- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Oil And Gas Corrosion Protection Market Size Report, 2030GVR Report cover

![Oil And Gas Corrosion Protection Market Size, Share & Trends Report]()

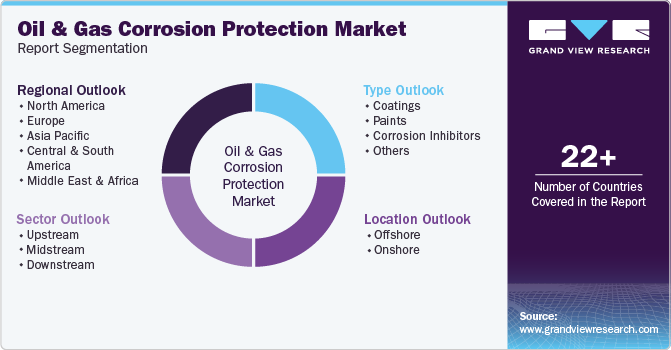

Oil And Gas Corrosion Protection Market Size, Share & Trends Analysis Report By Type (Coatings, Paints, Corrosion Inhibitors, Others), By Location, By Sector (Upstream, Midstream), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-713-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

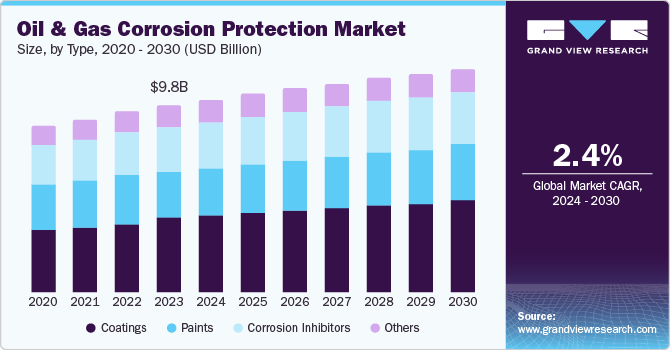

The global oil and gas corrosion protection market size was valued at 9.78 USD billion in 2023 and is projected to grow at a CAGR of 2.4% from 2024 to 2030.Increasing exploration and production of oil & gas, rising demand for corrosion protection solutions, and environmental concerns drive market growth. Rising global oil, gas & energy projects are another significant factor driving market growth. Growing stringent government regulations and standards for safety are driving the adoption of corrosion protection technologies. Increasing advancements in technology and manufacturing processes and adopting digital technology and monitoring processes are likely to propel the market growth.

Global demand for energy has led to a surge in oil and gas processing and production activity, making corrosion protection crucial to protect infrastructure and equipment from failure, safety risks, and environmental damage. In addition, aging infrastructure in the oil and gas industry is another significant factor driving market growth. Many pipelines and offshore oil & gas facilities are nearing the end of their design life, making them more susceptible to corrosion and other aquatic organisms that weaken the material, creating the need for effective corrosion protection solutions to extend their life. Furthermore, rising incidences of corrosion-related failures in the oil & gas industry have also increased the demand for effective- corrosion protection solutions. For instance, 25% of failures in the oil & gas industry are caused by corrosion-related failures.

The rise of shale gas is another major factor driving market growth. Economies such as China, Argentina, Mexico, and others with the largest shale gas reserves as shale gas often have high acidity and corrosive properties, driving demand for corrosion protection solutions to prevent such failures. Moreover, increasing regulatory requirements and industry standards for safety and environmental protection are driving the adoption of corrosion protection solutions. Several manufacturers engaged in this industry are increasingly shifting to sustainable and eco-friendly options to manufacture more effective and efficient solutions. For instance, 3M collaborated with Svante to develop carbon dioxide removal products to achieve net zero emissions and address global warming.

Type Insights

Based on the type, the coatings segment dominated the oil and gas corrosion protection market and accounted for a revenue share of 38.4% in 2023. The increasing number of offshore transportation required by multiple industries and a rise in oil & gas exploration activities worldwide have significantly contributed to the growth of this segment. Coatings provide a barrier against corrosive substances, preventing damage to infrastructure and extending asset life. Furthermore, coatings are applied on the shipping vessel stern and vehicles to improve performance and avoid loss of vehicle metals. Moreover, rising advancements in coatings development technologies and innovations such as Nano coatings and graphene-based coatings coupled with factors such as durability ease of application, and better performance are expected to develop greater demand for this segment.

The corrosion inhibitors segment is expected to experience significant growth over the forecast period. The growth factor for corrosion inhibitors is attributed to the noteworthy increase in demand for effective corrosion protection solutions in the oil & gas industry. Corrosion inhibitors are chemical formulations that are commonly added to fluids, such as drilling muds and production fluids, to prevent corrosion of metal surfaces. Corrosion inhibitors reduce the risk of corrosion caused by CO2, H2S, and other forms of corrosion, addressing the need to protect expensive equipment and infrastructure. Furthermore, the growing trend toward sustainability and environmental responsibility has increased the demand for environmentally friendly corrosion inhibitors. For instance, in August 2023, Hexigone collaborated with MCassab to provide corrosion inhibitors in Brazil.

Location Insights

The offshore segment in the oil and gas corrosion protection market dominated the market in 2023. The segment's dominance is driven by increasing demand for energy sources and presence of offshore infrastructure developed several years ago in many industries. Offshore oil & gas well are continuously exposed to ocean tides, drastic changes in the atmosphere around the equipment and platforms. In addition, presence of corrosive gases, salts, organic acids in the oil & gases leads to increased occurrence of corrosion. This factor is expected to generate greater demand for this segment in approaching years.

The onshore segment is expected experience significant growth during forecast period. Increasing production and transportation activities, extensive pipeline networks, and mature oil and gas fields are anticipated to develop upsurge in demand for growth of this segment in next few years. Onshore pipelines are generally longer and more complex than offshore ones, increasing the risk of corrosion and necessitating a higher demand for corrosion protection measures. In addition, onshore operations encounter diverse climatic conditions, including soil types and environmental factors that have been contributing to the rising demand for the effective corrosion protection solutions.

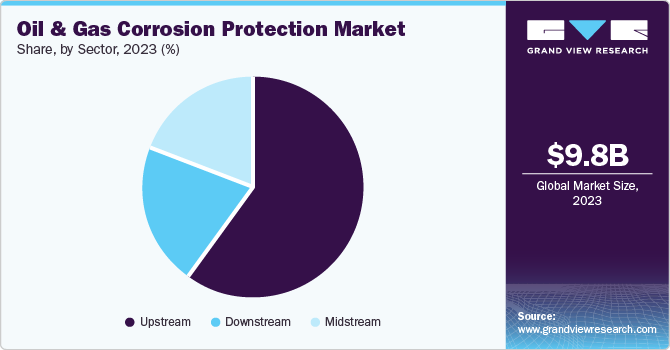

Sector Insights

Based on the sector, the upstream segment dominated the global industry in 2023. The nature of operating conditions, advanced performance requirements, and the rise in stringent regulations mainly drive the segment. The upstream segment in the oil and gas industry involves processes for finding and extracting crude oil and natural gas from the earth. Upstream sector operations entail highly corrosive environments, high pressure, extreme temperatures, and acidic substances such as carbon dioxide and hydrogen sulfide. Moreover, assets operated in upstream operations are costlier compared to other operations, thus requiring enhanced protection from corrosion. Furthermore, many upstream operations are in highly challenging environments, such as the US Gulf of Mexico and Block BM Seal-4 in Northern Brazil. This drives demand for specialized products and services, including corrosion protection solutions.

The downstream segment is expected to experience substantial growth from 2024 to 2030. Growth of this segment is mainly attributed to increasing demand for refined products, expanding refineries and vast distribution networks. The downstream segment includes refining, distribution, and marketing of petroleum products. Rising demand for energy such as petrochemicals and natural gas leads to increased production and transportation activities requiring enhanced corrosion protection and ensuring product safety. Furthermore, advancements in corrosion protection technologies such as coatings, inhibitors, and monitoring systems are expected to fuel market growth. Moreover, increasingly stringent government regulations to control leaks and spills requiring adequate corrosion protection are expected to drive segment growth.

Regional Insights

North America oil and gas corrosion protection market held a significant revenue share in 2023. The growth of this industry is driven by multiple factors such as continuous expansions in exploration and production activities, surge in energy demands, increasing investments in exploration activities, enhanced research and development leading to innovation in corrosion protection industry and more. Furthermore, preventive and proactive approach of companies has led to increasing demand for the corrosion protection offerings. Sustainability concerns and environment friendly alternatives offered by multiple companies are also expected to influence the growth of this industry in approaching years.

U.S. Oil And Gas Corrosion Protection Market Trends

U.S. the oil and gas corrosion protection market dominated in 2023. According to U.S. Energy Information Administration, in December 2023, the U.S. recorded oil and gas production of 13.3 million barrels per day. This marked 4 million barrels per day increase than highest production records in 2022. The unceasing growth in production experienced by the country due to increasing demand and dependability by other nations is expected to develop growth for impactful corrosion protection solutions. Growth in explorations, increasing embracement of advanced technology and rise in microbiologically influenced corrosion has been contributing to the growth experienced by the industry.

Europe Oil And Gas Corrosion Protection Market Trends

Europe oil and gas corrosion protection market held significant revenue share of the global industry in 2023. This regional market is primarily driven by the multiple factors such as rising demand for energy leading to growth in explorations as well as production activities, advancements associated with the manufacturing technologies in materials and coatings industry, increasing adoption of strategies such as asset integrity management that prioritize inspections in regular intervals and pro-active approach in managing the assets.

Norway oil and gas corrosion protection market is expected to experience a significant growth during forecast period. This is attributed to the significant oil and gas production capacities of country. According to International Trade Administration, Norway is ranked as eighth largest producer in the world for natural gas and holds position of fourth largest exporter in terms of natural gas through pipeline and LNG as well. Presence of vast oil and gas networks are expected to contribute to the growing demand for oil and gas corrosion protection solutions. For instance, the country supplies nearly 40% of gas consumed by the UK and provides noteworthy amounts of gas to countries such as Germany and France as well.

Middle East And Africa Oil And Gas Corrosion Protection Market Trends

The Middle East and Africa oil and gas corrosion protection market dominated the market with a revenue share of 32.5% in 2023. The region is home to vast oil and gas reserves in countries such as Saudi Arabia, Iraq, Kuwait, Iran, Oman and the UAE, necessitating extensive infrastructural developments and enhancements in regular intervals, including pipelines, refineries, and offshore platforms, as protecting these assets from corrosion is crucial to ensure their longevity and operation efficiency. For instance, according to current estimates by Organization of the Petroleum Exporting Countries (OPEC), 1,241.33 billion barrels of proven crude oil reserves worldwide are present in OPEC Member Countries. Out of these, the reserves present in Middle Eastern member of OPEC account for 67.3% of total reserves. These factors have resulted in the growing demand for corrosion protection solutions that can prevent loss of asset and equipment.

Key Oil And Gas Corrosion Protection Company Insights

Some key companies operating in the oil and gas corrosion protection market are Cortec Corporation, 3M,Axalta Coating Systems, SLB (Schlumberger Limited) and others. To address rapid growth in competition, the key market participants are adopting strategies such as innovation, enhanced research & development activities, collaborations, geographical expansions, new product developments and more.

-

Cortec Corporation, one of the key industry participants in the corrosion protection market, offers a wide range of solutions and specializes in MCI and VpCI corrosion protection technology offerings. The company provides a diverse product portfolio to multiple application industries such as metalworking, construction, electronics, packaging, and oil & gas. Some of its corrosion protection offerings for the oil & gas industry include CPS ECO FLOW SYSTEM, VpCI for Process Industries, Biodegradable Volatile Corrosion Inhibitors, and more.

-

Axalta Coating Systems is a global company specializing in coating solutions. Axalta caters to various sectors, including automotive, commercial vehicles, industrial, and others. The company operates in more than 140 countries, and its product portfolio encompasses a vast range of coatings, including liquid coatings, powder coatings, and electrocoating. The company’s offerings for the oil & gas industry include Electrocoat, Powder coatings, Thermoplastic coatings, Water & Solvent-borne primers, Topcoats, and Direct-to-metal.

Key Oil and Gas Corrosion Protection Companies:

The following are the leading companies in the oil and gas corrosion protection market. These companies collectively hold the largest market share and dictate industry trends.

- SLB (Schlumberger Limited)

- Northern Technologies International Corporation

- Cortec Corporation

- Maxwell Additives Pvt. Ltd.

- Imperial Oilfield Chemicals Pvt. Ltd.

- Hexigone Inhibitors Ltd.

- Axalta Coating Systems

- Teknos (Teknos Group)

- 3M

Recent Developments

-

In July 2024, TotalEnergies, one of the prominent companies in the energy industry, and Schlumberger NV (SLB), a key market participant in the energy technology industry, announced that the two had entered a 10-year partnership agreement aimed at achieving a collaborative effort to develop and deliver next-generation digital technology solutions.

Oil And Gas Corrosion Protection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.07 billion

Revenue Forecast in 2030

USD 11.64 billion

Growth Rate

CAGR of 2.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, location, sector, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Russia, Norway, UK, China, Australia, India, Kazakhstan, Brazil, Argentina, Columbia, Saudi Arabia, UAE, Oman, Qatar, Kuwait, Egypt.

Key companies profiled

SLB (Schlumberger Limited); Northern Technologies International Corporation; Cortec Corporation; Maxwell Additives Pvt. Ltd.; Imperial Oilfield Chemicals Pvt. Ltd.; Hexigone Inhibitors Ltd.; Axalta Coating Systems; Teknos (Teknos Group); 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil And Gas Corrosion Protection Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oil and gas corrosion protection market report based on type, location, sector, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Coatings

-

Paints

-

Corrosion Inhibitors

-

Others

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Offshore

-

Onshore

-

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream

-

Midstream

-

Downstream

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Norway

-

UK

-

-

Asia Pacific

-

China

-

Australia

-

India

-

Kazakhstan

-

-

Central & South America

-

Brazil

-

Argentina

-

Columbia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Kuwait

-

Egypt

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."