- Home

- »

- Advanced Interior Materials

- »

-

North America Polyurethane Processing Machinery Market, 2030GVR Report cover

![North America Polyurethane Processing Machinery Market Size, Share & Trends Report]()

North America Polyurethane Processing Machinery Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mixing Heads, Foaming Equipment), By Pressure, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-035-1

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

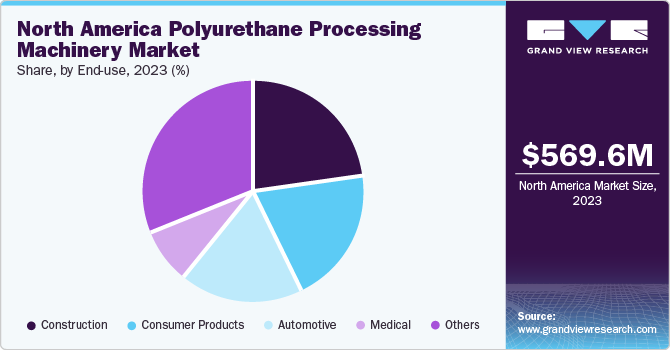

The North America polyurethane processing machinery market size was estimated at USD 569.6 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.6% from 2024 to 2030. The increasing spending and rising number of vehicle owners in North America are expected to boost the demand for polyurethane processing and, in turn, drive the growth of polyurethane processing machinery over the forecast period.

The rising application of polyurethane foam products in various end-use industries, such as construction, consumer products, automotive, etc., in the U.S. is expected to boost the demand for PU processing. Further, apart from various applications, the growth of the end-use industries in North America is catapulting the growth of the polyurethane processing machinery market.

The growing demand in construction, automotive, medical, and consumer goods is driving the demand for processed PU products such as foams, fittings, seals, tubes, packaging, etc. According to the International Organization of Motor Vehicle Manufacturers, the total number of vehicles produced in the U.S. soared by 10% in 2022 after registering a 4% increase in 2021 compared to the previous year. Thus, the growing demand for vehicles is consequently contributing to the market’s growth.

Moreover, polyurethane is an integral part of healthcare instruments and devices, where it is used in general products such as catheters, wound dressings, medical gloves, etc. Therefore, with rising healthcare spending coupled with the increasing trend of health consciousness, the demand for polyurethane processing machinery is anticipated to grow over the forecast period.

According to the National Health Expenditure Accounts (NHEA), total healthcare spending in the U.S. increased by 4.1% in 2022, reaching USD 4.5 trillion. Per capita healthcare spending was USD 13,493 in 2022, growing from USD 13,012 in 2021. The rising healthcare spending and increasing demand for medical devices and products are expected to support market growth over the forecast period.

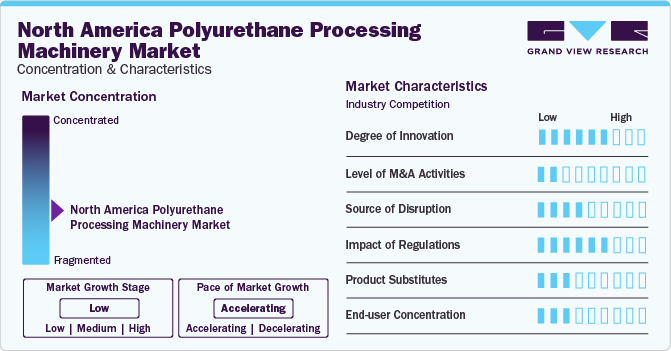

Market Concentration & Characteristics

The market growth stage is low, and the pace is accelerating. North America polyurethane processing machinery market is characterized by high competition due to the large number of manufacturers and providers of polyurethane processing machines. Moreover, the major companies have an edge over the small-scale and medium-scale companies in terms of their technical expertise and regional presence.

The growing demand from the automotive, consumer goods, medical, and construction industries to ensure product safety and quality, as well as to avail detailed product information, has resulted in increased investments from the manufacturers of polyurethane processing machinery. Product innovation, investments, expansions, collaboration, and joint ventures also characterize the North America polyurethane processing machinery market. Key market players adopting this inorganic growth strategy include Hennecke GmbH, KraussMaffei, Graco Inc., FRIMO, etc.

Manufacturers in this sector must comply with the set of laws and rules specific to the region. The polyurethane processing machinery market is largely ruled by various regulations, certifications, and standards offered by multiple organizations, such as the Polyurethane Foam Association, the National Emission Standards for Hazardous Air Pollutants (NESHAP), and the International Standards Organization (ISO), as well as by governments of different countries.

Moreover, Industry 4.0 is transforming the manufacturing industry by integrating different digital technologies. This trend in the U.S. & Canada polyurethane processing machinery market involves using IoT sensors, data analytics, and automation to create smart and highly connected machinery. For instance, smart sensors embedded in polyurethane processing machinery can monitor its health in real time, predict its maintenance requirements, and optimize its production parameters, thereby reducing downtime.

Additionally, collaborative robots can be integrated with assembly lines of polyurethane processing machinery to carry out repetitive or heavy tasks. These robots are designed to work alongside human operators to enhance the productivity of different manufacturing processes, thereby improving the overall efficiency of these processes. These manufacturing and technology trends collectively contribute to the evolution of the polyurethane processing machinery market in North America.

Product Insights

The mixing heads segment dominated the market and accounted for a revenue share of 29.8% in 2023. Mixing heads are responsible for mixing the chemicals supplied by the previous system and later distributing the mixture or blending through various methods such as spraying and closed or open pouring. The rising demand for consumer products is expected to positively influence the growth of the mixing heads segment over the forecast period. Further, the growing product launches are likely to boost the segment’s growth.For instance, in November 2021, Cannon Group introduced the talking head, a high-pressure mixing head fitted with around 30 sensors to track performance.

The foaming equipment segment is expected to witness the highest CAGR over the forecast. The segment’s growth is significantly attributed to the rising market demand for molded components, non-continuous rigid, self-skinning, and cold-curing foam. The applications of different types of foams include decoration, furniture, refrigerators, insulation materials, and various components of automobiles. Further, rising expenditure on furniture and mattresses in North America is anticipated to drive polyurethane foam products. Thus, the demand for foaming equipment is likely to surge over the forecast period.

Pressure Insights

The high-pressure segment accounted for the largest market revenue share in 2023. The high-pressure polyurethane processing machinery is mainly designed to manufacture PU products by automatically mixing & pouring polyurethane.High-pressure polyurethane processing machinery includes precision metering pumps and high-pressure mix heads for producing PU flexible, rigid, and PU skin foams. These machines provide high-quality foam with uniform cell structure and superior insulation performance.

The low-pressure segment is expected to grow at the fastest CAGR over the forecast period. Low-pressure PU processing machines support applications requiring higher viscosities, smaller quantities, or different viscosity levels among the various chemicals used in a mixture. These devices are also utilized when various chemical streams must be handled before mixing. In addition, the construction sector uses low-pressure PU processing machines to apply foams. Hence, the growing construction and automotive sectors are expected to increase demand for low-pressure PU processing machines over the forecast period.

End-use Insights

The construction segment accounted for the largest market revenue share in 2023.PU-based binders are used in wood-plastic composites for combining organic materials into particleboard, strawboard, laminated-veneer lumber, long-strand lumber, medium-density fiberboard (MDF), and oriented strand board (OSB). In addition, polyurethane-based composite materials are steadily gaining importance in modern lightweight construction. The PU processing equipment is in significant demand in the construction sector, including civil engineering projects like building construction and interior design. According to the Associated General Contractors, the multifamily houses construction in December 2023 increased by 3.2% compared to November 2023.

The automotive segment is expected to grow at the highest CAGR over the forecast period, owing to the increasing vehicle demand in North America. Further, with the technological advancements, new electric vehicles are continuously being developed and introduced to the market. The number of EV launches is facilitating the demand for polyurethane products. Polyurethane foams are used in various interior components such as headrests, armrests, and seats owing to their cushioning property, which aids in reducing the stress and fatigue associated with driving. Furthermore, polyurethane is used to provide insulation against the noise and heat of the engine.

Regional Insights

North America polyurethane processing machinery market was led by the U.S. in 2023 by market revenue share, accounting for 81.1%. Canada is expected to grow at the highest CAGR over the forecast period. The use of polyurethane is surging in the medical, consumer goods, and construction industries owing to its biocompatibility, robustness, flexibility, and chemical and abrasion resistance characteristics of processed PU products. Thus, the increasing use of polyurethane in North America is expected to fuel the demand for polyurethane processing machinery over the forecast period.

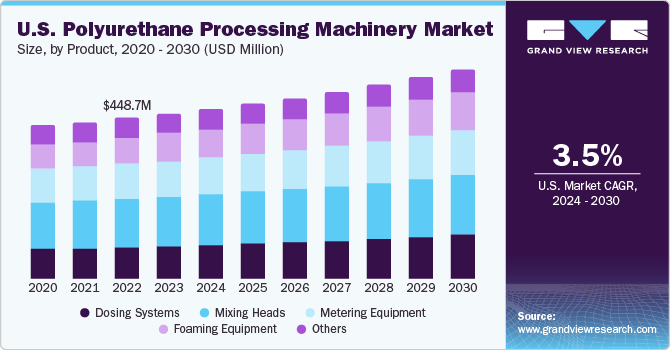

U.S. Polyurethane Processing Machinery Market

The polyurethane processing machinery market in the U.S. is expected to witness increased market demand owing to increasing construction activities, rising personal vehicle ownership, and increased consumer expenditure on healthcare services. Further, the attractive government and private initiatives introduced in the country to improve the domestic healthcare system are expected to boost the overall demand for processed PU products and drive market growth over the forecast period.

For instance, the Affordable Care Act (ACA) introduced in 2010 has significantly impacted on healthcare delivery by increasing access to health insurance and implementing various healthcare reforms. Further, in June 2022, the U.S. government introduced HHS (Health and Human Services) Action Plan to strengthen primary health care across the country. Such developments in the U.S. healthcare industry have led to an increase in demand for polyurethane products.

Canada Polyurethane Processing Machinery Market

The polyurethane processing machinery market in Canada is expected to witness lucrative growth over the forecast period. The increasing adoption of electric vehicles by end users in Canada is fueling the demand for polyurethane processing machinery in the country. Statistics Canada reported that during the third quarter of 2023, plug-in hybrid electric vehicles (PHEVs) experienced the most substantial percentage increase among fuel types, soaring by 170.1% compared to the same period in 2022.

Further, opportunities for public-private partnerships exist in Canada's public infrastructure and government initiatives. The Investing in Canada Plan, released by the Canadian government in 2016, calls for investing over USD 139 billion in crucial infrastructure sectors through 2028. This plan is anticipated to increase the investments in infrastructure projects and thus will assist the flourishing demand for polyurethane processing machinery over the forecast period.

Key North America Polyurethane Processing Machinery Company Insights

The North America polyurethane processing machinery market is characterized by the intense competition facilitating continuous efforts by the key companies to improve the consumer reach. Partnerships, collaboration, expansion, joint venture, innovation, and product launches are some of the key strategies that the key players adopt to stay ahead in the market and increase the market share.

In February 2021, Graco Inc. unveiled the Voltex Dynamic Mix Valve, specially crafted for dispensing two-component foaming urethanes and silicones. This valve ensures consistent and uniform blending of challenging-to-dispense chemicals, making it suitable for a range of applications.

Key North America Polyurethane Processing Machinery Companies:

The following are the leading companies in the North America polyurethane processing machinery market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these North America polyurethane processing machinery companies are analyzed to map the supply network.

- KraussMaffei

- Hennecke GmbH

- Cannon USA, Inc.

- FRIMO

- Hunter Polyurethane Equipment

- ESCO

- Linden Industries, LLC

- MAX PROCESS EQUIPMENT, LLC

- Polyurethane Machinery Corporation

- Graco Inc.

Recent Developments

-

In December 2023, Hennecke GmbH launched the first-ever configuration platform for metering machines. With this launch, the company expanded its online presence for the distribution of its polyurethane processing machines.

-

In October 2022, KraussMaffei introduced the precision Mixhead 8/12-2K-40, featuring a more compact and lightweight design. This latest product release brings about the advantage of simplified and interchangeable components in the new generation of mixing heads, enhancing ease of maintenance.

North America Polyurethane Processing Machinery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 586.2 million

Revenue forecast in 2030

USD 725.5 million

Growth rate

CAGR of 3.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, pressure end-use, country

Country scope

U.S.; Canada

Key companies profiled

KraussMaffei; Hennecke GmbH; Cannon USA, Inc.; FRIMO; Hunter Polyurethane Equipment; ESCO; Linden Industries, LLC; MAX PROCESS EQUIPMENT, LLC; Polyurethane Machinery Corporation; Graco, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Polyurethane Processing Machinery Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America polyurethane processing machinery market report based on product, pressure, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dosing Systems

-

Mixing Heads

-

Metering Equipment

-

Foaming Equipment

-

Others

-

-

Pressure Outlook (Revenue, USD Million, 2018 - 2030)

-

High Pressure

-

By Product

-

Dosing Systems

-

Mixing Heads

-

Metering Equipment

-

Foaming Equipment

-

Other Products

-

-

By End-use

-

Construction

-

Automotive

-

Medical

-

Consumer Products

-

Other End-use

-

-

-

Low Pressure

-

By Product

-

Dosing Systems

-

Mixing Heads

-

Metering Equipment

-

Foaming Equipment

-

Other Products

-

-

By End-use

-

Construction

-

Automotive

-

Medical

-

Consumer Products

-

-

-

-

Other End-use End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Automotive

-

Medical

-

Consumer Products

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. North America polyurethane processing machinery market size was estimated at USD 569.6 million in 2023 and is expected to be USD 586.2 million in 2024.

b. The North America polyurethane processing machinery market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 725.5 million by 2030.

b. The U.S. dominated the market in 2023 by accounting for a share of 81.1% of the market, which can be attributed to the presence of significant manufacturing industry.

b. Some of the key players operating in the North America polyurethane processing machinery market include KraussMaffei, Hennecke GmbH, Canon U.S.A., Inc., FRIMO, Hunter Polyurethane Equipment, ESCO, Linden Industries, LLC, MAX PROCESS EQUIPMENT, LLC., Polyurethane Machinery Corporation, and Graco Inc.

b. Key factors driving the North America polyurethane processing machinery market include expansion of construction activities, increasing demand for vehicles, and rising consumer spending on home appliances.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.