- Home

- »

- Advanced Interior Materials

- »

-

North And Central America Textiles Market Size Report, 2030GVR Report cover

![North And Central America Textiles Market Size, Share & Trends Report]()

North And Central America Textiles Market Size, Share & Trends Analysis Report By Product (Covered Yarns, Natural Fibers, Polyester, Nylon), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-065-1

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

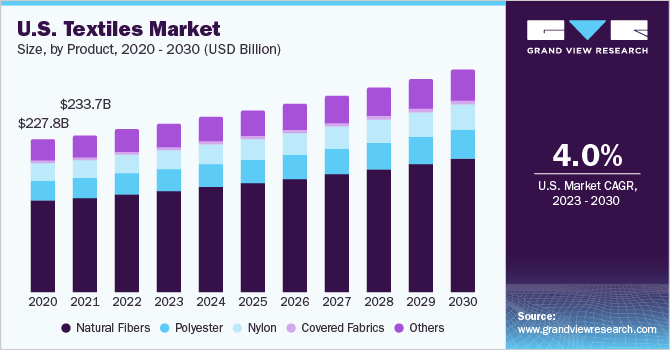

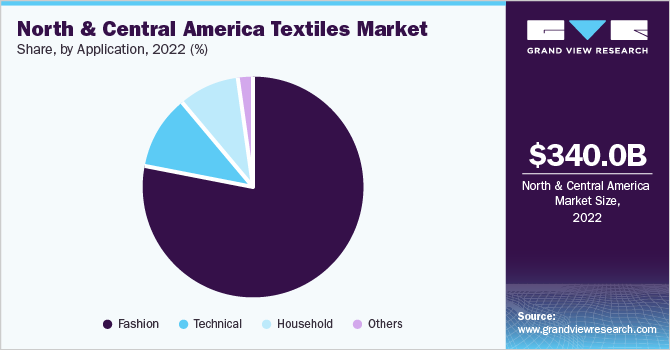

The North and Central America textiles market size was estimated at USD 340.04 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. This growth is attributed to the significant growth in the automotive manufacturing sector in emerging markets, including Mexico, as a result of favorable government schemes aimed at promoting investments, is expected to increase the need for textile products for OEMs as well as for protective equipment used in the sector. The manufacturing industry has been increasing its expenditure toward the incorporation of high-quality safety equipment on shop floors, and utility operating places. Furthermore, product innovations by companies, including 3M and DuPont in advanced protective clothing catering to the manufacturing sector, are expected to play a crucial role in increasing the demand for textiles over the forecast period.

The U.S. is the largest market for textiles in the region. This is attributed to the increasing demand for clothing and accessories and general research and development in the field of high-quality fabrics. As per the National Council of Textile Organization (NCTO), the U.S. is the second-largest exporter of textile-related products in the world after China. In addition, it is a forerunner in technology-based fabric manufacturing such as fabric with anti-static properties, antimicrobial fibers, heart rate and vital signs monitoring fabrics, life-saving body armors, and others.

The declining crude oil prices as a result of increasing inventory levels of crude oil are expected to play an important role in the availability of raw materials at low prices for textile manufacturers. However, increasing demand for engineering polymer products as lightweight materials in rigid applications of automotive, construction, and electronics sectors is expected to limit the availability of feedstock to textile producers.

North and Central America textile market is very competitive owing to the presence of many companies, whose focus is on acquiring local niche players to improve customer interaction, thereby improving their market position. Collaborations, capacity growth, product development, mergers, and acquisitions are some of the strategies used by the companies in North and Central textile market. The market participants strive for a competitive edge through low prices, a diverse assortment of products, and quick turnaround times. One of the critical factors affecting sales of goods is product availability; therefore, players prefer to get their raw materials from various sources rather than relying on one supplier, which might cause delays in the production process if the supplier cannot provide the raw materials on time.

Product Insights

The natural fibers market segment dominated the North and Central America textile market and accounted for revenue share of in 2022. The segment is further expected to expand at a CAGR of 4.2% over the forecast period owing to the surging demand the increasing use of hosiery products among the elder population to adapt to lower temperatures and prevent rashes and infection is increasing the demand for covered yarns in the textile market. Moreover, the changing trends in the fashion market and growing consumer inclination toward fast fashion are expected to positively influence the demand for covered yarns in the market over the forecast period.

The covered fabric segment of North and Central America textiles market accounted for the revenue of USD 4,751.0 million in 2022. The demand for covered fabric in this industry is growing by factors such as the increased level of industrial activity, technological advancements, and regulations regarding worker safety and environmental impact. The growing focus on sustainability and eco-friendliness is also driving market demand for rubber North and Central America Textiles. Many manufacturers are now using recycled rubber and other sustainable materials to create rubber North and Central America Textiles, which reduces their environmental impact.

The polyester segment is expected to expand at a CAGR of 3.8% over the forecast period. The use of recycled polyesters to produce new clothes is one of the emerging trends worldwide. Major apparel brands, such as Nike, Marks & Spencer, and Adidas, have started using recycled polyesters in their clothing range. Polyesters are blended with cotton or other natural fibers to produce clothes and apparel. The usage of polyester in apparel reduces the overall cost of production, thereby leading to the increased demand for these fibers over the forecast period.

Nylon is one of the most popularly used products in the synthetic textiles category. It has high resilience, superior elasticity, excellent luster, and low moisture absorbency. Nylon is used in apparel, home furnishing, and many other technical segments including industrial and automotive applications. The surging demand for synthetic fibers in the textile industry is expected to be one of the major factors driving this segment over the forecast period.

Application Insights

The technical application accounted for 10.8% of the total revenue in 2022. The increasing demand for high-performance and energy-efficient textiles and stringent government regulations regarding performance in various applications have driven the demand for technical textiles. Technical textiles are witnessing burgeoning penetration in various end-use industries including automotive, aerospace, marine, protective clothing, medical, and construction. As these industries require several technical advantages in textiles that may not be offered by conventional textiles.

As consumers search for replacement products for their new living spaces, the increase in new construction development and the number of single-person residences in the region are both raising the demand for home furnishings like home textiles. The market for home textiles is being further fueled by the commercial sector, as hotels, resorts, and restaurants are demonstrating a developing preference for cutting-edge home décor items like bed linens.

The fashion application segement in textiles market was valued at the revenue of USD 267.37 billion in 2022. Fashion is gaining importance in the lifestyle of consumers worldwide owing to their constant exposure to advertisements and sales that result in impulsive buying behavior in them. In addition, social media is a key factor contributing to the fast and latest fashion trends and propelling the demand for textiles in fashion applications.

The other application segment includes applications of textiles in sectors such as agriculture and fishing, to make sacks and fishing nets. The textile market growth in this application segment is expected to remain modest over the forecast period owing to its use in niche applications including horticultural and fishing. These applications involve the use of natural fibers such as jute and twine. Woven polypropylene fibers are used in agricultural and fertilizer packing and storage. These fibers aid in increasing the shelf life of stored goods as they offer essential thermal insulation and protection from the outside environment.

Regional Insights

North America was the largest market for North and Central America textiles and accounted for 85.4% of market share in 2022. The U.S. is expected to remain a major producer of cotton owing to rising textile demand from various end-use industries. The textile market is witnessing a huge product demand for industrial as well as home applications owing to the increase in awareness about the uses of technical textiles.

The U.S. accounts for the highest penetration of fashion and clothing fabrics in North America, owing to the surging awareness about the latest fashion trends and the growing importance of sustainability. Rising concerns about environmental safety are expected to boost the demand for eco-friendly textile products in the region. Fashion brands are focusing on sustainability of the fabric keeping the latest fashion trends in mind.

The Central America region is expected to witness fastest CAGR of 4.3% over the forecasted period. The availability of textile raw materials, such as polyester and cotton, coupled with the existence of textile manufacturing units in the region have made Central America one of the significant exporters of textiles including apparel to the U.S. The Central American textile market is expected to witness growth over the forecast period on account of growing population, increasing middle-class population, and increasing job opportunities in developing nations such as Costa Rica, Guatemala, and others.

The textile market in El Salvador is predicted to grow owing to the tremendous expansion of men's and women's apparel segment because of the growing fashion trends. Apparel companies within the country are attempting to increase emphasis on apparel exports, ranging from basic cotton to trending and sophisticated clothing. El Salvador's textile and clothing industry has a lot of room for growth because it only accounts for a small share of the U.S. market, which is expected to boost the market demand during the forecast period at a CAGR of 5.0%.

Key Companies & Market Share Insights

The market has been witnessing rapid growth due to growing expansion and merger and acquisitions activities. The companies are trying to increase their sales through various government trade agreements along with partnerships with e-commerce portals, such as Amazon, Flipkart, e-Bay, and others. The market is fragmented due to the presence of several small- and medium-scale manufacturers. Some of the prominent players in the North and Central America textiles market include:

-

Gulford

-

Nextil

-

Liztex

-

Honeywell International Inc.

-

Fabrico

-

Trelleborg Engineered North & Central America Textile

-

Unifi, Inc.

-

Albany International Corp.

-

INVISTA

-

DBL Group

North And Central America Textiles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 352.45 billion

Revenue forecast in 2030

USD 467.80 billion

Growth Rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in million tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North & Central America

Country Scope

U.S.; Canada; Mexico; Honduras; El Salvador; Guatemala; Nicaragua; Dominican Republic;

Costa Rica

Key companies profiled

Gulford; Nextil; Liztex; Honeywell International Inc.; Fabrico; Trelleborg Engineered North & Central America Textile; Unifi, Inc.; Albany International Corp.; INVISTA; DBL Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North And Central America Textiles Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North and Central America textiles market report on the basis of product, application, and region:

-

Product Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Covered Fabrics

-

Natural Fibers

-

Polyester

-

Nylon

-

Others

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Household

-

Bedding

-

Kitchen

-

Upholstery

-

Towel

-

Others

-

-

Technical

-

Construction

-

Transportation

-

Protective

-

Medical

-

Others

-

-

Fashion

-

Apparel

-

Ties & Clothing

-

Hosiery

-

Socks

-

Sportswear

-

Underwear

-

Others

-

-

Handbags

-

Others

-

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Central America

-

Honduras

-

El Salvador

-

Guatemala

-

Nicaragua

-

Dominican Republic

-

Costa Rica

-

-

Frequently Asked Questions About This Report

b. The North & Central America textiles market size was estimated at USD 340.04 billion in 2022 and is expected to reach USD 352.45 billion in 2023.

b. The North & Central America textiles market is expected to grow at a compound annual growth rate of a CAGR of 4.1% from 2023 to 2030 to reach USD 467.80 billion by 2030.

b. The natural fibers segment of North & Central America textiles market accounted for the largest revenue share of 53% in 2022 owing to their use in the diverse application of the fashion and apparel industry.

b. Some key players operating in the North & Central America Textiles market include Albany International Corp., Trelleborg Engineered Coated Fabrics, Honeywell International, Inc., Nextil, Inc., Liztex, INVISTA, DBL Group.

b. The key factors that are driving the market growth are the growing product demand for personal care & hygiene products, rising product use for the production of geotextiles, and a surge in demand for textiles for disposable protective gear for medical applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."