment held the largest revenue share in 2024. The rise of niche and experiential travel drives the market growth. LGBTQ travelers in the 25 - 45 age group increasingly adopt unique and personalized travel experiences beyond traditional tourism. This includes cultural and historical tours highlighting LGBTQ heritage, adventure travel, wellness retreats, and immersive local experiences. Travel providers are responding by offering specialized packages and tours that cater to these interests, providing opportunities for LGBTQ travelers to explore and connect with new cultures and communities.

The below 25 years segment is expected to witness the fastest CAGR during the forecast period. Expanding LGBTQ tourism infrastructure, including specialized travel agencies, LGBTQ-focused events, and tailored travel services, drives the market growth. Many cities have developed robust infrastructures to cater to LGBTQ travelers, offering services from guided tours to LGBTQ-specific travel agencies that curate personalized itineraries. This infrastructure makes travel more accessible and enhances the overall experience by ensuring young LGBTQ travelers access resources and support tailored to their needs. The presence of LGBTQ-friendly accommodations, restaurants, and entertainment options in popular destinations further contributes to the segment's growth.

Budget Insights

The moderate segment dominated the market in 2024. The rise of online travel platforms and review sites also plays a crucial role in supporting the moderate segment. Websites and apps such as TripAdvisor, Expedia, and LGBTQ-focused travel sites provide valuable information and reviews about mid-range accommodations, activities, and destinations. These platforms allow travelers to compare options, read reviews from fellow LGBTQ travelers, and make informed decisions based on their preferences and budget. The accessibility of detailed information helps moderate travelers find inclusive and affordable options that meet their expectations.

The luxury segment is expected to witness the fastest CAGR during the forecast period. The ongoing emphasis on sustainability and responsible travel drives the growth of the luxury LGBTQ tourism market. Many high-end LGBTQ travelers are conscious of their environmental and social impact and seek eco-friendly and ethically responsible travel options. Luxury travel providers are responding by incorporating sustainable practices into their operations, such as using renewable energy, reducing waste, and supporting local communities. Eco-luxury accommodations, sustainable dining options, and conservation-focused travel experiences are becoming increasingly popular among affluent LGBTQ travelers.

Destination Insights

The domestic segment held the largest revenue share in 2024. The rise in popularity of short-term vacation rentals through platforms such as Airbnb and Vrbo is also a crucial factor driving the domestic LGBTQ tourism market. These platforms provide detailed information about hosts and accommodations, allowing LGBTQ travelers to choose properties that explicitly support the LGBTQ community. The ability to stay in unique, local properties also enhances the travel experience, offering a more personalized and comfortable environment than traditional hotels.

The international segment is expected to witness the fastest CAGR during the forecast period. The growing trend of delayed LGBTQs has contributed to the segment's expansion. A growing network of LGBTQ social and professional organizations that facilitate travel and networking opportunities. Organizations such as the International Gay and Lesbian Travel Association (IGLTA) and the National LGBT Chamber of Commerce (NGLCC) are crucial in connecting LGBTQ travelers with LGBTQ-friendly businesses and destinations worldwide. These organizations provide valuable resources, including travel guides, destination recommendations, and networking events, which help LGBTQ travelers feel more confident and supported when planning international trips.

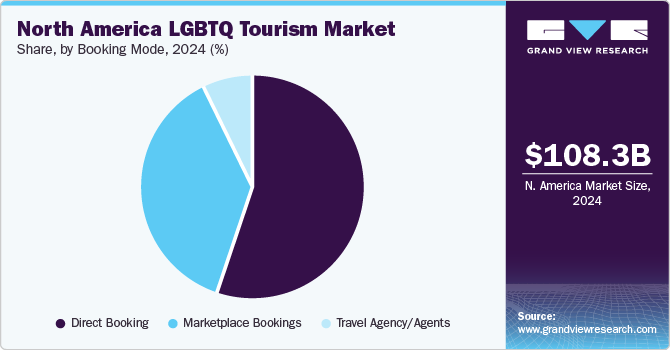

Booking Mode Insights

The direct booking segment held the largest revenue share in 2024. The influence of loyalty programs and membership benefits drives market growth. Many LGBTQ travelers prefer to book directly with service providers to take advantage of loyalty programs and exclusive benefits. Hotels, airlines, and other travel companies often offer rewards points, discounts, and special perks to members who book directly through their websites or apps. These loyalty programs can provide substantial savings and enhanced travel experiences, encouraging direct booking for frequent LGBTQ travelers.

The marketplace bookings segment is expected to witness the fastest CAGR during the forecast period. The trend towards experiential and community-based travel also influences the marketplace booking segment. LGBTQ travelers often seek unique and authentic experiences that allow them to connect with local LGBTQ communities and cultures. Platforms such as Airbnb and Vrbo offer private rentals and experiences hosted by local LGBTQ individuals, allowing travelers to immerse themselves in the local scene.

Country Insights

The U.S. accounted for a revenue share of 82.3% of the regional LGBTQ tourism market in 2024. The role of LGBTQ events and festivals is also significant in driving tourism. The U.S. hosts some of the world's largest LGBTQ events, including New York City's Pride Parade, San Francisco Pride, and Miami Beach Pride. These events encourage millions of attendees each year, significantly boosting local tourism. They offer LGBTQ travelers a chance to celebrate their identity, connect with the community, and enjoy a festive atmosphere. The success and popularity of these events highlight the strong demand for LGBTQ-friendly travel experiences and contribute to the market's growth.

Canada is expected to witness the fastest CAGR during the forecast period. Canada's extensive network of LGBTQ community centers provides valuable support and resources for LGBTQ travelers. These centers, such as the 519 in Toronto and QMUNITY in Vancouver, offer services, including information on local LGBTQ events, safe spaces, and support groups. They often serve as hubs for the LGBTQ community, offering travelers a place to connect, seek advice, and find resources. The presence of these community centers helps LGBTQ travelers feel more secure and supported during their visit, contributing to a positive travel experience.

Key North America LGBTQ Tourism Company Insights

Some of the key players operating in the North America LGBTQ tourism market include Atlantis Events, Inc.; Out Adventures; and Expedia, Inc.

-

Atlantis Events, Inc. is a travel company organizing LGBTQ cruises and resort vacations. The company's core offerings include all-gay cruises and all-gay resort vacations. These cruises typically feature many activities, including themed parties, world-class entertainment, and excursions to exotic destinations. In addition to cruises, Atlantis Events offers all-gay resort vacations at some of the most sought-after destinations.

-

Out Adventures is a premier travel company specializing in LGBTQ travel experiences. The company offers various tours, including adventure travel, cultural tours, and luxury vacations, all designed to meet the unique needs and interests of the LGBTQ community. In addition to group tours, Out Adventures offers private travel options and tailor-made holidays. These customized experiences cater to LGBTQ travelers who prefer to travel with their group of friends or family.

-

Expedia, Inc. is a travel technology company that provides various travel products and services, including flights, hotels, car rentals, vacation packages, and more. The company operates several well-known travel brands, including Expedia.com, Hotels.com, VRBO, and Travelocity. Expedia offers a wide range of LGBTQ-friendly travel options through its various brands. VRBO lists LGBTQ-friendly vacation rentals, allowing travelers to find inclusive trip accommodations. These features enable LGBTQ travelers to identify and book travel options that cater to their needs and preferences.

Key North America LGBTQ Tourism Companies:

- Contiki Holidays Limited

- Expedia, Inc.

- G Adventures

- Atlantis Events, Inc.

- Oscar Wilde Tours

- Out Adventures

- Hanns Ebensten Travel

- The Olivia Companies, LLC

- Global Travel Collection, LLC

- Brendan Vacations

- RSVP Vacations

- Booking.com

- Flight Centre Travel Group (Canada) Inc.

North America LGBTQ Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 114.83 billion

Revenue forecast in 2030

USD 170.53 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tour type, age group, budget, destination, booking mode, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Contiki Holidays Limited; Expedia, Inc.; G Adventures; Atlantis Events, Inc.; Oscar Wilde Tours; Out Adventures; Hanns Ebensten Travel; The Olivia Companies, LLC; Global Travel Collection, LLC; Brendan Vacations; RSVP Vacations; Booking.com; Flight Centre Travel Group (Canada) Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America LGBTQ Tourism Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America LGBTQ tourismmarket research report based on the tour type, age group, budget, destination, booking mode, and country:

-

Tour Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solo

-

Couple

-

Group

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Below 25 Years

-

25 - 45 Years

-

Above 45 Years

-

-

Budget Outlook (Revenue, USD Billion, 2018 - 2030)

-

Moderate

-

Luxury

-

Economy

-

-

Destination Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Marketplace Bookings

-

Travel Agency/Agents

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America LGBTQ tourism market size was estimated at USD 108.33 billion in 2024 and is expected to reach USD 114.83 billion in 2025.

b. The North America LGBTQ tourism market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 170.53 billion by 2030

b. U.S. dominated the North America LGBTQ tourism market with a share of 82.3% in 2024. The role of LGBTQ events and festivals is also significant in driving tourism. The U.S. hosts some of the world's largest LGBTQ events, including New York City's Pride Parade, San Francisco Pride, and Miami Beach Pride. These events encourage millions of attendees each year, significantly boosting local tourism.

b. Some key players operating in the North America LGBTQ tourism market include Contiki Holidays Limited, Travel, Expedia, Inc., G Adventures, Atlantis Events, Inc., Oscar Wilde Tours, Out Adventures, Hanns Ebensten Travel, The Olivia Companies, LLC, Global Travel Collection, LLC, Brendan Vacations, RSVP Vacations, Booking.com, Flight Centre Travel Group (Canada) Inc.

b. Factors such as the increase in the number of pride events and LGBTQ festivals and the growing popularity of LGBTQ cruises

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.