- Home

- »

- Consumer F&B

- »

-

Savory Ingredients Market Size, Share & Trends Report 2030GVR Report cover

![Savory Ingredients Market Size, Share & Trends Report]()

Savory Ingredients Market (2024 - 2030) Size, Share & Trends Analysis By Product, By Source (Natural, Synthetic), By Form (Powder, Liquid, Paste), By Application (Food, Pet Food, Others), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-108-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Savory Ingredients Market Size & Trends

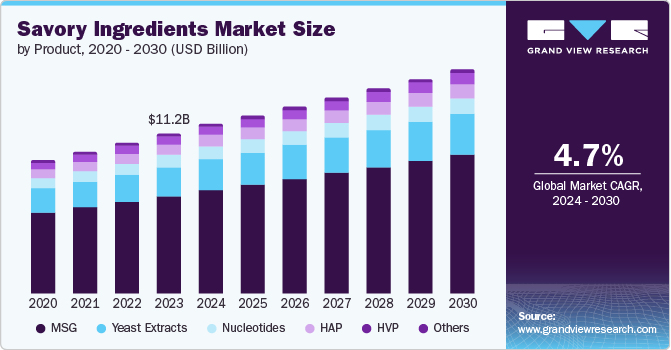

The global savory ingredients market size was valued at USD 11.15 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. Health-conscious consumers increasingly pursue savory ingredients that offer taste and nutritional benefits. This has led to developing and incorporating natural and organic ingredients and functional additives that contribute to health, such as low-sodium, low-fat, and high-protein options. The demand for products free from artificial additives and preservatives also drives innovation in the savory ingredients market.

With busy lifestyles and rising working individuals, a heightened demand for ready-to-eat meals and snack foods requires minimal preparation time. Savory ingredients are essential in enhancing the taste and increasing convenience products. This trend is further fueled by urbanization and the expansion of retail chains, making such products more accessible to a wider audience.

Market players acquire companies with unique savory ingredient offerings or advanced production technologies. These acquisitions enable larger companies to diversify their product lines, enter new geographic markets, and leverage the acquired company's expertise in specific savory segments. Such strategic moves enhance the acquiring company's competitive edge and drive innovation and growth within the savory ingredients market. For instance, Lesaffre acquired DSM-Firmenich's yeast extract business. This acquisition is part of a multi-part collaboration between Lesaffre and DSM-Firmenich in the yeast derivatives sector, specifically in the savory ingredients market. This acquisition allows Lesaffre to serve customers in savory and other fermentation-based applications.

Product Insights

The MSG segment accounted for the largest market revenue share of 61.1% in 2023. MSG is extensively used in the food industry due to its ability to enhance flavor, making it a prevalent additive in processed and packaged foods. The growing demand for ready-to-eat meals, snacks, canned foods, and instant noodles has significantly increased the consumption of MSG. As urbanization continues to rise and consumers seek quick and convenient meal options, the reliance on MSG as a cost-effective flavor enhancer is expected to drive market growth.

The yeast extracts segment is expected to register a significant CAGR during the forecast period. Yeast extracts provide several functional and nutritional benefits that food manufacturers and consumers demand. Rich in B vitamins, amino acids, and minerals, yeast extracts enhance the nutritional profile of food products. Their flavor improves taste and allows for the reduction of salt and other additives in formulations. This advantage of improving flavor while providing nutritional benefits drives the incorporation of yeast extracts in various food products, from processed meals to snacks and others.

Source Insights

The natural segment accounted for the largest market revenue share in 2023. Natural ingredients are perceived as healthier alternatives to artificial additives, contributing to a balanced diet without the associated risks of synthetic chemicals. Natural ingredients enhance flavor and provide various health benefits, such as anti-inflammatory and antioxidant properties. This growing awareness and preference for health-promoting ingredients drive the natural savory ingredients market.

The synthetic segment is anticipated to register the fastest CAGR over the forecast period. Synthetic ingredients are produced in large quantities at a lower cost. The consistent and controlled production of synthetic ingredients allows manufacturers to meet high demand without the fluctuations in supply and price that affect natural ingredients. This cost-effective advantage makes it a low-cost ingredient for food manufacturers. Moreover, synthetic savory ingredients get less degraded from environmental factors such as light, heat, and air. This stability ensures that synthetic ingredients maintain their flavor profile over time, making them ideal for use in processed meals, which require a consistent taste throughout their shelf life. These factors combined are driving demand for synthetic ingredients.

Form Insights

The powder segment accounted for the largest market revenue share in 2023. Powdered savory ingredients have a longer shelf life. The drying process removes moisture, which stops the growth of bacteria and mold. This stability is particularly advantageous for food manufacturers and retailers, as it reduces wastage and ensures a consistent supply of ingredients over time. The reliable shelf life and stability of powdered ingredients make them a preferred choice in the food industry. Additionally, the powder method ensures uniform flavor distribution, improving the finished product's quality by enabling accurate measurement and continuous dispersion.

The liquid segment is anticipated to register the fastest CAGR over the forecast period. Liquids are easily mixed and blended without additional processing steps, simplifying production and reducing preparation time. This convenience is especially beneficial in industrial food production, where efficiency and speed are essential. Integrating liquid ingredients into recipes enhances their utilization for both large-scale food manufacturers and small-scale food producers. Moreover, the liquid form allows for the solubility of flavors throughout the food product, ensuring a more uniform taste. This enhanced solubility enables chefs and food manufacturers to achieve high-quality taste in their products.

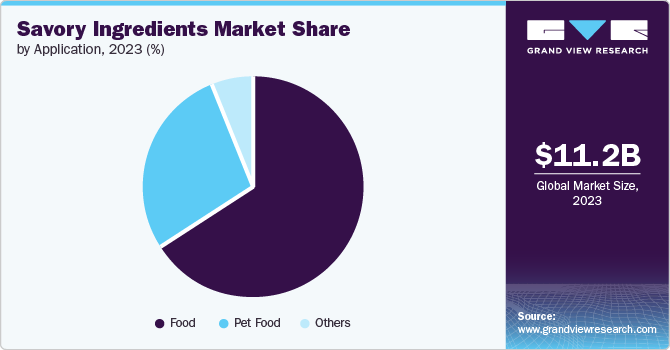

Application Insights

The food segment accounted for the largest market revenue share in 2023. The growing need for quick meal solutions has increased demand for ready-to-eat food, snacks, and packaged foods. Savory ingredients play a crucial role in enhancing these product's flavor, texture, and overall requirements. Additionally, Consumers are increasingly pursuing healthier food options that offer nutritional benefits without compromising taste. Using savory ingredients to reduce sodium, sugar, and fat content in foods caters to the growing preference for healthier diets.

The pet food segment is expected to witness significant growth over the forecast period. As more individuals adopt pets, particularly dogs and cats, there is a growing demand for high-quality pet food products. Pet owners increasingly invest in premium pet food with nutritional benefits and extensive flavors. Savory ingredients improve the taste, making it better for pets and meeting the growing expectations of pet owners for high-quality products. The rising pet ownership rates and increased spending on pet care are driving demand for the savory ingredients market in the pet food segment.

End-use Insights

The processed meals segment accounted for the largest market revenue share in 2023. Consumers increasingly pursue meal solutions requiring minimal preparation and quick, convenient dining options. Processed meals, including microwaveable dinners, frozen entrees, and meal kits, rely on savory ingredients to provide flavors and tastes. Savory ingredients are essential for achieving the flavor of the products, increasing their demand for convenience without sacrificing taste.

The snacks segment is anticipated to register a significant CAGR over the forecast period. Savory ingredients with functional properties, such as probiotics, antioxidants, or added vitamins, are incorporated into snack formulations for consumers looking for snacks that taste good and offer additional health benefits. The emphasis on functional benefits drives the development of snacks that combine taste with health advantages, supporting the growth of the savory ingredients market.

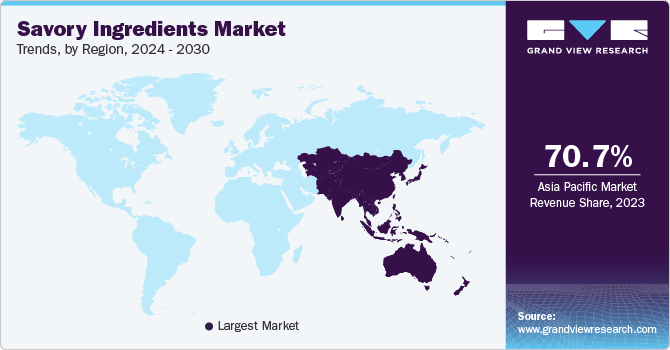

Regional Insights

North America savory ingredients market is expected to witness a significant CAGR over the forecast period. Busy lifestyles and an increasing preference for quick and easy meal solutions have led to a rise in the consumption of processed and ready-to-eat foods. Savory ingredients are essential for delivering the taste and quality consumers expect from these convenience products. The growing market for convenience foods in North America drives the need for a wide range of savory ingredients to meet consumers' diverse flavor preferences and demands.

U.S. Savory Ingredients Market Trends

The U.S. savory ingredients market is expected to witness significant growth over the forecast period. As more households adopt pets, there is a growing demand for high-quality pet food products that cater to pets' nutritional needs and preferences. For instance, as of 2024, 66% of U.S. households own a pet. U.S. pet owners spend about $136 billion on their pets and pet products every year. Pet owners invest in premium and nutritious food options for their pets, which include products enhanced with savory ingredients to improve taste. This rise in pet ownership and spending supports the demand for diverse savory ingredients that enhance the flavor and taste of pet food.

Asia Pacific Savory Ingredients Market Trends

Asia Pacific savory ingredients market accounted for the largest revenue share of 70.7% in 2023. Consumers are pursuing foods that offer additional health benefits beyond basic nutrition, such as improved digestion, better immune function, or enhanced energy levels. Savory ingredients that provide functional benefits, such as added vitamins, minerals, or probiotics, are becoming more prevalent. The trend towards functional foods drives the demand for savory ingredients, contributing to taste and health benefits. Additionally, improvement in supply chain logistics and transparency aids ensure the availability and quality of savory ingredients. As companies focus on optimizing their sourcing and supply chain strategies, the market for savory ingredients benefits from increased efficiency and reliability in ingredient procurement and distribution.

The China savory ingredients market is expected to witness significant growth over the forecast period. With more consumers cooking at home, there is a growing interest in meal kits that provide convenient cooking solutions. Savory ingredients, including pre-measured seasonings, sauces, and flavor bases, are integral to these meal kits, simplifying the cooking process and enhancing the taste of home-prepared meals. The trend towards home cooking and meal kits drives demand for high-quality savory ingredients that offer convenience and taste. Moreover, as more consumer's food choices change, there is a growing demand for international and exotic flavors. Savory ingredients with international seasoning blends and global flavors are increasingly used to create products that reflect diverse culinary traditions, driving its demand in the market.

Europe Savory Ingredients Market Trends

Europe savory ingredients market is expected to witness significant growth over the forecast period. As more consumers shift to online platforms for their food shopping and meal delivery needs, there is an increased demand for a wide range of food products, including those featuring savory ingredients. Online retailers and food delivery services offer convenience and variety, which include specialty and gourmet items. This shift in shopping habits drives the need for savory ingredients that cater to diverse consumer preferences and enhance the offerings available through these channels.

The UK savory ingredients market is expected to witness significant growth over the forecast period. Consumers are increasingly interested in exploring new flavors and culinary traditions, which fuels the demand for ingredients that recreate or innovate upon international dishes. Savory ingredients are used to offer authentic and enhanced food experiences. This trend towards culinary exploration supports the market for a wide range of savory ingredients that cater to the consumer experience.

Key Savory Ingredients Company Insights

Some of the key players in savory ingredients market include Ajinomoto Co., Inc., AngelYeast Co., Lesaffre, Kerry Group plc., and others.

-

Ajinomoto Co., Inc. is a leading global food and biotechnology manufacturer. Ajinomoto offers a diverse portfolio that includes seasonings, cooking oils, processed foods, frozen foods, beverages, and sweeteners. Their extensive product line features popular brands such as AJI-NO-MOTO PLUS, Birdy, AJI-NO-SILLAO, and others.

-

Lesaffre is a global player in yeast and fermentation. The company specializes in providing yeast extracts and other fermentation-based ingredients used to enhance the flavor and nutritional profile of various food and beverage products.

Key Savory Ingredients Companies:

The following are the leading companies in the savory ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Ajinomoto Co., Inc.

- AngelYeast Co.

- Vedan International (Holdings) Ltd.

- Kerry Group plc.

- Sensient Technologies Corporation

- Givaudan

- Diana Group S.r.l

- Symrise

- Lesaffre

- Tate & Lyle

Recent Developments

-

In February 2024, McDonald's launched a limited-time sauce, Savory Chili WcDonald's Sauce. This sauce is part of a promotional campaign featuring an anime series and manga-style packaging. It is made with a mixture of garlic, soy, and other ingredients.

-

In August 2021, Angel Yeast Co., Ltd. formed a joint venture to acquire Shandong Bio Sunkeen Co., Ltd. The acquisition of Bio Sunkeen enables Angel Yeast to expand its production capacity by 15,000 tons for yeast extracts and yeast.

Savory Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.85 billion

Revenue forecast in 2030

USD 15.62 billion

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilo Tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, form, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Ajinomoto Co.; Inc.; AngelYeast Co.; Vedan International (Holdings) Ltd.; Kerry Group plc.; Sensient Technologies Corporation; Givaudan; Diana Group S.r.l; Symrise; Lesaffre; Tate & Lyle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Savory Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the savory ingredients market report based on product, source, form, application, end-use and region.

-

Product Outlook (Revenue, Kilo Tons, USD Million, 2018 - 2030)

-

Yeast Extracts

-

HVP

-

HAP

-

MSG

-

Nucleotides

-

Others

-

-

Source Outlook (Revenue, Kilo Tons, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue, Kilo Tons, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

Paste

-

-

Application Outlook (Revenue, Kilo Tons, USD Million, 2018 - 2030)

-

Food

-

Pet Food

-

Others

-

-

End-use Outlook (Revenue, Kilo Tons, USD Million, 2018 - 2030)

-

Food

-

Processed Foods

-

Snacks

-

Feed

-

Others

-

-

Regional Outlook (Revenue, Kilo Tons, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.