- Home

- »

- Biotechnology

- »

-

Nucleotide Market Size And Share, Industry Report, 2030GVR Report cover

![Nucleotide Market Size, Share & Trends Report]()

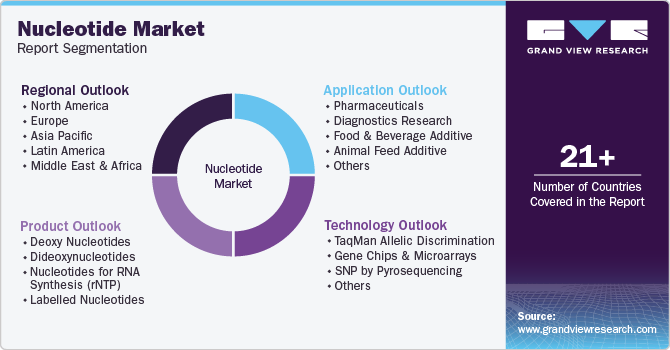

Nucleotide Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Deoxy Nucleotides), By Technology (TaqMan Allelic Discrimination, Gene Chips & Microarrays), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-627-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nucleotide Market Summary

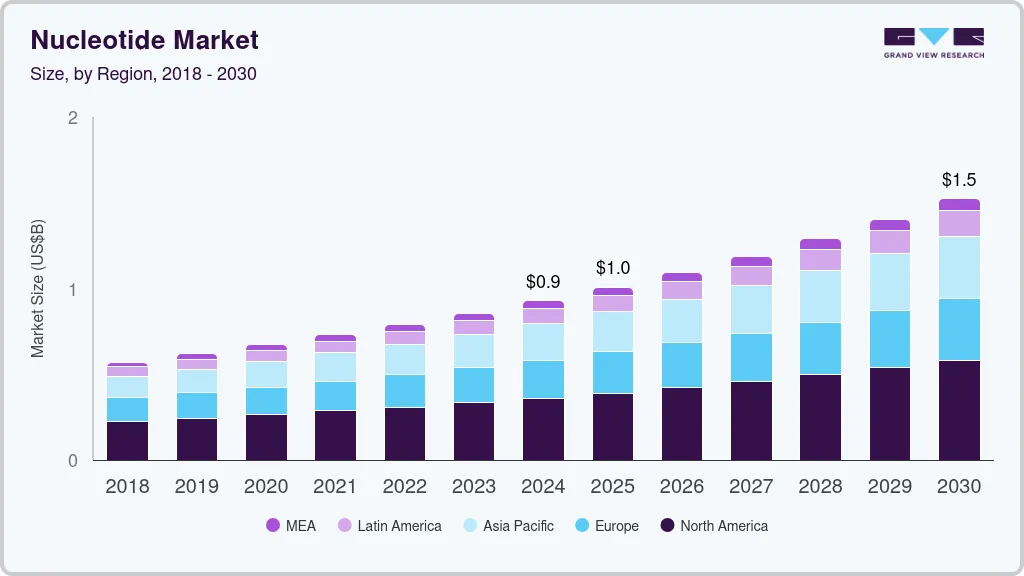

The global nucleotide market size was estimated at USD 928.2 million in 2024 and is projected to reach USD 1,522.8 million by 2030, growing at a CAGR of 8.6% from 2025 to 2030. The growing application scope of nucleotides in various industries, including pharmaceuticals, food & beverage additives, animal feed additives, and diagnostics research, is likely to augment the market growth.

Key Market Trends & Insights

- North America nucleotide market secured the largest market share of 38.9% in 2024.

- The growing support from regulatory agencies for gene therapies and the burgeoning demand for gene editing are shaping the U.S. nucleotide industry.

- By product, the deoxy nucleotides segment dominated the market with the largest revenue share of 48.4% in 2024.

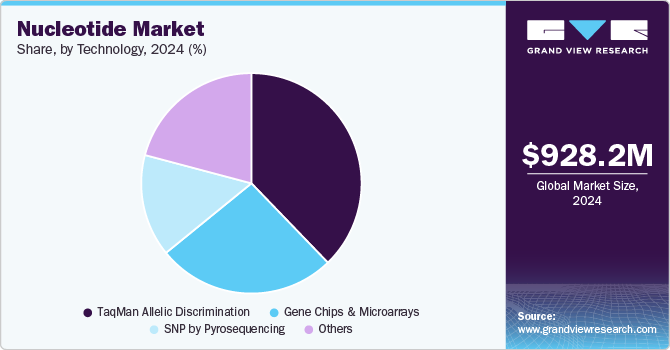

- By technology, the TaqMan allelic discrimination segment secured the largest revenue share of 37.8% in 2024.

- By application, the diagnostics research segment secured the largest revenue share of 41.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 928.2 Million

- 2030 Projected Market Size: USD 1,522.8 Million

- CAGR (2025-2030): 8.6%

- North America: Largest market in 2024

Nucleotides are fundamental in genetic testing, enabling accurate diagnosis, identification of mutations, and personalized treatment plans. With rising consumer awareness related to the ill effects of savory ingredients, the demand for nucleotide-based flavor enhancers is anticipated to drive industry demand. With the increasing global burden of genetic conditions such as cancer, cardiovascular diseases, and inherited disorders, the demand for advanced diagnostic tools is surging. Moreover, the integration of nucleotides in technologies, particularly next-generation sequencing (NGS) and PCR, is revolutionizing molecular diagnostics, fueling the market growth and broadening its applications across healthcare and research.

The growing demand for agricultural biotechnology and increased investment in biotechnology and healthcare are projected to accelerate the nucleotide industry. Nucleotides play a crucial role in genetic modification and the development of genetically engineered crops that improve yield, resistance, and nutritional value. In healthcare, advancements in gene therapies, diagnostics, and personalized medicine further amplify the need for nucleotides. As more investments flow into biotech and healthcare sectors to address global challenges in food security and healthcare, the market is set to witness robust growth, driving innovation and expanding applications across industries.

Product Insights

The deoxy nucleotides segment dominated the market with the largest revenue share of 48.4% in 2024, propelled by their pivotal role in DNA synthesis and genetic research. As essential building blocks for DNA, deoxy nucleotides are critical in applications such as PCR (Polymerase Chain Reaction), gene sequencing, and molecular diagnostics. Their widespread use in biotechnology and advancements in genomics and personalized medicine has driven demand. In addition, the surging prevalence of genetic disorders and the growing focus on gene therapy have further fueled the growth of deoxy nucleotide applications, strengthening their market dominance.

The nucleotides for RNA synthesis (rNTP) segment is anticipated to emerge as the fastest-growing segment and grow at a CAGR of 8.1% from 2025 to 2030, owing to its pivotal role in RNA synthesis and biotechnology advancements. As RNA-based therapies, including mRNA vaccines and gene editing technologies, continue to grow, the demand for high-quality rNTPs is escalating. These nucleotides are essential in the production of RNA for therapeutic applications, diagnostics, and research. With sizable investments in RNA-related research and clinical trials, the rNTP segment is expected to experience rapid growth, driving the expansion of the nucleotide market.

Technology Insights

The TaqMan allelic discrimination segment secured the largest revenue share of 37.8% in 2024, attributed to its widespread application in genotyping, genetic research, and diagnostics. TaqMan assays, which use specific primers and probes, enable highly accurate detection of genetic variations and allelic differences. This technology is widely used in areas such as disease susceptibility testing, personalized medicine, and pharmacogenomics. Its reliability, precision, and ease of use in PCR-based assays have made it a preferred choice for researchers and clinicians, solidifying its leading position in the market.

The gene chips & microarrays segment is expected to stand out as the fastest-growing segment and capture a CAGR of 8.4% during the forecast period, spurred by their growing applications in high-throughput genomic analysis. These technologies enable the simultaneous examination of thousands of genes, allowing for large-scale gene expression profiling, mutation detection, and disease research. As personalized medicine and genomic studies gain momentum, the demand for gene chips and microarrays in diagnostics, drug development, and disease research is increasing. Their ability to deliver comprehensive and precise data is positioning this segment for significant growth in the nucleotide market.

Application Insights

The diagnostics research segment secured the largest revenue share of 41.2% in 2024 due to the escalating demand for advanced molecular diagnostic techniques. Nucleotides are crucial in DNA sequencing, genetic testing, and diagnostic tools, enabling faster and more accurate disease detection. The surging prevalence of genetic disorders, cancer, and infectious diseases has spurred the adoption of nucleotide-based diagnostic solutions. Also, advancements in next-generation sequencing technologies and their integration into personalized medicine further fueled the growth of this segment, cementing its prominence in the market.

The pharmaceuticals segment is expected to stand out as the fastest-growing segment and capture a CAGR of 10.1% from 2025 to 2030, fueled by the burgeoning demand for innovative therapies such as gene therapies, RNA-based treatments, and personalized medicine. Nucleotides are essential in drug development, enabling the creation of targeted therapies that address genetic disorders and other complex diseases. Advancements in CRISPR technology and RNA interference are further fueling the segment expansion. As pharmaceutical companies increasingly focus on genomic-based solutions, the demand for nucleotides in drug discovery, development, and manufacturing is set to experience substantial growth in the near future.

Regional Insights

North America nucleotide market secured the largest market share of 38.9% in 2024, owing to the advancements in gene therapy and the escalating demand for genetic testing. Gene therapies for genetic disorders and certain cancers rely heavily on nucleotides for precision in treatment development. Furthermore, the rising popularity of genetic testing for personalized medicine, disease prevention, and early detection is boosting market demand. As healthcare systems prioritize personalized and precision medicine, the need for accurate genetic analyses and sequencing technologies continues to expand, further fueling the growth of the nucleotide market in North America.

U.S. Nucleotide Market Trends

The growing support from regulatory agencies for gene therapies and the burgeoning demand for gene editing are shaping the U.S. nucleotide industry. Regulatory approvals and guidelines facilitate faster gene therapy development and commercialization, while gene editing techniques such as CRISPR are transforming precision medicine. As these technologies gain widespread acceptance in treating genetic disorders, the demand for nucleotides, essential building blocks for gene editing and therapy, is anticipated to rise, driving market growth and innovation in the biotechnology sector.

Rising health awareness and the growth in DNA sequencing are set to propel the size of the Canada nucleotide market. As more individuals seek personalized healthcare solutions, the demand for genetic testing and diagnostics is increasing, which relies heavily on nucleotides. In addition, advancements in DNA sequencing technologies are making genetic analysis more accessible and affordable, further boosting their use in research, diagnostics, and drug development. With an increasing focus in Canada on precision medicine and genetic therapies, the nucleotide industry is set for substantial growth in the years ahead.

Europe Nucleotide Market Trends

Europe nucleotide market is set to expand at the fastest-growing CAGR of 8.4% from 2025 to 2030, propelled bythe focus on cancer treatment and the integration of AI and bioinformatics with nucleotide sequencing methods. Genomic sequencing advances enable more precise cancer diagnostics and targeted therapies, enhancing treatment outcomes. Also, the incorporation of AI and bioinformatics allows for faster and more accurate analysis of genetic data, accelerating drug discovery and personalized treatment development. This synergy of technology and cancer research is projected to fuel demand for nucleotide-based innovations, driving market growth across Europe.

The growing shift toward personalized and precision medicine and the adoption of CRISPR and gene editing technologies are expected to boost the UK nucleotide industry. Personalized medicine, which tailors treatments based on genetic profiles, heavily relies on nucleotides for diagnostics, drug development, and targeted therapies. The widespread adoption of CRISPR and other gene editing technologies further fuels the demand for nucleotides in genetic research and therapeutic applications. As these advancements continue to evolve, the need for precise and efficient nucleotide solutions is set to propel significant market growth in the UK.

The rising use of mRNA technology and the expansion of biomanufacturing are anticipated to drive market expansion across Germany. mRNA-based therapies, particularly in vaccine development, have gained significant momentum, increasing the demand for nucleotides in drug production. Besides, the growing biomanufacturing sector in Germany, supported by advancements in biotechnology, is fostering the mass production of nucleotide-based therapeutics. As pharmaceutical companies scale up their mRNA research and production, the need for high-quality nucleotides will continue to rise, fueling market growth in the country.

Asia Pacific Nucleotide Market Trends

Innovations in biotechnology and the rapid expansion of the pharmaceutical industry are projected to drive the growth of the Asia Pacific nucleotide market. Breakthroughs in gene therapies, CRISPR technology, and RNA-based treatments are creating new opportunities for nucleotide applications in drug development and precision medicine. The booming pharmaceutical sector in the region is increasingly adopting nucleotide-based solutions for targeted therapies, cancer treatment, and genetic research. With ample investments in biotech and pharmaceutical infrastructure, the demand for nucleotides is expected to surge, expanding the market across the Asia Pacific.

Japan is anticipated to achieve a noteworthy share during the forecast period, driven bythe integration of Artificial Intelligence (AI) and the expansion of clinical applications. AI is enhancing the analysis of genetic data, improving diagnostic accuracy, and streamlining the interpretation of complex genomic information. As AI-powered tools become more widely adopted, they enable faster and more precise genomic research, benefiting personalized medicine and targeted therapies. Moreover, the increasing use of nucleotides in clinical applications, such as cancer diagnostics and drug development, further accelerates market expansion in Japan.

China is projected to grow at a commendable CAGR over the forecast period due tothe increasing focus on infectious disease diagnostics, genetic sequencing, and healthcare integration. As the country emphasizes improving disease detection and treatment, the demand for nucleotide-based technologies, such as next-generation sequencing (NGS), is rising. These technologies enable rapid and accurate identification of pathogens and genetic mutations. Furthermore, integrating genetic data with healthcare systems supports personalized medicine and targeted therapies, fueling the expansion of the nucleotide market in China as the nation strengthens its biotechnology and healthcare infrastructure.

Key Nucleotide Company Insights

Some of the key companies in the nucleotide industry include CJ CheilJedang Corp.; Star Lake Bioscience; Thermo Fisher Scientific Inc.; MEIHUA HOLDINGS GROUP CO., LTD.; F. Hoffmann-La Roche Ltd.; Biorigin; DSM; Promega Corporation; Agilent Technologies, Inc.; Lallemand Inc.; Nanjing Biotogether Co., Ltd.; NuEra Nutraceuticals Inc. and Ohly.

-

Thermo Fisher Scientific Inc. provides various scientific services, including laboratory instruments, reagents, consumables, and software. It specializes in life sciences, analytical instruments, biotechnology, pharmaceuticals, and diagnostics to support research, healthcare, and production industries.

-

F. Hoffmann-La Roche Ltd delivers innovative healthcare solutions, specializing in pharmaceuticals and diagnostics. It offers medicines, biologics, and diagnostic tools across various therapeutic areas, including oncology, immunology, infectious diseases, and personalized healthcare, aiming to improve global health.

Key Nucleotide Companies:

The following are the leading companies in the nucleotide market. These companies collectively hold the largest market share and dictate industry trends.

- CJ CheilJedang Corp.

- Star Lake Bioscience

- Thermo Fisher Scientific Inc.

- MEIHUA HOLDINGS GROUP CO., LTD.

- F. Hoffmann-La Roche Ltd.

- Biorigin

- DSM

- Promega Corporation

- Agilent Technologies, Inc.

- Lallemand Inc.

- Nanjing Biotogether Co., Ltd.

- NuEra Nutraceuticals Inc.

- Ohly

Recent Developments

-

In January 2025, Intellia Therapeutics, Inc. outlined its strategic priorities and key milestones for 2025, emphasizing the advancement of its late-stage programs, NTLA-2002 and Nexiguran Ziclumeran (Nex-Z). These initiatives aim to transform patient care and usher in a new era in medicine.

-

In November 2024, PTC Therapeutics, Inc. announced the FDA's accelerated approval of its gene therapy for AADC deficiency. This milestone makes it the first-ever gene therapy in the U.S. to be directly administered to the brain for treatment.

-

In January 2023, Agilent Technologies Inc. partnered with Quest Diagnostics to expand access to the Agilent Resolution ctDx FIRST liquid biopsy test. The collaboration allows healthcare providers and patients across the U.S. to order the next-generation sequencing (NGS) test starting today.

Nucleotide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.01 billion

Revenue forecast in 2030

USD 1.52 billion

Growth Rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

CJ CheilJedang Corp.; Star Lake Bioscience; Thermo Fisher Scientific Inc.; MEIHUA HOLDINGS GROUP CO., LTD.; F. Hoffmann-La Roche Ltd.; Biorigin; DSM; Promega Corporation; Agilent Technologies, Inc.; Lallemand Inc.; Nanjing Biotogether Co., Ltd.; NuEra Nutraceuticals Inc. and Ohly

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nucleotide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nucleotide market report on the basis of product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Deoxy Nucleotides

-

Enzyme Sourced

-

Chemical Synthesis

-

-

Dideoxynucleotides

-

Nucleotides for RNA Synthesis (rNTP)

-

Labelled Nucleotides

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

TaqMan Allelic Discrimination

-

Gene Chips & Microarrays

-

SNP by Pyrosequencing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Diagnostics Research

-

Food & Beverage Additive

-

Animal Feed Additive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nucleotide market size was estimated at USD 928.15 million in 2024 and is expected to reach USD 1.01 billion in 2025.

b. The global nucleotide market is expected to grow at a compound annual growth rate of 8.62% from 2025 to 2030 to reach USD 1.52 billion by 2030.

b. North America dominated the nucleotide market with a share of 38.87% in 2024. This is attributable to growing interest of consumers in nutritional food products. Also, increasing demand for self-medication coupled with rising awareness regarding health safety is likely to propel the demand.

b. Some key players operating in the nucleotide market include CJ CheilJedang Corporation, Star Lake Bioscience Co., Inc, ThermoFisher Scientific Inc., Meihua Group, F. Hoffmann-La Roche Ltd, Biorigin, DSM Nutritional Products Ltd., Promega Corporation, Affymetrix Inc., Agilent Technologies Inc., Lallemand Inc., Nanjing BioTogether Co., Ltd., NuEra Nutrition and Ohly GmbH.

b. Key factors that are driving the market growth include growing and expanding use of nucleotide in diagnostics research, favorable government policies, and rising consumer awareness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.