- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyurea Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Polyurea Market Size, Share & Trends Report]()

Polyurea Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (Aromatic, Aliphatic), By Product (Coating, Lining, Adhesives & Sealants), By Application (Construction, Industrial, Transportation), By Region, And Segment Forecasts

- Report ID: 978-1-68038-224-2

- Number of Report Pages: 164

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyurea Market Summary

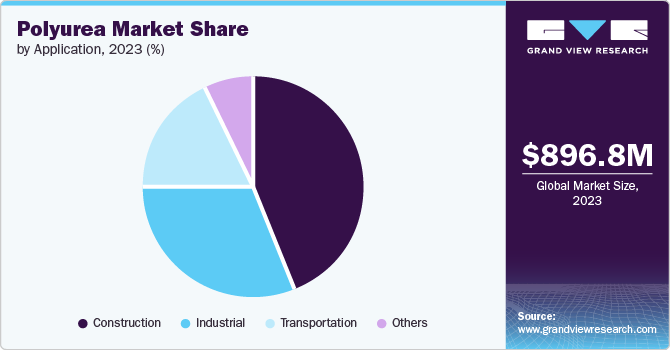

The global polyurea market size was estimated at USD 896.8 million in 2023 and is projected to reach USD 1,373.34 million by 2030, growing at a CAGR of 6.4% from 2024 to 2030. The market growth is being fueled by the use of polyurea in many construction applications, including containment liners, waterproofing membranes, and flooring systems.

Key Market Trends & Insights

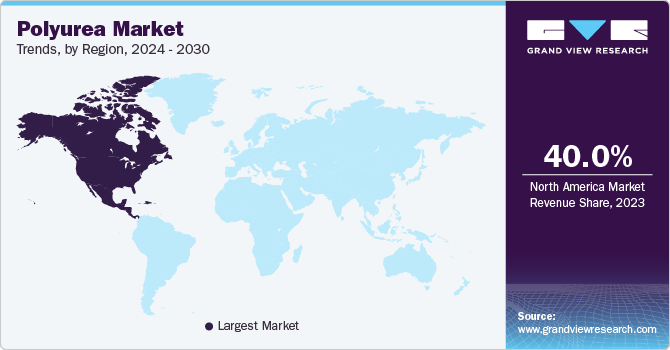

- The polyurea market in North America dominated the global industry in 2023 and accounted for a revenue share of more than 40.0%.

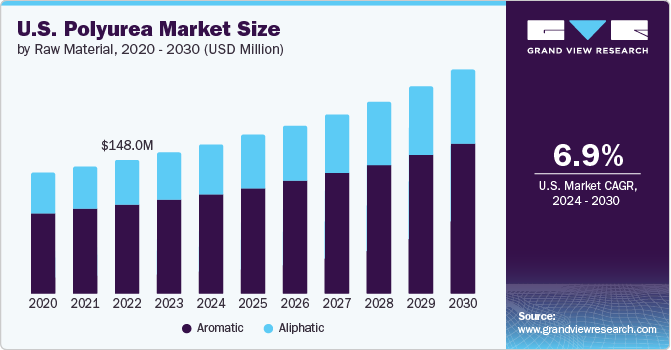

- U.S. Polyurea Market led the North America regional market with a revenue share of 42.9%.

- Based on raw material, the aromatic raw material segment dominated the global market and accounted for more than 67.0% of the total market share in 2023.

- In terms of product, the coating segments dominated the global market in 2023.

- On the basis of application, the construction segment dominated the market and accounted for a share of more than 43.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 896.8 million

- 2030 Projected Market Size: USD 1,373.34 million

- CAGR (2024-2030): 6.4%

- North America: Largest market in 2023

Polyurea coatings offer high corrosion protection standards, abrasion resistance, waterproofing, chemical and atmospheric resistance, and structural enhancement. Moreover, these products exhibit superior characteristics in spray applications, such as high thermal, mechanical, & chemical resistance, short setting & curing time, absence of solvents, hydrolysis stability, water insensitivity, and a high degree of adherence as compared to their substitutes. The expansion of these end-use industries is expected to propel the growth of the coatings market over the forecast period.

To cater to the increasing growth in the automotive industry, polyurea plastics are being utilized for providing rust prevention and UV resistance. Polyurea is increasingly being used to substitute metal fasteners in automobiles to reduce overall car weight by around 15%, leading to a reduction in carbon emissions. The aforementioned trends are expected to promote the application of polyurea in the automotive and construction industries.

Increasing requirements for coating solutions with specifications, such as enhanced service life, improved corrosion resistance, and good thermal stability on account of the rising importance of condition-based monitoring over breakdown maintenance in manufacturing industries is expected to fuel market growth.

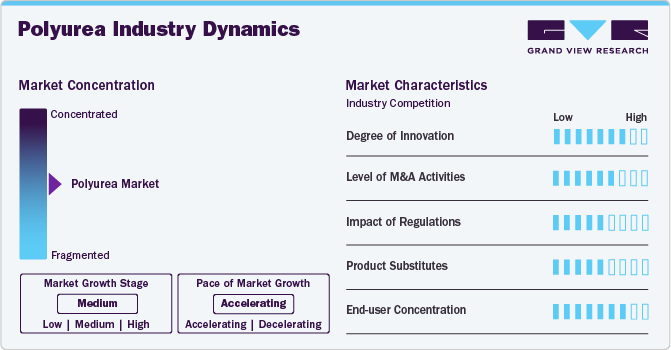

Market Concentration & Characteristics

The polyurea market is moderately consolidated in nature BASF; W.R. Grace; SWD Polyurethane; Specialty Products Inc.; LINE-X Protective Coatings; Nukote Coating Systems International; VersaFlex Inc. Nukote Coating Systems, and PPG Industries, which dominate a significant market share. These companies often engage in aggressive marketing strategies, R&D initiatives, and M&As to strengthen their market position and expand their product offerings.

In the polyurea market, there are several product substitutes that cater to similar applications. Polyurethane coatings and epoxy coatings are prominent alternatives offering comparable protective qualities and versatility in applications, such as waterproofing, corrosion protection, and industrial coatings. Polyurethanes are valued for their flexibility and chemical resistance, while epoxies are known for their high adhesion and durability. In addition, acrylic coatings are another substitute known for their weather resistance and aesthetic appeal in architectural and automotive applications.

The polyurea market is characterized by a significant end-use concentration showcasing a substantial presence in construction, automotive, and industrial applications. In construction, polyurea coatings are extensively used for waterproofing and protecting concrete structures due to their rapid curing time and durability. The automotive sector utilizes polyurea for protective coatings on vehicles and components to enhance resistance against wear, chemicals, and UV exposure. In industrial settings, polyurea is favored for its versatility in corrosion protection, containment linings, and flooring applications.

Raw Material Insights

The aromatic raw material segment dominated the global market and accounted for more than 67.0% of the total market share in 2023. These raw materials provide good physical properties and easy processability. Hence, aromatic systems are coated with aliphatic topcoats for desired color stability on exposure to UV light. Because they exhibit excellent flexibility characteristics, aromatics-based polyurea compounds are expected to find applications in the construction and manufacturing sectors in developed countries, including Germany, the UK, and Spain.

Factors, such as suitable demographics for production and a rise in population, are expected to drive the product demand in the construction industry. Polyurea is used for vacuum construction, pipes, and fittings due to its excellent mechanical strength and low weight. Products made using polyurea are corrosion-resistant and more durable than polyvinyl chloride (PVC), and they are used to manufacture waste collector products. These advantageous properties are anticipated to augment demand for aromatic compounds in the polyurea market.

Product Insights

Based on product, the coating segments dominated the global market in 2023. The rising importance of coatings as a surface protection medium in the automotive, aerospace, civil construction, oil & gas sectors is anticipated to positively impact the polyurea industry. However, the high market visibility of other coating formulations, including acrylic, epoxy, and polyurethane, is expected to restrict polyurea application.

In addition, increasing construction spending in China and India owing to regulatory support aimed at infrastructure improvement at a domestic level is expected to fuel polyurea demand. Furthermore, the strong presence of automotive manufacturing units in the U.S. and Mexico is expected to fuel the demand for polyurea coatings.

The lining segment is expected to witness significant growth over the forecast period. This growth is driven primarily by its exceptional properties, which make it ideal for various industrial applications. Polyurea linings are valued for their rapid curing time, which minimizes downtime during installation, which is crucial for industries where operational continuity is paramount. These linings offer superior chemical resistance, durability, and flexibility, making them suitable for containment applications such as tanks, pipelines, and secondary containment systems.

Application Insights

The construction segment dominated the market and accounted for a share of more than 43.5% in 2023. This can be attributed to the increasing investments in infrastructural activities in developing economies such as the Asia Pacific and Middle East & Africa regions. Polyurea coatings are highly valued in construction for their fast curing times, which allow for quick project turnaround and reduced downtime. They offer exceptional durability and flexibility, making them ideal for waterproofing applications on roofs, parking decks, and building exteriors. Their ability to adhere to various substrates, including concrete, metal, and wood, makes them versatile for new construction and renovation projects.

The industrial segment is poised to witness significant growth over the forecast period, owing to the rapid industrialization in emerging economies and growing exports by well-developed countries. Polyurea coatings are highly sought after in industries such as oil and gas, mining, and manufacturing due to their superior chemical resistance, durability, and ability to withstand extreme conditions. These coatings offer adequate protection against corrosion, abrasion, and impact damage, prolonging the lifespan of equipment, storage tanks, and infrastructure.

Regional Insights

The polyurea market in North America dominated the global industry in 2023 and accounted for a revenue share of more than 40.0%. Expansions in the shale gas industry of the U.S. and Canada, on account of increasing expenditure on hydraulic fracturing, are expected to fuel polyurea demand as coatings and lining systems over the forecast period. Sluggish growth in the manufacturing sectors of developed countries including Canada and Mexico, on account of increasing utility expenditure, is expected to reduce product consumption in the form of sealants and coatings.

U.S. Polyurea Market Trends

U.S. Polyurea Market led the North America regional market with a revenue share of 42.9%. Increasing construction activities for residential purposes in the U.S. is expected to have a positive impact on the coatings market over the forecast period. Recovery after the great recession in 2008-09 has played an important role in driving the growth of the U.S. construction industry.

The Polyurea Market in Canada is expected to witness significant growth. The harsh climate, characterized by freezing winters and hot summers, underscores the necessity for durable and reliable coatings like polyurea. These coatings are essential for infrastructure projects, such as bridges, roads, and buildings, where they provide robust protection against temperature fluctuations and environmental wear.

Europe Polyurea Market Trends

The Europe polyurea market is anticipated to grow at a significant pace during the forecast period. In Europe, the market benefits significantly from stringent environmental standards that prioritize sustainability and safety. These regulations propel the adoption of polyurea coatings due to their low volatile organic compound (VOC) emissions and eco-friendly properties, aligning with Europe's commitment to reducing environmental impact.

Polyurea Market in Germany held the largest share of the Europe regional market. The country is renowned for its precision engineering and high-quality standards. Polyurea coatings play a crucial role in Germany's automotive industry, where they are essential for vehicle assembly, component protection, and aftermarket applications. These coatings are valued for their exceptional durability, providing reliable protection against wear and corrosion, which is crucial for extending the lifespan of automotive components and ensuring long-term vehicle performance.

The UK Polyurea Market is significantly growing owing to the growing emphasis on sustainability and energy efficiency in construction practices. This focus drives the adoption of polyurea coatings for their eco-friendly attributes, such as low volatile organic compound (VOC) emissions and energy-saving capabilities. These coatings are highly valued in the construction sector for their ability to enhance building envelopes and roofing systems, providing effective waterproofing, insulation, and durability.

Asia Pacific Polyurea Market Trends

The polyurea market in Asia Pacific accounted for a substantial market share in 2023 owing to the robust presence of automobile manufacturing facilities in China, India, Japan, and South Korea in light of easy access to consumables. In addition, high market visibility for conventional coatings including epoxy in China in light of an increased number of local manufacturing units is expected to reduce the application of polyurea coatings over the forecast period.

The China Polyurea Market dominated the Asia Pacific regional market in 2023 due to rapid urbanization and extensive infrastructure development. As cities expand and modernize, there is a heightened demand for polyurea coatings in construction projects aimed at waterproofing, corrosion protection, and enhancing structural durability across buildings and transportation infrastructure. The booming construction sector in China, driven by government investments and urban development initiatives, continues to propel the adoption of polyurea coatings as a critical solution for ensuring the long-term sustainability and resilience of infrastructure projects.

The Polyurea Market in Japan is anticipated to grow at a substantial CAGR from 2024 to 2030, benefiting significantly from its advanced manufacturing sector, which necessitates high-performance coatings for critical applications in electronics, automotive components, and precision machinery. As Japan continues to innovate in technology and manufacturing, the demand for polyurea coatings is expected to grow, driven by their ability to meet stringent quality standards and enhance the performance and longevity of sophisticated industrial equipment and products.

Central & South America Polyurea Market Trends

The Central and South America polyurea market is experiencing significant growth driven by expanding industrial sectors including mining, oil & gas, and manufacturing. These industries require robust protective coatings such as polyurea for equipment and infrastructure to withstand harsh environmental conditions and operational challenges. In addition, increasing investments in infrastructure projects across the region, including transportation networks and energy facilities, further stimulate the demand for polyurea coatings.

Middle East & Africa Polyurea Market Trends

The polyurea market in the Middle East and Africa is witnessing steady growth driven by infrastructure development, and increasing disposable income. Large-scale infrastructure projects, such as Saudi Arabia’s NEOM city and the UAE’s Expo 2020 developments, increase the demand for high-performance coatings and materials that use saturated polyester resins for long-lasting protection.

Another key factor driving growth is the region's prominent oil and gas industry, which relies heavily on polyurea coatings for critical applications such as pipeline protection, corrosion resistance, and containment solutions. Furthermore, substantial investments in regional infrastructure projects, including urban development and transportation networks, propel the demand for polyurea coatings.

Key Polyurea Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansions, and joint ventures, to maintain and expand their market share.

-

In October 2023, Everest Systems Co. launched EverMax Polyurea, a flexible roof coating. Evermax Polurea offers resistance to mechanical damage, flexibility, and low shrinkage.

-

In October 2020, PPG, a global coatings company, launched PPG SaniShield 3000/5000, a polyurea coating system. This system is designed to provide long-lasting protection against viruses, bacteria, and other microorganisms on various surfaces. The PPG SaniShield 3000/5000 is a two-component, fast-curing polyurea coating that can be applied to floors, walls, and other surfaces in commercial and industrial settings. It offers excellent chemical resistance, abrasion resistance, and flexibility, making it suitable for high-traffic areas.

Key Polyurea Companies:

The following are the leading companies in the polyurea market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- W.R. Grace

- SWD Polyurethane

- Specialty Products Inc.

- LINE-X Protective Coatings

- Nukote Coating Systems International

- VersaFlex Inc. Nukote Coating Systems

- PPG Industries

Polyurea Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 944.51 million

Revenue forecast in 2030

USD 1,373.34 million

Growth rate

CAGR of 6.4% from 2024 to 2030

Base Year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

BASF; W.R. Grace; SWD Polyurethane; Specialty Products Inc.; LINE-X Protective Coatings; Nukote Coating Systems International; VersaFlex Inc. Nukote Coating Systems, PPG Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyurea Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyurea market report based on raw material, product, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aromatic

-

Aliphatic

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coating

-

Lining

-

Adhesives & Sealants

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Industrial

-

Transportation

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyurea market size was estimated at USD 896.8 million in 2023 and is expected to reach USD 944.5 million in 2024.

b. The global polyurea market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 1,373.3 million by 2030.

b. The coating segment dominated the polyurea market with a share of 66.3% in 2023. This is attributable to the rising demand for coatings in construction, automotive, and healthcare applications.

b. Some key players operating in the polyurea market include BASF; W.R. Grace; SWD Polyurethane; Nukote Coating Systems International; LINE-X Protective Coatings; PPG Industries; Specialty Products Inc.; and VersaFlex Inc. Nukote Coating Systems.

b. Key factors that are driving the market growth include growing use of protective coatings in automotive and construction applications on account of their rust prevention and high durability properties and increasing application in adhesives and sealants as bonding agents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.