- Home

- »

- Renewable Chemicals

- »

-

Octadecanedioic Acid Market Size, Industry Report, 2030GVR Report cover

![Octadecanedioic Acid Market Size, Share & Trends Report]()

Octadecanedioic Acid Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Polyester polyols, Cosmetics, Powder coatings, Lubricating oils), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-782-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Octadecanedioic Acid Market Summary

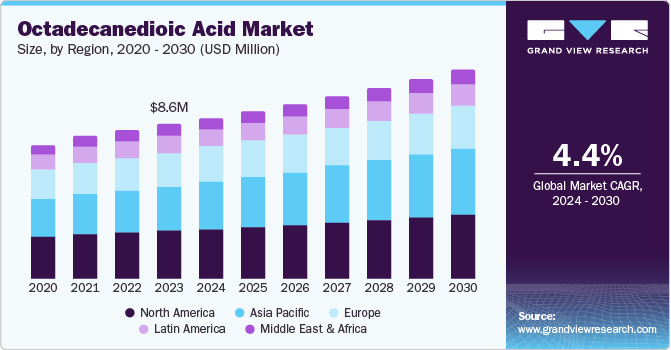

The global octadecanedioic acid market size was estimated at USD 8.6 million in 2023 and is projected to reach USD 11.6 million by 2030, growing at a CAGR of 4.4% from 2024 to 2030. The increasing consumer demand for biodegradable polymers, expanding applications across industries such as automotive and textiles, technological advancements in raw material processing, and supportive government policies promoting eco-friendly materials are among factors driving market growth worldwide.

Key Market Trends & Insights

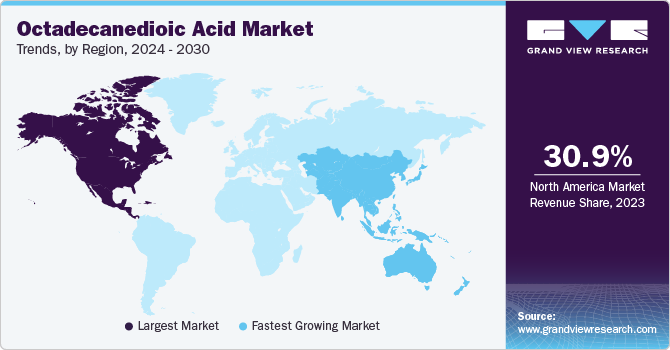

- The North America octadecanedioic acid market dominated the global octadecanedioic acid market with a market share of 30.9% in 2023.

- The Asia Pacific octadecanedioic acid market is expected to register the fastest CAGR of 5.6% in the forecast period.

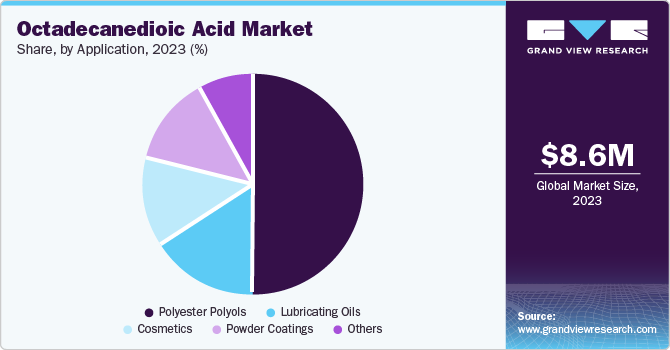

- Based on application, the polyester polyols application dominated the market with a revenue share of 50.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.6 Million

- 2030 Projected Market Size: USD 11.6 Million

- CAGR (2024-2030): 4.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The demand for durable and versatile polyester materials in various industries, including automotive, construction, and consumer goods, is a significant driver of market growth. Furthermore, the expanding applications of octadecanedioic acid (ODDA) in the healthcare sector, where it is used in drug delivery systems and biocompatible materials, are also contributing to its growing market presence.

Regulatory compliance and environmental considerations are another key driver of the ODDA market. Stricter regulations regarding the use of chemicals in various applications are pushing companies towards eco-friendly alternatives, making ODDA an attractive option for manufacturers seeking to comply with regulations while maintaining product performance. Furthermore, advancements in material science are leading to the development of new applications for ODDA, particularly in the formulation of advanced polymers and coatings. This trend includes increasing research into biotechnological production methods that utilize renewable resources, aligning with sustainability goals across industries.

The growth of the ODDA market is also being driven by infrastructure development, particularly in emerging economies, which is creating substantial demand for durable materials that incorporate ODDA. The compound’s properties enhance the performance of coatings and composites used in construction projects, thereby driving market growth. Moreover, the increasing demand from end-use industries such as automotive, textile, electronics, etc. is also influencing the ODDA market. With increased environmental consciousness, companies are moving to using sustainable materials, and efforts made by governments to implement regulations that would lead to sustainability are also helping with the growth of the market.

Application Insights

Polyester polyols application dominated the market with a revenue share of 50.2% in 2023. ODDA’s exceptional flexibility and elongation make it an ideal choice for applications requiring superior strength and durability. Moreover, its chemical resistance enhances material properties in harsh environments. The automotive and construction industries utilize polyester polyols to produce high-performance coatings with exceptional adhesion and weather resistance.

Cosmetics application is expected to register the fastest CAGR of 5.1% during the forecast period. The demand for anti-aging skincare products has surged, driven by increasing consumer awareness of skin health. ODDA’s benefits on skin elasticity and hydration enhance its effectiveness in anti-aging formulations. As the cosmetic industry prioritizes product safety and efficacy, demand for products comprising ODDA is expected to rise.

Regional Insights

North America octadecanedioic acid market dominated the global octadecanedioic acid market with a market share of 30.9% in 2023. The region has a well-developed industrial base that favors the manufacturing and usage of the chemical compound such as ODDA. The area has numerous chemical manufacturing industries, several of which have expanded their R&D activities with a view of improving production processes and quality of products. This strong industrial infrastructure creates a favorable background to implement large production and distribution of ODA at a high level.

U.S. Octadecanedioic Acid Market Trends

The octadecanedioic acid market dominated the North America octadecanedioic acid market with a market share of 78.0% in 2023. The U.S. boasts a mature chemical manufacturing industry, characterized by advanced technology, skilled personnel, and intricate supply chains, facilitating the synthesis of ODDA. Furthermore, the U.S. government encourages the adoption of bio-based chemicals, such as ODDA, to promote environmental sustainability.

Asia Pacific Octadecanedioic Acid Market Trends

Asia Pacific octadecanedioic acid market is expected to register the fastest CAGR of 5.6% in the forecast period. The Asia Pacific is one of the fast-growing markets for ODDA due to industrialization, urbanization, and infrastructure development in the region. Huge investments in automobiles, construction, and electronics are fueling growth especially from the countries such as China, India, and Japan. The cosmetics sector in the region shows great potential for development, due to the growing incomes per capita and the shift in demand for high-quality skin care products.

The octadecanedioic acid market in India is expected to grow during the forecast period. India has confirmed its position as the largest producer of ODDA since it has invested heavily in chemical manufacturing industry. This has made the country have several large scale production facilities that use modern technologies in the production of ODDA. This capacity makes it easy for India to meet both the domestic and international market demand as required.

Europe Octadecanedioic Acid Market Trends

Europe octadecanedioic acid market held significant market share in 2023. Europe is another market for ODDA as it has a reliable industrial base and a focus on environmental concerns. EPA regulations that limit the use of chemicals in the regional industries promote the use of ODDA in sustainable products such as powder coatings and bio-based lubricants. Moreover, the cosmetics industry in Europe also appreciates ODDA as a natural material that is good for the skin, which corresponds to the European trend towards organic and environmentally friendly cosmetics.

The octadecanedioic acid market in Germany held substantial market share in 2023. Germany has a very well developed chemical industry, which can be considered among the largest in Europe. There are several renowned chemical companies present in the country that have emphasized on R&D of specialty chemicals including ODDA. This strong industrial base facilitates effective manufacturing operations and continuous product development.

Key Octadecanedioic Acid Company Insights

Some key companies in the octadecanedioic acid market include Larodan AB; Procter & Gamble; Cathay Biotech Inc.; Tokyo Chemical Industry (India) Pvt. Ltd.; and others. Market players employ strategies such as new product launches, expanded distribution channels, and geographic expansion to stay competitive.

-

Larodan AB is a provider of high-quality lipids and related products for research and industry. Its diverse product portfolio includes fatty acids, esters, phospholipids, and other lipid-related products, catering to the needs of various customers.

-

Procter & Gamble leverages ODDA in its diverse consumer products, particularly in personal care and household cleaning items, due to its emulsifying properties and effectiveness in enhancing product performance. This commitment to sustainability and innovation supports P&G’s market position.

Key Octadecanedioic Acid Companies:

The following are the leading companies in the octadecanedioic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Larodan AB

- Procter & Gamble

- Cathay Biotech Inc.

- Tokyo Chemical Industry (India) Pvt. Ltd.

- INDOFINE Chemical Company, Inc.

- XIAMEN SINOPEG BIOTECH CO., LTD.

- Hunan Huateng Pharmaceutical Co., Ltd

Recent Developments

-

In August 2024, Cathay Biotech Inc. announced its aim to provide comprehensive material solutions across the entire production, transportation, storage, and application chain in support of the renewable energy sector.

-

In April 2024, ACS Pharmacology & Translational Science launched the ODDA-TP conjugate, enhancing the cyclic peptide’s half-life and safety profile, enabling noncovalent binding to serum albumin via native fatty acid binding modes.

Octadecanedioic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.0 million

Revenue forecast in 2030

USD 11.6 million

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilograms, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Germany, France, Japan

Key companies profiled

Larodan AB; Procter & Gamble; Cathay Biotech Inc.; Tokyo Chemical Industry (India) Pvt. Ltd.; INDOFINE Chemical Company, Inc.; XIAMEN SINOPEG BIOTECH CO., LTD.; Hunan Huateng Pharmaceutical Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Octadecanedioic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global octadecanedioic acid market report based on application, and region.

-

Application Outlook (Volume, Kilograms; Revenue, USD Million, 2018 - 2030)

-

Polyester Polyols

-

Cosmetics

-

Powder Coatings

-

Lubricating Oils

-

Others

-

-

Regional Outlook (Volume, Kilograms; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

-

Latin America

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.