- Home

- »

- Advanced Interior Materials

- »

-

North America Ultraviolet Disinfection Equipment Market Report, 2030GVR Report cover

![North America Ultraviolet Disinfection Equipment Market Size, Share & Trends Report]()

North America Ultraviolet Disinfection Equipment Market Size, Share & Trends Analysis Report By End-use (Commercial, Industrial), By Component Type (Quartz Sleeves, UV Lamps), By Application, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-964-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

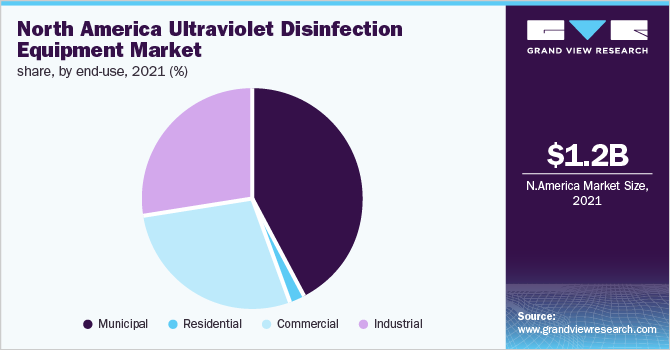

The North America ultraviolet disinfection equipment market size was estimated at USD 1.20 billion in 2021 and is anticipated to register a compounded annual growth rate (CAGR) of 5.6% over the forecast period. Factors, such as the rising prevalence of coronavirus and increasing R&D spending, are expected to boost the product demand. The impact of COVID-19 is expected to create delays in construction projects in the near future. However, in the coming years, national governments may choose to take advantage of the low prices of raw materials and start investing heavily in the infrastructure, which is expected to create an increase in the demand for ultraviolet disinfection equipment.

Air quality policies, such as the United States Clean Air Act, and the United States Environmental Protection Agency, have established national ambient air quality standards. Furthermore, Environment Canada’s comprehensive emission reduction strategies are expected to open up new markets for ultraviolet (UV) disinfection equipment for air purification.UV air purification is an established technique and several organizations, such as the WHO and CDC, have frequently encouraged its usage in labs, hospitals, operating rooms, and colleges. Furthermore, UV air purifiers help enhance the air quality in both the residential and commercial sectors by removing particulate matter and dust.

UV disinfection systems have a lower environmental effect than sodium hypochlorite since UV is largely controlled by the composition of the electrical grid. With the growing prevalence of COVID-19 cases, several hospitals have begun implementing UV systems to disinfect high-risk indoor settings, which is likely to increase product demand in the coming years. UV disinfection systems have been acknowledged by public health agencies as an effective technique for treating reclaimed water, drinking water, and wastewater. This has prompted nations across the globe to implement these systems as they are safe and do not require the use of toxic chemicals to conserve water resources and meet sustainability goals.

Component Type Insights

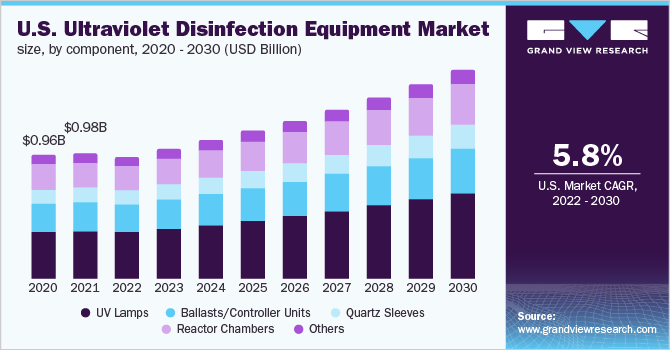

The UV lamps segment dominated the industry in 2021 and accounted for a share of 37.2% of the total revenue. Low-pressure low-input, low-pressure high-output, and medium-pressure UV lamps are the three common types of UV lamps. Low-pressure bulbs are employed in applications with low flow rates and longer exposure durations, which is expected to drive the segment over the forecast period. According to the U.S. EPA wastewater technology fact sheet, quartz sleeves are intended to last up to eight years and are typically replaced after five years. Quartz sleeve fouling is typically caused by the accumulation of algae, calcium ions, and magnesium, as well as an iron layer, developed owing to poor equipment maintenance.

Reactor chambers are estimated to witness a steady CAGR from 2022 to 2030. Owing to its heat- and corrosion resistance, reactor chambers are often composed of stainless steel. Despite their small size, these reactors are simple to install, have head losses of less than 0.5 meters, and have a high flow capacity. Electronic ballasts are made of various electronic components that work together to form a power supply. These ballasts may send up to 50,000 pulses per second of electrical current. When compared to magnetic ballasts, electronic ballasts are more efficient, lighter in weight, and smaller in size. They also generate less noise and have a longer bulb operational life.

Application Insights

The water & wastewater segment dominated the market in 2021 with a revenue share of more than 44.65% owing to the stringent government requirements relating to safe and ecologically friendly water and wastewater treatment. Furthermore, an increase in consumption of safe and clean drinking water as a result of the rising population and diminishing freshwater pools is likely to benefit the industry. Even in developed economies, the majority of wastewater is released directly into the water bodies without adequate treatment, which destroys the economic productivity, ecosystems, and quality of ambient freshwater resources.

The product demand from the wastewater industry is expected to increase as the technology offers shorter contact time, no by-products formation, and high efficiency against viruses. The surface disinfection segment is estimated to witness a steady CAGR over the forecast period. On surfaces, such as conveyor belts, especially in the meat and meat processing industry, UV light can offer continuous disinfection through a module that is designed to expose the conveyer to UV light as it passes. The air treatment application segment is expected to have considerable growth over the forecast period owing to the poor indoor air quality that leads to several health problems, such as allergies and asthma. UV air purifiers are specially designed to use UV-C light to inactivate microorganisms and airborne pathogens, such as viruses, bacteria, and molds.

End-use Insights

The municipal segment dominated the market in 2021 with a revenue share of 42.1% on account of the increased penetration of the technology in water & wastewater treatment plants in developed countries. Several municipal wastewater treatment plants have started to prefer UV disinfection treatment options as they are cost-effective, safer, and environmentally friendly. Increased consumer awareness regarding air pollution, along with the rising frequency of airborne illnesses, has compelled manufacturers to invest in green technology to reduce pollution levels globally. As a result, manufacturers are integrating technologies like UV disinfection, filtration, and photocatalytic purification to eradicate all causes of air pollution.

The commercial end-use segment is expected to witness a steady CAGR over the forecast period. Rising demand for commercial water treatment systems to meet the high-volume water treatment needs of restaurants, schools, manufacturing plants, healthcare facilities, and laboratories, to remove contaminants, such as sediments, sulfates, and arsenic, is expected to boost the product demand. A large number of pharmaceutical companies depend on UV equipment for water disinfection as the water used in healthcare and pharmaceutical products must be free of chemicals like ozone, pathogens, and chlorine. In addition, the process also finds its application in the cosmetics industry on account of the high demand for clean water to ensure better shelf life and quality of cosmetic products.

Country Insights

The U.S. is anticipated to emerge as a major market in North America as it accounted for a share of more than 81.00% of the region’s total revenue in 2021. Increasing hygiene and safety concerns, especially in the healthcare and food industries, coupled with the rising COVID-19 infections and an aging population accelerate the industry growth. The rising pollution levels and increasing prevalence of airborne diseases in the U.S. have resulted in the growth of awareness among consumers, which is augmenting the product demand for air purification. Favorable investments in the water treatment industry on a domestic level are expected to have a positive impact on the regional market over the forecast period.

Canada is anticipated to grow at a steady CAGR over the forecast period owing to the rising number of UVC LED suppliers in Canada. In addition, the increasing establishment of innovative UV light disinfection equipment that is less expensive, highly functional, ecologically friendly simple to run, and leaves no residue will drive the market growth. Mexico is also estimated to witness considerable growth owing to the rising awareness among consumers and governments about the health hazards of conventional chemical-based disinfectants, which is the driving factor for ultraviolet disinfection equipment. In addition, easy installation, low maintenance, and lower operating costs are anticipated to drive market growth.

Key Companies & Market Share Insights

Major manufacturers are focusing on product innovations and technological advancements owing to the rising demand for devices equipped with UV technology amid the COVID-19 outbreak. For instance, GermFalcon is using a UV-C light system that is explicitly designed for airplanes and can disinfect a 30-row aircraft in less than three minutes. In addition, Puro is supplying UV-C light to New York City transportation services to clean subway cars and buses.

Manufacturers are also undertaking other strategies, such as mergers & acquisitions, to strengthen their foothold in the industry. In March 2021, Atlantic Ultraviolet Corp. announced upgrades to the Sanidyne Ultraviolet Portable Area Sanitizer Line. New features found in the Sanidyne Prime Remote and Sanidyne Plus expansion provide users with added safety assurance with new occupancy sensors and remote operation, as well as easier portability. Some prominent players in the North America ultraviolet disinfection equipment market include:

-

Xylem

-

Trojan Technologies

-

Halma PLC

-

Calgon Carbon Corp.

-

Atlantic Ultraviolet Corp.

-

Evoqua Water Technologies LLC

-

Advanced UV, Inc.

-

American Ultraviolet

-

Atlantium Technologies Ltd.

-

Dr. Hönle AG

-

Lumalier Corp.

-

Xenex

-

ENAQUA

-

Sanuvox

-

LightSources

North America Ultraviolet Disinfection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.17 billion

Revenue forecast in 2030

USD 1.97 billion

Growth rate

CAGR of 5.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component type, application, end-use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Xylem Inc.; Trojan Technologies; Halma PLC; Calgon Carbon Corporation; Atlantic Ultraviolet Corp.; Evoqua Water Technologies LLC; Advanced UV, Inc.; American Ultraviolet; Atlantium Technologies LTD.; Dr. Hönle AG; Lumalier Corp.; Xenex; ENAQUA; Sanuvox; LightSources.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Ultraviolet Disinfection Equipment Market Segmentation

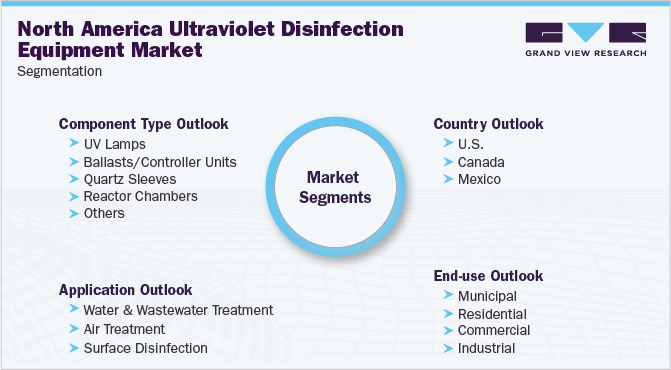

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the North America ultraviolet disinfection equipment market report on the basis of component type, application, end-use, and country:

-

Component Type Outlook (Revenue, USD Million, 2017 - 2030)

-

UV lamps

-

Ballasts/Controller Units

-

Quartz Sleeves

-

Reactor Chambers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Water & Wastewater Treatment

-

Air Treatment

-

Surface Disinfection

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Municipal

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America ultraviolet disinfection equipment market size was estimated at USD 1.20 billion in 2021 and is expected to be USD 1.17 billion in 2022

b. The ultraviolet disinfection equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2022 to 2030 to reach USD 1.97 billion by 2030

b. The U.S. dominated the ultraviolet disinfection equipment market with a revenue share of 81.2% in 2021. The rising spending capability of consumers and the growing emphasis on water treatment in the region are expected to drive the demand for UV water treatment systems in the market during the forecast period.

b. Some of the key players operating in the ultraviolet disinfection equipment market include: Xylem Inc.; Trojan Technologies; Halma PLC; Calgon Carbon Corporation; Atlantic Ultraviolet Corp.; Evoqua Water Technologies LLC; Advanced UV, Inc.; American Ultraviolet; Atlantium Technologies LTD.; Dr. Hönle AG; Lumalier Corp.; Xenex; ENAQUA; Sanuvox; LightSources

b. Key factors that are driving the ultraviolet disinfection equipment market growth include rising demand for UV disinfection equipment in the healthcare industry and increasing government subsidies along with technological innovation is expected to drive the demand for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."