- Home

- »

- Medical Devices

- »

-

Ocular Trauma Devices Market Size, Industry Report, 2030GVR Report cover

![Ocular Trauma Devices Market Size, Share & Trends Report]()

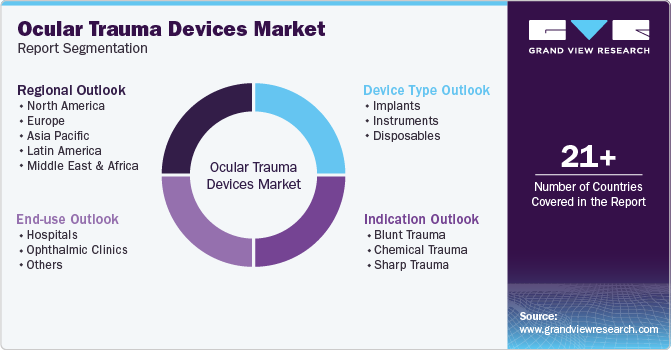

Ocular Trauma Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Device Type (Implants, Instruments), By Indication (Blunt Trauma, Chemical Trauma), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-993-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ocular Trauma Devices Market Trends

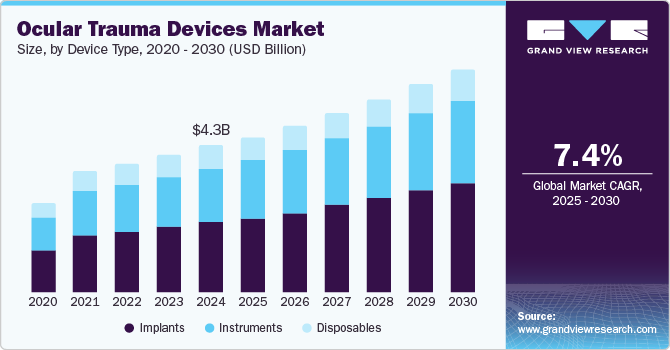

The global ocular trauma devices market size was estimated at USD 4.28 billion in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2030. The increasing prevalence of optical conditions, including glaucoma, cataracts, diabetic retinopathy, and vitreoretinal disorders, combined with advancements in ophthalmic instruments, contributes significantly to market expansion. Enhanced government initiatives aimed at raising awareness of visual impairment are expected to further support market growth. In addition, the aging population, which is more susceptible to age-related ophthalmic conditions, is expected to drive the demand for ophthalmic devices and procedures, such as implants. For instance , according to World Report on Vision published by World Health Organization (WHO estimated that at least 2.2 billion individuals globally have a vision impairment, with nearly half of these cases being preventable or yet to be addressed.

The ocular trauma devices market experiences significant growth due to the increasing prevalence of ophthalmic conditions, such as cataracts, glaucoma, age-related macular degeneration, and diabetic retinopathy, which are among the leading causes of visual impairment and blindness worldwide. For instance , according to the article published in Cureus Journal in May 2023, approximately 200 million people were affected by age-related macular degeneration (AMD) globally in 2020, and this number is projected to rise to about 288 million by 2040. This condition significantly contributes to vision impairment, accounting for nearly 9% of all blindness cases worldwide. These rising numbers are driving the demand for ocular trauma devices as essential solutions for restoring and enhancing vision.

Supportive government policies significantly drive the growth of the ocular trauma devices market by expanding access to eye care services and enabling more patients to undergo diagnostic and corrective procedures. For instance, in May 2023, the article published by National Health Service (NHS) England outlines new measures introduced to enhance eye care services and reduce waiting times for patients. The NHS plans to increase the use of community-based eye care clinics, allowing optometrists to handle more routine cases, which in turn eases pressure on hospital ophthalmology departments. This approach aims to streamline patient referrals, ensuring that those with more severe eye conditions receive timely specialist care.

Increasing prevalence of geriatric population, which faces increased susceptibility to age-related ophthalmic conditions, is expected to significantly drive demand for ophthalmic devices and procedures, including implants. For instance, the United Nations projected that by 2050, the global population aged 65 and older are expected to exceed 1.5 billion, nearly double the 2020 figure of 727 million. This demographic shift is expected to lead to a higher incidence of conditions such as cataracts, glaucoma, and macular degeneration, which are already among the leading causes of vision impairment. As a result, the rising elderly population is expected to boost demand for corrective interventions, particularly implants, which help restore vision and enhance quality of life.

Market Concentration & Characteristics

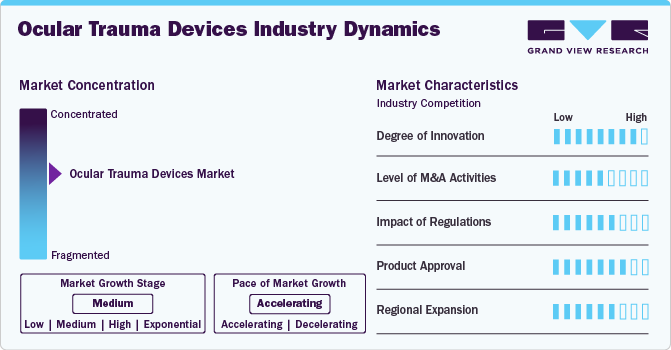

The ocular trauma devices market exhibits a moderate level of industry concentration, with a combination of established multinational corporations and emerging enterprises competing for market share. Key players leverage advanced technological solutions, extensive distribution networks, and significant investments in research and development to maintain their dominance. Prominent companies such as Alcon Inc., Bausch & Lomb., Carl Zeiss AG, Johnson & Johnson Services, Inc., CooperVision, TOPCON CORPORATION, EssilorLuxottica, HOYA Corporation, Glaukos Corporation lead in innovation, driving the development of advanced ocular trauma devices. These market leaders benefit from strong brand recognition, comprehensive device type portfolios, and a global presence, providing them with a competitive advantage. Concurrently, emerging firms are introducing innovative technologies and focusing on specialized solutions to address unmet patient needs, thereby contributing to the market's dynamic growth.

The ocular trauma devices market exhibits a high degree of innovation, with continuous advancements in surgical techniques and device technology aimed at improving patient outcomes and reducing recovery times. For instance, micro-incision vitrectomy systems have been developed to allow for more precise and minimally invasive surgeries, minimizing patient discomfort and enhancing recovery. In addition, the use of real-time imaging technologies, such as optical coherence tomography, has improved the accuracy of diagnoses and treatment planning, allowing for earlier intervention. In addition, the development of biodegradable implants, such as those made from collagen or synthetic polymers, is reducing the risk of complications and promoting faster healing, showcasing how innovation is transforming ocular trauma care.

The impact of regulations on the ocular trauma devices market is significant, as regulatory frameworks ensure the safety, efficacy, and quality of devices used in treating ocular injuries. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), establish strict guidelines for the approval of new ocular trauma devices, which includes extensive clinical trials and safety testing. These regulations help maintain high standards of care and minimize the risk of adverse outcomes for patients. However, they also introduce challenges, including longer time-to-market and higher costs for manufacturers as they comply with approval processes. For instance, the FDA's 510(k) approval process requires manufacturers to demonstrate that their device is substantially equivalent to an existing, legally marketed device, which can be a lengthy and costly procedure.

The level of mergers and acquisitions (M&A) activities in the ocular trauma devices market has been rising, as companies aim to enhance their device type portfolios and expand their market presence. For instance, in July 2024, Bausch + Lomb acquired Trukera Medical, a U.S.-based diagnostic company, to enhance its surgical presence and strengthen its position in dry eye management. This acquisition enables Bausch + Lomb to offer advanced preoperative diagnostic tools, especially valuable for cataract and refractive surgeries. The acquisition aligns with the growing need for effective dry eye management in surgical settings, as it can significantly impact patient satisfaction and surgical results. These strategic acquisitions are examples of how M&A activities are driving innovation and expanding market access in the ocular trauma devices sector.

In the ocular trauma devices market, device type substitutes, such as non-invasive diagnostic tools or emerging therapies such as stem cell treatments, can significantly influence market dynamics by offering alternative methods to treat eye injuries. These substitutes may appeal to patients seeking less invasive options, driving manufacturers to innovate and improve existing devices to maintain competitiveness. For instance, drug therapies or advancements in biomaterials may present more cost-effective or efficient solutions, prompting a shift in the types of device types preferred by healthcare providers and patients.

In addition, substitutes can lower the overall cost of care, increasing accessibility for patients. With the rapid advancement in digital health technologies, telemedicine consultations for eye injuries could also become an alternative, affecting demand for physical trauma devices. These shifts could encourage the development of hybrid solutions that combine the best of both traditional and modern approaches to ocular trauma treatment.

Regional expansion in the ocular trauma devices market is a significant driver of growth as it allows companies to cater to the diverse needs of different regions, while capitalizing on local opportunities. For instance, in North America, the demand for advanced ocular trauma devices has been supported by the presence of established healthcare systems, high awareness, and a focus on cutting-edge medical technologies. Similarly, in Europe, regional expansion is driven by healthcare advancements and a growing elderly population, which increases the prevalence of ocular trauma. In Asia-Pacific, particularly in countries such as India, technological advancements in implants have boosted the market, while in China, rising healthcare expenditures and improved healthcare infrastructure support the adoption of advanced devices. In Latin America, the increasing awareness of corrective eye surgeries has stimulated demand for ocular trauma devices, contributing to market growth. As companies expand their reach in these diverse regions, they adapt to specific regional demands, enabling sustained market development.

Device Type Insights

The market is classified by device type into implants, instruments and disposables. Implants segment held the largest market share at 45.99% in 2024 and is projected to experience the fastest CAGR of 8.1% from 2025 to 2030, driven by several key factors. One of the primary drivers is the increasing prevalence of eye-related disorders and injuries, such as age-related macular degeneration, cataracts, glaucoma, and scleritis. These conditions often result in significant damage to the eye, necessitating surgical intervention and the use of advanced ocular implants. For instance, age-related macular degeneration and cataracts are becoming more common as the global population ages, which is driving the demand for implants that can restore vision or improve eye function.

Similarly, glaucoma and scleritis, which can cause damage to the eye's internal structures, are prompting the need for advanced surgical solutions, including the implantation of devices. In addition, technological advancements in implant materials and design, such as the development of biocompatible materials and more precise surgical techniques, have contributed to the growth of this segment.

The implants segment in the ocular trauma devices market is expected to grow rapidly due to several key factors. Technological advancements in implant materials and designs, including biocompatible materials and improved surgical techniques, have enhanced the safety and effectiveness of these devices, further encouraging their adoption. In addition, rising awareness of eye health and expanding healthcare access in emerging markets are contributing to the segment’s growth. As healthcare systems in both developed and developing regions increasingly prioritize advanced medical technologies, the implants segment is projected to experience the fastest growth within the ocular trauma devices market.

Indication Insights

Based on indication, the market is segmented into blunt trauma, chemical trauma, and sharp trauma. The blunt trauma segment held a dominant market share of 47.21% in 2024. Blunt trauma to the eye area can result from a combination of forces, including acceleration and deceleration, shearing, and crushing pressure. This type of injury refers to damage or wounds in the vicinity of the eye caused by a significant impact or physical assault using a blunt object. For instance, according to the World Health Organization (WHO), the global elderly population is expected to exceed 2 billion by 2050. This demographic shift is anticipated to drive the growth of the blunt trauma segment worldwide, as age-related conditions and an increased risk of injuries among the elderly is expected to contribute to a higher demand for related medical treatments.

The sharp trauma segment is anticipated to experience the fastest growth during the forecast period, with a CAGR of 8.9%. This growth is primarily driven by the rising number of sharp object eye injuries, particularly in workplace settings. For instance, according to the U.S. Bureau of Labor Statistics, sharp objects are responsible for approximately 30% of all occupational eye injuries in the U.S. In addition, these injuries, along with slips, trips, falls, and contact with equipment, contribute to a significant portion of workplace accidents, highlighting the increasing demand for treatments related to sharp trauma and supporting the segment's rapid expansion. With stricter workplace safety regulations and improved awareness, there is a growing emphasis on injury prevention and faster treatment, further driving the need for specialized ocular trauma devices. This trend is expected to strengthen the market for sharp trauma treatments globally.

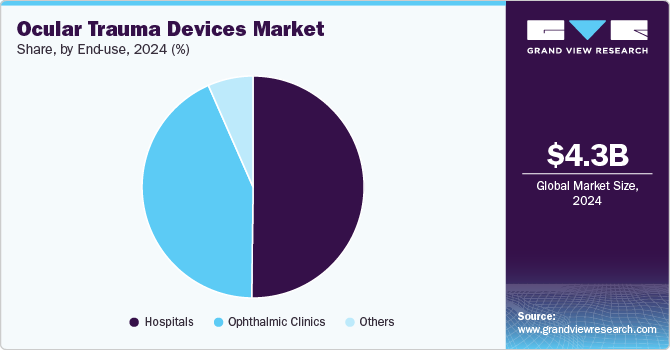

End Use Insights

The market is segmented by end use into hospitals, ophthalmic clinics, and others. The hospital segment led the market in terms of revenue share in 2024, accounting for 50.05%. This dominance is attributed to the growing utilization of advanced ophthalmic technology and the availability of affordable, efficient treatment options within hospital settings. In the coming years, the demand for new device installations is expected to rise, driven by the increasing number of collaborations between ophthalmic clinics and hospitals. As more patients opt for ocular procedures to be performed in hospitals rather than clinics, this trend is anticipated to further boost the need for advanced ocular trauma devices in hospital environments. In addition, hospitals are investing in state-of-the-art equipment to enhance treatment outcomes and accommodate the growing patient load, further contributing to the expansion of the market. These factors are expected to support the continued growth of the hospital segment throughout the forecast period.

The ophthalmic clinics segment is expected to register the fastest growth during the forecast period, with a CAGR of 8.0% from 2025 to 2030. This growth is primarily driven by the increasing demand for eye care services in remote and outlying locations, where access to specialized care in hospitals may be limited. Ophthalmic clinics, offering a range of eye care services, are becoming crucial in providing treatment to underserved populations. In addition, the sharp rise in the number of specialty ophthalmic centers is contributing to the growth of the segment. These centers cater to specific eye care needs, such as trauma treatment, cataract surgeries, and advanced diagnostics, which are essential in meeting the rising demand for specialized services. The growing number of trained ophthalmologists in developing economies is expected to play a significant role in expanding the segment. The increasing affordability and focus on specialized care are expected to make ophthalmic clinics a preferred choice for eye treatments, especially in regions with growing healthcare infrastructure.

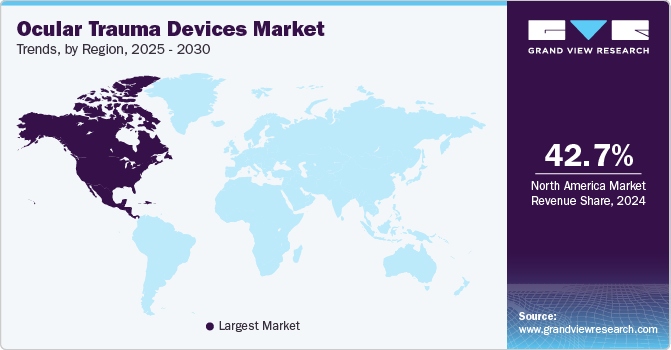

Regional Insights

North America ocular trauma devices market dominated the global ocular trauma devices market, accounting for 42.68% of the revenue share in 2024. This leadership is primarily driven by the high prevalence of eye diseases and the region’s advanced healthcare infrastructure. For instance, according to the Centers for Disease Control and Prevention (CDC), approximately 12 million people aged 40 and older in the United States are affected by visual impairment, including conditions such as cataracts, glaucoma, and age-related macular degeneration. In addition, the region benefits from robust healthcare systems, with significant investments in medical technologies, which enhance the availability and accessibility of advanced ocular trauma devices. The U.S. healthcare system is known for its emphasis on cutting-edge ophthalmic technology, providing a wide range of treatment options for patients suffering from ocular trauma. These factors, coupled with the increasing demand for specialized treatments, are expected to sustain North America's dominant position in the ocular trauma devices market throughout the forecast period.

U.S. Ocular Trauma Devices Market Trends

The ocular trauma devices market in the U.S. is anticipated to maintain a significant share of the North American market in 2024, driven by factors such as the high prevalence of eye diseases and injuries. With the aging population in the U.S. increasing, the demand for ocular treatments is rising. By 2030, it is estimated that nearly 20% of the U.S. population is expected to be aged 65 or older, significantly increasing the number of individuals susceptible to age-related eye conditions such as macular degeneration and cataracts. In addition, the U.S. has a well-established healthcare system that fosters rapid adoption of advanced ocular trauma devices, supported by a high level of healthcare spending, which exceeds USD 4 trillion annually. The market is further strengthened by the presence of leading ophthalmic device manufacturers, who continue to innovate and improve treatments for ocular trauma.

Europe Ocular Trauma Devices Market Trends

The ocular trauma devices market in Europe is experiencing significant growth, driven by a high prevalence of eye injuries and vision-related disorders, particularly among the elderly population. With approximately 30 million people affected by visual impairment across the region, the demand for ocular trauma devices is expected to increase. The growing number of ophthalmic clinics and healthcare centers, along with the rising number of specialized care facilities, is also contributing to market expansion. Germany is expected to maintain its leadership in the European market, with strong contributions from other countries such as France and the UK. The increasing focus on technological advancements and innovations in ophthalmic care further supports market growth. In addition, the expanding healthcare infrastructure in these regions are expected to play a crucial role in meeting the rising demand for ocular trauma treatments.

UK ocular trauma devices market is poised for steady growth, driven by factors such as an aging population, an increasing prevalence of eye injuries, and advancements in ophthalmic technologies. The UK’s aging population is expected to further fuel demand, as elderly individuals are more susceptible to ocular trauma and age-related eye diseases. Technological innovations, including Optical Coherence Tomography (OCT) scanners, are significantly enhancing diagnostic and treatment capabilities, improving the early detection and management of retinal injuries. The rising adoption of these advanced diagnostic tools and surgical devices in healthcare facilities is expected to support the market's expansion. In addition, as more eye care centers incorporate modern, minimally invasive solutions, the market is expected to benefit from improved accessibility and the ability to address complex eye injuries more efficiently, thereby contributing to overall market growth.

The ocular trauma devices market in France is experiencing significant growth, driven by factors such as the increasing prevalence of eye injuries and a growing demand for advanced treatment options. In particular, industries with high risks of ocular injuries, such as construction and manufacturing, are expected to contribute to the demand for these devices. In addition, the aging population in France, with over 15% of the population aged 65 or older as of 2021, significantly influences the market, as older individuals are more prone to eye injuries and conditions. The modernizing healthcare system and advancements in ophthalmic technologies, such as the adoption of minimally invasive surgical tools and diagnostic devices, are improving the management and treatment of ocular trauma. Furthermore, an increase in specialized eye care centers is enhancing access to ocular trauma treatments across the country.

The Germany ocular trauma devices market is expanding, driven by technological advancements, an aging population, and rising eye-related conditions. With over 50% of the population aged 50 or older, Germany is seeing a higher prevalence of age-related eye disorders such as cataracts and glaucoma, which significantly increases the demand for ocular trauma devices. For instance, in 2020, over 500,000 cataract surgeries were performed in the country, highlighting the need for surgical devices such as intraocular lenses and lasers. In addition, with increasing adoption of diagnostic technologies, such as optical coherence tomography (OCT), the precision and effectiveness of treatments are improving. Germany’s well-developed healthcare system and investments in ophthalmic research are fostering growth, with devices such as the Technolas Teneo M2 excimer laser helping to provide customized solutions for various eye conditions.

Asia Pacific Ocular Trauma Devices Market Trends

Asia Pacific ocular trauma devices market is experiencing rapid growth, driven by increasing healthcare investments, rising awareness of eye health, and a growing population in the region. The market is projected grow, supported by the rising prevalence of eye conditions such as glaucoma, cataracts, and diabetic retinopathy, particularly in China, Japan, and India. For instance, in Japan, over 1.2 million people are living with glaucoma, while India reports a high incidence of cataracts, which collectively increase the demand for advanced ocular trauma devices. Innovations such as small-gauge posterior-segment instruments and high-resolution surgical microscopes are enabling better treatment of complex ocular injuries. Asia-Pacific ocular trauma devices market is expected to expand significantly, with growing healthcare infrastructure, increasing disposable income, and higher patient awareness across countries such as China, India, and Japan.

The ocular trauma devices market in Japan is experiencing growth, driven by advancements in technology and the country’s aging population. With over 36 million people aged 65 and older, Japan has one of the world’s most rapidly aging populations. This demographic shift contributes to a rising incidence of age-related eye diseases such as cataracts, glaucoma, and macular degeneration. For instance, cataracts are a leading cause of blindness in Japan, affecting millions, which has led to increased demand for advanced ocular devices, including intraocular lenses and implants. In addition, Japan is adopting innovative surgical technologies, such as small-gauge surgical instruments, which enable more precise treatment for complex ocular injuries. These developments in both demographic trends and medical technology are expected to continue driving the expansion of the ocular trauma devices market in the country.

The ocular trauma devices market in China is poised for substantial growth, bolstered by factors such as an aging population, rising ocular injury rates, and government initiatives aimed at increasing awareness and improving healthcare infrastructure. China’s elderly population is experiencing a surge in age-related eye conditions, including cataracts and glaucoma, contributing to a growing demand for ocular trauma devices. In addition, the government has initiated numerous public health campaigns to raise awareness about eye health, focusing on both prevention and the need for treatment of ocular trauma. For instance, the "National Blindness Prevention and Treatment Program" aims to educate the population about eye care and encourage the use of advanced diagnostic and treatment technologies. In addition, workplace eye injuries, particularly in industries such as construction and manufacturing, are common, and government regulations are being introduced to improve workplace safety standards and increase the use of protective eyewear.

The ocular trauma devices market in India is experiencing significant growth, driven by an aging population, increasing awareness of eye health, and technological advancements in ophthalmology. For instance, the number of cataract surgeries performed annually in India exceeds 6 million, with cataracts being one of the leading causes of visual impairment in the country. As the elderly population continues to grow, with projections estimating that by 2030, over 141 million people in India is expected to be aged 60 and above, the demand for ocular trauma devices is expected to rise accordingly. In addition, government programs such as the National Programme for Control of Blindness, which aims to reduce preventable blindness, are promoting eye health awareness and driving more individuals to seek treatment for eye injuries and conditions. This growing demand, coupled with advancements in surgical technologies such as minimally invasive procedures, is fueling market growth in India.

Latin America Ocular Trauma Devices Market Trends

The Latin American ocular trauma devices market is expected to witness substantial growth, driven by an increase in eye-related conditions and greater access to healthcare. For instance, the prevalence of glaucoma is rising in the region, as the region's elderly population continues to grow, with over 27% of people aged 60 and older projected by 2030, the prevalence of age-related ocular conditions such as macular degeneration and cataracts is also rising. This growing demographic is expected to drive the demand for more advanced ocular trauma devices. In addition, rising industrial accidents in countries such as Mexico and Argentina are leading to more workplace-related eye injuries, contributing to an uptick in demand for specialized ocular trauma equipment. The combination of these factors, alongside increasing awareness campaigns on eye health, is expected to drive the Latin American ocular trauma devices market to new heights.

The ocular trauma devices market in Saudi Arabia is expanding rapidly, driven by factors such as an increasing number of eye-related conditions and rising healthcare awareness. For instance, the prevalence of cataracts in the country is significant, with studies indicating that approximately 25% of the Saudi population aged 60 and older is affected by this condition, driving the demand for cataract-related trauma devices. In addition, the incidence of diabetic retinopathy is rising, affecting 10-15% of patients with diabetes, a demographic that is increasing in Saudi Arabia due to lifestyle changes. In addition, the healthcare sector in Saudi Arabia is evolving with the introduction of advanced ophthalmic treatments and government initiatives, which aims to reduce preventable blindness and enhance eye care services across the country. These efforts are further stimulating the growth of the ocular trauma devices market, as there is greater emphasis on improving the accessibility and quality of eye care services.

Key Ocular Trauma Devices Company Insights

The competitive scenario in the ocular trauma devices market is highly competitive, with key players such as Alcon, Inc., Bausch + Lomb., and others. The major companies are undertaking various organic and inorganic strategies such as new device type development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Ocular Trauma Devices Companies:

The following are the leading companies in the ocular trauma devices market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon, Inc.

- Bausch + Lomb.

- Carl Zeiss AG

- Johnson & Johnson Services, Inc.

- CooperVision

- TOPCON CORPORATION

- EssilorLuxottica

- HOYA Corporation

- Glaukos Corporation.

Recent Developments

-

In October 2024, Bausch + Lomb announced that the U.S. Food and Drug Administration (FDA) approval of its enVista Envy intraocular lens (IOL). This new IOL offers a continuous range of vision with enhanced dysphotopsia tolerance, expanding upon the widely used enVista IOL platform. The approval marks a significant milestone for the company in providing advanced solutions for cataract surgery, aiming to improve visual outcomes and patient satisfaction.

-

In December 2023, Glaukos Corporation. announced the U.S. Food and Drug Administration (FDA) approval of its iDose TR (travoprost intracameral implant). This implant is designed for a single administration per eye and is indicated for reducing intraocular pressure (IOP) in patients with ocular hypertension (OHT) or open-angle glaucoma (OAG). The approval represents a significant advancement in the treatment of these conditions, offering a long-term solution for managing IOP with a single implant.

-

In October 2020, Bausch + Lomb introduced the SimplifEYE intraocular lens (IOL) delivery system, which is available exclusively for the enVista MX60PL and enVista toric MX60PT IOLs. This new system is the first preloaded toric IOL available in the United States, designed to enhance cataract surgery by simplifying the IOL implantation process.

Ocular Trauma Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.59 billion

Revenue forecast in 2030

USD 6.56 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, indication and end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Alcon, Inc., Bausch + Lomb., Carl Zeiss AG, Johnson & Johnson Services, Inc., CooperVision, TOPCON CORPORATION, EssilorLuxottica, HOYA Corporation, Glaukos Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ocular Trauma Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ocular trauma devices market report on the basis of device type, indication, end use and region:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Instruments

-

Disposables

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Blunt Trauma

-

Chemical Trauma

-

Sharp Trauma

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Clinics

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ocular trauma devices market size was estimated at USD 4.28 billion in 2024 and is expected to reach USD 4.59 billion in 2025.

b. The global ocular trauma devices market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 6.56 billion by 2030.

b. North America dominated the global ocular trauma devices market with a share of 42.7% in 2024. This is attributable to the well-established healthcare system and easy availability of products in the country along with the growing prevalence of eye disorders.

b. Some of the key player's global ocular trauma devices market are Alcon Bausch & Lomb, Inc. Carl Zeiss AG, Johnson & Johnson Vision, CooperVision, TopCon, EssilorLuxottica, Hoya Corporation, Glaukos Corporation, and Others.

b. Increasing prevalence of eye disorders, favorable demographics, and rising geriatric population base are the major factors driving the growth of ocular trauma devices market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.