- Home

- »

- Automotive & Transportation

- »

-

On-demand Transportation Market Size & Share Report 2030GVR Report cover

![On-demand Transportation Market Size, Share & Trends Report]()

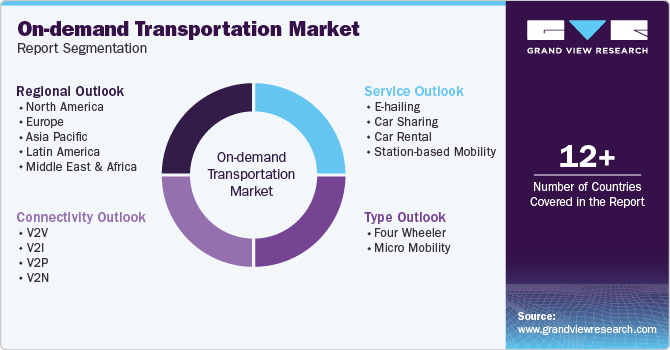

On-demand Transportation Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Four Wheeler, Micro Mobility), By Service, By Connectivity (V2V, V2I, V2P, V2N), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-097-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

On-demand Transportation Market Trends

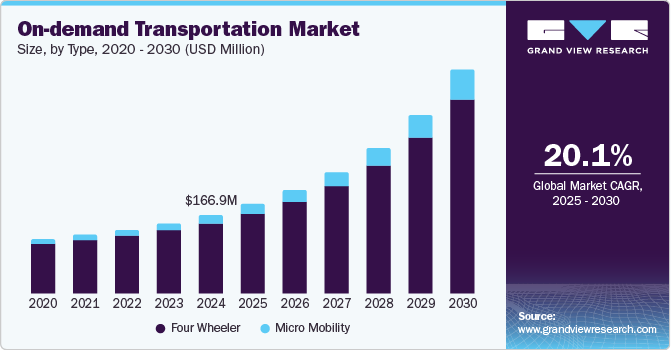

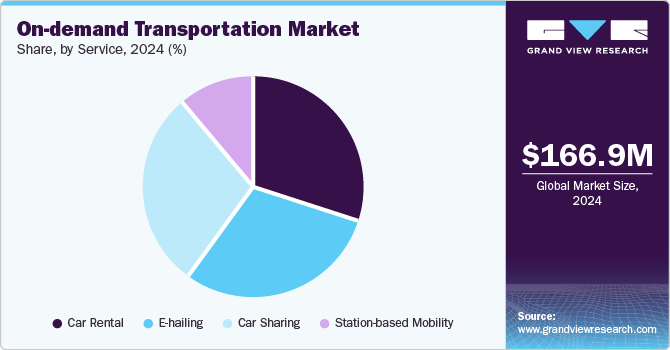

The global on-demand transportation market size was valued at USD 166.9 million in 2024 and is projected to grow at a CAGR of 20.1% from 2025 to 2030. The increasing challenges associated with traffic congestion, rising fuel prices, and limited parking availability are significant factors driving the growth of the on-demand transportation market. As consumers seek more convenient and cost-effective solutions, the high expenses related to car ownership have led to a greater preference for on-demand services that allow users to easily pre-book, modify, and cancel their rides through mobile applications.

Rapid urbanization worldwide is driving market growth, particularly in emerging economies in Asia and Africa. As more individuals move to cities for improved job opportunities and living conditions, the need for efficient and adaptable transportation solutions has increased significantly. For instance, The United Nations, 2018 Revision of World Urbanization Prospects projects that by 2050, nearly 60% of the global population will reside in urban areas, with significant growth concentrated in a few countries.

In addition, technological advancements are fueling market growth, particularly through the integration of artificial intelligence (AI) and mobile applications. These technologies enhance the efficiency of on-demand transportation services by enabling real-time tracking, dynamic pricing models, and improved safety features. Moreover, the widespread adoption of smartphones has made it easier for consumers to access these services through user-friendly apps, allowing seamless booking and payment processes.

Economic considerations further drive the growth of the on-demand transportation industry. Rising fuel prices and the high costs associated with vehicle ownership are prompting consumers to seek more economical alternatives. On-demand services such as ride-sharing and carpooling enable users to share expenses while enjoying the convenience of private transport without the burdens of maintenance or parking. This shift toward shared mobility solutions prioritizes flexibility and cost-effectiveness, making on-demand transportation an attractive choice for a growing number of consumers.

Type Insights

The four wheeler segment dominated the market with a revenue share of 89.3% in 2024, primarily due to its widespread acceptance and versatility. This segment's appeal lies in its ability to offer a comfortable and secure travel experience, accommodating various passenger needs, from families to business professionals. The convenience of booking through mobile applications enhances user experience, enabling features such as ride tracking and upfront pricing. Furthermore, as urban areas continue to expand and public transportation systems struggle to keep pace, the demand for reliable four wheeler services is expected to grow.

The micro mobility segment is projected to grow at the highest CAGR during the forecast period, as urban areas face increasing traffic congestion and environmental concerns. Micro mobility options like e-bikes and scooters provide a flexible and affordable choice for short-distance travel. These options are especially attractive to younger consumers who value sustainability and convenience. With cities introducing stricter regulations to encourage environmentally friendly transportation, these alternatives are expected to become more popular. For instance, Velivert launched France's third fully electric bike-sharing system, supporting Saint-Étienne Métropole's ambitious cycling plan to triple bike trips in the region by 2029.

Service Insights

The car rental segment dominated the market with the highest market share in 2024 due to its ability to cater to both leisure and business travelers seeking flexibility without the long-term commitment of vehicle ownership. The rise in tourism and business travel has bolstered demand for rental services, with many consumers opting for rentals as a cost-effective solution amidst rising fuel prices and maintenance costs associated with personal vehicles. In addition, advancements in online booking platforms have simplified the rental process, further driving market growth.

The e-hailing segment is expected to grow at the highest CAGR over the forecast period as more consumers embrace app-based ride services for convenience and accessibility. As urban populations expand and traffic congestion worsens, e-hailing services are becoming an attractive solution for commuters looking for quick and reliable transport options without the need for personal vehicle ownership. Moreover, partnerships between e-hailing companies and public transit systems are emerging, creating integrated mobility solutions that enhance user convenience. For instance, Atlanta, GA, has integrated its transit app, MARTA on the Go, with the Uber app, allowing commuters to easily request a ride upon reaching their final public transit destinations. This collaboration enhances convenience for users by streamlining their travel experience and providing seamless access to ride-hailing services after using public transit.

Connectivity Insights

The V2V segment dominated the market with the highest revenue share in 2024 due to advancements in technology that enhance safety and efficiency on the roads. V2V systems enable vehicles to communicate with each other about their speed, direction, and location, significantly reducing the risk of accidents by providing drivers with real-time alerts about potential hazards. This technology improves road safety and contributes to smoother traffic flow by enabling better vehicle coordination. As automakers increasingly incorporate V2V capabilities into their vehicles and governments promote smart city initiatives that rely on connected infrastructure, this segment is expected to see sustained investment and growth.

The V2P segment is expected to grow at the highest CAGR over the forecast period as cities implement smart infrastructure solutions aimed at enhancing pedestrian safety through real-time communication between vehicles and pedestrians. For instance, The Federal Highway Administration has launched the Vehicle-to-Pedestrian (V2P) Technology Test Bed to evaluate systems designed to enhance pedestrian safety. This initiative focuses on reducing vehicle-pedestrian collisions by enabling vehicles to detect and communicate with vulnerable pedestrians using advanced sensors and communication technologies. V2P technology allows vehicles to detect pedestrians in their vicinity and communicate potential hazards or intentions through alerts or notifications. This capability is crucial in urban environments where pedestrian traffic is high, and accidents can occur frequently. With increasing focus on creating safer streets for all users, especially vulnerable populations such as children and the elderly, cities are investing in technologies that support V2P communication systems.

Regional Insights

The North America on-demand transportation market dominated the market with a revenue share of 35.2% in 2024, due to its advanced technological infrastructure and high consumer adoption rates. The widespread availability of smartphones and high-speed internet facilitates easy access to ride-hailing and other on-demand services, making them a preferred choice for urban mobility. In addition, a supportive regulatory environment encourages the growth of these services while ensuring safety and quality. Rising costs associated with vehicle ownership, such as fuel and maintenance, further drive consumers toward more economical alternatives such as ride-hailing and car-sharing.

U.S. On-demand Transportation Market Trends

The U.S. on-demand transportation market is experiencing growth as consumers increasingly turn to ride-hailing and car-sharing services for their daily commutes. In addition, rising costs associated with vehicle ownership, such as maintenance and fuel, are driving individuals to seek more economical alternatives, making on-demand transportation a preferred choice in urban areas. For instance, according to the American Public Transportation Association, more than three in four Americans (77%) view public transit as essential to a multi-transit lifestyle that incorporates current and future technologies, including ride-hailing services such as Uber and Lyft, bike sharing, car sharing, and autonomous vehicles.

Europe On-demand Transportation Market Trends

In Europe, the on-demand transportation market is thriving due to increasing urbanization and a growing interest in shared mobility solutions. With a rising population demanding flexible transportation options, countries such as Germany and France are leading the way in deploying ride-hailing, car-sharing, and bike-sharing services. Digital platforms facilitate seamless access to these services, while advancements in electric and autonomous vehicles are expected to enhance efficiency and safety, addressing both consumer needs and environmental concerns.

Asia Pacific On-demand Transportation Market Trends

The Asia Pacific region is expected to grow at the highest CAGR of the on-demand transportation industry during the forecast period. The Asia Pacific on-demand transportation market is poised for rapid expansion driven by urbanization and a growing population seeking efficient mobility solutions. As cities grow and more people migrate from rural areas, there is heightened demand for accessible transportation options. Rising disposable incomes and a preference for convenience are further propelling the adoption of ride-hailing and car-sharing services. Government initiatives aimed at improving transportation infrastructure and promoting smart mobility solutions are also expected to play a crucial role in enhancing market growth across the region.

China dominated the regional on-demand transportation market in 2024, owing to increasing fuel prices and limited parking spaces, encouraging consumers to opt for on-demand services, enhancing their convenience and cost-effectiveness. Also, the rise in smartphone penetration facilitates easier access to transportation services, further fueling the market growth. For instance, according to the DATAREPORTAL Digital 2023: China report, China had 1.05 billion internet users, representing a penetration rate of 73.7%.

Key On-demand Transportation Company Insights

The on-demand transportation industry is characterized by the presence of several key players that significantly influence its dynamics. Key players in the on-demand transportation market include Uber Technologies, Inc., Lyft, Inc., and Grab, each significantly shaping the industry's landscape. Uber remains a dominant force globally, offering a wide range of services from ride-hailing to food delivery. Lyft focuses primarily on the North American market, emphasizing its commitment to sustainability and community engagement through initiatives such as carbon offsetting for rides.

-

Uber Technologies, Inc. is known for transforming the ride-hailing industry with its innovative mobile app. The company connects riders with drivers and offers various services, including food delivery through Uber Eats and freight transport solutions. Uber's adaptability to market demands, such as introducing shared ride options and expanding into logistics, has solidified its status as a dominant force in the global transportation landscape.

-

Lyft, Inc. is primarily recognized for its ride-hailing services. The company emphasizes user experience and community engagement, promoting sustainability through initiatives such as carbon offsetting for rides. Lyft has diversified its offerings to include bike-sharing and scooter rentals, enhancing urban mobility solutions. Lyft's commitment to improving the rider experience and building partnerships with public transit systems is shaping its role in the evolving transportation industry.

Key On-demand Transportation Companies:

The following are the leading companies in the on-demand transportation market. These companies collectively hold the largest market share and dictate industry trends.

- Uber Technologies, Inc.

- Lyft, Inc.

- Ola Electric Mobility Pvt Ltd.

- Grab

- Beijing Xiaoju Technology Co, Ltd.

- Bolt Technology OÜ

- Gojek Tech

- FREE NOW GmbH

- Maxi Mobility SL

- Gett

Recent Development

-

In September 2024, Waymo and Uber announced an expansion of their partnership to introduce autonomous ride-hailing services in Atlanta and Austin. This collaboration aims to integrate Waymo's self-driving technology into Uber's platform, enhancing the availability of autonomous rides for users in these cities.

On-demand Transportation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 189.6 million

Revenue forecast in 2030

USD 473.0 million

Growth rate

CAGR of 20.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, connectivity, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa

Key companies profiled

Uber Technologies, Inc.; Lyft, Inc.; Ola Electric Mobility Pvt Ltd.; Grab ; Beijing Xiaoju Technology Co, Ltd. ; Bolt Technology OÜ; Gojek Tech; FREE NOW GmbH; Maxi Mobility SL; Gett

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global On-demand Transportation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global On-demand transportation market report based on type, service, connectivity, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Four Wheeler

-

Micro Mobility

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

E-hailing

-

Car Sharing

-

Car Rental

-

Station-based Mobility

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

V2V

-

V2I

-

V2P

-

V2N

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.