- Home

- »

- Renewable Chemicals

- »

-

Oleoresin Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Oleoresin Market Size, Share & Trends Report]()

Oleoresin Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Paprika, Black Pepper, Capsicum), By Application (Food, Beverage, Fragrances, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: 978-1-68038-774-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oleoresin Market Summary

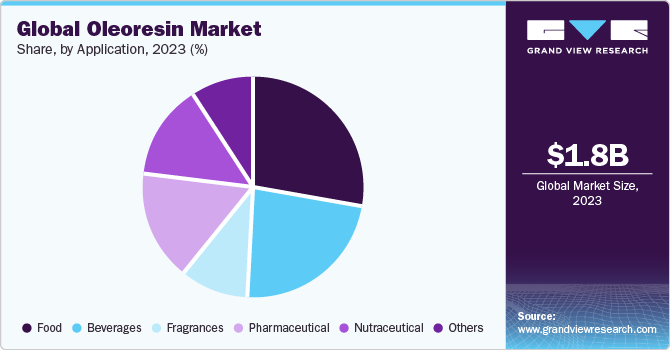

The global oleoresin market size was estimated at USD 1.8 billion in 2023 and is projected to reach USD 2.83 billion by 2030, growing at a CAGR of 6.9% from 2024 to 2030. This is attributed to the rising demand for oleoresins like turmeric in the pharmaceutical and healthcare sectors due to its therapeutic benefits, which have bolstered the market growth.

Key Market Trends & Insights

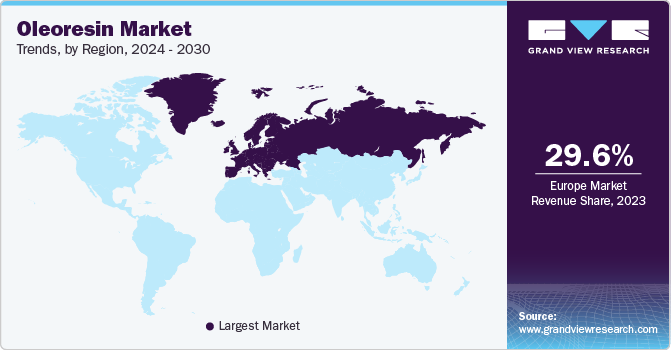

- Europe dominated the market with a revenue share of 29.60% in 2023.

- Asia Pacific stands out as a significant player in spice production and oleoresin processing.

- Based on product, the black pepper oleoresin segment dominated the market with a share of 25.46% in 2023.

- In terms of application, the food application segment dominated the market with a share of 28.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.8 Billion

- 2030 Projected Market Size: USD 2.83 Billion

- CAGR (2024-2030): 6.9%

- Europe: Largest market in 2023

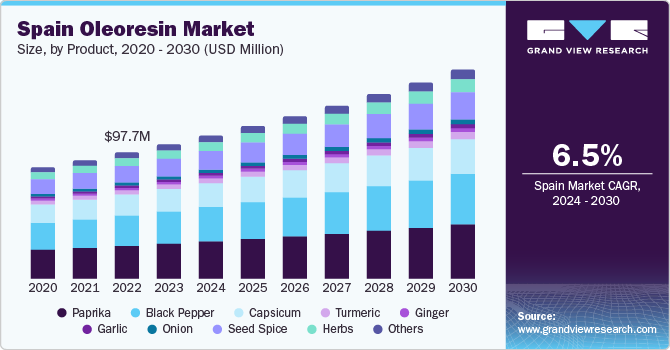

Turmeric oleoresin is widely used in healthcare and pharmaceutical industries due to its applications, which include pain relief and reduction in stress and depression, exhibiting robust growth in demand for the overall market over the forecast period. It is also called pinyon gum and has been considered to have medicinal properties and used by consumers globally.Spain is among the major importers of oleoresins in Europe, along with Germany, UK, Belgium, and Austria being the other key importing countries. The country's demand for the product is driven by several industries, including personal care & cosmetics, perfumery, and pharmaceuticals, which extensively incorporate it into their products. In addition, Spain's preference for ethnic food and the ascending demand for the market in healthcare applications contribute to the market growth in the region.

Spain is also one of the largest producers of olive oil, and the country's agricultural conditions, such as drought, can impact prices and production in the market. As the olive oil is considered a staple ingredient in Spanish cuisine, it is extensively used in cooking for sautéing, frying, and as a final change in various dishes.

Garlic is another essential ingredient in Spanish cuisine, known for its aromatic and flavorful properties. It is widely used in various dishes, such as stews, sauces, and marinades. Garlic is often combined with olive oil to create a flavorful base for many Spanish recipes. Paprika, which is produced as a non-pungent oleoresin in Spain, is also a popular ingredient in the local cuisine. It adds vibrant color and a distinct smoky flavor to dishes like paella, chorizo, and various sauces.

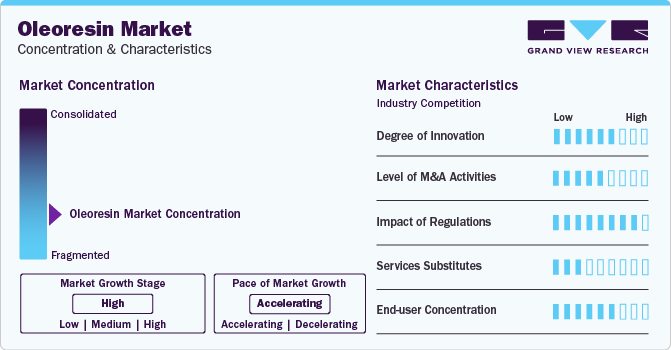

Market Concentration & Characteristics

The global market is characterized by its fragmented nature, with dominant players such as Givaudan, Kancor Ingredients Ltd., Kalsec Inc., Chenguang Biotech Group Co. Ltd., Universal Oleoresins, Akay Group Ltd., and Synthite Industries Ltd. These manufacturers rely on products for their natural flavors, colors, and therapeutic properties. The market is influenced by the fluctuations and volatility in the raw material market, as it is derived from spices and herbs. To ensure a steady supply of raw materials, industry players often establish long-term contracts with raw material producers.

The market's highly fragmented nature is also influenced by the rising prevalence of gastrointestinal diseases among people and is expected to drive the demand for the product due to its anti-inflammatory and antioxidant properties. Chilli, for example, is used in pharmaceutical applications due to its analgesic, antioxidant, anti-cancer, and anti-inflammatory features. It also helps to reduce free radicals in the human body.

In addition, black pepper oleoresin extracted from dried berries plant stimulates the appetite and provides relief to people suffering from nausea, dysentery, and dyspepsia. Owing to its anti-inflammatory and insecticidal properties, it acts as a nervous system depressant and assists in controlling fever and pain.

Research and development initiatives are being undertaken to explore more potential applications derived from products, creating many opportunities for the healthcare and pharmaceutical industries. Black pepper oleoresin, for instance, can be used as a pain reliever for people suffering from arthritis. Capsicum oleoresins have also been used in creams and plasters, and there has been production of capsules containing cayenne powder. These functional properties contribute to the growth of the market, benefiting the healthcare industry.

Application Insights

The food application segment dominated the market with a share of 28.0% in 2023.This high percentage can be attributed to oleoresins being extensively utilized in the food industry, especially for marinades, meat preparations, gourmet foods, and convenience food products. It provides the flavor and aroma of spices and herbs to food products. Turmeric and paprika oleoresins also provide color. Furthermore, the product is used to impart flavor to cold drinks. They have fast replaced the use of ground spice owing to their standardized taste and consistent aroma. They are economical, require less storage space, have no bacterial contamination, and possess a long shelf life.

Oleoresins are used to impart flavor to beverages. As the product is soluble in water and works well when mixed with other liquids, they become an ideal part of the complex flavor profile. It is used in flavored milk, carbonated beverages, tea, fruit juices, etc. The consistency of the product makes it more suitable for batch production of beverages and also leads to fewer potential losses during the manufacturing process. In addition, the market can be used to add natural color to beverages, which further increases their usability in the industry. Such factors are likely to propel the product demand in beverage applications.

A variety of oleoresins are used in perfumes and cologne. Their versatile properties along with different aroma compounds make them suitable for perfumery formulations. For example, berry oil oleoresin that is manufactured in small quantities contains glycerol laurate and finds extensive application in perfumery. The pungent smell characteristic of the product has increased the scope of its application in the perfumery industry. Growing demand for luxury fragrances along with increasing demand for natural perfumes is projected to foster the growth of this segment over the forecast period.

Product Insights

The black pepper oleoresin segment dominated the market with a share of 25.46% in 2023. This is attributable to the widely utilized black pepper in food products owing to its pungent taste and spicy aromatic properties. Black pepper oleoresin is generally prepared from ethanolic extraction combined with a small proportion of dried ground black pepper. Rising demand for the product owing to its antioxidant & antimicrobial properties is expected to positively affect the overall market over the forecast period.

Turmeric oleoresin is widely employed in the personal care sector for treatment purposes, especially for skin-related problems. Turmeric is generally used to treat skin problems such as acne & eczema, to prevent and heal dry skin, and to hinder the ageing process. Curcumin, which is used for cream formulation, is extensively sourced from turmeric oleoresins. In addition, leaf oil and extract of turmeric can be used in sunscreens and bio pesticides. Effective healing properties of turmeric have boosted its application in the cosmetics industry, which is further anticipated to assist the growth of overall market.

Ginger oleoresin is produced via the extraction of unpeeled and dried rhizome and various other types of ginger. The majority of ginger oleoresins are extracted from Jamaican and Nigerian ginger which has best-refined aroma. These products exhibit antifungal & antibacterial properties against food borne pathogens, namely fungi & bacteria.

Regional Insights

Europe dominated the market with a revenue share of 29.60% in 2023. This high share is attributable to the market growth in this region and increasing demand for flavorings & colorants from the food & beverage industry. Paprika oleoresin is extensively utilized as a coloring and flavoring agent in the food & beverage sector and accounts for a relatively higher market share compared to other product. Increasing competitive rivalry for herbs and spices to extract oleoresin is projected to prompt European importers to opt for new sources.

Furthermore, in Europe, various industries such as personal care & cosmetics, perfumery, and pharmaceuticals extensively integrate oleoresins into their product formulations. This has led to an increased import rate of product, with Austria, the UK, Germany, Belgium, and Spain emerging as major importers in the region. The market in Europe is primarily driven by shifting consumer preferences towards ethnic cuisine and the growing demand for market in healthcare applications.

Asia Pacific stands out as a significant player in spice production and oleoresin processing. Countries like India, China, Vietnam, and Indonesia are key producers of spices in the region. Market players in this region are continuously striving to enhance their production facilities and expand their market presence. Especially, India has emerged as a major exporter of oleoresins to both European and American markets. Notably, paprika oleoresins manufactured in India are highly favored due to their exceptional stability under varying light and heat conditions, making them preferable over those produced in China.

Moreover, India experiences a shorter harvesting period compared to Peru, which may result in fluctuations in product demand. Nevertheless, India remains a dominant producer of spice oleoresins, accounting for approximately 60% of global production and consuming around 80% of domestically produced turmeric. The country's increasing focus on product processing is expected to further bolster market growth.

The U.S. emerged as the largest market in North America. Increasing consumption of organic food & beverages has bolstered the demand for organic spices, which, in turn, is likely to create ample growth opportunities for organic oleoresins in food & beverage applications. Moreover, consumers opt for convenience products that have more non-volatile content. The market has a high content of non-volatile matter as compared to essential oils and is thus gaining popularity among the manufacturers of pharmaceuticals, cosmetics, and flavors & fragrances.

Key Companies & Market Share Insights

Some of the key players operating in the market include Chenguang Biotech Group Co. Ltd., Universal Oleoresins and Givaudan.

-

Chenguang Biotech Group Co. Ltd. specializes in manufacturing and exporting products such as spice extracts, oleoresins, natural colors, and essential oils. The company’s oleoresin product portfolio includes paprika, capsicum, curcumin, Sichuan pepper and marigold.

-

Universal Oleoresins company specializes in manufacturing and exporting products such as spice oils, oleoresins, natural colors, and spice drops. This company is an affiliated to Shah Group of Concerns with expertise in fields such as manufacturing molded products, tea exports, stock broking, real estate, outdoor advertising, three-dimensional displays, and vacuum formed products. They have separate extraction plants to produce oleoresins, the products are free from contaminants and 100% natural.

-

Givaudan is a producer of organic & natural oils. The company’s business portfolio includes the production and supply of essential oils and natural extracts. The company acquired Ungerer & Company, a prominent manufacturer of oleoresins, to expand its product portfolio.

Kancor Ingredients Ltd, AVT and Indo-Worldare are some of the emerging market participants in the market.

-

Kancor Ingredients Ltd is engaged in the manufacture and distribution of natural ingredients such as essential oils, oleoresins, floral extracts, organic ingredients, menthol & isolates etc.

-

AVT is owned by AVT Group of Companies, which specializes in marigold cultivation. The product portfolio of the company includes feed grade oleoresins, and food grade oleoresins, nutraceuticals grade products, marigold oleoresins, spice oils, and tea.

Key Oleoresin Companies:

- Chenguang Biotech Group Co. Ltd.

- Kancor Ingredients Ltd.

- Kalsec Inc.

- Universal Oleoresins

- Givaudan

- Akay Group Ltd.

- Synthite Industries Ltd.

- AVT Natural

- Indo-World

- Paprika Oleo's India Limited

- Paras Perfumers

- Manohar Botanical Extracts Pvt. Ltd.

- Naturite Agro Products Ltd

- MRT GREEN PRODUCTS

- All-Season Herbs

- TMV Aroma

- Plant Lipids

- Ozone Naturals

Recent Developments

-

In August 2023, Divi's and Algalif collaborated to develop concentrated beadlets of sustainable natural astaxanthin. It is utilized in renewable energy sources to extract astaxanthin oleoresin from microalgae in a naturally derived manner.

-

In July 2023, KLK OLEO, GNT introduced shade vivid orange - OS, a groundbreaking 100% oil-soluble, plant-based color in their Exberry portfolio. This color is derived from non-GMO paprika. This new color solution addresses the need for clean-label ingredients and provides an alternative to artificial colors and paprika oleoresin across a wide range of applications.

-

In January 2022, Givaudan announced its acquisition of a 48% stake in Nanovetores Group. The stake was acquired from The Criatec Fund, a Brazilian investment fund that focuses on innovative, early-stage companies. This acquisition demonstrates Givaudan's strategic interest in expanding its presence in the beauty products business and capabilities in the market.

Oleoresin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.89 billion

Revenue forecast in 2030

USD 2.83 billion

Growth Rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Spain; France; Germany; Belgium; Austria; Italy; Netherlands; Switzerland; China; India; Japan; Vietnam; Indonesia; Sri Lanka; Oceania; Thailand; Malaysia; Bangladesh; Hong Kong; South Korea; Taiwan; Singapore; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; North Africa

Key companies profiled

Chenguang Biotech Group Co. Ltd.; Kancor Ingredients Ltd.; Kalsec Inc. Universal Oleoresins; Givaudan; Akay Group Ltd.; Synthite Industries Ltd.; AVT; Indo-World; Paprika Oleo's India Limited; Paras Perfumers; Manohar Botanical Extracts Pvt. Ltd.; Naturite Agro Products Ltd; MRT GREEN PRODUCTS; All-Season Herbs; TMV Aroma; Plant Lipids; Ozone Naturals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oleoresin Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oleoresin market report based on product, application, and region.

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Paprika

-

Black Pepper

-

Capsicum

-

Turmeric

-

Ginger

-

Garlic

-

Onion

-

Seed Spice

-

Herbs

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Fragrances

-

Pharmaceutical

-

Nutraceutical

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Spain

-

France

-

Germany

-

Belgium

-

Austria

-

Italy

-

Netherlands

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Vietnam

-

Indonesia

-

Sri Lanka

-

Oceania

-

Thailand

-

Malaysia

-

Bangladesh

-

Hong Kong

-

South Korea

-

Taiwan

-

Singapore

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

North Africa

-

-

Frequently Asked Questions About This Report

b. The global oleoresin market size was estimated at USD 1.80 billion in 2023 and is expected to reach USD 1.89 billion in 2024.

b. The global oleoresin market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 2.83 billion by 2030.

b. Europe dominated the oleoresin market with a share of over 29% in 2023. This is attributable to the growth of various end-use industries in Europe such as personal care & cosmetics, perfumery, and pharmaceuticals extensively incorporating oleoresins in their products.

b. Some key players operating in the oleoresin market include Universal Oleoresins, Ungerer & Company, Akay, Synthite, AVT Natural Products Limited (AVT NPL), Indo World, Paprika Oleo’s, Paras Perfumers, Manohar Botanical Extracts Pvt. Ltd., Ambe Group, Gurjar Phytochem Pvt. Ltd., MRT Organic Green Products, Nature Plus Herbal Cosmetics, Cymbio Pharma Pvt. Ltd., All-Season Herbs Pvt. Ltd., Asian Oleoresin Company, Bioprex Labs, TMV Group, Plant Lipids, Ozone Naturals and Hawkins Watts.

b. Key factors that are driving the oleoresin market growth include the rising consumption of oleoresin as a food flavoring agent in processed meat, confectionery, and baked food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.