- Home

- »

- Drilling & Extraction Equipments

- »

-

North America Piling Machine Market, Industry Report, 2033GVR Report cover

![North America Piling Machine Market Size, Share & Trends Report]()

North America Piling Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Impact Hammer, Vibratory Drivers, Piling Rigs), By Piling Method (Impact Driven, Drilled Percussive), By Tonnage Capacity, By Torque, By End-use (Industrial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-035-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Piling Machine Market Summary

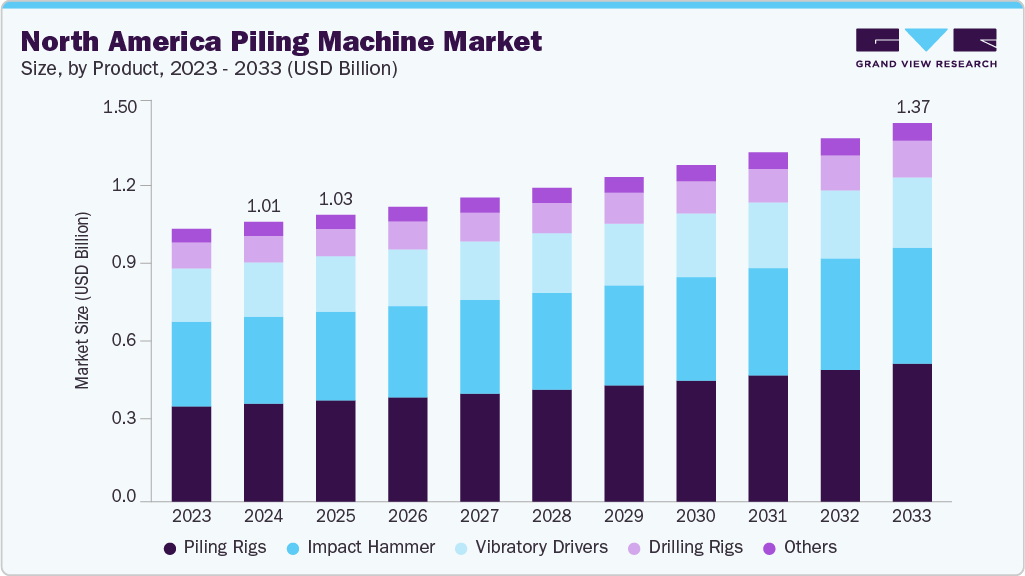

The North America piling machine market size was estimated at USD 1,009.1 million in 2024 and is projected to reach USD 1,365.5 million by 2033, growing at a CAGR of 3.5% from 2025 to 2033. Government initiatives, particularly in the U.S., are driving investments in transportation networks, bridges, ports, and public utilities, which in turn boost demand for piling equipment used in deep foundation construction.

Key Market Trends & Insights

- By product, the piling rigs segment led the market with the largest revenue share of 35.1% in 2024.

- By piling method, the impact driven segment led the market with the largest revenue share of 31.94% in 2024.

- By tonnage capacity, the medium (51 to 150 ton) segment ed the market with the largest revenue share of 46.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,009.1 Million

- 2033 Projected Market Size: USD 1,365.5 Million

- CAGR (2025-2033): 3.5%

Offshore wind energy and coastal protection projects are also fueling the need for specialized piling machines in marine environments. Technological advancements in piling machines, including low-vibration systems, automated controls, and eco-friendly piling techniques, are significantly enhancing project efficiency and safety.

These innovations reduce noise and ground disturbance, making them suitable for urban or sensitive environments. Automation improves precision and productivity, while environmentally friendly methods help meet stricter regulations, supporting sustainable construction practices across infrastructure and energy projects.

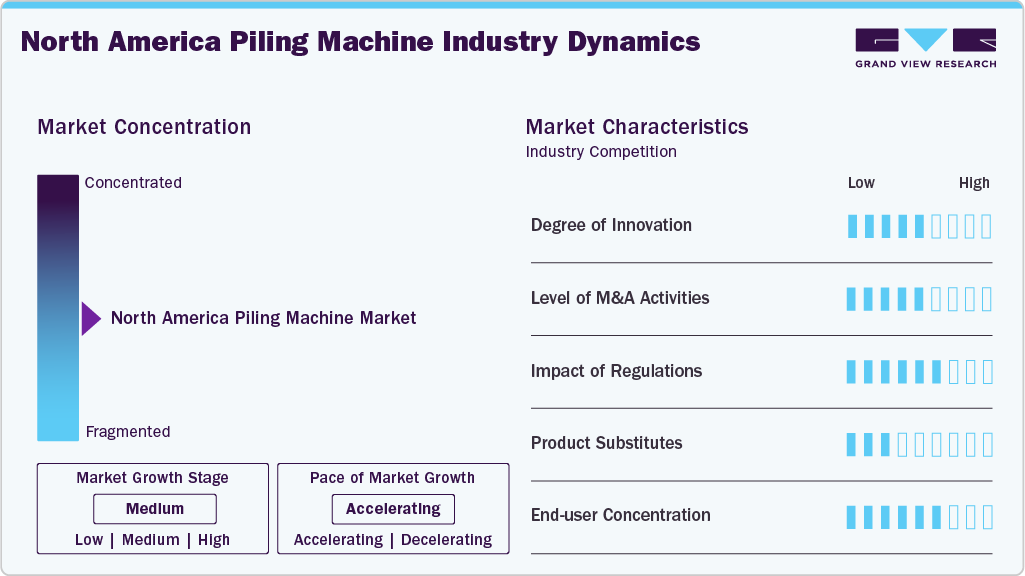

Market Concentration & Characteristics

North America piling machine industry is moderately concentrated, with a mix of established global players and regional manufacturers competing for market share. A few key companies dominate due to their strong distribution networks, advanced technology offerings, and long-standing industry presence. However, there is room for mid-sized firms and specialized equipment providers to compete, especially in niche applications or regions. This competitive structure allows for innovation and pricing flexibility, but also creates barriers to entry for new market participants.

Innovation in the North America piling machines industry is driven by the demand for efficient, low-noise, and environmentally friendly solutions. Advancements include low-vibration technology, automation, GPS-guided systems, and energy-efficient engines. Manufacturers are focusing on smart controls, modular designs, and integration with digital construction platforms. These innovations aim to enhance productivity, reduce environmental impact, and improve worker safety in urban and environmentally sensitive construction zones.

Merger and acquisition activities in the market are centered on expanding product portfolios, gaining access to advanced technologies, and entering new regional or application markets. Key players are acquiring specialized firms to strengthen their position in high-demand areas like renewable energy foundations and urban infrastructure. These strategic moves help streamline operations, enhance competitiveness, and improve service capabilities across a broader customer base.

Environmental regulations, noise restrictions, and worker safety standards are significantly shaping the North America piling machines industry. Authorities enforce limits on emissions, ground disturbance, and operational noise, especially in urban areas. As a result, manufacturers must develop quieter, cleaner, and more precise equipment. Compliance with regulatory frameworks pushes innovation in low-impact piling methods, such as vibratory or hydraulic systems, and drives demand for machines with enhanced monitoring and control features.

Drivers, Opportunities & Restraints

Surge in infrastructure investment across transportation, energy, and public works sectors is significantly driving the market. Government funding for roads, bridges, and renewable energy installations creates steady demand for advanced piling equipment. The growing need for deep foundation systems in high-rise buildings, ports, and offshore projects further fuels market expansion, as contractors seek reliable, efficient machinery for complex ground conditions.

A major opportunity lies in the growing adoption of piling machines in renewable energy projects, especially offshore wind and solar infrastructure. As the U.S. and Canada prioritize clean energy, demand for advanced foundation equipment suited for remote, marine, or unstable terrains increases. Manufacturers offering specialized, low-emission, and automated piling solutions are well-positioned to capitalize on this shift, tapping into new market segments and expanding their customer base.

A significant challenge for the North America piling machines industry is the high initial investment and operational cost associated with advanced machinery. Smaller contractors may struggle to adopt newer technologies due to budget constraints. In addition, skilled labor shortages and complex regulatory compliance add operational hurdles. These factors can slow adoption rates, limit innovation diffusion, and create disparities between large and small players in terms of technology access and competitiveness.

Product Insights

The piling rigs segment led the market with the largest revenue share of 35.1% in 2024, due to their versatility and widespread application across various construction activities. These machines are integral to the installation of deep foundations and are commonly used in the construction of commercial buildings, industrial facilities, bridges, and transportation infrastructure.

The drilling rigs segment is expected to grow at the fastest CAGR of 3.7% during the forecast period, supported by increasing demand for deep foundation solutions in challenging ground conditions and geotechnical environments. Drilling rigs are essential for installing bored piles, caissons, and other deep foundation elements, particularly in projects where driven piles are not feasible due to soil sensitivity, vibration concerns, or spatial limitations.

Piling Method Insights

The impact driven segment led the market with the largest revenue share of 31.94% in 2024. This method is widely used in large-scale civil engineering projects such as bridges, ports, industrial facilities, and transportation infrastructure, where load-bearing capacity is critical. The technique’s ability to penetrate dense soil layers and deliver high driving energy makes it ideal for projects requiring robust pile installation. The continued replacement of aging infrastructure and expansion of port and highway networks are expected to sustain demand for impact-driven piling solutions in the coming years.

The continuous flight auger segment is anticipated to grow at the fastest CAGR of 5.5% during the forecast period, driven by its speed, efficiency, and suitability for urban and mid-rise developments. CFA allows for drilling and concrete placement in one continuous process, reducing cycle times and ensuring borehole stability throughout.Its compatibility with sustainable and environmentally conscious construction practices further strengthens its market appeal. CFA piling aligns well with growing demand for affordable housing, mixed-use buildings, and infrastructure that meets modern environmental standards.

Tonnage Capacity Insights

The medium (51 to 150 ton) segment led the market with the largest revenue share of 46.3% in 2024, driven by its versatility across a wide range of infrastructure and commercial projects. Machines in this tonnage class strike an optimal balance between power, mobility, and application flexibility. They are capable of handling a diverse set of piling tasks from mid-rise commercial and industrial construction to bridgework, highway foundations, and energy infrastructure making them the workhorses of many large-scale developments.

The large (above 150 ton) piling machine segment is anticipated to grow at the fastest CAGR of 3.3% during the forecast period, driven by rising demand from large-scale infrastructure and energy projects requiring deep and high-capacity foundation systems. These heavy-duty machines are essential for deep foundation works that require large-diameter or exceptionally long piles, particularly in applications such as offshore and nearshore wind farms, major bridge projects, high-speed rail networks, and large industrial or energy facilities.

Torque Insights

The medium (80 to 200 kN.m) segment led the market with the largest revenue share of 47.2% in 2024. These machines are widely used in commercial buildings, infrastructure developments, bridge foundations, and large-scale residential complexes. With infrastructure renewal and expansion, a national priority spanning transportation, public utilities, and industrial zones-demand for medium-torque rigs is increasing rapidly.

The large torque (above 200 kN.m) segment is expected to expand at the fastest CAGR of 3.4% during the forecast period, driven by its application in heavy-duty piling operations for deep foundations in bridges, ports, and high-rise structures. Machines in this torque class deliver high power and are essential for handling large-diameter piles, deeper foundation drilling, and operation in tough ground conditions.

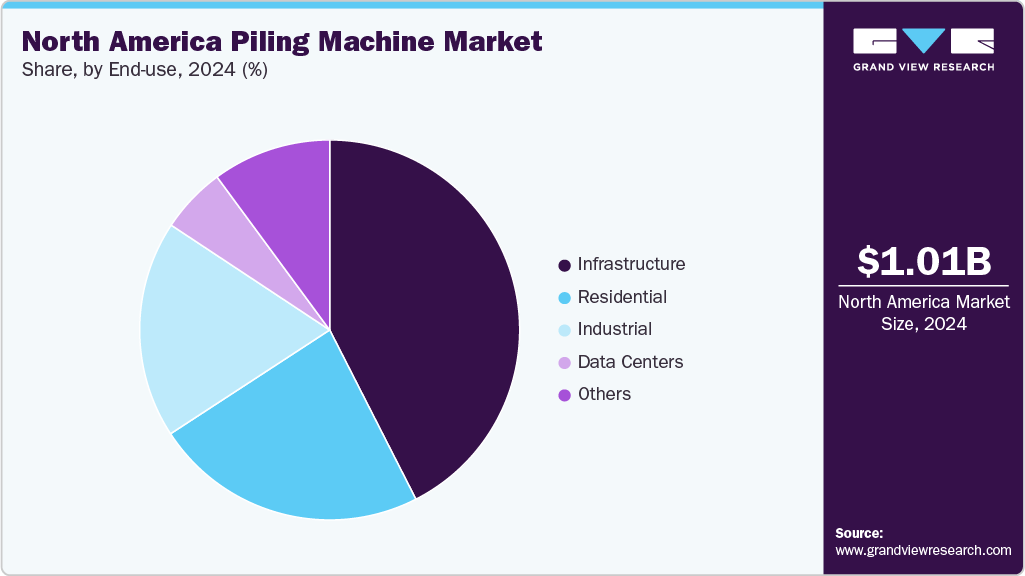

End-use Insights

The infrastructure segment led the market with the largest revenue share of 42.5% in 2024. This segment is one of the most dynamic and essential areas, covering a broad range of public works such as bridges, highways, tunnels, ports, railways, and airports. As governments at both federal and state levels continue to prioritize infrastructure development and rehabilitation, the demand for reliable and efficient piling machines is increasing.

The data centers segment is anticipated to grow at the fastest CAGR of 4.2% during the forecast period, driven by the rapid expansion of digital infrastructure. As cloud computing, AI, and edge processing grow in demand, technology companies are building massive data centers across the U.S. and Canada. These facilities require specialized foundation solutions due to their high structural loads, sensitive equipment, and 24/7 operational requirements.

Country Insights

The piling machine market in the U.S. accounted for the largest market revenue share of 83.2% in North America in 2024, driven by large-scale investments in infrastructure, industrial development, and renewable energy. The federal government’s multi-trillion-dollar infrastructure programs are fueling demand for deep foundation equipment across highways, bridges, rail, airports, and coastal projects. Urban expansion and high-density housing projects are also creating a need for advanced piling machines in residential construction.

Canada Piling Machine Market Trends

The Canada piling machine market is poised for steady growth, supported by ongoing investment in infrastructure, urban development, and resource-based projects. The country’s expansive geography and challenging soil conditions in regions like Ontario, British Columbia, and Alberta demand specialized foundation equipment for a variety of applications. Major public works projects such as bridge replacements, highway expansions, and flood resilience initiatives are key drivers of piling machine demand.

Mexico Piling Machine Market Trends

The piling machine market in Mexico is expected to witness growing momentum, supported by increased investment in industrial development, logistics infrastructure, and public construction projects. The country has positioned itself as a key manufacturing hub due to nearshoring trends, especially from U.S.-based firms looking to diversify supply chains.

Key North America Piling Machine Company Insights

Some of the key players operating in the market include Junttan USA, Bauer AG, Liebherr Group

-

Junttan USA is the American branch of Finnish piling‑equipment specialist Junttan Oy. It provides sales, rentals, repairs, parts, and technical support for hydraulic piling machines and related equipment in the U.S. Their inventory includes pile driving rigs, drilling rigs, hammers, rotary heads, and power packs, with dedicated service facilities and direct support from the parent company.

-

Bauer AG is a German construction and machinery company focused on specialist foundation engineering, deep excavation, and geotechnical solutions. It designs and manufactures equipment such as drilling rigs, piling machines, trench cutters, and anchor systems. The company also delivers turnkey foundation and environmental engineering services, operating globally in infrastructure, energy, and resource development projects.

Key North America Piling Machine Companies:

- Junttan USA

- Bauer AG

- Liebherr Group

- Solimec

- Hammer & Steel, Inc.

- Sany Group

- ABI Equipment Ltd

- Casagrande S.p.A.

- ICE USA

- Watson Inc.

Recent Developments

-

In August 2025, Liebherr launched LB 45.1 and LRB 19 drilling rigs, designed for enhanced productivity and versatility in piling operations. The LB 45.1 delivers 450 kW power and 450 kNm torque with advanced automation for deeper drilling, while the LRB 19 offers 450 kW and 180 kNm torque, suitable for a variety of foundation applications.

-

In January 2025, Junttan launched its new Evolution series, representing a major step forward in foundation machinery. The DR5 drilling rig, the first model in this lineup, delivers high-performance single pass drilling for both Full Displacement Piling (FDP) and Continuous Flight Auger (CFA) projects.

North America Piling Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,034.8 million

Revenue forecast in 2033

USD 1,365.5 million

Growth rate

CAGR of 3.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, piling method, tonnage capacity, torque, end-use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Junttan USA; Bauer AG; Liebherr Group; Soilmec; Hammer & Steel, Inc.; Sany Group; ABI Equipment Ltd; Casagrande S.p.A.; ICE USA; Watson Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Piling Machine Market Report Segmentation

This report forecast revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America piling machine market report based on the product, piling method, tonnage capacity, torque, end-use and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Impact hammer

-

Vibratory drivers

-

Piling rigs

-

Drilling Rigs

-

Others

-

-

Piling Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Impact driven

-

Drilled percussive

-

Rotary bored piling

-

Air-lift RCD

-

Auger boring

-

Continuous flight auger

-

Others

-

-

Tonnage Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Small (up to 50 ton)

-

Medium (51 to 150 ton)

-

Large (above 150 ton)

-

-

Torque Outlook (Revenue, USD Million, 2021 - 2033)

-

Small (up to 80 kN.m)

-

Medium (80 to 200 kN.m)

-

Large (above 200 kN.m)

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Residential

-

Infrastructure

-

Premium Infrastructure

-

Power Plant

-

Other Premium Infrastructure

-

-

Non-premium Infrastructure

-

-

Data Centers

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America piling machines market size was estimated at USD 1,009.1 million in 2024 and is expected to reach USD 1,034.8 million in 2025.

b. The North America piling machines market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2033 to reach USD 1,365.5 million by 2033..

b. Infrastructure segment led the market and accounted for 42.5% market share in 2024. This segment is one of the most dynamic and essential areas, covering a broad range of public works such as bridges, highways, tunnels, ports, railways, and airports. As governments at both federal and state levels continue to prioritize infrastructure development and rehabilitation, the demand for reliable and efficient piling machines is increasing.

b. Some of the key players operating in the North America piling machines market include Junttan USA, Bauer AG, Liebherr Group, Soilmec, Hammer & Steel, Inc., Sany Group, ABI Equipment Ltd, Casagrande S.p.A., ICE USA, Watson Inc.

b. Key factors driving the North America piling machines market include rising infrastructure development, urban expansion, renewable energy projects, and government investment in public works. Demand for efficient, low-noise, and environmentally friendly piling solutions is also boosting technological advancements and equipment upgrades.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.