- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Plastic Electrical Boxes Market, Industry Report 2033GVR Report cover

![North America Plastic Electrical Boxes Market Size, Share & Trends Report]()

North America Plastic Electrical Boxes Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (PVC, PC), By Product (Wall-mounted Electrical Boxes, Weatherproof & Outdoor Boxes), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-732-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Plastic Electrical Boxes Market Summary

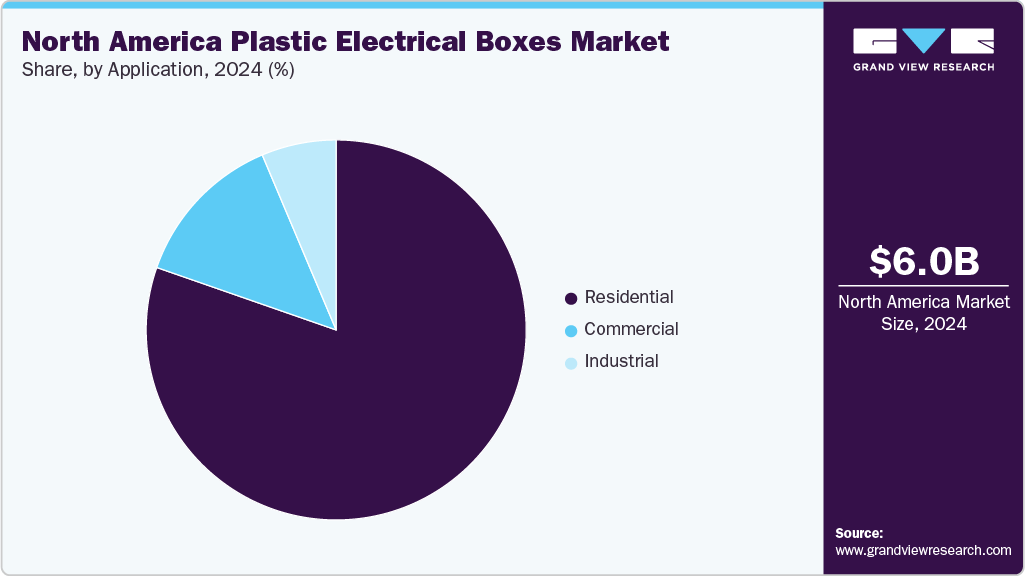

The North America plastic electrical boxes market size was estimated at USD 6.01 billion in 2024 and is projected to reach USD 10.34 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The industry is driven by the surge in residential electrification, fueled by rising developments of housing units, renovation projects, and smart home adoption.

Key Market Trends & Insights

- The U.S. dominated the North American plastic electrical boxes market with the largest revenue share of 88.51% in 2024.

- By material, the polycarbonate (PC) segment is expected to grow at a considerable CAGR of 6.7% from 2025 to 2033 in terms of revenue.

- By product, the weatherproof & outdoor boxes segment is expected to grow at a considerable CAGR of 6.8% from 2025 to 2033 in terms of revenue.

- By application, the residential segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 6.01 Billion

- 2033 Projected Market Size: USD 10.34 Billion

- CAGR (2025-2033): 6.3%

- U.S.: Largest market in 2024

As homeowners integrate more outlets, switches, lighting, and smart devices, the demand for cost-effective, easy-to-install, and code-compliant electrical enclosures is expected to further boost the product demand. The North American industry for plastic electrical boxes is closely tied to the region’s construction cycle, with residential and commercial activity setting the benchmark for sustained growth. As homebuilding surges and nonresidential projects expand, manufacturers find both stable baseline demand and opportunities to differentiate through specialized offerings.

Drivers, Opportunities & Restraints

The rapid proliferation of smart home and IoT devices across North America is creating unprecedented demand for the underlying infrastructure that makes these systems safe, reliable, and code-compliant. As more homeowners adopt voice-activated lighting, connected security systems and energy-management platforms, the need for standardized enclosure solutions has surged. These devices require reliable housing that safeguards wiring connections and meets stringent building-code requirements, making plastic electrical boxes an essential component in every installation.

The rapid deployment of smart home technologies and grid modernization programs opens significant growth avenues for plastic electrical box manufacturers. As utilities and contractors outfit homes and commercial buildings with advanced sensors, smart meters, and IoT devices, demand rises for purpose-built enclosures that support low-voltage wiring and embedded connectivity modules.

Retrofit projects in aging housing stock represent a particularly fertile segment, since slim-profile, snap-in boxes can be installed without extensive drywall work. Suppliers that develop catalogue ranges specifically for smart devices and partner with electrical distributors to bundle “smart retrofit kits” stand to capture early-mover advantages.

However, raw material price swings in resin markets create uncertainty that directly erodes manufacturer margins. When oil or natural gas prices spike, the cost of PVC, ABS, and polycarbonate can climb sharply, forcing producers to absorb higher expenses or pass them on to customers. In a market with tight competition, only a portion of these increases can be recouped, compressing profitability and discouraging investment in capacity expansion.

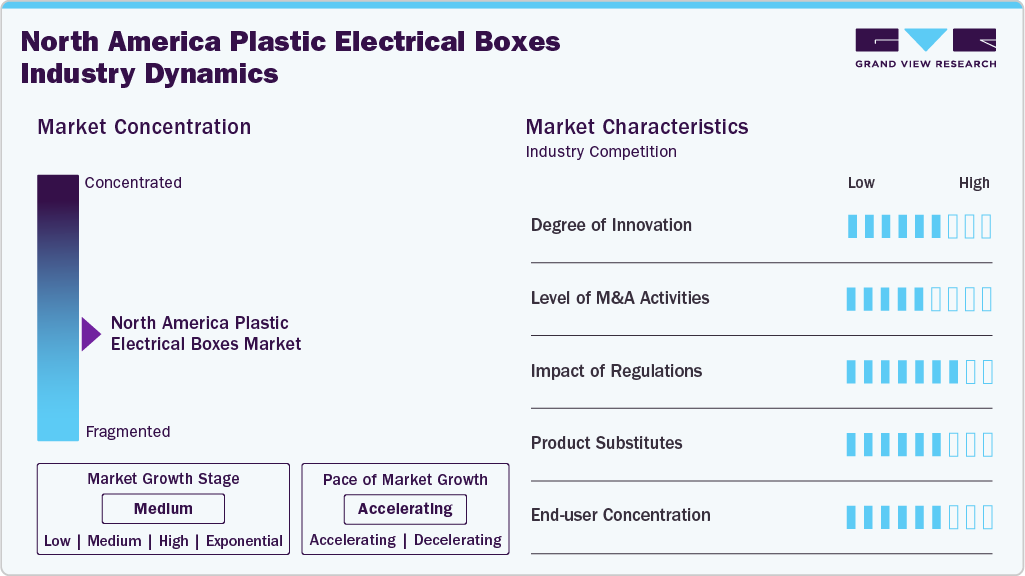

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is witnessing a moderate degree of innovation, driven by the ongoing wave of technological transformation that touches every stage of production and end use. Automation and digitalization are driving efficiency gains in molding operations and quality assurance. Advances in tooling and material engineering are enabling faster development cycles and higher-performance products.

Players are adopting a merger & acquisition strategy to expand their product portfolio and customer base while solidifying their market position. For instance, in June 2025, ABB Electrification Canada Inc. completed its acquisition of Bel Products Inc. This deal expands ABB’s portfolio and manufacturing footprint in Canada and the U.S., strengthening its ability to serve commercial, industrial, utility, and data‑center customers with locally made enclosure solutions.

Regulations have a moderate impact on the market. It operates under strict product safety and performance standards set by recognized testing bodies. In the U.S., Underwriters Laboratories (UL) certifies boxes to UL 514A for conduit bodies and UL 50/50E for enclosures. While in Canada, the Canadian Standards Association (CSA) issues CSA C22.2 No. 18.1 for electrical enclosures, enforced through Provincial electrical authorities.

Metal enclosures, steel or aluminum, and fiber-reinforced composites represent viable substitutes that offer extra mechanical strength or temperature resistance. When metal prices spike or new fire-safety regulations favor non-plastic materials, the substitution risk rises, but for now, plastics’ performance-to-cost ratio keeps the threat at a moderate level.

In the North American market for plastic electrical boxes, end-user concentration is particularly evident in the residential sector, followed by the commercial sector, fueled by demand from office buildings, retail spaces, and broader infrastructure growth. Meanwhile, industrial applications, including automation, manufacturing, and smart grid facilities, reflect the escalating need for durable and scalable electrical installations across energy and production environments.

Material Insights

The polyvinyl chloride (PVC) segment accounted for the largest revenue share of 59.84% of the overall market in 2024. The factors such as cost-effectiveness, durability, and compliance with residential electrical codes propel the product demand. Additionally, its non-conductive and corrosion-resistant nature makes it ideal for a wide range of indoor applications, especially in environments where grounding metal boxes is not required.

Acrylonitrile Butadiene Styrene (ABS) strikes a balance between mechanical robustness and cost effectiveness, making it ideal for commercial and mid-range residential boxes. Its good impact resistance and ease of coloring allow brands to standardize tooling across multiple product lines, reducing capital expenditure.

The polycarbonate segment is anticipated to grow at the fastest CAGR of 6.7% over the forecast period. Polycarbonate commands a premium position in markets that demand superior strength, heat resistance, and optical clarity. Its high impact toughness and dimensional stability underload make it ideal for data center enclosures, industrial control panels, and outdoor junction boxes.

Product Insights

Based on product, the wall-mounted electrical boxes dominated the revenue share of 35.78% in 2024. These boxes are the primary enclosures used for outlets, light switches, and low-voltage systems in residential and commercial buildings. With growing electrification needs per square foot, wall-mounted plastic boxes continue to see strong demand due to their versatility, insulation properties, and regulatory compliance.

The weatherproof & outdoor boxes segment is expected to grow at the fastest CAGR of 6.8% over the forecast period. Outdoor-rated enclosures must withstand UV exposure, temperature cycling, and moisture ingress, driving the use of UV-stabilized polycarbonate and PC-ABS blends with halogen-free flame retardants. Manufacturers deploy multi-shot molding to bond gasketed covers, achieving NEMA Type 3R or 4X ratings that command premium pricing in utilities and infrastructure projects.

Ceiling and fan-rated boxes require higher structural strength and vibration tolerance, so nylon and polycarbonate are often specified over PVC. Nylon’s inherent toughness under load makes it ideal for heavy ceiling fans and lighting fixtures, while PC versions support integrated sensor mounts for occupancy or daylight harvesting controls.

Application Insights

Based on applications, the residential segment accounted for the largest revenue share of 80.34% of the overall market in 2024. Plastic boxes are the preferred choice in residential settings due to their cost-effectiveness, light weight, and suitability for non-metallic wiring systems. Additionally, their widespread use is supported by national codes that permit plastic enclosures in non-combustible environments. The segment is also expected to grow at the fastest CAGR of 6.6% over the forecast period.

The industrial segment is anticipated to grow at a CAGR of 3.4% over the forecast period, due to the steady expansion of U.S. industrial activity, which is driving demand for specialized plastic enclosures built to withstand harsh conditions. Additionally, in manufacturing and processing environments, IP66/IP67-rated wall-mounted boxes protect control switches and operator panels from water and chemical exposure.

In corporate interiors and large-scale fit-outs, developers increasingly favor low-profile floor-box systems and modular junction enclosures to streamline network and power distribution. Plastic alternatives offer a lower total cost of ownership than metal enclosures by reducing the need for grounding and corrosion control. Surface-mount and recessed data-communication boxes further add value by allowing quick reconfiguration in response to tenant changes, helping preserve rental yields.

Country Insights

U.S. Plastic Electrical Boxes Market Trends

The U.S. plastic electrical boxes market accounted for the largest revenue share of 88.51% in 2024. It is due to its high volume of residential construction, renovations, and widespread use of plastic-based electrical infrastructure. National Electrical Code (NEC) regulations allow the use of non-metallic boxes in most residential and light commercial applications, which has fueled the widespread adoption of PVC and other polymer-based electrical boxes.

Canadian Plastic Electrical Boxes Market Trends

The Canadian plastic electrical boxes market is projected to grow steadily, driven by energy-efficient construction norms, urban residential development, and stringent building code enforcement. Plastic boxes are widely used in single-family homes and multi-unit dwellings due to their insulation properties, compliance with standards, and cost-effectiveness.

Mexico Plastic Electrical Boxes Market Trends

Mexico plastic electrical boxes marketis projected to experience robust growth from 2025 to 2033. The industry is driven by strong demand from automotive and electronics manufacturing. Plastic electrical boxes are gaining popularity due to their lightweight, non-corrosive, and insulating properties, characteristics especially valued in residential and commercial infrastructure. While specific market-size data for plastic electrical boxes in Mexico is limited, the strong growth in engineering plastics and industrial automation strongly suggests notable demand growth for plastic enclosures in electrical installations, power distribution, and renewable energy systems.

Key North America Plastic Electrical Boxes Companies Insights

Key players operating in the North America plastic electrical boxes market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key North America Plastic Electrical Boxes Companies:

- Hubbell Incorporated

- Cantex Inc.

- Polycase

- Kraloy Fittings

- Wesco International

- Hammond Manufacturing Ltd.

- Mier Products, Inc.

- ABB Electrification Canada Inc.

- Schneider Electric

- Custom Design Technologies Ltd.

- Termination Technology

- KAISER GmbH & Co. KG

- Foshan City Kingsun Electrical Co., Ltd.

Recent Developments

-

In February 2025, ABB Electrification Canada Inc. completed its acquisition of Bel Products Inc., a custom electrical enclosure manufacturer based in Montreal. This deal expands ABB’s portfolio and manufacturing footprint in Canada and the U.S., strengthening its ability to serve commercial, industrial, utility, and data‑center customers with locally made enclosure solutions.

-

In November 2024, ABB Group and Niedax Group completed their previously announced 50/50 joint venture, forming Abnex Inc., to expand cable tray manufacturing and complementary product and service capabilities in North America. The new company combined ABB’s Installation Products Division and Niedax’s expertise to offer a broad range of cable tray solutions for electrical contractors, distributors, and system integrators across the US, Canada, and Mexico.

North America Plastic Electrical Boxes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.36 billion

Revenue forecast in 2033

USD 10.34 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Hubbell Incorporated; Cantex Inc.; Polycase; Kraloy Fittings; Wesco International; Hammond Manufacturing Ltd.; Mier Products, Inc.; ABB Electrification Canada Inc.; Schneider Electric; Custom Design Technologies Ltd.; Termination Technology; KAISER GmbH & Co. KG; Foshan City Kingsun Electrical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Plastic Electrical Boxes Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America plastic electrical boxes market report based on material, product, application, and country:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Polyvinyl Chloride (PVC)

-

Polycarbonate (PC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Other Materials

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Wall-Mounted Electrical Boxes

-

Ceiling Boxes / Fan Boxes

-

Weatherproof & Outdoor Boxes

-

Other Products

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America plastic electrical boxes market was estimated at around USD 6.01 billion in 2024 and is expected to reach around USD 6.36 billion in 2025.

b. The North America plastic electrical boxes market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030, reaching around USD 10.34 billion by 2033.

b. The polyvinyl chloride (PVC) segment recorded the largest market revenue share of over 59.84% in 2024 owing to the factors such as cost-effectiveness, durability, and compliance with residential electrical codes.

b. The key players in the North America plastic electrical boxes market include Hubbell Incorporated, Cantex Inc., Polycase, Kraloy Fittings, Wesco International, Hammond Manufacturing Ltd., Mier Products, Inc., ABB Electrification Canada Inc., Schneider Electric, Custom Design Technologies Ltd., Termination Technology, KAISER GmbH & Co. KG, and Foshan City Kingsun Electrical Co.,Ltd

b. The North America plastic electrical boxes market is driven by the surge in residential electrification, fueled by rising developments of housing units, renovation projects, and smart home adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.