- Home

- »

- Medical Devices

- »

-

North America Oxygen Concentrators Market, Report, 2030GVR Report cover

![North America Oxygen Concentrators Market Size, Share & Trends Report]()

North America Oxygen Concentrators Market Size, Share & Trends Analysis Report By Product (Portable, Fixed), By Application, By Technology (Continuous Flow, Pulse Flow), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-367-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The North America oxygen concentrators market size was estimated at USD 1.3 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. The market is growing due to an increase in the prevalence of respiratory conditions such as COPD, asthma, and sleep apnea. According to a February 2023 report by the American Lung Association, over 34 million Americans suffer from chronic lung diseases like emphysema, COPD, asthma, and chronic bronchitis. In addition, advancements in respiratory technology are significantly supporting market growth.

Furthermore, favorable reimbursement policies have enhanced the attractiveness of the global oxygen concentrators market. For instance, in March 2024, a U.S. Congressman introduced the Supplemental Oxygen Access Reform (SOAR) Act to reform and improve access to supplementary oxygen for Medicare beneficiaries. These policies have increased the adoption of oxygen concentrators in the U.S. In addition, rising healthcare spending in the U.S. and Canada is driving the demand for effective diagnosis and treatment of respiratory diseases, thereby boosting the market for oxygen concentrators

Initiatives by public and private authorities, such as the World Health Organization's distribution of oxygen concentrators and the efforts of associations like the American Lung Association, promote awareness of respiratory diseases. Market players also employ strategies such as acquisitions, collaborations, expansions, and new product launches to extend their product offerings and geographical reach. For instance, React Health's acquisition of Invacare's Respiratory line in February 2023 strengthened its market position, expanded its product portfolio, and enabled them to cater to a wider customer base.

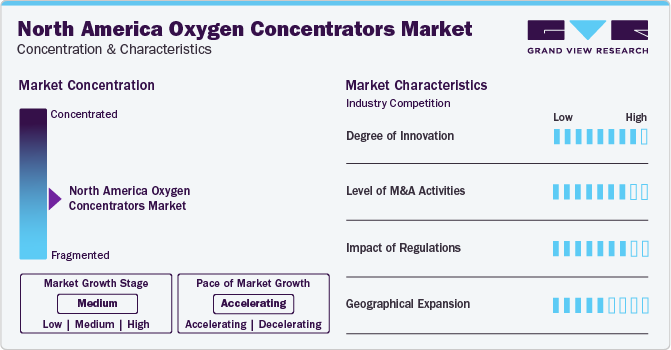

Market Concentration & Characteristics

North American oxygen concentrators industry exhibits a high degree of innovation, with companies like Inogen introducing cutting-edge products. For instance, in December 2022, Inogen received 510(k) premarket clearance from the U.S. Food and Drug Administration (FDA) for its new portable oxygen concentrator, Rove 4. This product is expected to enhance Inogen's leadership in portable oxygen concentrators. Such regulatory milestones strengthen manufacturers' portfolios, as seen with Inogen's Rove series.

M&A activities like mergers, acquisitions, and partnerships facilitate geographic expansion and market entry for companies. For example, React Health, a player in medical device development, manufacturing, and distribution, acquired Invacare's Respiratory line in February 2023. This strategic move bolsters React Health's market standing, broadens its product offerings, and enhances its ability to serve a wider customer base.

Regulatory framework for oxygen concentrators represents a significant barrier, particularly in terms of regulatory stringency impact. Companies such as Invacare Corporation and Philips have encountered prolonged consent decrees from the U.S. FDA, illustrating the stringent regulatory environment in the U.S. market.

Concerns have emerged regarding the disruptive effects of frequent regulatory scrutiny on market stability. There is a growing consensus that an overly stringent focus on regulatory perfection may impede the development of practical solutions. This underscores the necessity for a balanced approach that prioritizes both regulatory compliance and innovation.

Geographic expansion plays a key role in driving the growth of North American market by fostering collaboration, access to diverse datasets, and talent pools across regions. It enables companies to tap into new markets, leverage local expertise, comply with region-specific regulations, and gain insights from different healthcare systems, ultimately driving innovation and accelerating the adoption of oxygen concentrators.

Product Insights

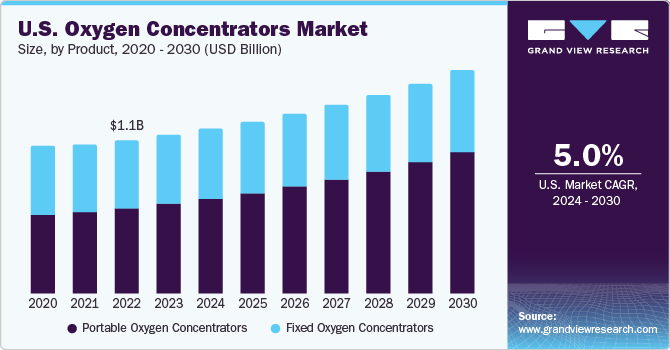

The market is segmented into portable oxygen concentrators and fixed oxygen concentrators. The portable oxygen concentrators (POCs) segment led the market with the largest revenue market share of 54.8% in 2023. Moreover, the segment is anticipated to witness at the fastest CAGR over the forecast period. The growth is owing to the increasing need for portable medical oxygen concentrators, especially among mobile patients seeking out-of-home solutions. Inogen's 10K report for the fiscal year ended December 31, 2021, highlights that approximately 80% of long-term oxygen therapy users in the U.S. prefer ambulatory oxygen, indicating a robust demand for portable medical oxygen concentrators. Consequently, companies are actively pursuing opportunities to expand in this market segment. For instance, in June 2022, Carire launched a new portable oxygen concentrator, LifeStyle, in the U.S. market. This product has substantially improved the quality of life for oxygen users worldwide by providing a more convenient and reliable oxygen source.

The fixed concentrators segment is expected to grow at a moderate CAGR over the forecast period. Factors such as a substantial number of long-term patients, the growing elderly population, and the rising demand for these hospital devices contribute to the segment's steady performance.

Technology Insights

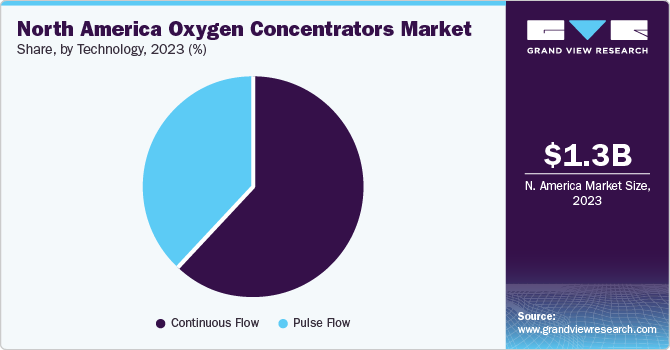

Based on technology, the market is segmented into continuous flow and pulse flow. The continuous flow segment led the market with the largest revenue share of 61.6% in 2023. This segment's dominance can be attributed to the increasing prevalence of long-term respiratory disorders, including asthma, COPD, bronchiectasis, and chronic sinusitis. Continuous flow technology is also widely used in residential and military applications, providing a safer alternative to storing oxygen under pressure.

The pulse flow technology segment is expected to experience at the fastest CAGR during the forecast period. The growth is driven by the advantages offered by pulse flow technology, including high mobility, lightweight design, and suitability for patients with active lifestyles. Pulse flow technology is particularly beneficial for treating respiratory conditions that require a lower oxygen delivery rate per minute. It is extensively used in portable oxygen concentrators (POCs). For example, in April 2019, Inogen, Inc. introduced the Inogen One G5, a portable oxygen concentrator featuring pulse dose delivery.

Application insights

Based on application, the market is segmented into home care and non-home care. The home care segment led the market with the largest revenue share of 66.7% in 2023. Furthermore, the home care segment is projected to experience at the fastest CAGR during the forecast period. The growth can be attributed to the rising adoption of Long-Term Oxygen Therapy (LTOT) devices in home settings, the availability of a wide range of home oxygen therapy devices (including Liquid Oxygen systems and portable concentrators), and the shifting preferences of patients towards receiving treatment at home.

The non-homecare segment is expected to exhibit at a moderate CAGR over the forecast period, driven by the increased adoption of oxygen therapy in hospitals and clinics. The segment also witnessed growth in 2020 due to the heightened usage of oxygen therapy for hospitalized COVID-19 patients. Moreover, increasing number of hospital admissions due to respiratory diseases contribute to the segment’s growth.

Country Insights

U.S. Oxygen Concentrators Market Trends

The oxygen concentrators market in the U.S. dominated the North America region due to its significant investment in R&D, advanced healthcare infrastructure, access to the newest technology, and new product launches. According to analyzed Medicare claims data, the Medicare penetration rate for portable oxygen concentrators (POCs) in the U.S. has steadily risen. For instance, in 2021, the POC penetration was 22.0%, while that of stationary was 17%. This is a developing trend favoring portable oxygen concentrators (POCs) over fixed oxygen concentrators and fueling market expansion. Government support, such as the Federal Aviation Administration's (FAA) approval of portable concentrators during plane travel, further drives the region's growth.

Key North America Oxygen Concentrators Company Insights

The respiratory care market is poised for rapid expansion in the coming years. Key market players are employing strategies such as introducing new products and expanding their service networks to attract customers and enhance their product offerings. For instance, in July 2022, OMRON Healthcare, announced the launch of its a portable oxygen concentrator, catering to the needs of home care providers in managing the therapy and lifestyle requirements of individuals with COPD and respiratory issues. This exemplifies the commitment of market participants to meet the evolving demands of healthcare professionals and patients by leveraging cutting-edge technologies in the respiratory care industry.

In the competitive oxygen concentrators market, Inogen holds a dominant position in the U.S. market. Its position has been further strengthened by recent product recalls from other companies. For example, DeVilbiss Healthcare recalled the DeVilbiss 525 5-liter Oxygen Concentrator and the Go 2 Portable Oxygen Concentrator in December 2022, while Invacare Corporation recalled the Invacare Platinum 5NXG Oxygen Concentrator in December 2022.

Exit Strategies of Existing Market Players and Their Impact on Market Competitors

INVACARE

-

Invacare Corporation has announced its decision to discontinue its respiratory products line, including HomeFill and stationary & portable oxygen concentrators.

-

This strategic move, disclosed alongside the company's third-quarter financial results of 2022, highlights Invacare's commitment to taking decisive action to enhance shareholder value and accelerate the execution of its strategic plan.

-

Following an extensive review process lasting almost a year, the decision demonstrates the company's acknowledgment of unfavorable market conditions.

In accordance with the insights from secondary research, Invacare Corporation has pivoted its mission focus toward the following key product lines:

These product lines have experienced a significant increase in orders, growing by 30% in the 2022 year compared to the previous year.

Entry of react health following Invacare's exit and its anticipated impact

The acquisition of Invacare's respiratory assets by React Health is likely to have significant implications for the oxygen concentrator market, including changes in competition, product availability, market dynamics, customer support, etc.

-

KONINKLIJKE PHILIPS N.V.

Philips' exit strategy, characterized by the slogan "NOTHING FAZES US ANYMORE," reflects the company's determination to navigate challenges and transitions in the respiratory devices market.

-

With Koninklijke Philips N.V.'s recent announcement of discontinuing select respiratory products in the U.S. and its territories, such as the SimplyGo Mini, SimplyGo, and Everflo oxygen concentrators, the oxygen concentration market is undergoing significant changes. Effective from January 25, 2024, Philips Respironics halted the sale of their POCs, with end of service scheduled for January 25, 2029.

Key North America Oxygen Concentrators Companies:

- Inogen, Inc.

- Respironics (a subsidiary of Koninklijke Philips N.V.) {Effective from January 25, 2024, Philips Respironics halted the sale of their POCs, with end of service scheduled for January 25, 2029.}

- React Health (Respiratory Product Line from Invacare Corporation)

- Caire Medical (Acquired by Niterra Co., Ltd. formerly known as NGK SPARK PLUG CO., LTD.)

- DeVilbiss Healthcare (a subsidiary of Drive Medical)

- O2 Concepts

- Nidek Medical Products, Inc

- GCE

- Rhythm Healthcare

- MedaCure Inc.

- GF Health Products, Inc.

- Direct Supply

- Compass Health Brands

Recent Developments

-

In July 2023, Canta Medical introduced an entire oxygen product range to the FIME 2023 United States. FIME 2023 is one of the largest international medical exhibitions for the U.S. healthcare market. It attracts over 10,000 healthcare participants and hosts over 500 medical device manufacturers and distributors

-

In May 2023, Drive DeVilbiss Healthcare introduced an energy-efficient 10-liter oxygen concentrator designed to meet the demand for oxygen therapy in rural and semi-urban areas at both primary & secondary healthcare levels. The 1060AW oxygen concentrator is characterized by its reliability, durability, and energy efficiency. It was scheduled for commercial release in 2024

-

In January 2023, Inogen, Inc., announced that it achieved key regulatory milestones in the U.S. and the Europe to strengthen its portable oxygen concentrator products. This accomplishment signifies Inogen's continued commitment to meeting regulatory requirements and underscores the company's focus on ensuring its products meet the highest standards of quality and safety

-

In November 2022, The Bolivian government selected CANTA oxygen concentrators to supply to La Paz, the highest capital city in the world. This decision was based on the quality and reliability of the CANTA oxygen concentrators

-

In October 2022, O2 Concepts, a provider of portable oxygen concentrator solutions, launched its latest advanced technology, the Oxlife Liberty. The company aims to revolutionize the delivery of oxygen therapy with its innovative products. The Oxlife Liberty is built on the successful format of Oxlife Freedom, further demonstrating the company's commitment to advancing its technology

North America Oxygen Concentrators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.4 billion

Revenue forecast in 2030

USD 1.9 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Inogen, Inc.; Respironics (a subsidiary of Koninklijke Philips N.V.); React Health (Respiratory Product Line from Invacare Corporation); Caire Medical (Acquired by Niterra Co., Ltd. formerly known as NGK SPARK PLUG CO., LTD.); DeVilbiss Healthcare (a subsidiary of Drive Medical); GCE; O2 Concepts; Nidek Medical Products, Inc; Rhythm Healthcare; MedaCure Inc.; GF Health Products, Inc.; Direct Supply; Compass Health Brands

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Oxygen Concentrators Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America oxygen concentrators market report based on product, application, technology, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Portable Medical Oxygen Concentrators

-

Fixed Medical Oxygen Concentrators

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Care

-

Non- Home Care

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Continuous Flow

-

Pulse Flow

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America oxygen concentrators market size was estimated at USD 1.30 billion in 2023 and is expected to reach USD 1.4 billion in 2024.

b. The continuous flow technology segment dominated the North America oxygen concentrators market and accounted for the largest revenue share of 61.6% in 2023.

b. The home care segment dominated the North America oxygen concentrators market and held the largest revenue share of 66.7% in 2023.

b. The North America oxygen concentrators market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 1.9 billion by 2030.

b. Some of the prominent players in the North America oxygen concentrators market include Inogen, Inc.; Respironics (a subsidiary of Koninklijke Philips N.V.); React Health (Respiratory Product Line from Invacare Corporation); Caire Medical (Acquired by Niterra Co., Ltd. formerly known as NGK SPARK PLUG CO., LTD.); DeVilbiss Healthcare (a subsidiary of Drive Medical); GCE; O2 Concepts; Nidek Medical Products, Inc; Rhythm Healthcare; MedaCure Inc.; GF Health Products, Inc.; Direct Supply; Compass Health Brands

b. The market is growing due to an increase in the prevalence of respiratory conditions such as COPD, asthma, and sleep apnea. In addition, advancements in respiratory technology are significantly supporting market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."