- Home

- »

- Medical Devices

- »

-

Peripheral Artery Disease Market Size, Industry Report, 2033GVR Report cover

![Peripheral Artery Disease Market Size, Share & Trends Report]()

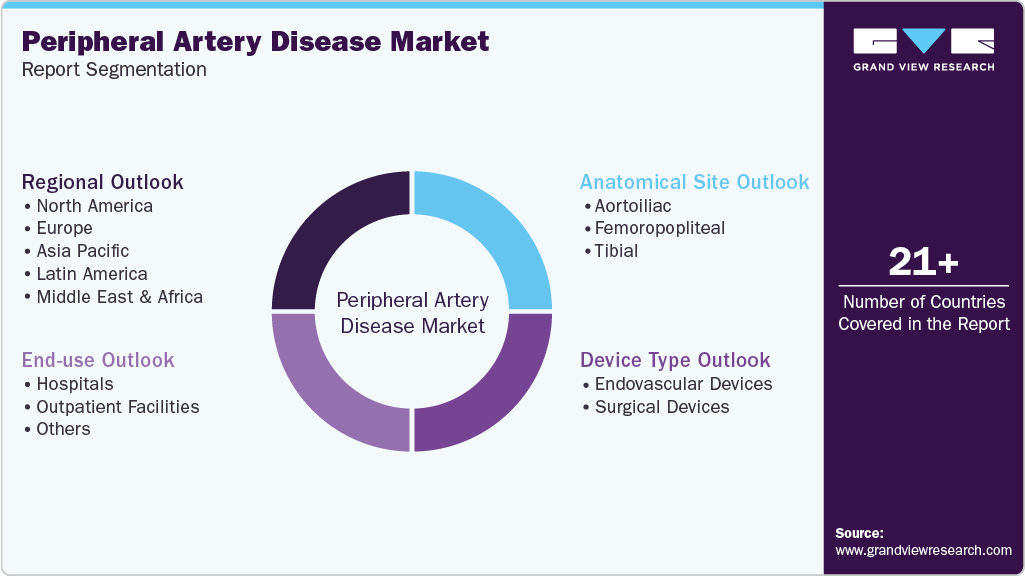

Peripheral Artery Disease Market (2025 - 2033) Size, Share & Trends Analysis Report By Services (Endovascular Devices, Surgical Devices), By Anatomical Site (Aortoiliac, Femoropopliteal), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-660-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Peripheral Artery Disease Market Summary

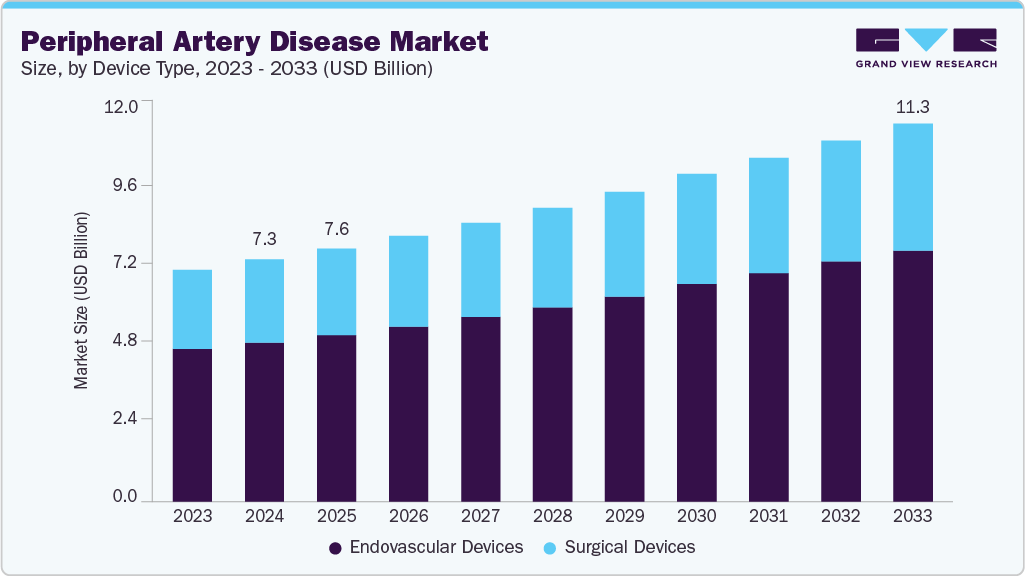

The global peripheral artery disease market size was estimated at USD 7.3 billion in 2024 and is projected to reach USD 11.3 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The intersecting forces of rising disease burden, continuous technological advancement, and demographic aging drive the peripheral artery disease (PAD) industry.

Key Market Trends & Insights

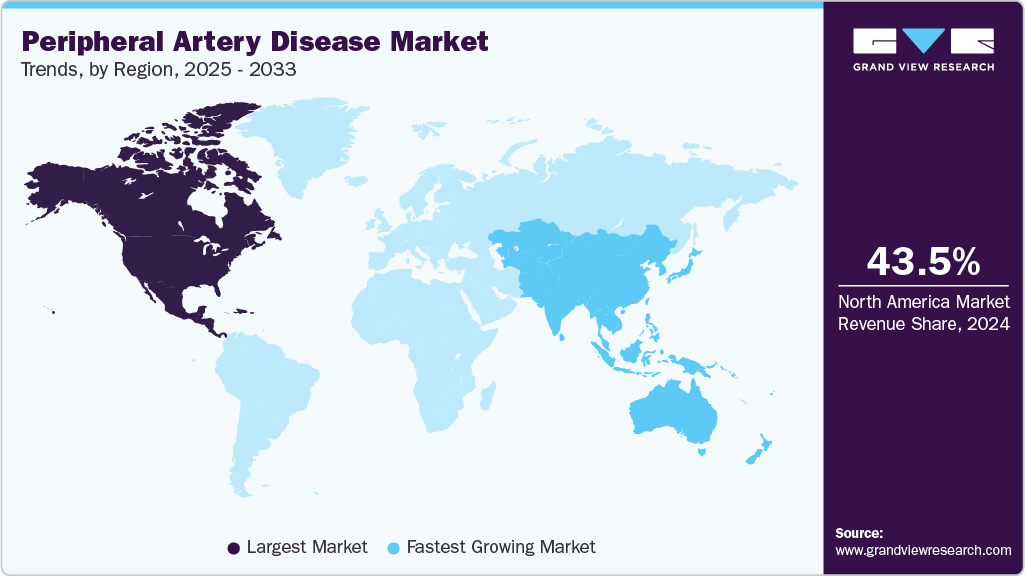

- North America peripheral artery disease market held the largest share of 43.5% of the global market in 2024.

- The peripheral artery disease industry in the U.S. is expected to grow significantly over the forecast period.

- By device type, the endovascular devices segment held the highest market share of 65.9% in 2024.

- Based on anatomical site, the femoropopliteal segment held the highest market share in 2024.

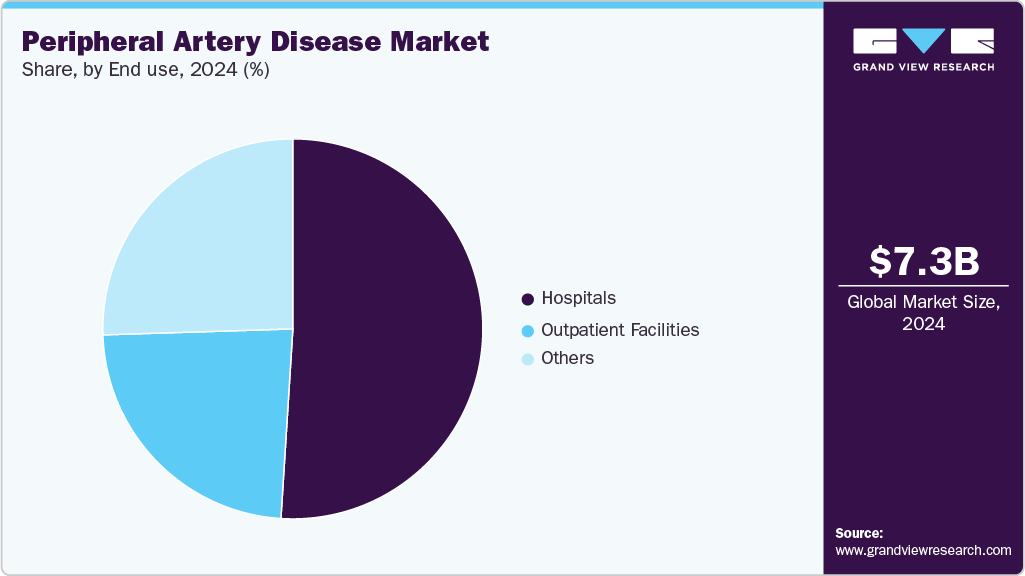

- By end use, the hospital segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.3 Billion

- 2033 Projected Market Size: USD 11.3 Billion

- CAGR (2025-2033): 5.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This alignment of unmet clinical needs with evolving therapeutic capabilities accelerates demand across care settings. The growing prevalence of diabetes and tobacco use remains a foundational force driving the market. Both risk factors contribute directly to the progression of atherosclerosis, the core pathological mechanism behind PAD. With diabetes rates climbing globally-particularly in aging, urban populations-and smoking still widespread in lower-income countries, the incidence of PAD continues to rise.

In March 2025, an Intermountain Health study presented at the ACC conference revealed that only 29.6% of women and 33.5% of men with symptomatic peripheral artery disease received full guideline-directed therapy. Among 7,522 patients tracked, the mortality rate exceeded 50%, underscoring severe gaps in diagnosis and treatment. Despite similar referral rates, women were less likely to receive optimal care. The study emphasized the need for improved screening protocols and focused PAD management.

Rapid innovation in endovascular technologies is reshaping treatment strategies and reinforcing market momentum. Next-generation tools such as drug-coated balloons, atherectomy systems, and bioresorbable stents offer improved efficacy, fewer complications, and shorter recovery times. These solutions are increasingly favored for treating complex lesions precisely while reducing restenosis and the need for repeat interventions. In March 2025, a study in Scientific Reports introduced DBMedDet, a deep-learning model that improved stent placement accuracy during endovascular procedures. With high precision (mAP 0.841) and real-time detection (127 FPS), it outperformed YOLO models in identifying stent boundaries across coronary, peripheral, and cerebrovascular cases.

Population aging further amplifies the market potential for PAD interventions, with individuals over 65 facing significantly elevated risk. Age-related arterial stiffening and the accumulation of comorbidities make this demographic especially vulnerable. In March 2025, the Aging Journal published findings from the Long Life Family Study showing individuals from long-lived families have a significantly lower risk of PAD. PAD prevalence among offspring of these families was only 1%, versus an expected 12%. Researchers linked this to protective genetic traits and healthier vascular profiles, identifying four genomic regions potentially tied to PAD resistance.

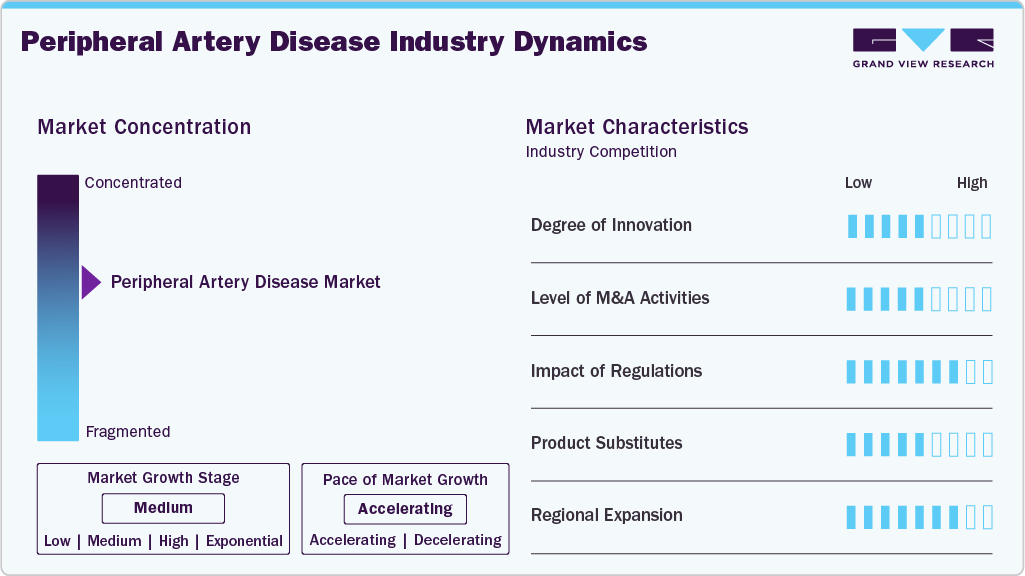

Market Concentration & Characteristics

Innovation in the peripheral artery disease industry is moderate, with most developments centered on incremental improvements to existing endovascular devices and delivery systems. While drug-coated technologies and image-guided tools have enhanced procedural outcomes, breakthrough innovations remain limited, reflecting a cautious but steady pace of advancement. Clinical unmet needs such as treatment durability in complex lesions and device efficacy in calcified arteries continue to drive targeted R&D investment.

The peripheral artery disease industry has a moderate level of mergers and acquisitions, driven by strategic portfolio consolidation rather than aggressive expansion. Key players selectively acquire complementary technologies and smaller firms to strengthen capabilities, improve geographic reach, and align with evolving clinical needs. M&A activity often focuses on expanding into high-growth segments such as drug-delivery platforms and chronic total occlusion treatment tools.

Regulatory influence on the peripheral artery disease industry is high, shaped by stringent safety standards and the need for long-term clinical data. Regulatory bodies in developed and emerging markets demand robust evidence of efficacy and durability, influencing device design, approval timelines, and market access strategies. The introduction of value-based assessment frameworks and evolving post-market surveillance policies further heightens the regulatory burden for manufacturers.

The presence of product or service substitutes in the peripheral artery disease industry is moderate, with pharmacological therapies and lifestyle interventions serving as alternatives in early disease stages. However, device-based interventions remain essential for advanced cases, limiting the overall substitutability of interventional procedures. Emerging substitutes such as cell therapies and wearable monitoring technologies are still early and lack broad clinical adoption.

Regional expansion in the peripheral artery disease industry is high, supported by the growing adoption of minimally invasive procedures in emerging markets and improving healthcare infrastructure. As awareness and diagnostic capabilities improve, manufacturers increasingly target underserved regions to unlock new growth opportunities. Government-led screening programs and international funding support are also helping to close treatment gaps in high-burden geographies.

Device Type Insights

The endovascular devices segment held the largest market share in 2024, accounting for approximately 65.9% of total revenue. This dominance reflects the growing clinical preference for minimally invasive procedures, which offer reduced recovery times, lower complication rates, and increased patient acceptance compared to open surgical approaches. This segment’s growth has been further supported by rising volumes of angioplasty and stenting procedures, particularly for patients with complex or multilevel arterial blockages. In January 2025, a review in the Journal of Vascular Diseases emphasized advances in endovascular revascularization for total femoropopliteal occlusions. It highlighted lesion-specific tools like drug-coated balloons, atherectomy, and lithotripsy and supported hybrid approaches for complex cases. Persistent issues with restenosis and long-term durability were also noted.

This segment is also projected to grow at the highest CAGR over the forecast period, driven by continuous advancements in device technologies such as drug-coated balloons, self-expanding stents, and image-guided atherectomy tools. As clinical guidelines increasingly endorse endovascular-first strategies, demand is rising in both developed and emerging markets. In April 2025, R3 Vascular began its ELITE-BTK pivotal trial with the first patient treated using the MAGNITUDE drug-eluting bioresorbable scaffold for below-the-knee peripheral artery disease. The scaffold combines sirolimus coating with advanced polymer engineering to treat chronic limb-threatening ischemia for long-term support and full bioresorption. The trial is a key step toward FDA approval, aiming to address significant gaps in BTK PAD therapy.

Anatomical Site Insights

The femoropopliteal segment held the largest share of 44.7% in 2024, driven by the high prevalence of occlusions in this anatomical region. This segment represents a common site of atherosclerotic plaque buildup, especially in patients with diabetes and smoking history, making it a focal point for both diagnosis and intervention. The complexity and frequency of lesions in the femoropopliteal arteries have led to strong procedural demand and device utilization, particularly for stents, balloons, and atherectomy systems. In May 2025, according to UC Davis Health, vascular surgeons successfully performed the region’s first percutaneous transmural arterial bypass (PTAB) using the DETOUR System to treat femoropopliteal PAD. This minimally invasive procedure bypasses blockages in the superficial femoral artery via the femoral vein, offering an alternative to open surgical bypass.

This segment is also projected to grow fastest, fueled by ongoing innovation in lesion-specific devices and evolving clinical strategies for chronic total occlusions and long-segment disease. The shift toward minimally invasive treatment and increased awareness among clinicians regarding early revascularization is further accelerating adoption. In April 2025, the CX Symposium spotlighted bioresorbable scaffolds as a promising option for femoropopliteal interventions in CLTI. Trials like MOTIV-BTK and EFEMORAL I showed improved patency and limb salvage. Sirolimus-coated balloons and drug-eluting stents outperformed non-drug therapies in long-term outcomes.

End Use Insights

Hospitals held the largest revenue market share in 2024, supported by their capacity to handle complex cases, advanced diagnostics, and comprehensive post-procedure care. They remain the central hub for PAD interventions, especially in patients with multiple comorbidities or those requiring emergency revascularization. High patient throughput, broad reimbursement coverage, and access to specialized vascular teams continue to make hospitals the dominant treatment setting. In August 2024, Loma Linda University Health reported strong outcomes from its PAD program, using advanced endovascular techniques to prevent amputations and enable same-day discharge in 90% of cases. Minimally invasive procedures with catheter-based access reduce complications and speed recovery.

Ambulatory surgery centers are the fastest-growing segment, driven by the rising shift toward outpatient PAD procedures and the increasing use of minimally invasive technologies. With shorter procedure times, lower costs, and reduced hospital stay requirements, ASCs are gaining traction among clinicians and payers. As device designs become more portable and clinical protocols evolve to support same-day interventions, ASCs are emerging as a key growth engine for PAD care delivery. As of August 2024, there are nearly 9,600 active ambulatory surgery centers (ASCs) in the U.S., according to Definitive Healthcare. These outpatient facilities increasingly handle procedures like cataract removal, colonoscopies, and joint replacements, reflecting a broader shift from hospital-based to outpatient surgical care.

Regional Insights

North America dominated the peripheral artery disease market with the largest market share of 43.5% in 2024, driven by a high disease burden, advanced healthcare infrastructure, and strong uptake of endovascular technologies. Favorable reimbursement and widespread use of outpatient settings are further boosting procedural volumes. In March 2025, the American Heart Association reported stark sex-based disparities in peripheral vascular disease. While PAD prevalence is similar, women face up to a 27.6% lifetime risk, greater functional decline, and underuse of supervised therapy. They also have a threefold higher aneurysm rupture risk at comparable sizes and higher in-hospital mortality from acute aortic syndromes. These gaps point to urgent deficiencies in diagnosis and care.

U.S. Peripheral Artery Disease Market Trends

The peripheral artery disease market in the U.S. continues to drive regional growth through nationwide screening programs, expansion of ASCs and office-based labs, and high adoption of drug-coated and image-guided devices. Strong payer support and a dense network of vascular specialists ensure market momentum. In June 2023, the American Heart Association reported major racial and ethnic disparities in PAD prevalence and outcomes across the U.S. PAD affects over 12 million Americans, with critical limb ischemia impacting 1.3% of adults. Lifetime risk can reach 30% in certain groups, driven by clinical risks and unequal access to care.

Europe Peripheral Artery Disease Market Trends

The peripheral artery disease market in Europe held the second-largest market share in 2024, supported by public health initiatives, rising geriatric populations, and improved access to PAD treatments. Countries are emphasizing early diagnosis and minimally invasive procedures. In June 2024, according to the European Heart Journal, isolated superficial femoral artery lesions are rarely the sole contributors to chronic limb-threatening ischemia. Instead, combined femoropopliteal, aorto-iliac, or infrapopliteal disease is frequently observed. In 40% of cases, inflow treatment of femoropopliteal disease is required to facilitate effective revascularization.

Germany peripheral artery disease market is growing steadily due to its well-established hospital infrastructure, widespread use of advanced revascularization devices, and strong reimbursement frameworks. In January 2025, a study published in the Journal of Vascular Surgery analyzed ten-year trends in amputation surgeries for PAD in Germany. Reviewing over 365,000 patient records from 2012-2021, the study found declining rates of major amputations and in-hospital mortality, along with increased revascularization procedures.

The peripheral artery disease market in the UK maintained a significant market share in 2024, driven by NHS-backed vascular care pathways, centralized procedure hubs, and increased focus on limb salvage. In December 2024, new research highlighted that thousands of lower limb amputations caused by peripheral artery disease could be avoided each year in the UK. The report estimated that preventing such amputations could save the NHS millions.

Asia Pacific Peripheral Artery Disease Market Trends

The peripheral artery disease market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period, led by rising PAD prevalence, improving healthcare access, and expanding interventional capacity. In July 2024, the Heart Research Institute opened Australia’s first Centre for Peripheral Artery Disease in Sydney to boost research and early detection. PAD affects 1 in 5 Australians over 75 and causes five deaths daily, yet it is often missed until the late stages.

China peripheral artery disease market accounted for a significant share in Asia Pacific in 2024, fueled by rising chronic disease burden, expansion of tertiary hospitals, and growing domestic medtech innovation. In June 2025, a Frontiers in Cardiovascular Medicine study reported that China's annual new PAD cases reached 2.45 million in 2021 and are projected to rise to over 4 million by 2046. While male incidence rates are increasing, female rates are declining despite a larger absolute number of cases. Period effects drove risk, while cohort effects were protective.

The peripheral artery disease market in Japan is anticipated to grow significantly in the region, supported by high clinical standards, an aging population, and advanced reimbursement coverage. In January 2022, a Japanese study linked ulcerated femoropopliteal plaques to thrombus embolization in PAD. Angioscopy in 31 patients found upstream plaques with mural thrombi in 22 cases, correlating with poor runoff. The findings challenge coronary-based thrombus models and support lesion-specific plaque assessment.

India peripheral artery disease market is experiencing rapid growth, driven by its large diabetic population, increasing awareness, and expanding vascular specialty services. In September 2024, a systematic review in Diabetes & Metabolic Syndrome estimated PAD prevalence among people with type 2 diabetes in India at 18%. Based on data from nearly 197,000 individuals across nine states and one union territory, the study found substantial regional variation and low overall certainty.

Latin America Peripheral Artery Disease Market Trends

The peripheral artery disease market in Latin America is seeing steady progress, supported by improved access to PAD care, growing public health initiatives, and rising demand for minimally invasive procedures. In January 2025, the International Journal of Cardiovascular Medicine published a Brazilian study analyzing 20 years of PAD-related lower limb procedures. Among 114,417 angioplasties and 47,502 open revascularizations, mortality rates were 1.3% and 3.4%, respectively. Most interventions were performed urgently rather than electively, underscoring systemic delays and gaps in PAD management and data reporting.

Brazil peripheral artery disease market is expanding due to high cardiovascular disease rates and increasing investment in hospital-based vascular services. In April 2025, a study published in Jornal Vascular Brasileiro found a 14.6% prevalence of peripheral arterial disease among type 2 diabetes patients in Brazil, with 75% of those affected showing no symptoms. The research, conducted at the Federal University of Paraná, also noted higher age and BMI among PAD-positive individuals and limited correlation with typical claudication.

Middle East & Africa Peripheral Artery Disease Market Trends

The peripheral artery disease market in the Middle East and Africa is witnessing rising demand due to the increasing prevalence of diabetes, smoking, and sedentary lifestyles. Infrastructure modernization and public-private investments are improving diagnostic and treatment capacity. In April 2025, Arab News reported that King Faisal Specialist Hospital adopted a minimally invasive technique using bioresorbable stents to treat below-the-knee peripheral artery disease. Inserted via catheter without open surgery, the stent restores blood flow, reduces pain, and lowers amputation risk. The center is the first in Saudi Arabia to use this approach.

Saudi Arabia peripheral artery disease market is expected to grow at a strong CAGR due to national health reforms, expanded tertiary care access, and rising awareness of PAD risks. In December 2023, Clinics and Practice reported low awareness of PAD among 1,035 high-risk individuals in Saudi Arabia, with an average score of 5.7 out of 26. Older age, higher education, and prior exposure improved knowledge. The study calls for targeted education to close this critical awareness gap.

Key Peripheral Artery Disease Company Insights

Key market players include BD, Abbott Laboratories, Medtronic, Boston Scientific Corporation, W. L. Gore & Associates, Inc., and Terumo Corporation. These companies focus on tech-enabled service models, personalized wellness solutions, and expanding mobile reach. Cook, Bentley InnoMed, and Biotronik emphasize service innovation, while Scitech Medical and iVascular target niche demand and localized delivery to stay competitive.

Key Peripheral Artery Disease Companies:

The following are the leading companies in the peripheral artery disease market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Bentley InnoMed

- Scitech Medical

- Abbott Laboratories

- Boston Scientific Corporation

- W. L. Gore & Associates, Inc.

- Medtronic

- Cook

- Terumo Corporation

- iVascular

- Getinge AB

- Biotronik SE & Co KG

Recent Developments

-

In March 2025, Shockwave Medical launched its Shockwave Javelin intravascular lithotripsy catheter in the U.S., targeting complex calcified lesions in peripheral artery disease. The forward IVL platform delivers 120 shockwave pulses via a single distal emitter to cross tight, calcium-rich blockages. Results from the FORWARD PAD trial showed safety and efficacy comparable to existing balloon-based IVL devices.

-

In January 2025, AngioDynamics launched the AMBITION BTK randomized controlled trial to evaluate the Auryon Atherectomy System in treating tibial lesions in patients with critical limb ischemia. The trial compares Auryon-assisted atherectomy with balloon angioplasty versus angioplasty alone.

-

In March 2024, BD launched the AGILITY study to assess its Vascular Covered Stent for treating peripheral artery disease. The low-profile, self-expanding, PTFE-encapsulated nitinol stent is being tested in a 315-patient, multi-center trial across the U.S., Europe, Australia, and New Zealand. The stent aims to improve long-term vessel support and expand endovascular treatment options for advanced PAD.

Peripheral Artery Disease Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.6 billion

Revenue forecast in 2033

USD 11.3 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, anatomical site, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD; Bentley InnoMed; Scitech Medical; Abbott Laboratories; Boston Scientific Corporation; W. L. Gore & Associates, Inc.; Medtronic; Cook; Terumo Corporation; iVascular; Getinge AB; Biotronik SE & Co KG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Peripheral Artery Disease Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global peripheral artery disease market report based on device type, anatomical site, end use, and region:

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Endovascular Devices

-

Surgical Devices

-

-

Anatomical Site Outlook (Revenue, USD Million, 2021 - 2033)

-

Aortoiliac

-

Femoropopliteal

-

Tibial

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peripheral artery disease market size was estimated at USD 7.3 billion in 2024 and is expected to reach USD 7.6 billion in 2025.

b. The global peripheral artery disease market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 11.3 billion by 2033.

b. North America dominated the peripheral artery disease market with the largest market share of 43.5% in 2024, driven by a high disease burden, advanced healthcare infrastructure, and strong uptake of endovascular technologies.

b. The peripheral artery disease market is dominated by key industry players such as BD; Bentley InnoMed; Scitech Medical; Abbott Laboratories; Boston Scientific Corporation; W. L. Gore & Associates, Inc.; Medtronic; Cook; Terumo Corporation; iVascular; Getinge AB; Biotronik SE & Co KG.

b. The market is driven by the intersecting forces of rising disease burden, continuous technological advancement, and demographic aging. This alignment of unmet clinical need with evolving therapeutic capabilities is accelerating demand across care settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.