- Home

- »

- Advanced Interior Materials

- »

-

North America Wood Flooring Market Share Report, 2030GVR Report cover

![North America Wood Flooring Market Size, Share & Trends Report]()

North America Wood Flooring Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Solid, Engineered), By Wood Type, By Application, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-3-68038-047-7

- Number of Report Pages: 92

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

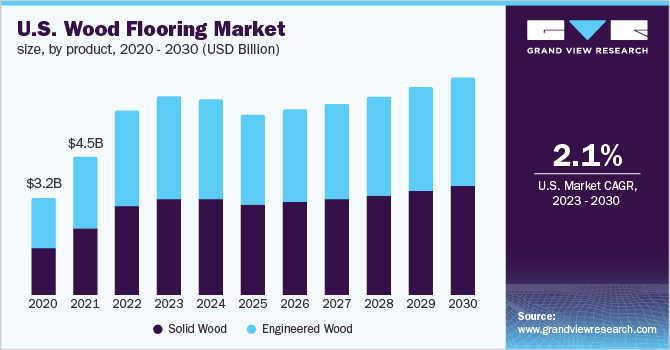

The North America wood flooring market size was estimated at USD 7,377.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 2.4% from 2023 to 2030. The growth is expected to be driven by rising demand for highly durable and aesthetically superior flooring products. Moreover, rising expenditure on renovation and remodeling of old housing structures is expected to significantly impact product growth in North America during the upcoming period. Significant & continual growth of high-end residential housing structures in North America and the subsequent and growing preference for single-family housing structures are further driving the demand for wood flooring in the region. Furthermore, with the ever-increasing growth of interior decoration and real estate sectors, floor-covering solutions, accessories, and equipment have gained considerable importance. Wooden flooring products are expected to continue witnessing an ascending demand over the coming years owing to their natural look and longevity in comparison with conventional flooring solutions.

The engineered wood flooring product segment accounted for the largest share of the North America market in 2022. The product is highly used as deck flooring on account of its enhanced features such as reliability, abrasion resistance, and dimensional accuracy. Furthermore, the advent of engineered wood has significantly reduced the cost of wooden flooring thereby providing a major boost to product adoption in North America.

The U.S. dominated the North America wood flooring market in 2022 and is expected to grow at a significant rate during the forecast period. The strong foothold of residential and commercial infrastructure on a domestic level is expected to keep the domination of the U.S. in the wood flooring industry over the forecast period. Furthermore, improvement in the U.S. economy post-COVID-19 pandemic in 2020, coupled with growing investment in the repair and renovation of existing building structures is expected to drive growth over the forecast period.

Consumer awareness about environmental conservation has led to high demand for eco-friendly flooring products such as bamboo, glass, rubber, cork, linoleum, and hardwood. Installation of flooring is a difficult and time-consuming task, but now companies have come up with products that do not require any kind of glue to stick the product to the floor. The materials are made in such a way that tiles can get interlocked with each other. This is a major development in the flooring industry in North America as the cost of installing such materials is reduced drastically.

Key players in North America are focusing on achieving optimal operational costs, enhancing product quality, maximizing production output, and the acquisition of small players to sustain the competition. These players are increasingly focusing on mergers & acquisitions, joint ventures, and agreements.

Product Insights

Engineered wood flooring was the largest product segment, accounting for 66.6% of revenue share in 2022. Engineered wood is less prone to extensions as well as does not shrink with humidity and temperatures when compared to solid wood. Additionally, engineered wood is widely used as deck flooring on account of its enhanced features such as reliability, abrasion resistance, and dimensional accuracy. This is expected to propel its demand in the region during the forecast period.

Engineered wood is alternately also known as composite wood and consists of several wooden products manufactured by binding wood-based panels such as plywood and wood veneer together with adhesives to form composite materials. They are modeled to supreme design requirements as per the specifications of end users or clients and are tested to meet international and national standards.

The solid wood product segment is expected to grow at the highest CAGR of 2.9% during the forecast period. The product offers an option to choose from a wide variety of dent and scratch-resistant wood species, which is expected to increase the demand for solid wood floors in North America. In addition, it has a superior ability to protect against stains along with a well-polished nature. Solid wood floors can be sanded and re-finished multiple times over their lifetime on account of their top-to-bottom solid core.

High durability and easy installation are more of the characteristic attributes associated with solid wood floors. Solid wood floors come in narrower plank sizes and exhibit very tight seams between boards. Furthermore, solid wood flooring is highly preferred for its durability and longevity.

Wood Type Insights

In 2022, the red oak segment emerged as the largest wood type segment while accounting for 35.2% revenue share of the North America wood flooring market. Factors such as abundant domestic availability of the red oak timber coupled with its affordable cost, and moderate to heavy graining were responsible for the segment growth and are further expected to increase the demand for the product in North America.

Red oak is widely used in the wooden flooring industry owing to its relatively lower cost. Further characteristics, which are increasing the demand for red oak for the production of wooden floors include a straight graining pattern, coarse texture, and superior durability with a Janka value of 1290. The red oak wood is relatively easy to work with and can be easily machined and nailed to the subfloor.

White oak accounted for revenue of USD 2,209.5 million in 2022 and is expected to grow at a significant CAGR during the forecast period. White oak or Quercus alba is one of the most commonly used hardwood timber species native to the Eastern and Central North America region. The name of this species comes from the color of the finished wood obtained from it. Moreover, it is mostly straight-grained and exhibits a medium to coarse texture, and longer rays than red oak.

White oak hardwood flooring is more water resistant as compared to the other types of floors, making it a good option for use in kitchens along with entryways, dining rooms, and bedrooms. Furthermore, these types of flooring are available in a smooth and homogenous texture, which is expected to pave the way for use in the North America flooring industry during the forecast period.

End-use Insights

In 2022, the replacement segment led the market with a 53.6% revenue share and is expected to grow at a CAGR of 2.6% during the forecast period. Growing expenditure on repairs and renovation of existing housing structures. Additionally, the replacement of existing flooring such as terrazzo, vinyl, and carpet with wood flooring is expected to drive the product demand during the forecast period.

Additionally, continued investment in the repair and renovation of existing housing structures was the primary factor driving the segment growth. Wooden floors on account of their elegant looks have an aspirational value attached to them. As a result, more and more people are replacing their existing flooring with wooden floors, thereby, increasing the demand for wood flooring in the replacement segment.

The new construction end-use segment accounted for a volume of 95.4 million square meters in 2022. The segment is further expected to grow at a significant CAGR over the forecast period. Increasing new residential as well as commercial construction in North America is fueling the new construction sector, which in turn is expected to propel the demand for wooden flooring products during the forecast period.

The U.S. residential construction sector witnessed an upward trend in terms of growth in 2021. As per IBIS World, the total value of residential construction in the U.S. in 2021 accounted for USD 719.40 billion as compared to USD 649.90 billion in 2020. Rising demand for single-family dwellings is the key growth contributor. Furthermore, the advent of engineered wood has significantly reduced the cost of wood floors, thereby providing a major boost to product adoption in new constructions in North America.

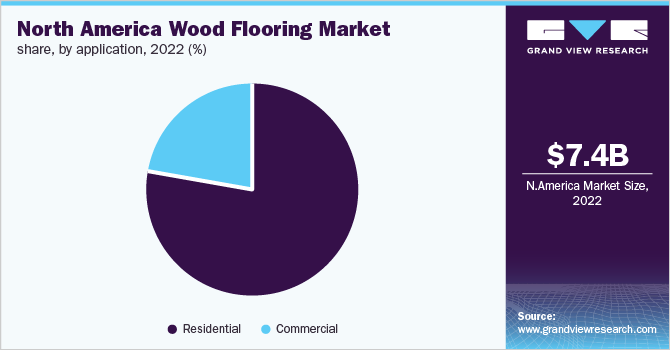

Application Insights

The residential application segment dominated in 2022 with a 77.9% share of total revenue. The rising number of single-family houses in the U.S. post the great recession of 2008-2009 has played an important role in increasing the usage of wooden floor covering materials in the residential segment. Additionally, increasing renovation and refurbishment activities in North America to maintain the structural integrity of buildings and to ensure the safety of the residents have triggered a number of redevelopment projects related to residential as well as commercial sectors in developed countries from North America such as the U.S., Canada, and Mexico.

The growing rate of domestic as well as international migration and high urbanization in North America are expected to drive product growth in the residential application segment during the forecast period. Additionally, engineered wood flooring is increasingly replacing traditional solid wood flooring in the residential sector owing to its cost-effectiveness, ease of installation, and superior moisture resistance properties.

The commercial segment accounted for a volume of 45.7 million square meters in 2022. The commercial application segment includes commercial buildings, hotels, restaurants, cafes, retail stores, offices, gymnasiums, basketball courts, and hospitals. Wooden floors are widely used in commercial applications owing to their long lifecycle. Growing demand for sustainable building materials from the commercial construction industry within the U.S. and Mexico is expected to boost the demand for wooden floors during the forecast period.

Increasing investment in the development and renovation of tourism infrastructure within several countries of North America such as the U.S. and Mexico is further projected to drive product growth in the upcoming future. Furthermore, wooden floors absorb sound waves, thus making them an ideal option for commercial buildings such as offices and hospitals where acoustic solutions are highly required.

Country Insights

The U.S. dominated the North America wood flooring industry with a volume of 164.0 million square meters in 2022 and is further anticipated to grow at a significant CAGR over the forecast period, on account of the rising number of single-family houses and strengthening residential replacement in the country.

In addition, the well-established manufacturing industry in the country along with the presence of MNCs operating across all manufacturing industries has played a major role in driving the demand for wood floors in non-residential applications in the country. Additionally, domestic and foreign manufacturers are also heavily investing in the U.S. flooring market to meet the rising demand from various application industries.

The Canada wood flooring market is expected to grow at a CAGR of 2.3% during the forecast period. Growing population, rapid urbanization, and increasing rate of migration are expected to significantly boost the growth of the residential construction sector in the country, thereby propelling the growth of wood floors in the country.

Furthermore, increased immigration in Toronto, Edmonton, Calgary Area, and Vancouver positively influenced residential construction activities in the country and surged the demand for wood floorings in residential applications. In addition, the increasing focus of consumers and the Government of Canada on the adoption of highly efficient construction practices is expected to fuel the demand for wood flooring in the country. These floors involve easy installation and are highly durable, thus lasting for a longer time.

Key Companies & Market Share Insights

The industry is characterized by strong competition owing to the presence of prominent manufacturers. Manufacturers holding a major share of the North America market have established channels of distribution across various countries. Additionally, manufacturers are also establishing a strong online presence for the sake of gaining a competitive edge in the region. Some prominent players in the North America wood flooring market include:

-

Mohawk Industries, Inc.

-

Shaw Industries Group, Inc.

-

Mannington Mills, Inc.

-

Pergo

-

Flooring Innovations

-

EGGER Group

-

Goodfellow, Inc.

-

Bruce Evans Flooring, LLC

-

Somerset Hardwood Flooring, Inc.

-

Home Legend, LLC

-

DuChateau

-

Provenza Floors, Inc.

-

Launstein Hardwood Floors

-

QEP Co., Inc.

North America Wood Flooring Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.93 billion

Revenue forecast in 2030

USD 8.95 billion

Growth Rate

CAGR of 2.4% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Million Square Meters and Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, wood type, application, end-use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Mohawk Industries, Inc.; Shaw Industries Group, Inc.; Mannington Mills, Inc.; Pergo; Flooring Innovations; EGGER Group; Goodfellow, Inc.; Bruce Evans Flooring, LLC; Somerset Hardwood Flooring, Inc.; Home Legend, LLC; DuChateau; Provenza Floors, Inc.; Launstein Hardwood Floors; QEP Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Wood Flooring Market Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America wood flooring market report based on product, wood type, application, end-use, and country:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Solid Wood

-

Engineered Wood

-

-

Wood Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Red Oak

-

White Oak

-

Maple

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Replacement

-

New Construction

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America wood flooring market size was estimated at USD 7,377.4 million in 2022 and is expected to reach USD 7,939.4 million in 2023.

b. The North America wood flooring market is expected to grow at a compound annual growth rate of 2.4% from 2023 to 2030 to reach USD 8,953.5 million by 2030.

b. Red Oak emerged as the largest wood type segment in North America wood flooring market in 2022 with revenue of 2,595.2 million owing to its growing adoption propelled by its low cost, durability, and aesthetic attributes

b. Some of the key players operating in the North America wood flooring market include Mohawk Industries, Inc., Shaw Industries Group, Inc., Mannington Mills, Inc., Pergo, Flooring Innovations, EGGER Group, Goodfellow, Inc., Bruce Evans Flooring, LLC, and Somerset Hardwood Flooring, Inc.

b. The key factors that are driving the North America wood flooring market includes growth of construction activities coupled with rising expenditure on renovation and remodeling of old housing structures in developed countries such as U.S. and Mexico.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.