- Home

- »

- Advanced Interior Materials

- »

-

North America Outdoor Play Structures Market Report, 2033GVR Report cover

![North America Outdoor Play Structures Market Size, Share & Trends Report]()

North America Outdoor Play Structures Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-068-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Outdoor Play Structures Market Summary

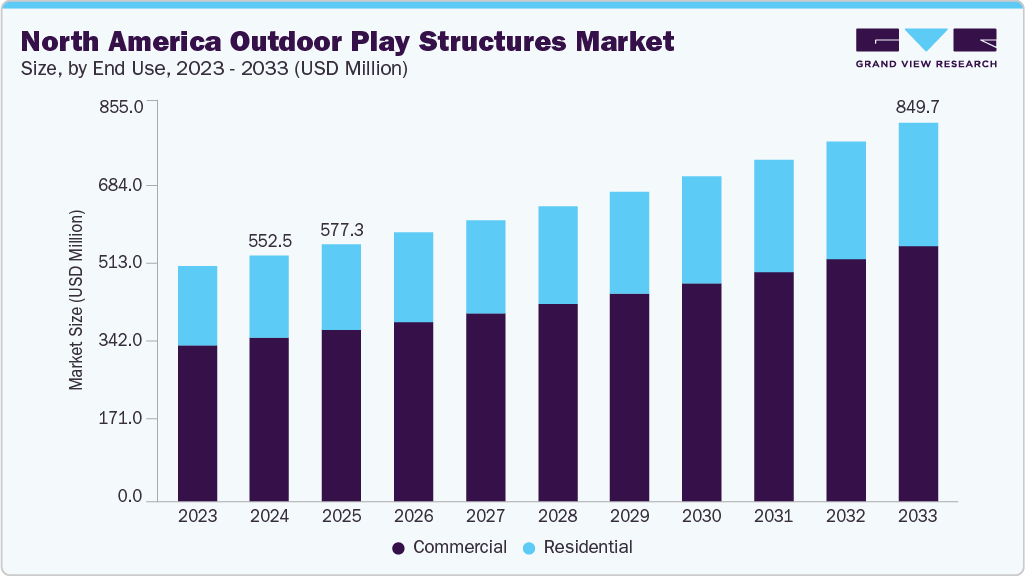

The North America outdoor play structures market size was estimated at USD 552.5 million in 2024 and is projected to reach USD 849.7 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033, driven by a growing societal focus on children’s physical well-being and overall developmental health. Schools, municipal authorities, and childcare centers are increasingly prioritizing outdoor environments that promote active play, balance, coordination, and motor-skill development.

Key Market Trends & Insights

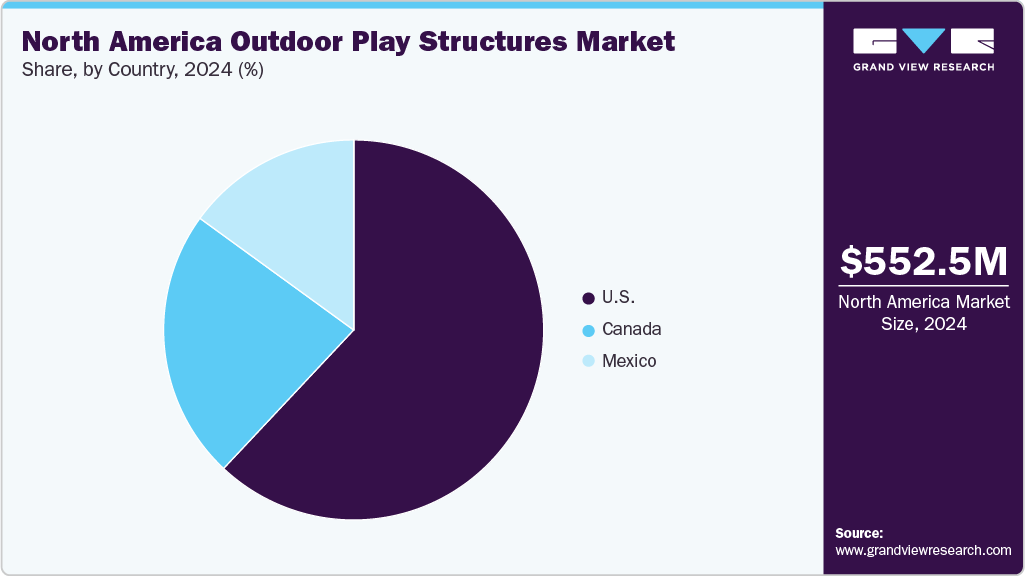

- U.S. dominated the North America outdoor play structures market with the largest revenue share of 62.0% in 2024.

- By end use, the commercial segment is expected to grow at fastest CAGR of 5.1% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 552.5 Million

- 2033 Projected Market Size: USD 849.7 Million

- CAGR (2025-2033): 4.9%

- U.S.: Largest market in 2024

Rising awareness of childhood obesity has further encouraged parents and institutions to support outdoor recreational activities. As a result, playground developers are investing in structures that combine fitness, creativity, and interactive movement. This demand supports continued market expansion across both public and private installations.Regional governments and local municipalities are actively upgrading public recreational infrastructure, which has become a major driver of demand for outdoor play structures. Large-scale urban revitalization projects often include new parks, community plazas, and green spaces designed to improve neighborhood livability. Federal and state funding programs directed toward public wellness and community engagement have also increased allocations for modern playgrounds. In addition, the trend toward mixed-use developments integrates recreational areas into residential and commercial planning. These initiatives collectively elevate the need for durable, safe, and inclusive play structures.

Innovation in materials and design is further advancing market growth, as manufacturers adopt safer, longer lasting, and environmentally responsible components. High-performance plastics, weather-resistant composites, and recycled materials are becoming standard in modern outdoor play structures. Smart design software and modular engineering also allow faster installation and customization across diverse site conditions. Sustainability certifications and green-building practices are influencing procurement decisions for schools and municipalities. These technological and eco-friendly improvements enhance product longevity and user safety, reinforcing market momentum across the region.

Market Concentration & Characteristics

The North America outdoor play structures industry exhibits moderate concentration, with several established manufacturers holding significant share while small regional providers contribute to localized competition. The degree of innovation is steadily rising, driven by demand for inclusive designs, advanced safety features, and sustainable materials. Companies are increasingly integrating modular engineering, impact-resistant components, and sensory-rich elements to differentiate their offerings. Although mergers and acquisitions occur periodically, they are not highly aggressive; instead, they primarily aim to expand product portfolios and enhance distribution networks. This balanced competitive environment supports continuous product refinement without creating excessive market dominance.

Regulations play a substantial role in guiding market characteristics, particularly through stringent safety standards, accessibility requirements, and environmental compliance obligations. These regulations shape design priorities and elevate the need for certified, high-quality materials. Service substitutes-such as indoor play centers or digital entertainment-offer some competition, yet they do not fully replace outdoor structures due to their distinct developmental and community-building benefits. End-user concentration is diverse, spanning municipal authorities, educational institutions, residential developers, and commercial recreation operators. This broad user base stabilizes market demand and encourages manufacturers to design versatile, compliant, and durable solutions suitable for multiple applications.

End Use Insights

The commercial segment led the market with the largest revenue share of 66.6% in 2024 and is anticipated to grow at the fastest CAGR of 5.1% during the forecast period, driven by the increasing development of public recreational spaces, schools, and community parks. Municipal investments in safe, durable, and inclusive playgrounds are rising to encourage physical activity and social engagement among children. Regulatory standards for safety and accessibility, such as ADA compliance, are pushing demand for certified and high-quality play structures. In addition, urbanization and the growth of educational institutions are creating sustained opportunities for large-scale commercial playground installations. Multi-use and themed play structures that cater to diverse age groups are further enhancing adoption in this segment.

The residential segment is expected to grow at a significant at CAGR over the forecast period, driven by the growing trend of home-based recreation and family-oriented outdoor activities. Rising disposable incomes and the desire for personalized backyard play solutions are encouraging homeowners to invest in residential play structures. The availability of customizable and modular designs allows families to select age-appropriate and safe equipment for their children. Health and fitness awareness among parents is also contributing to demand, as outdoor play promotes physical activity.

Regional Insights

U.S. Outdoor Play Structures Market Trends

U.S. dominated the North America outdoor play structures market with the largest revenue share of 62.0% in 2024, driven by substantial federal and state spending on community wellness programs and school infrastructure improvements. Public awareness of childhood obesity and sedentary lifestyles has intensified demand for safe, stimulating outdoor play environments. Urban revitalization projects frequently incorporate modern playgrounds to enhance neighborhood livability and attract families. Furthermore, strict safety and accessibility regulations such as ASTM standards and ADA guidelines which encourage the adoption of compliant, high-quality equipment. The country’s extensive network of public schools, residential communities, and commercial entertainment facilities further underscores the need for durable and innovative play structures.

The outdoor play structures market in Canada is notably shaped by the country’s strong commitment to inclusive, community-centric recreational areas. Federal and provincial grants aimed at enhancing public wellness and social integration support continuous investment in modern play structures. Harsh climatic conditions also drive demand for robust, weather-resilient materials that can withstand extreme temperatures and extended outdoor use. The increasing focus on mental well-being and nature-based play encourages municipalities to integrate playgrounds into green spaces and urban forests. In addition, Canadian standards emphasizing safety and environmental stewardship reinforce the shift toward eco-friendly and long-lasting designs.

The Mexico outdoor play structures market is growing at a rapid pace. Urbanization and demographic growth play a central role in driving the outdoor play structures industry. Expanding residential developments, public housing projects, and new municipal park initiatives create strong demand for accessible recreational areas. Government efforts to improve public safety and community engagement further encourage the installation of structured play environments. Rising awareness of child development benefits, especially among middle-income households, also supports broader adoption of outdoor play facilities. Moreover, the tourism sector, including resorts and hospitality venues, increasingly incorporates themed play structures to enhance guest experiences and attract family-oriented clientele.

Key North America Outdoor Play Structures Company Insights

Some of the key players operating in the market include PlayCore, Landscape Structures Inc.

-

PlayCore is a major playground equipment and recreation solutions company, offering a full suite of outdoor play structures, surfacing, and site amenities. Through its Play & Park Structures division, it emphasizes evidence-based design to create inclusive, safe, and engaging play environments.

-

Landscape Structures Inc. is a US-based manufacturer of commercial playground equipment, shade structures, and site furnishings. It’s known for design innovation, creating inclusive and nature-inspired playgrounds, and manufacturing many of its core play structure lines-such as Quantis, PlayBooster, and Forma in-house.

KOMPAN, PlayPower, Inc. are some of the emerging market participants in market.

-

KOMPAN is a globally renowned designer and producer of commercial playground systems, outdoor fitness equipment, and natural play installations. Its playground systems include rope climbers, themed play towers, and natural wood structures made from durable Robinia timber.

-

PlayPower, Inc. is a leading recreational products company in North America, which owns several major playground brands. Little Tikes Commercial produces developmentally appropriate play systems, Miracle Recreation focuses on durable, themed playgrounds, and Playworld designs inclusive and electronic-play playgrounds.

Key North America Outdoor Play Structures Companies:

- PlayCore

- Landscape Structures Inc.

- KOMPAN

- PlayPower, Inc.

- GameTime

- SportsPlay Equipment, Inc.

- PlayCraft Systems

- Vortex Aquatic Structures International

- BCI Burke

Recent Developments

-

In February 2023, Landscape Structures Inc. launched a new product line, called the Forma playsystem. The product line includes a mix of rich materials and angular designs. The product can be combined with any playground equipment of the company and is suitable for all age groups.

North America Outdoor Play Structures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 577.3 million

Revenue forecast in 2033

USD 849.7 million

Growth rate

CAGR of 4.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

PlayCore; Landscape Structures Inc.; KOMPAN; PlayPower, Inc.; GameTime; SportsPlay Equipment, Inc.; PlayCraft Systems; Vortex Aquatic Structures International; BCI Burke.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Outdoor Play Structures Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America outdoor play structures market report based on end use, and region.

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America outdoor play structures market size was estimated at USD 552.5 million in 2024 and is expected to reach USD 577.3 million in 2025.

b. The North America outdoor play structures market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 849.7 million by 2033.

b. Commercial segment accounted for the largest revenue share of 66.6% in 2024, driven by the increasing development of public recreational spaces, schools, and community parks.

b. Key players operating in the market are PlayCore, Landscape Structures Inc., KOMPAN, PlayPower, Inc., GameTime, SportsPlay Equipment, Inc., PlayCraft Systems, Vortex Aquatic Structures International, and BCI Burke.

b. The key factors that are driving the North America outdoor play structures include rising investment in public recreational infrastructure, increasing emphasis on child health and inclusive play, growing urban development, and the demand for durable, safe, and customizable playground solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.