- Home

- »

- Network Security

- »

-

Office Software Market Size & Share Report, 2028GVR Report cover

![Office Software Market Size, Share & Trends Report]()

Office Software Market (2022 - 2028) Size, Share & Trends Analysis Report By Deployment, By Type (Spreadsheet Software, Word Processing Software, Visualization Software, Presentation Software), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-931-6

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Office Software Market Summary

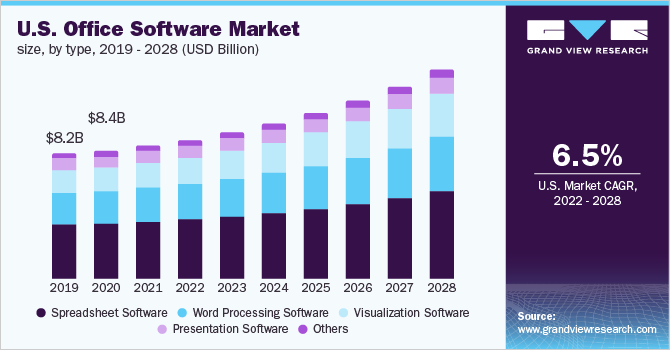

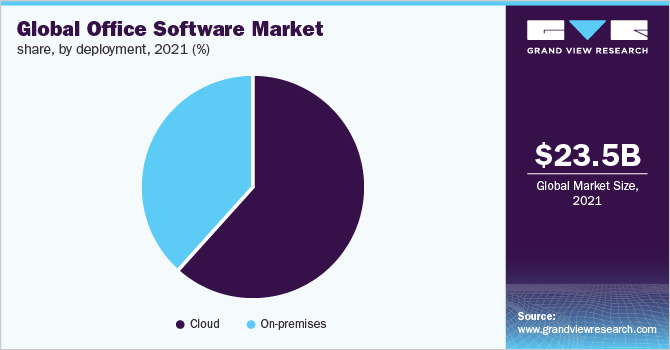

The global office software market size was estimated at USD 23.5 billion in 2021 and is projected to reach USD 37.4 billion by 2028, growing at a CAGR of 6.9% from 2022 to 2028. The growth of the global market is attributable to the increasing adoption of enterprise software among companies to meet unique needs and objectives, the growing adoption of cloud technology, and the need to enhance internal business agility while addressing varied challenges.

Key Market Trends & Insights

- North America captured the largest market share over 45% in terms of revenue in 2021.

- The Asia Pacific market for office software is poised to develop at a 7.7% CAGR during the forecast period.

- Based on type, the spreadsheet software segment captured the largest market share of more than 41% in 2021 and is expected to showcase promising growth in the near future.

- In terms of deployment, the cloud deployment segment held the largest market share of more than 61% in 2021, in terms of the total revenue.

- On the basis of deployment, the on-premises deployment segment captured a significant market share in 2021.

Market Size & Forecast

- 2021 Market Size: USD 23.5 billion

- 2028 Projected Market Size: USD 37.4 billion

- CAGR (2022-2028): 6.9%

- North America: Largest market in 2021

The market will continue to grow in the post-COVID-19 period, as more companies globally intend to implement productivity solutions into their business suit amid growing trends of mobility and BYOD. In 2020, digital resilience, or an organization's capacity to quickly adjust to business disruptions by harnessing digital capabilities to restore company operations and profit from changing conditions, became a major business focus. Office software solutions are crucial to an organization's resiliency and digital-first strategy as they are the basic technological systems that most firms employ for business.

With office software solutions, processes that formerly required human interaction have now become automated, allowing the employees to concentrate on their business-critical functionalities. This has benefitted companies in encouraging minimum resource utilization and balancing the business automation processes. Furthermore, office software offers company employees excellent tools for designing business rules based on the needs of a company project.

The office software market is further predicted to develop due to several benefits such as better labor efficiency, quicker reaction time for important tools, process agility, and effective management of business processes. In addition, SMEs are striving to cut expenditures and decrease complications wherever feasible, since they have a limited budget for specialist communications and IT service providers. This is also expected to help emerging and frontier markets to thrive.

During the COVID-19 pandemic, organizations were forced to use WFH models due to the lockdowns enforced by governments in various countries. Organizations were compelled to reevaluate their work practices as a result of these abrupt changes, and digitization became a top priority for them in order to keep their operations going. Because of the ongoing COVID-19 pandemic, the worldwide office software industry is predicted to have a mixed impact, due to the adoption of Bring Your Own Devices (BYOD) and the developing WFH culture.

During the pandemic, businesses and SMEs in a variety of industries, including IT and telecommunications, healthcare, and BFSI, are becoming more interested in cloud-based business applications and services. The mandate to work from home is providing a once-in-a-lifetime opportunity for solution and service providers to promote office suite as a key factor of business stability and demonstrate the flexibility and business agility it offers, and this trend is expected to drive the market growth.

Type Insights

The spreadsheet software segment captured the largest market share of more than 41% in 2021 and is expected to showcase promising growth in the near future. The significant growth of this segment is due to the fact that companies are integrating spreadsheet software for storing, organizing, and analyzing data in tabular format. In the coming years, the escalating tendency of SMEs working with e-commerce players and integrating with other online applications, such as automated bank feeds and billing abilities & enhanced visualization capabilities are likely to increase spreadsheet software adoption.

The visualization software segment is expected to exhibit the highest CAGR of 7.9% during the forecast period. The market is expected to expand due to the increasing usage of new technologies for product design and development. Additionally, the adoption of user-friendly software interfaces and increased competitive rivalry are likely to boost the demand for these software solutions.

Deployment Insights

The cloud deployment segment held the largest market share of more than 61% in 2021, in terms of the total revenue. The cloud deployment type is likely to gain popularity throughout the projection period since it provides the flexibility of on-demand resource provision and consumption. Companies are opting for the cloud deployment model since it provides ease of access, as well as lower capital and operational costs.

The use and subscription of cloud-based office software have increased dramatically in recent years, propelling the industry forward. Additionally, cloud-based office software is gaining popularity since a variety of apps may be conveniently utilized by end-users, such as word processors, graphics software, spreadsheets, and database management systems.

The on-premises deployment segment captured a significant market share in 2021. The on-premise deployment strategy is growing due to its ability to provide organizations with comprehensive software and service control. The organization has full access and control over its data and maintenance, once the license copy of the product is supplied by the vendor at the time of deployment.

With the on-premises deployment of office software, companies have better access to the data and troubleshooting, while managing disaster recovery. Large enterprises across the globe are opting for the on-premises deployment of office software due to the security and enhanced functionality it offers.

Regional Insights

North America captured the largest market share over 45% in terms of revenue in 2021. The office software solution is predicted to develop quicker in North America, owing to factors such as increased usage of enterprise office software and cloud computing technologies and solutions throughout the region.

Furthermore, the rise of small firms and increased SME investments in the cloud and SaaS industry are expected to propel the market forward. Local governments play a crucial role in the growth of the cloud integration services market across the region, thus creating additional prospects for the global market, by undertaking various measures to promote greater corporate trust in the cloud.

The Asia Pacific market for office software is poised to develop at 7.7% CAGR during the forecast period, owing to rising demand for better business communication infrastructure and supportive government measures to improve the region's ICT infrastructure. The spread of the COVID-19 virus in key emerging nations including China, India, and Japan has prompted companies to adopt the work-from-home model, and thus install more office software in business infrastructure. Additionally, the regional market outlook is witnessing a strong uplift due to the growing usage of cloud computing services.

Key Companies & Market Share Insights

The key players operating in the global market are focusing their efforts on improving their products in order to enhance the capabilities of their office software solutions and obtain a competitive advantage over their business rivals. Companies are also developing new solutions in order to broaden and reinforce their present portfolios, while also attracting new customers. Some prominent players in the global office software market include:

-

Microsoft Corporation

-

Google LLC

-

Oracle Corporation

-

Salesforce.com, Inc.

-

VMWARE, INC.

-

Symantec Corporation

-

Dell EMC

-

Hewlett Packard Co. (HP Inc.)

-

International Business Machines Corp.

-

Citrix Systems Inc.

Office Software Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 24.7 billion

Revenue forecast in 2028

USD 37.4 billion

Growth rate

CAGR of 6.9% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Argentina; GCC; South Africa

Key companies profiled

Microsoft Corporation; Google LLC; Oracle Corporation; Salesforce.com, Inc.; VMWARE, INC.; Symantec Corporation; Dell EMC; Hewlett Packard Co. (HP Inc.); International Business Machines Corp.; Citrix Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global office software market report based on deployment, type, and region:

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2028)

-

Cloud

-

On-premises

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2028)

-

Spreadsheet Software

-

Word Processing Software

-

Visualization Software

-

Presentation Software

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global office software market size was estimated at USD 23.5 billion in 2021 and is expected to reach USD 24.7 billion in 2022.

b. The global office software market is expected to grow at a compound annual growth rate of 6.9% from 2022 to 2028 to reach USD 6.9% billion by 2028.

b. North America dominated the office software market with a share of 45.6% in 2021. This is attributable to increased usage of enterprise office software and cloud computing technologies and solutions throughout the region.

b. Some key players operating in the office software market include Microsoft Corporation, Google LLC, Oracle Corporation, Salesforce.com, Inc., VMWARE, INC., Symantec Corporation, Dell EMC, Hewlett Packard Co. (HP Inc.), International Business Machines Corp., and Citrix Systems Inc.

b. Key factors that are driving the office software market growth include increasing adoption of enterprise software among companies to meet unique needs and objectives, growing adoption of cloud technology, and the need to enhance internal business agility while addressing the varied challenges.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.