Market Size & Trends

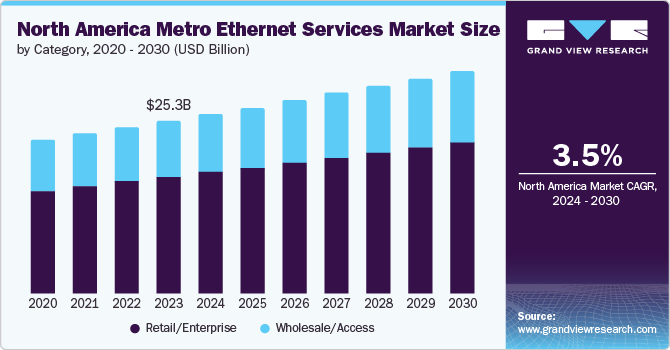

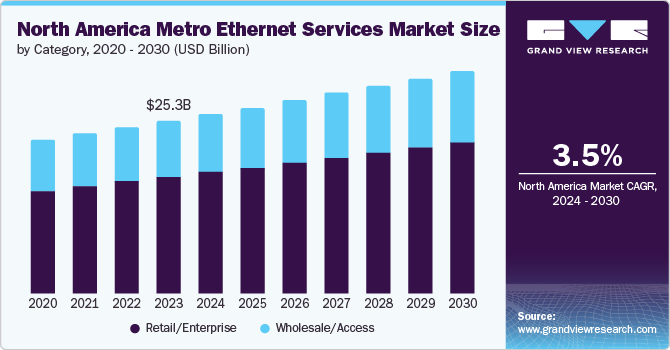

The North America metro ethernet services market size was valued at USD 25.29 billion in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. The rapid expansion of cloud-based services and applications drives the need for robust, high-speed, and reliable network connectivity. Businesses increasingly rely on cloud infrastructure for operations, necessitating efficient data transfer capabilities. Metro ethernet services provide the scalable bandwidth required to support these cloud-based applications, ensuring seamless access to data and services hosted on remote servers.

The rise in digital transformation initiatives across various industries fuels the demand for advanced networking solutions. Companies increasingly adopt digital technologies to streamline operations, improve customer experiences, and drive innovation. Metro ethernet services offer the high-bandwidth, reliable connectivity necessary to support these initiatives, enabling businesses to leverage digital tools and platforms effectively. Another key driver is the growing emphasis on disaster recovery and business continuity planning. In an era of increasing data breaches and cyber-attacks, organizations are prioritizing secure and resilient network infrastructures. Metro ethernet services provide the redundancy and high availability needed to ensure that critical business functions can continue uninterrupted in the event of network failures or security incidents.

Furthermore, the widespread deployment of 5G networks creates new opportunities for Metro Ethernet services. As 5G technology promises to deliver ultra-fast speeds and low latency, the backhaul infrastructure required to support these networks becomes increasingly important. Metro ethernet offers the high-capacity, flexible connections needed to handle the substantial data traffic generated by 5G-enabled devices and applications, making it a vital component of the broader telecommunications ecosystem. In addition, the growing adoption of video conferencing and collaboration tools has heightened the need for robust network solutions. Businesses and educational institutions rely heavily on these tools for communication and collaboration, necessitating high-quality, reliable connectivity. Metro ethernet services ensure these applications run smoothly, providing bandwidth and low latency to support real-time video and data transmission.

Category Insights

The retail/enterprise segment held the largest market revenue share of 67.5% in 2023. The rising adoption of cloud-based services by enterprises in the region for data storage, applications, and collaboration tools drives the segment growth. Metro ethernet services provide reliable connectivity to cloud platforms, supporting seamless access and data transfer. The growing demand for reliable and high-speed data services by retailers in North America drives the market for metro Ethernet services. With the rising dependency of businesses on digital communication, video conferencing, and VoIP, the need for strong network solutions also increases, leading to increased demand for these services.

Wholesale/Access segment is projected to grow significantly in the coming years. The increasing need for high-speed, reliable connectivity as businesses and consumers rely more heavily on cloud services, remote working, and data-intensive applications. Metro Ethernet provides scalable bandwidth and low-latency connections, essential for supporting these services. Additionally, the proliferation of smart city initiatives and the expansion of 5G networks require robust backhaul solutions, further boosting demand. Wholesale providers also leverage metro Ethernet to offer competitive, cost-effective solutions that quickly adapt to changing market needs, making it an attractive option for many customers.

Service Insights

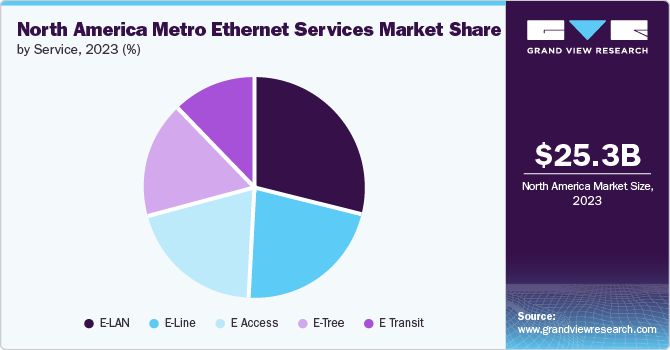

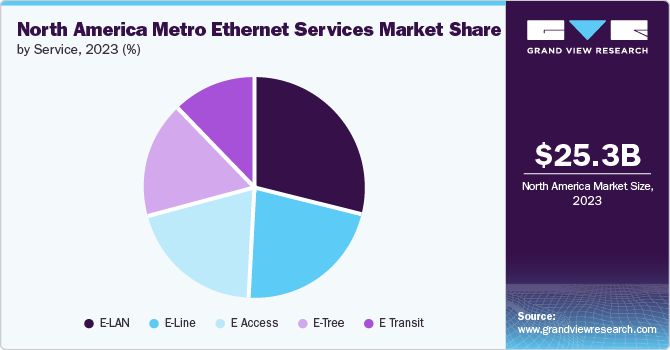

The E-LAN segment held the largest market revenue share in 2023. The demand is increasing due to its ability to provide scalable, flexible, and cost-effective solutions for enterprises requiring reliable, high-speed connectivity across multiple locations. E-LAN, or Ethernet Local Area Network, supports a mesh topology that enables any-to-any communication, making it suitable for businesses with distributed networks that need seamless data transfer and robust network performance. Additionally, the growing adoption of cloud services, remote working, and data-intensive applications is driving the need for efficient and resilient network infrastructure, further boosting the popularity of E-LAN in the metro Ethernet services market.

The E-Tree segment is projected to grow at the fastest CAGR over the forecast period. E-Tree services offer a more flexible and scalable solution for businesses that require a point-to-multipoint Ethernet service, enabling them to connect multiple branch offices and remote sites to a central headquarters or data center. This architecture is particularly beneficial for centralized data processing and distribution applications, such as cloud computing, video conferencing, and large-scale data transfers. Additionally, E-Tree services provide robust security and traffic management capabilities, essential for enterprises handling sensitive information and requiring high performance and reliability.

Key North America Metro Ethernet Services Company Insights

Some of the key companies in the North America metro ethernet services market include Verizon; CenturyLink, Inc.; AT&T Intellectual Property.; Charter Communications; Cogent Communications; and others.

-

CenturyLink, Inc. provides metro Ethernet solutions which is a flexible data solution that extends local area network (LAN) across their metro network. It provides convenient Ethernet connectivity, scalable bandwidth, and carrier-class reliability. With options up to 1 Gbps.

-

Verizon, with its business ethernet network services offers reliable, high-speed connectivity for businesses. Their E-Line service provides point-to-point or hub-and-spoke connections, while E-LAN offers flexible any-to-any connectivity. They offer secure options, and easy implementation, of these services.

Key North America Metro Ethernet Services Companies:

- AT&T Intellectual Property

- Charter Communications

- Cogent Communications

- Comcast

- Frontier Communications Parent, Inc.

- CenturyLink, Inc.

- Mediacom Communications Corporation

- NewWave Communications, LLC

- Verizon

- Zayo Group, LLC.

Recent Developments

-

In July 2024, Zayo Group, LLC. announced the expansion of its network connectivity offerings, which include new 400G-enabled wavelength routes. This expansion of Zayo’s 90% fiber network in North America will enable 400G. Which will significantly assist users in enhancing their operations.

North America Metro Ethernet Services Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 26.21 billion

|

|

Revenue forecast in 2030

|

USD 32.29 billion

|

|

Growth rate

|

CAGR of 3.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Category, service

|

|

Country scope

|

U.S., Canada, Mexico

|

|

Key companies profiled

|

AT&T Intellectual Property. ; Charter Communications; Cogent Communications; Comcast; Frontier; Communications Parent, Inc.; CenturyLink, Inc. ; Mediacom Communications Corporation; NewWave Communications, LLC; Verizon; Zayo Group, LLC.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

North America Metro Ethernet Services Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North American metro ethernet services market report based on category, and service.

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail/Enterprise

-

Wholesale/Access

-

Light Weapons

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

E-Line

-

E-LAN

-

E-Tree

-

E Access

-

E Transit

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)