- Home

- »

- Food Additives & Nutricosmetics

- »

-

Omega 3 Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Omega 3 Market Size, Share & Trends Report]()

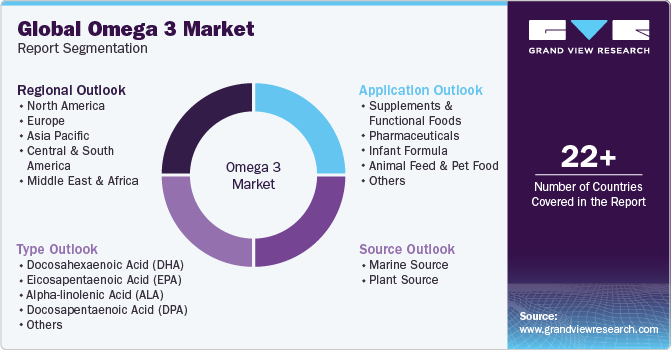

Omega 3 Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (EPA, DHA, ALA), By Source (Marine, Plant), By Application (Supplements & Functional Foods), By Region, And Segment Forecasts

- Report ID: 978-1-68038-079-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Omega 3 Market Summary

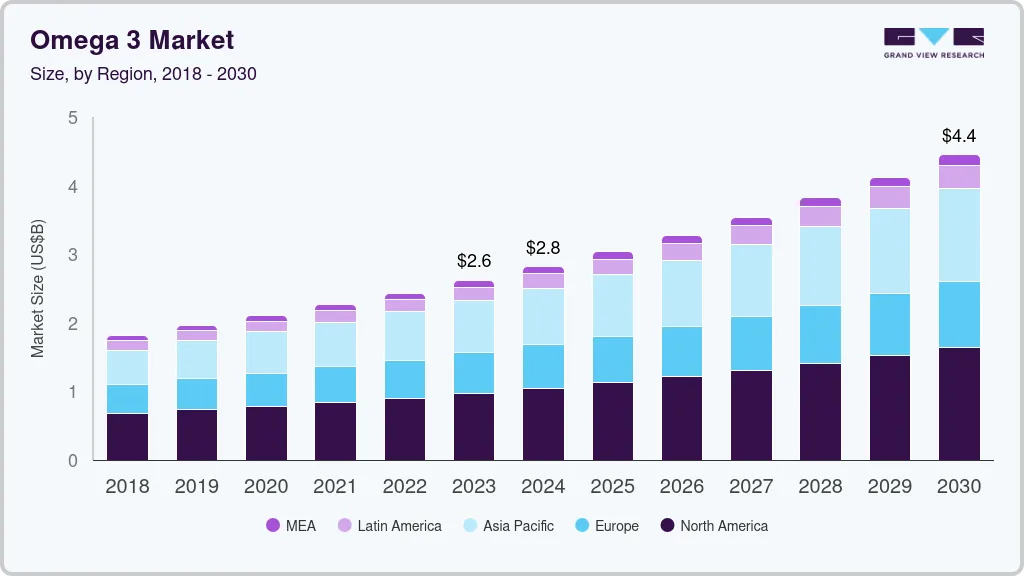

The global omega 3 market size was estimated at USD 2.62 billion in 2023 and is projected to reach USD 4.45 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. This is attributable to the rising use of ingredients in the human diet to support brain and heart health.

Key Market Trends & Insights

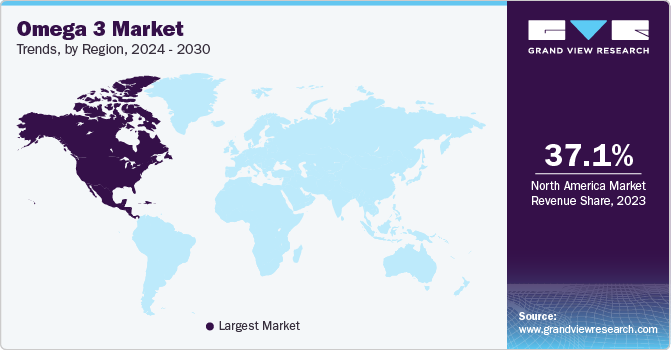

- North America region dominated the market with a revenue share of more than 37.1% in 2023.

- In Europe, the demand for omega 3 is anticipated to witness a significant increase over the forecast period

- Based on type, docosahexaenoic acid (DHA) dominated the market with a revenue share of more than 56% in 2023.

- Based on source, marine source dominated the market with the highest revenue share of 83.5% in 2023.

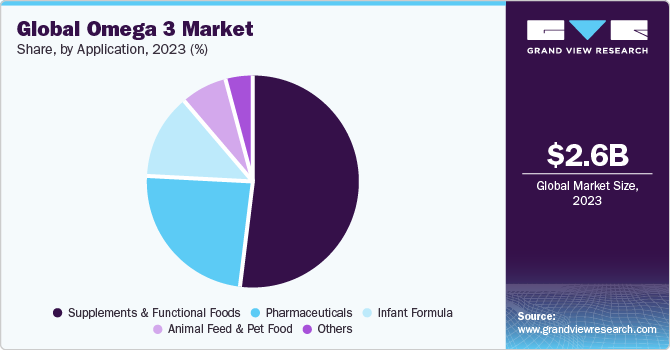

- Based on application, supplements & functional foods dominated the market with a revenue share of over 51% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.62 Billion

- 2030 Projected Market Size: USD 4.45 Billion

- CAGR (2024-2030): 7.9%

- North America: Largest market in 2023

Furthermore, the increasing consumer investment in healthcare and one’s well-being is also expected to boost product demand. The market is witnessing continuous diversification in its product offerings as consumers are looking for alternatives to traditional fish oil. Krill oil is one of the widely used sources of omega-3 due to its superior properties as compared to conventional fish oil. The majority of consumers in Europe and North America prefer krill oil over any other source of fish oil owing to its acid reflux, unpleasant taste, and large-sized pills. Such factors are anticipated to trigger product demand during the forecast period.

The demand for omega-3 fatty acids in the U.S. is projected to grow significantly over the next few years owing to rising consumer awareness in the country regarding the several health benefits offered, including lowering blood pressure and cholesterol and reducing risks related to heart diseases. Moreover, growing consumer preference for a healthy and nutritional diet is further expected to fuel product demand shortly.

Numerous manufacturers present in the U.S., including BioProcess Algae, Martek Biosciences Corporation, and Omega Protein Corporation are focusing on research and development activities for launching pharmaceutical-grade product in the market. Increasing consumption of enhanced medicines to treat and prevent chronic diseases is likely to spur overall consumption in the coming years.

Rising pressure on anchovy fisheries to extract fish oil has increased the demand from non-fish sources, including flaxseed, walnuts, algae, and krill oil. Furthermore, increasing government initiatives to promote the product usage in different end-use applications are projected to positively impact the market demand.

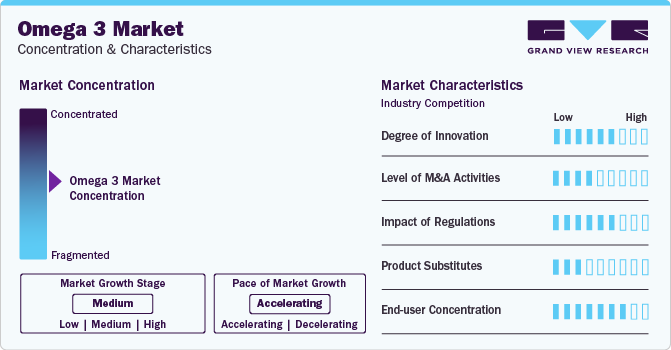

Market Concentration & Characteristics

The global market is consolidated with a few large market players accounting for a majority share. For instance, the acquisition of Ocean Nutrition Canada and Martek Biosciences by DSM shaped it as one of the largest suppliers of ingredients, in terms of volume, across the globe.

The market is growing steadily, driven by various factors; one of the key drivers is the increased awareness of the health benefits of omega-3 fatty acids. Omega-3 is known to support heart health, brain function, and overall well-being. As a result, there is a growing demand for infused supplements and fortified foods.

The market is expanding beyond traditional fish oil sources. With rising pressure on anchovy fisheries and concerns about sustainability, there is a shift towards non-fish sources of omega 3, such as flaxseed, walnuts, algae, and krill oil. Algae-based omega-3 ingredients, in particular, are gaining popularity due to their sustainability and suitability for vegan and vegetarian diets.

Geographically, North America has been a leading region, with the highest revenue share in 2023. This is attributed to the presence of prominent manufacturers of omega-3-based pharmaceutical products and supplements in the region. However, the market is not limited to North America; other regions, such as Europe and Africa, also contribute to the global market share.

Additionally, the rising consumption in the pharmaceuticals industry and the growing research and development activities related to the product are expected to drive the market growth in North America over the forecast period. Moreover, the surging consumption of improved medicines in the region, along with the requirement to increase the life expectancy of the aging population, is expected to propel the demand for omega 3-based pharmaceuticals in North America over the forecast period.

Type Insights

Docosahexaenoic acid (DHA) dominated the market with a revenue share of more than 56% in 2023. This is attributed to the growing utilization of the product in infant formulas to improve an infant's overall health. In the human diet, DHA is the most essential and abundant omega-3 fatty acid, which helps maintain the health of the human body.

DHA is a crucial component for developing and maturing an infant's brain and eyesight. Moreover, it is widely used in nutritional supplements and fortified foods. It is also used in treating dementia, attention deficit hyperactivity disorder, coronary artery disease (CAD), and Type 2 diabetes. The advantages of DHA for health and longevity have also resulted in its use in geriatric nutrition products.

Omega-3 PUFAs, including DPA, have been associated with cardiovascular health benefits. They may help reduce the risk of heart disease by lowering triglyceride levels, reducing inflammation, improving blood vessel function, and reducing the risk of arrhythmias. Additionally, omega-3 PUFAs are crucial for brain health and development. While DHA is the most studied omega-3 PUFA in the brain, there is growing evidence suggesting the unique effects of DPA. DPA has been linked to neuroprotective properties and may have potential benefits in neurodegenerative and neurological disorders.

The demand for Eicosapentaenoic acid (EPA) will increase globally during the forecast period owing to several health benefits, such as avoiding inflammation, high blood pressure, coronary heart diseases, and excessive triglycerides (blood fats). It is also used for treating diabetes, addressing chemotherapy-related side effects, and enabling recovery from surgeries, among others.

Source Insights

The marine source dominated the market with the highest revenue share of 83.5% in 2023. This is attributable to the abundance of DHA and EPA omega-3s in fish bodies or oily, liver oil, or fatty fish, and marine microorganisms, such as marine and algae omega 3 ingredient including krill. High-omega-3 content sources for human consumption include salmon, pollock, tuna, and mackerel.

Other high EPA and DHA content sources include forage fish species with small bodies. This fish category includes anchovies, herring, sardines, mackerel, hoki, and capelin. Thus, marine, in general, is recognized worldwide as a major source of EPA and DHA, thereby leading to rising demand for omega-3 obtained from marine sources.

The plant source segment is expected to register growth over the forecast period, mainly because the global demand for vegetable oils obtained from seeds of soybeans, safflower, sunflower, cotton, and corn is surging as they are rich sources of omega 3. Key players are also shifting to plant sources as an alternative to fish oil due to their environmental benefits. For instance, in May 2023, Nuseed Global introduces Nuseed Nutriterra plant-based oil enriched with omega-3, tailored to meet the needs of the human nutrition and dietary supplement markets. Moverover, Nordic Naturals Algae Omega is a popular product in the market that provides vegans and vegetarians with a safe, sustainable, and reliable plant-based source of omega-3s EPA and DHA in high-quality algae oil. It supports brain, eye, and heart wellness, as well as immune system function.

Application Insights

Supplements & functional foods dominated the market with a revenue share of over 51% in 2023.This is attributable to the exceptional benefits offered by the product such as muscle gain, mineral fortification weight management, and beauty benefits. Growing awareness concerning a reduction in calorie intake amongst athletes and gym professionals in key countries such as India, Italy, China, and the U.S. is likely to promote the use of sports supplements and functional food products.

The pharmaceuticals segment is expected to register significant growth over the forecast period on account of its growing usage in the dermatology sector due to its scalp nourishment properties. It is used to preserve the lipid content of the skin, thus preventing moisture loss, and maintaining skin hydration. The rising utilization of omega 3 in pharmaceutical applications to treat the aforementioned skin and scalp conditions is further expected to drive the market over the forecast period.

The growing aging population, increasing lifestyle-related diseases, and rising prevalence of cancer are expected to fuel the demand for omega-3-based pharmaceutical products. In addition, technological advancements in API (active pharmaceutical ingredient) manufacturing are expected to augment the product market growth during the forecast period.

Regional Insights

North America region dominated the market with a revenue share of more than 37.1% in 2023. The demand in this geographical area is additionally stimulated by the existence of prominent pharmaceutical corporations, including Pfizer, Inc., Johnson & Johnson, Amway, and Amarin Pharma, Inc., among other entities.

The rising consumption of omega-3 in the pharmaceuticals industry and the growing research and development activities related to the product are expected to drive the growth of the market in North America over the forecast period. Moreover, the rising consumption of omega 3-rich supplements and functional food products by athletes owing to their ability to improve protein synthesis, increase muscle health, and enhance the physical performance of consumers is anticipated to further drive the market growth over the forecast period.

UK Omega 3 Market

In Europe, the demand for omega 3 is anticipated to witness a significant increase over the forecast period owing to surging product consumption, especially in the form of dietary supplements by the continuously increasing aging population, particularly of developed economies such as Germany, France, the Netherlands, and the UK. Moreover, the demand in the UK is largely driven by the continuous introduction of innovative products in the market. For instance, the launch of MegaRed by Reckitt Benckiser has driven the growth of omega 3-based supplements industry in the country as this product improves the heart, joint, eye, and brain health of consumers.

Asia Pacific is likely to witness growth owing to the rising demand for packaged baby nutrition formulas owing to the increasing participation of women in the workplace is anticipated to propel the demand for infant formulas in countries such as India, China, Japan, Australia, and Thailand. Furthermore, the increasing significance of omega 3 DHA for the development of the infant nervous system, vision, and brain along with the product’s ability to support long-term health is projected to drive market growth in the coming years.

Key Companies & Market Share Insights

Growing consumption of the product in various applications coupled with rising awareness regarding health and chronic diseases, and regulations favoring the use of omega-3 in infant formulations has influenced manufacturers to invest in technologies and product development in order to meet consumer demands. The market has been experiencing an increase in the number of new entrants across the value chain owing to the growing profits and huge market potential of manufacturers.

-

In March 2023, Epax announced an investment of USD 40 million in molecular distillation technology for improving the processing of highly concentrated omega 3.

-

In May 2023, Nuseed Global introduces Nuseed Nutriterra plant-based oil enriched with omega-3, tailored to meet the needs of the human nutrition and dietary supplement markets.

-

In addition, key companies such as Aker Biomarine Antarctic AS are focusing on expanding their capacity by introducing new catching vessels to increase their products, which was reflected in the sales of the company in the year 2021. Governments across developing regions are taking several initiatives to support Antarctic Krill fishing by providing research funds and creating innovation alliances, which may trigger industry growth.

Key Omega 3 Companies:

- Aker Biomarine Antarctic AS

- Orkla Health

- BASF SE

- Omega Protein Corp.

- GC Reiber Oils

- Lonza

- Croda International Plc

- EPAX

- BioProcess Algae, LLC

- Koninklijke DSM N.V.

Global Omega 3 Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.82 billion

Revenue forecast in 2030

USD 4.45 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Source, Application and Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; Norway; The Netherlands; China; India; Japan; Australia; New Zealand Brazil; Argentina; UAE, South Africa

Key companies profiled

Aker Biomarine Antarctic AS; Orkla Health; BASF SE; Omega Protein Corp.; GC Reiber Oils; Lonza; Croda International Plc; EPAX; BioProcess Algae; LLC; Koninklijke DSM N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Omega 3 Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global omega 3 market report on the basis of type, source, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Docosahexaenoic acid (DHA)

-

Eicosapentaenoic acid (EPA)

-

Alpha-linolenic acid (ALA)

-

Docosapentaenoic acid (DPA)

-

Others

-

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Marine Source

-

Fish Oil

-

Algal Oil

-

Krill Oil

-

Others

-

-

Plant Source

-

Nuts & Seeds

-

Vegetable Oils

-

Soy

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Supplements & Functional Foods

-

Pharmaceuticals

-

Infant Formula

-

Animal Feed & Pet Food

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

The Netherlands

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global omega 3 market size was estimated at USD 2.43 billion in 2022 and is expected to reach USD 2.61 billion in 2023.

b. The global omega 3 market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 4.45 billion by 2030.

b. The docosahexaenoic acid (DHA) segment dominated the omega 3 market with a share of nearly 62.42% in 2022 owing to its widespread application in improving heart health, brain health, and prenatal care.

b. Some of the key players operating in the global omega 3 market include Aker Biomarine Antarctic AS, Orkla Health, BASF SE, Omega Protein Corporation, GC Reiber Oils, Lonza, Croda International Plc, EPAX, BioProcess Algae, LLC, and.Koninklijke DSM N.V. among others.

b. The key factors that are driving the global omega 3 market include the rising prevalence of cardiovascular diseases, a surge in demand for nutritional supplementation for pregnant and lactating women, and soaring adoption of a healthy diet among the middle-class population

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.