North America Polyurea Market Trends

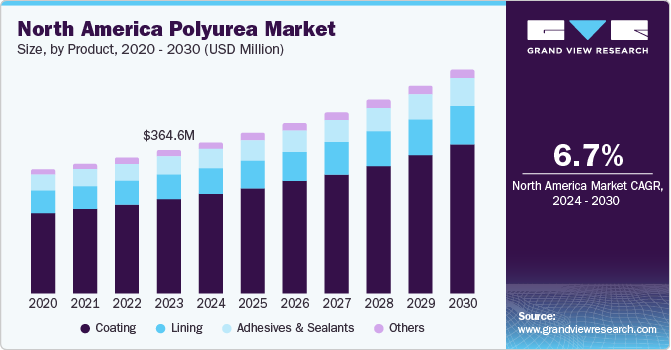

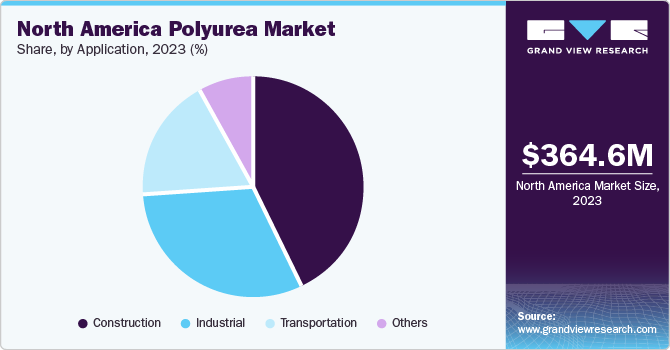

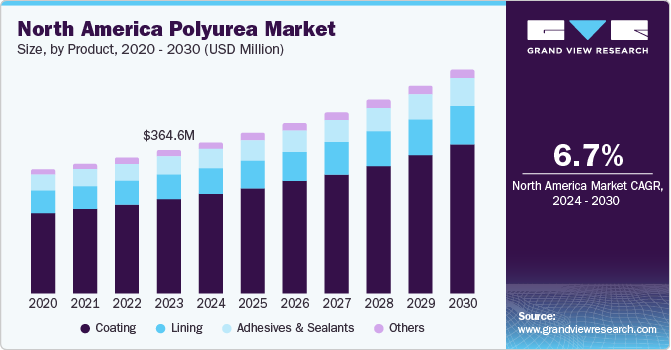

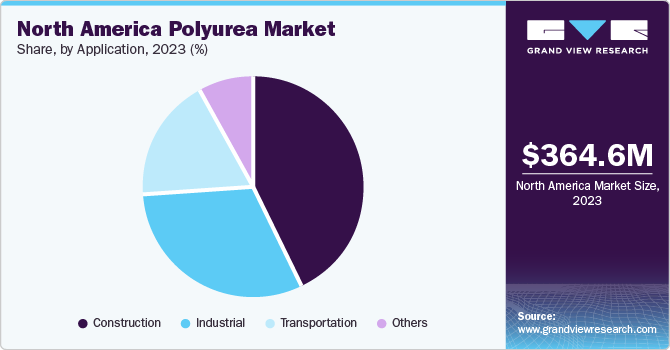

The North America polyurea market size was valued at USD 364.6 million in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. The market is growing due to the increasing demand for durable and high-performance coatings in various industries such as construction, automotive, and industrial applications. The exceptional properties of polyuria such as rapid curing, high chemical resistance, and adhesion are increasing the demand for protective coatings and linings, are fueling market growth.

Polyurea has witnessed a growing demand in the construction industry for waterproofing, flooring, and corrosion protection in buildings and infrastructure projects. The ever-increasing infrastructure and renovation projects encourage market demand. Moreover, the automotive industry has increased the adoption of polyurea for truck bed liners, underbody coatings, and sound-dampening applications, contributing to market developments.

The oil and gas industry requires polyurea for pipeline protection, tank linings, and secondary containment systems. Polyurea can withstand harsh chemicals and extreme temperatures. Environmental regulations and sustainability concerns drive market expansion. This has led to an increasing adoption of polyurea to replace traditional coating materials in various applications. In addition, technological advancements in the formulation and application of polyurea have further expanded the industry.

Product Insights

Coatings dominated the market and accounted for a share of 65.7% in 2023 owing to its exceptional characteristics and demand from various industries that drive market growth. Polyurea coatings are durable, abrasion-resistant, and chemical-resistant, making them suitable for protection in harsh environments such as industrial facilities, infrastructure projects, and automotive applications. In addition, the availability of environmentally friendly solutions have increased the adoption of polyurea coatings.

The lining segment is expected to register a CAGR of 6.6% over the forecast period. The increasing demand for polyurea linings provides the best solution to harsh chemicals, abrasion, and impact and is ideal for tanks, pipework, and containment zones. The growing focus on the environmental standards and requirements for secondary containment in industrial settings also contributes to the higher demand for polyurea linings. The curing time of polyurea allows quick and easy installation and minimal downtime, which is required in various industries. The growth in the mining industry, where polyurea linings are used for wear protection, and in the food and beverage for hygienic coatings, is driving the market expansion.

Application Insights

Construction accounted for the largest market share of 43.1% in 2023 pertaining to the widespread adoption of polyurea in the construction industry is mainly for its robust features and applicability. Polyurea's rapid curing time allows for faster project completion and quick return to service, which is crucial for construction work. Its waterproofing capabilities make it highly demanded in roofing foundations, increasing the market growth. In addition, its resistance to chemicals and UV radiation makes it suitable for interior and exterior use. The growing trend towards sustainable practices has further boosted polyurea's popularity, as it is low in volatile organic compounds (VOCs) and can contribute to energy efficiency in buildings.

The industrial segment is expected to register a fast-growing CAGR of 6.7% over the forecast period. Polyurea coatings and linings are popular in industries due to their high chemical resistance, abrasion resistance, and durability in harsh environments. These characteristics of polyurea make them suitable for protecting equipment, machinery, tanks, and pipelines in industries such as oil and gas, the chemical industry, automotive, and others. The increased awareness of safety, especially in the workplace and environmental impacts, is thus putting pressure on sound protection in case of leaks, spillage, and corrosion. The rising demand for polyurea in applications such as secondary containment systems, flooring, and water treatment plants also increases its demand in the industrial segment.

Country Insights

U.S. Polyurea Market Trends

The U.S. polyurea market dominated North American with a share of 42.8% in 2023 due to increasing infrastructure development, renovation projects, and industrial applications. Furthermore, the construction sector requires durable coatings, and the automotive industry requires protective linings. Hence, the demand for durable products is anticipated to propel market growth in the U.S. The preference for environmentally friendly coatings with polyurea's low-VOC properties contributes to the market demand in the U.S.

Canada Polyurea Market Trends

Canada polyurea market held a significant revenue share in 2023 owing to its focus on infrastructure development. Its suitability in harsh climate conditions adds to its demand in Canada. The oil and gas industry's demand for protective coatings in pipelines and storage tanks is highly evident in the country’s market trends.

Mexico Polyurea Market Trends

Mexico polyurea market growth is positively projected in the coming years due to its industrialization and increasing foreign investments in manufacturing sectors. In addition, growing construction activities, especially in the commercial and industrial sectors, are expected to contribute to the development of in-house industries. The focus on upgrading infrastructure, including bridges and highways, creates opportunities for polyurea coatings and augments the market demand.

Key North America Polyurea Company Insights

Some key companies in the North America polyurea market include Huntsman International LLC, Teknos Group, KOWA AMERICAN Corporation, ArmorThane, and BASF. Organizations focus on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Huntsman International LLC is a global manufacturer of various products used in industries, such as aerospace, automotive, construction, electronics, energy, furniture, and textiles. The company operates through four main business divisions: polyurethanes, performance products, advanced materials, and textile effects. Their product portfolio includes MDI-based polyurethanes, epoxy resins, thermoplastic polyurethanes (TPU), amines, surfactants, maleic anhydride, and textile dyes and chemicals.

-

Teknos Group is a global company that produces high-quality paints and coatings for architectural, industrial, and consumer markets. It offers various products, such as powder coatings, liquid paints, wood coatings, and functional coatings for various surfaces and applications. The company is known for its innovative approach, focusing on developing sustainable coating solutions.

Key North America Polyurea Companies:

- Huntsman International LLC

- Teknos Group

- KOWA AMERICAN Corporation

- ArmorThane

- Polycoat Products

- BASF

- PPG Industries

- VersaFlex Inc. Nukote Coating Systems

- Nukote Coating Systems International

- SWD Polyurethane

Recent Developments

-

In July 2024, Huntsman announced its IROGRAN products have received bluesign approval, demonstrating their commitment to environmentally friendly and sustainable manufacturing practices. The bluesign certification ensures that these products meet high standards for safety, resource efficiency, and minimal environmental impact throughout their lifecycle.

-

In May 2020, Teknos has launched Teknopur 400, a new high-performance polyurea coating designed for industrial applications. This product offers exceptional durability and resistance to abrasion, chemicals, and weathering, making it suitable for harsh environments. Teknopur 400 is engineered to provide a long-lasting, protective finish while maintaining excellent aesthetic qualities.

North America Polyurea Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 385.1 million

|

|

Revenue forecast in 2030

|

USD 569.7 million

|

|

Growth rate

|

CAGR of 6.7% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, country

|

|

Country scope

|

U.S.; Canada; Mexico

|

|

Key companies profiled

|

Huntsman International LLC; Teknos Group; KOWA AMERICAN Corporation; ArmorThane; Polycoat Products; BASF; PPG Industries; VersaFlex Inc; Nukote Coating Systems International; SWD Polyurethane

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

North America Polyurea Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North American polyurea market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coating

-

Lining

-

Adhesives & Sealants

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Industrial

-

Transportation

-

Others

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)