- Home

- »

- Medical Devices

- »

-

U.S. Office-based Labs Market Size & Share Report, 2030GVR Report cover

![U.S. Office-based Labs Market Size, Share & Trends Report]()

U.S. Office-based Labs Market (2025 - 2033) Size, Share & Trends Analysis Report By Modality (Single Specialty, Multi-Specialty), By Service (Cardiac, Endovascular Intervention, Venous), By Specialist, And Segment Forecasts

- Report ID: GVR-2-68038-900-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Office-based Labs Market Summary

The U.S. office-based labs market size was estimated at USD 13.90 billion in 2024 and is expected to reach an estimated value of USD 35.21 billion by 2033, growing at a CAGR of 11.16% from 2025 to 2033. Growing preference for office-based labs by patients in the U.S. in recent years and the increasing trend of performing surgical interventions in outpatient settings are among key factors driving the market growth. Office-based labs (OBLs) are playing a vital role in transforming the healthcare delivery system and are supporting the growth of medical devices, equipment, and other products.The rapidly transitioning healthcare delivery scenario is driving key market players to transform their business models to achieve maximum benefit from ongoing transition.

The rising number of cardiovascular and radiological procedures in the U.S. is a significant growth driver for the office-based labs (OBLs) market. Cardiovascular disease remains the leading cause of death in the U.S. A report from the 2024 Heart Disease and Stroke Statistics indicates that nearly half of the U.S. population (48.6%) has some form of cardiovascular disease, including coronary heart disease, heart failure, stroke, and high blood pressure. This growing disease burden is translating into an increased demand for diagnostic and interventional procedures, thereby supplementing market growth.

Peripheral artery disease in particular is fueling demand for outpatient interventional care. According to the American Heart Association report published in 2022, peripheral artery disease (PAD) affected approximately 8.5 million people aged 40 and in the U.S. Peripheral artery disease often requires minimally invasive vascular interventions, such as angioplasty, atherectomy, or stenting, which are increasingly being performed in outpatient settings.

Case Study: Peripheral Vascular Interventions for Peripheral Artery Disease (PAD) in Office-Based Labs

Background: The study evaluated the safety and efficacy of peripheral vascular interventions (PVIs) conducted for PAD treatment in office-based laboratories compared to those performed in hospital inpatient and outpatient settings.

Methods: A retrospective cohort analysis was conducted using data from the Vascular Quality Initiative registry, covering 22,642 procedures performed between 2010 and 2015. Patients were stratified based on the site of service: office-based laboratories (OBLs), hospital outpatient departments (HOPDs), and inpatient hospitals.

Findings:

-

OBLs accounted for a growing share of PVIs during the study period.

-

PAD patients treated in OBLs had comparable or better outcomes than those treated in hospitals, including lower in-hospital complication rates.

-

Same-day discharge was common in OBLs, with no compromise in procedural safety or efficacy.

Implications: The findings validate the clinical viability of treating PAD through PVIs in OBLs, supporting the continued expansion of these settings for vascular care.

Moreover, the U.S. healthcare system is undergoing a notable shift in where outpatient procedures are performed, with a growing migration from hospital outpatient departments (HOPDs) to office-based labs (OBLs). This trend is primarily driven by the cost-efficiency, convenience, and improved care coordination that OBLs offer. Medicare and commercial payers have increasingly supported this transition by adjusting reimbursement policies to incentivize the use of lower-cost care settings without compromising patient outcomes.

Moreover, physicians and health systems are also recognizing the financial and operational benefits of performing procedures in OBLs. These labs allow physicians more autonomy and control over scheduling, staffing, and resource allocation, leading to improved workflow efficiency and better continuity of care. In addition, OBLs are designed for high patient throughput with minimal overhead, making them ideal for repetitive procedures such as angioplasty, vascular access maintenance, and endovascular interventions.

Philips' General Manager for Office-Based Labs, Lindsay Pack, confirms this trend: “More and more physicians are willing to open these [OBL] centers on their own. There is an overwhelming interest to be able to do what they want to do in these centers... I have multiple physicians who come out of research centers who are looking to open their own facility. They don't have to be part of the hospitals to do that”. In addition, Pack explains, “There's a lot of conversation about recognizing the value these centers provide to economics. OBLs reduce overall cost of care to patients and insurers”.

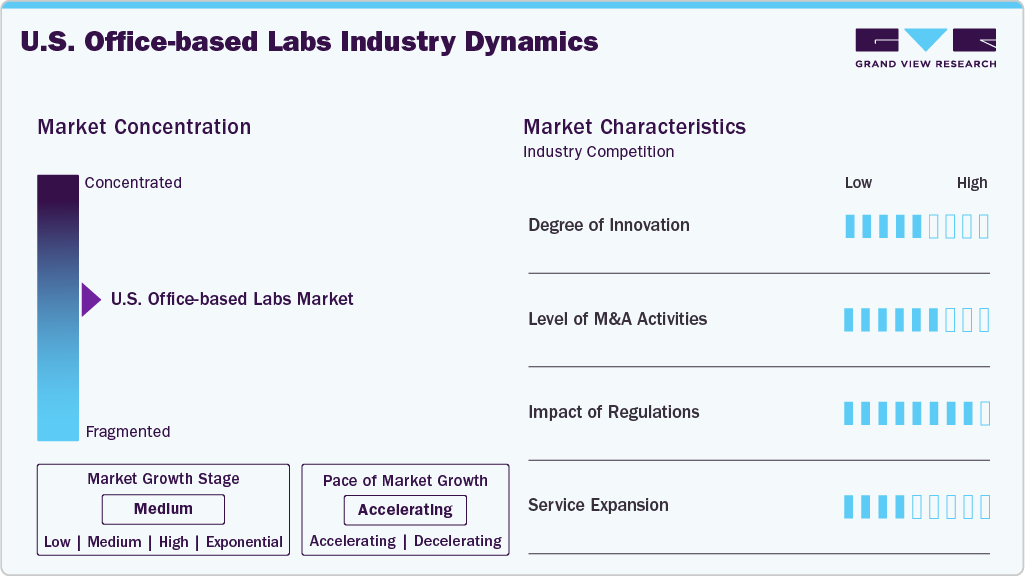

Market Concentration & Characteristics

The degree of innovation in the U.S. office-based labs market is notably high, driven by advances in minimally invasive technologies, imaging modalities, and device miniaturization that enable complex procedures to be safely performed outside traditional hospital settings. OBLs increasingly adopt cutting-edge tools such as intravascular ultrasound, atherectomy devices, drug-coated balloons, and advanced electrophysiology systems, facilitating precision treatments with faster patient recovery and lower costs.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business geographies. For instance, in February 2023, GE Healthcare acquired Caption Health, Inc., a privately held artificial intelligence (AI) healthcare leader that develops clinical applications to aid in early disease identification, including the use of AI to assist with ultrasound scans.

OBLs are subject to rigorous oversight from federal and state agencies, including adherence to standards set by the Centers for Medicare & Medicaid Services (CMS), Occupational Safety and Health Administration (OSHA), and state health departments, which govern aspects such as facility accreditation, procedural safety, and infection control. Reimbursement policies, particularly under Medicare’s Physician Fee Schedule, significantly influence the economic sustainability of OBLs, as shifts in payment rates or coverage determinations can directly affect procedure volumes and profitability.

Service expansion within the U.S. Office-Based Labs (OBLs) industry has become a significant strategic initiative, propelled by the increasing demand for accessible, cost-effective, and specialized outpatient care. Numerous OBLs are extending their procedural capabilities beyond traditional vascular interventions to encompass areas such as interventional oncology, pain management, peripheral nerve treatments, and advanced diagnostic imaging, thereby enhancing patient retention and diversifying revenue streams.

Modality Insights

The single specialty segment held the largest revenue share of 41.55% in 2024. Single-specialty labs within the U.S. office-based labs market are witnessing robust growth, primarily driven by the rising demand for focused and high-efficiency care delivery in specific therapeutic areas such as vascular, endovascular, orthopedic, ophthalmologic, and pain management procedures. These labs benefit from streamlined operations, specialized staff expertise, and lower overhead costs compared to multi-specialty centers and hospital outpatient departments.

The hybrid segment is expected to grow at a significant CAGR over the forecast period. The hybrid lab model, a strategic integration of office-based labs (OBLs) and ambulatory surgery centers (ASCs), is rapidly gaining traction within the U.S. outpatient care environment. This approach leverages a dual-facility framework that enables both diagnostic and interventional procedures to be performed in a single setting, alternating between OBL and ASC operations based on procedural needs.

As Donald S. Cross, Vice President of Operations at Oklahoma Heart Institute, explained, “Our hybrid lab performs approximately 95 to 110 procedures per month, with about 80% utilization. We perform diagnostic caths and peripheral angiograms in the OBL, and pacemaker and defibrillator implants in the ASC.” This model enhances procedural capacity and allows facilities to align site-of-service with clinical complexity, optimizing both patient care and reimbursement outcomes.

Service Insights

The peripheral vascular intervention (PAD) segment held the largest revenue share of 36.84% in 2024. PAD is caused by the hardening of arteries or partial blockage of arteries due to the formation of plaque. PAD primarily affects the arms, intestines, head, and, most commonly, the legs. Increasing prevalence of PAD, favorable reimbursement, and technological advancements in minimally invasive vascular procedures are anticipated to fuel market growth. An increase in the use of advanced products helps remove atherosclerotic plaque rapidly and safely in an outpatient setting. Outpatient settings performing various procedures such as angioplasty, stenting, venous ablation, atherectomy, and thrombectomy have proven to be more convenient with faster turnaround time and reduced risk of infection, thereby boosting the market.

The cardiac segment is expected to grow at a significant CAGR over the forecast period. Growing globalization and adoption of unhealthy lifestyle habits are directly contributing to the rise in the prevalence of lifestyle-associated disorders and cardiovascular diseases such as ischemic heart disease, cerebrovascular disease, & rheumatic heart disease, which is anticipated to boost market growth. According to the American Heart Association, Inc., by 2035, more than 130 million adults in the U.S. will suffer from cardiovascular disease, and the total cost of treating cardiovascular diseases will reach USD 1.1 trillion. According to Baystate Health, 400,000 coronary artery bypass grafting surgeries are performed each year in the U.S.

Specialist Insights

The vascular surgeons segment dominated the U.S. office-based labs industry the largest revenue share of 40.28% in 2024. Advancements in medical technology, increasing preference for better & efficient care, and patient demographics are factors expected to fuel the demand for specialists. According to Merritt Hawkins, the demand for doctors is extremely high in the U.S., while the supply is limited. For instance, the Journal of Vascular Surgery projected that there will be an 11.6% deficit of vascular surgeons by 2033. Moreover, the office-based labs are the top preference of vascular surgeons, as performing surgeries at office-based facilities has financial benefits for surgeons, with all the excess margin for surgical procedures going to the surgeon directly & indirectly.

The interventional radiologists segment is expected to grow at the fastest CAGR over the forecast period. Interventional radiologists use minimally invasive image-guided techniques for the diagnosis and treatment of diseases. Interventional radiology therapies include angiography, balloon angioplasty, central venous access, stent placement, biliary drainage & stenting, thrombus management, MRI-guided ultrasound, and radiofrequency ablation. Interventional radiology reduces costs, recovery time, pain, and risk to patients. Furthermore, the rise of assisted living, memory care communities, and in-home care services, which are often not covered by Medicaid, has fueled demand within the private payer segment.Moreover, the lack of physicians in the field of radiology creates demand for specialists, thereby boosting the market.

Key U.S. Office-based Labs Company Insights

The office-based labs market is highly fragmented, with several small players operating in it.The market players undertake several strategic initiatives, such as partnerships & collaborations, service launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key U.S. Office-based Labs Companies:

- Suppliers

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- Medtronic PLC

- Boston Scientific Corporation

- Abbott

- Service Providers

- Envision Healthcare Corporation (KKR)

- Surgical Care Affiliates (SCA)

- Surgery Partners

- Cardiovascular Coalition

- TH Medical

- Vascular Care Group

- Coastal Vascular Institute

Recent Developments

-

In May 2025, GE HealthCare launched CleaRecon DL, an AI-based 3D reconstruction technology, to enhance cone-beam computed tomography (CBCT) images in interventional suites. It is designed to improve the quality of CBCT images by utilizing a deep-learning algorithm. This technology aims to remove streak artifacts, which can reduce image clarity and accuracy, and improve confidence in image interpretation. It has received FDA 510(k) clearance and CE mark and is available for use on GE HealthCare's Allia platform.

-

In April 2023, Philips collaborated with Saint-Joseph Hospital and Marie-Lannelongue Hospital to combine all imaging data into an integrated diagnosis to improve clinical decision-making and patient care.

-

In March 2023, GE Healthcare and Advantus Health Partners agreed to a 10-year agreement worth up to USD 760 million to supply GE HealthCare's Healthcare Technology Management services to Advantus Health Partners' clients.

-

In January 2023, BD launched a new robotic track system for the BD Kiestra microbiological laboratory solution that automates lab specimen processing, potentially reducing manual labor and waiting time for results.

U.S. Office-based Labs Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 15.11 billion

Revenue forecast in 2033

USD 35.21 billion

Growth rate

CAGR of 11.16% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, modality, specialist

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Medtronic PLC; Boston Scientific Corporation; Abbott; Envision Healthcare Corporation (KKR); Surgical Care Affiliates (SCA); Surgery Partners; Cardiovascular Coalition; TH Medical; Vascular Care Group; Coastal Vascular Institute

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Office-based Labs Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. office-based labs market report based on service, modality, and specialist:

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Peripheral Vascular Intervention

-

Atherectomy

-

Vascular Angioplasty

-

Stenting

-

Other PVI

-

-

Endovascular Interventions

-

Cardiac

-

Interventional radiology

-

Uterine Fibroid Embolization (UFE)

-

Prostate Artery Embolization (PAE)

-

Y90/Oncology

-

Other IR

-

-

Venous

-

RFA (Radiofrequency Ablation) and EVLT (Endovenous Laser Therapy)

-

Sclerotherapy/Glue

-

Venous Stenting

- Other Deep Vein

-

-

Others

-

-

Services Outlook (Number of Procedures, 2021 - 2033)

-

Peripheral Vascular Intervention

-

Atherectomy

-

Vascular Angioplasty

-

Stenting

-

Other PVI

-

-

Endovascular Interventions

-

Cardiac

-

Interventional radiology

-

Uterine Fibroid Embolization (UFE)

-

Prostate Artery Embolization (PAE)

-

Y90/Oncology

-

Other IR

-

-

Venous

-

RFA (Radiofrequency Ablation) and EVLT (Endovenous Laser Therapy)

-

Sclerotherapy/Glue

-

Venous Stenting

-

Other Deep Vein

-

-

Others

-

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Specialty

-

Multi-Specialty

- Hybrid

-

-

Specialist Outlook (Revenue, USD Million, 2021 - 2033)

-

Vascular Surgeons

-

Interventional Cardiologists

-

Interventional Radiologists

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. office-based labs market size was estimated at USD 13.90 billion in 2024 and is expected to reach USD 15.11 billion in 2025.

b. The U.S. office-based labs market is expected to grow at a compound annual growth rate of 11.16% from 2025 to 2033 to reach USD 35.21 billion by 2033.

b. Single specialty OBLs spearheaded the U.S. office-based labs market in 2024 whereas hybrid laboratories are anticipated to witness high growth during the forecast period.

b. Among medical imaging device manufacturers, Philips Healthcare, Siemens Healthineers, and GE Healthcare are the key providers of equipment required in setting up OBLs.Many service providers are available in the U.S., such as National Cardiovascular Partners and Envision Healthcare and Surgery Partners.

b. The increasing trend of surgical procedures being performed in outpatient settings and the rising incidence of various vascular diseases are among the major factors driving the OBL market in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.