- Home

- »

- Automotive & Transportation

- »

-

Off-highway Vehicles Market Size, Industry Report, 2030GVR Report cover

![Off-highway Vehicles Market Size, Share & Trends Report]()

Off-highway Vehicles Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Construction, Mining, Agriculture), By Propulsion Type (ICE, Electric), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-549-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Off-highway Vehicles Market Summary

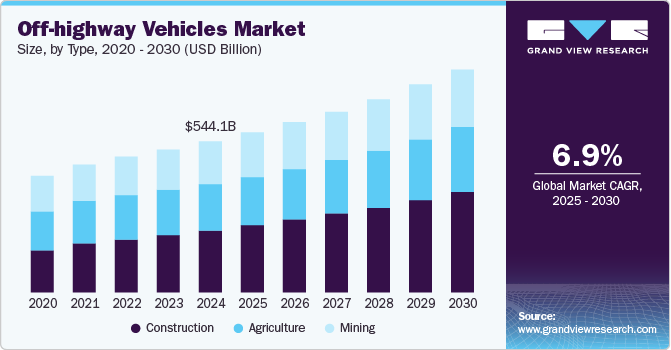

The global off-highway vehicles market size was estimated at USD 544.07 billion in 2024 and is projected to reach USD 804.86 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The market is growing due to rising infrastructure projects, increased mechanization in agriculture, and the need for more efficient mining equipment.

Key Market Trends & Insights

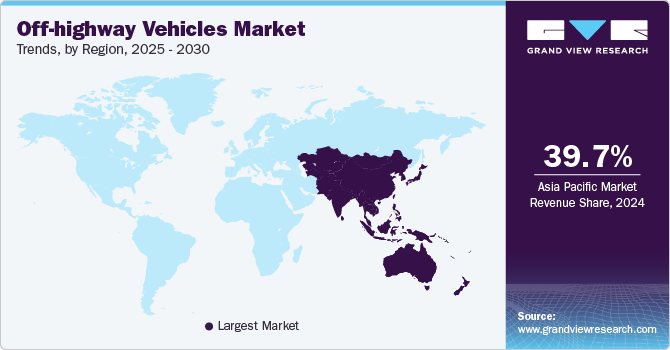

- The off-highway vehicles market in Asia Pacific accounted for a 39.7% share of the overall market in 2024.

- The off-highway vehicles industry in the U.S. held a dominant position in 2024.

- Based on type, the construction segment held the largest share of 41.1% in 2024.

- Based on propulsion type, the electric segment is estimated to grow at a significant CAGR during the coming years.

Market Size & Forecast

- 2024 Market Size: USD 544.07 Billion

- 2030 Projected Market Size: USD 804.86 Billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

Additionally, advancements in electrification, autonomous technology, and low-emission powertrains are driving further expansion. However, high initial costs and strict emission regulations remain key challenges. Massive infrastructure investments worldwide are fueling the growing demand for off-highway vehicles. China’s Belt and Road Initiative (BRI) has provided USD 679 billion for global projects in transportation and energy, boosting the need for construction & mining machinery. Similarly, in January 2025, the U.S. RAISE program allocated USD 1.32 billion to modernize roads and bridges, increasing demand for earthmoving and material-handling equipment. These initiatives highlight the growing reliance on off-highway vehicles to support large-scale infrastructure expansion.

The industry is driven by the need for more efficient and technologically advanced mining equipment as global mineral extraction intensifies. For instance, India is a major producer of coal, iron ore, and bauxite and relies heavily on open-pit mining, which makes up 90% of its mining operations. This has led to a surging demand for high-performance haul trucks, excavators, and drilling machines to improve efficiency and reduce costs. Additionally, India’s 100% FDI policy in mining is accelerating investment in automated and fuel-efficient mining equipment, further boosting the adoption of next-generation off-highway vehicles for large-scale extraction activities.

Rising labor shortages, increasing food demand, and government incentives are driving rapid mechanization in agriculture. For instance, India’s Sub-Mission on Agricultural Mechanization (SMAM) provides up to 50% financial assistance for purchasing equipment and setting up Custom Hiring Centres to improve small farmers’ access to machinery. Similarly, China has achieved a 72% mechanization rate in crop cultivation and harvesting, reflecting a global push toward automation. Advanced off-highway agricultural vehicles, including tractors, harvesters, and autonomous planting systems, are needed to improve efficiency, increase yields, and reduce costs. This shift is supporting demand for mechanization, shaping the future of the agricultural equipment market.

High initial costs and strict emission regulations remain key challenges in the off-highway vehicle market. For instance, the European Union's Stage V emission standards impose stringent limits on particulate matter and NOx emissions for non-road mobile machinery, increasing compliance costs for manufacturers. The U.S. Environmental Protection Agency’s (EPA) Tier 4 regulations require advanced exhaust after-treatment systems, adding to equipment costs. Additionally, the transition to electric and hybrid powertrains demands significant investment in R&D and infrastructure, further raising initial expenses.

Type Insights

The construction segment held the largest share of 41.1% in 2024. Various factors, such as the increasing infrastructure development projects, rapid urbanization, and rising investments in smart cities and commercial real estate. Additionally, government initiatives to improve road networks, bridges, and public transportation systems are further fueling demand for construction equipment.

The agriculture segment is anticipated to grow at a significant CAGR during the coming years. Factors such as the rising adoption of mechanized farming techniques, growing demand for high-efficiency agricultural equipment, and government subsidies promoting farm automation are contributing to the segment growth. For instance, the U.S. Department of Agriculture (USDA) has provided USD 2.5 billion in assistance to over 47,800 distressed farm loan borrowers under the Inflation Reduction Act to help farmers retain land and sustain operations. The final USD 300 million in aid, announced in December 2024, will further support over 12,800 borrowers, ensuring continued investment in farm modernization and equipment upgrades.

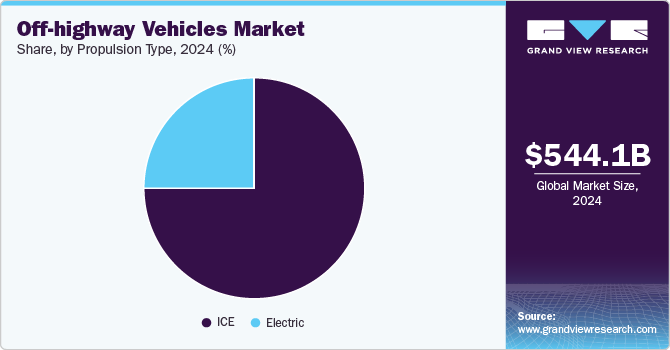

Propulsion Type Insights

The ICE segment accounted for the largest share in 2024, driven by the continued reliance on diesel-powered off-highway vehicles in construction, agriculture, and mining. The dominance of ICE vehicles is supported by high fuel energy density, longer operational range, and well-established refueling infrastructure. However, strict emission regulations and rising fuel costs are prompting a gradual shift toward cleaner alternatives.

The electric segment is estimated to grow at a significant CAGR during the coming years. Stringent emission norms, advancements in battery technology, and government incentives for electrification are supporting the market growth. For instance, the German government aims to have 15 million EVs on roads by 2030, with 2.3 million EVs already in operation as of 2023. Similarly, major off-highway equipment manufacturers like Yanmar and EKA Mobility are investing in electric powertrains to accelerate the adoption of zero-emission machinery in construction and agriculture.

Regional Insights

North America off-highway vehicles industry held a significant share in 2024. The market is being driven by large-scale infrastructure investments, increasing construction activities, and the rising adoption of advanced machinery. The Infrastructure Investment and Jobs Act (IIJA), signed into law in November 2021, is a major growth catalyst, providing USD 1.2 trillion in funding to upgrade highways, bridges, airports, and energy infrastructure. With 80% of the USD 550 billion in new spending allocated to grant-funded projects, demand for construction and material-handling equipment is surging, further boosting the off-highway vehicles market in North America.

U.S. Off-highway Vehicles Industry Trends

The off-highway vehicles industry in the U.S. held a dominant position in 2024. Factors such as rising infrastructure investments, growing demand for advanced construction and agricultural equipment, and the push for electrification and automation.The expansion of precision farming technologies and incentives for adopting electric and hybrid heavy equipment are playing a key role in shaping the market’s trajectory.

Asia Pacific Off-highway Vehicles Industry Trends

The off-highway vehicles market in Asia Pacific accounted for a 39.7% share of the overall market in 2024. The market in this region is undergoing significant transformation, driven by rapid infrastructure development, increasing mechanization in agriculture, and rising demand for construction & mining equipment. For instance, China’s USD 1 trillion investment in infrastructure megaprojects, announced in August 2022, is expected to significantly boost construction activities, with an average annual growth rate of 9.3% in construction between 2023-2025. Similarly, Japan, in collaboration with the Asian Development Bank (ADB), has pledged approximately USD 110 billion in quality infrastructure investments across Asia over five years, further fueling demand for off-highway vehicles.

China off-highway vehicles industry held a substantial market share in 2024. The Off-highway vehicles market in China is experiencing rapid growth by large-scale infrastructure projects, rising urbanization, and growing demand for advanced construction and mining equipment. With strong policy support, technological advancements, and rising industrial automation, China remains a dominant force in the global off-highway vehicle market.

The off-highway vehicles industry in Japan held a significant share in 2024. The market is influenced by technological advancements, automation in agriculture and construction, and strong government support for sustainable infrastructure.The Japanese government has set ambitious targets, such as achieving 100% electric vehicles in new light-duty vehicle sales by 2035 and a 46% reduction in CO2 emissions by 2030. These policies encourage the adoption of electric and automated off-highway vehicles, promoting innovation and sustainability in the sector.

Europe Off-highway Vehicles Market Industry Trends

The off-highway vehicles industry in Europe was identified as a lucrative region in 2024. The market is witnessing significant transformation, driven by increasing infrastructure investments, stringent emission regulations, and advancements in automation and electrification. The European Funds for Infrastructure, Climate, and Environment (2021-2027) has allocated USD 31.7 billion, prioritizing road and railway development fueling demand for construction and earthmoving equipment. Additionally, the EU's USD 7.6 billion investment in sustainable transport infrastructure, mainly in rail and inland waterways, is driving the adoption of specialized off-highway machinery. Stricter EU Stage V emission norms and incentives for electric and hybrid equipment are further accelerating market growth.

Germany off-highway vehicles market is being shaped by increasing infrastructure investments, advancements in automation, and the transition to low-emission machinery. On March 21, 2025, Germany announced a USD 540 billion (EUR 500 billion) infrastructure fund to modernize key sectors, including transport, energy, and digitalization. This initiative, which operates outside the country’s debt brake (Schuldenbremse), dedicates USD 108 billion (EUR 100 billion) to state and municipal projects and USD 432 billion EUR 400 billion) to federal initiatives over 12 years. With USD 108 billion EUR 100 billion) specifically allocated to energy transition and carbon neutrality by 2045. This funding is expected to drive demand for advanced, sustainable off-highway vehicles in construction and energy-related projects.

Key Off-highway Vehicles Company Insights

Some of the key players operating in the market include Caterpillar Inc., CNH Industrial N.V., Komatsu Ltd., Deere & Company, and Hitachi Construction Machinery Co.

-

Founded in 1925 and headquartered in Texas, U.S., Caterpillar Inc. is a foremost manufacturer of construction & mining equipment, diesel and natural gas engines, industrial gas turbines, and locomotives. The company offers a wide range of off-highway vehicles, including excavators, loaders, bulldozers, and haul trucks, serving industries such as construction, agriculture, mining, and agriculture. Caterpillar operates globally, providing innovative technology solutions, autonomous machinery, and sustainability-focused equipment.

-

Founded in 1921 and headquartered in Tokyo, Japan, Komatsu Ltd. is a global manufacturer of construction, mining, and industrial equipment. The company produces off-highway vehicles such as hydraulic excavators, bulldozers, dump trucks, and wheel loaders, catering to construction, mining, and forestry industries. Komatsu is known for its advancements in autonomous and electric-powered machinery.

Key Off-Highway Vehicles Companies:

The following are the leading companies in the off-highway vehicles market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar Inc.

- Komatsu Ltd.

- Deere & Company

- CNH Industrial N.V.

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Volvo Group (AB Volvo)

- XCMG Group

- Kubota Corporation

- SANY Group

Recent Developments

-

In March 2025, Yanmar announced a new Electrification Unit to advance e-powertrain solutions for compact off-highway vehicles, including excavators and wheel loaders, starting in April 2025.

-

In April 2024, Cummins Inc. launched the Next Generation X15 diesel engine at Intermat 2024 in Paris. Part of the HELM™ platform, it enhances reliability, lowers costs, and improves fuel efficiency while supporting diesel, natural gas, or hydrogen with tailored cylinder heads and fuel systems.

-

In January 2024, Allison Transmission and SANY announced a strategic partnership to integrate Allison’s Off-Road Series™ and Wide Body Dump Series™ transmissions into SANY’s next-generation mining dump trucks and articulated dump trucks.

-

In June 2023, Forsee Power, Vensys Group, and Parker Hannifin announced a partnership to develop retrofit kits for converting thermal construction machinery into electric vehicles, reducing emissions, noise, and vibrations.

-

In September 2021, Symboticware and Cyngn announced a partnership to integrate Cyngn’s autonomous vehicle technology, DriveMod, with Symboticware’s 4-Sight.ai operating system, enhancing industrial fleet automation and safety.

Off-highway Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 576.63 billion

Revenue Forecast in 2030

USD 804.86 billion

Growth Rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Type, propulsion type, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, U.A.E., Kingdom of Saudi Arabia (KSA), South Africa

Key companies profiled

Caterpillar Inc.; Komatsu Ltd.; Deere & Company; CNH Industrial N.V.; Hitachi Construction Machinery Co., Ltd.; Liebherr Group; Volvo Group (AB Volvo); XCMG Group; Kubota Corporation; SANY Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Off-highway Vehicles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global off-highway vehicles market report based on type, propulsion type, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Mining

-

<500 HP

-

500-2000 HP

-

>2000 HP

-

-

Agriculture

-

Less than 40 HP

-

41 to 100 HP

-

More than 100 HP

-

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global off-highway vehicle market size was estimated at USD 544.07 billion in 2024 and is expected to reach USD 576.63 billion in 2025.

b. The global off-highway vehicle market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 804.86 billion by 2030.

b. Asia Pacific dominated the off-highway vehicle market with a share of 39.7% in 2024. The market in this region is undergoing significant transformation, driven by rapid infrastructure development, increasing mechanization in agriculture, and rising demand for construction & mining equipment.

b. Some key players operating in the off-highway vehicle market include Caterpillar Inc., Komatsu Ltd., Deere & Company, CNH Industrial N.V., Hitachi Construction Machinery Co., Ltd., Liebherr Group, Volvo Group (AB Volvo), XCMG Group, Kubota Corporation, SANY Group.

b. Key factors that are driving the market growth include the expansion of construction and mining activities and rising mechanization in the agriculture and forestry sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.