- Home

- »

- Next Generation Technologies

- »

-

Online Advertising Market Size, Share, Industry Report, 2033GVR Report cover

![Online Advertising Market Size, Share & Trends Report]()

Online Advertising Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Native Advertising, Video Advertising, Display Advertising), By Platform (Mobiles, Laptops, Desktops & Tablets), By Pricing Model, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-088-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Advertising Market Summary

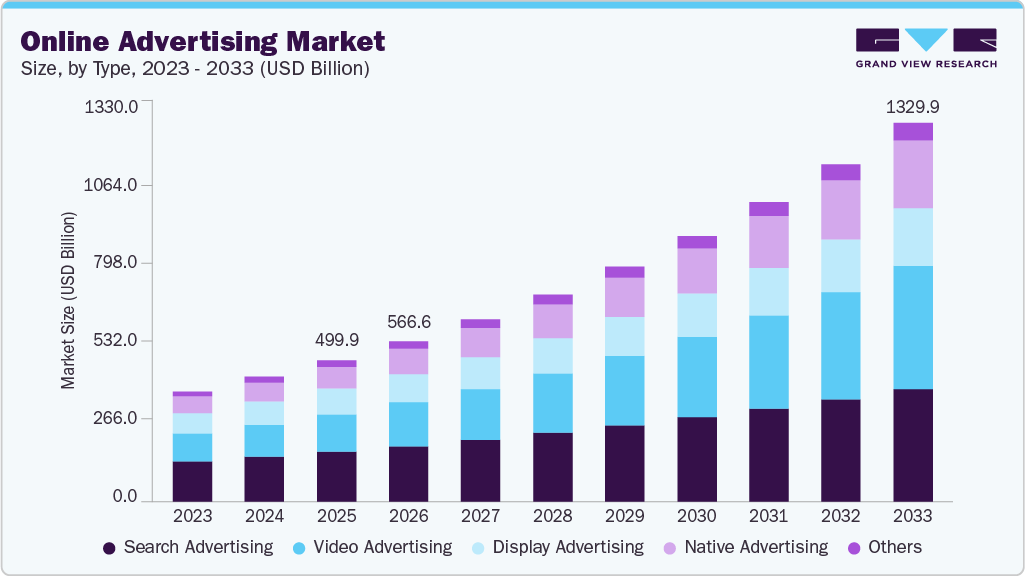

The global online advertising market size was estimated at USD 499.95 billion in 2025 and is projected to reach USD 1,329.88 billion by 2033, growing at a CAGR of 13.0% from 2026 to 2033. The market growth is primarily driven by the explosive expansion of e-commerce and digital commerce platforms, which require targeted ad spending, surging smartphone penetration enabling mobile-first ad formats, and AI-driven personalization that boosts engagement through dynamic creative optimization and predictive targeting across search, social, video, and retail media channels.

Key Market Trends & Insights

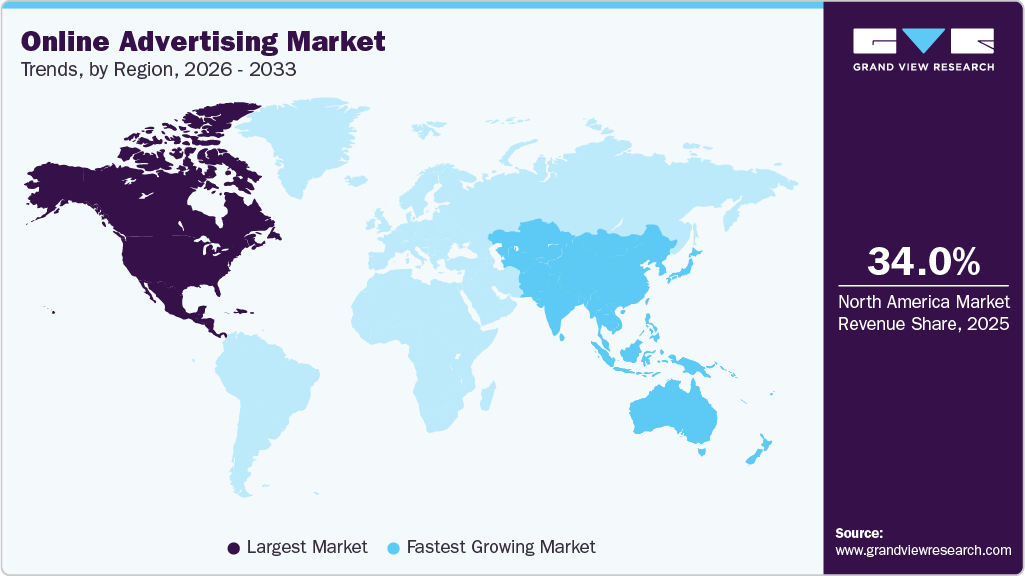

- North America dominated the global online advertising industry with the largest revenue share of over 34% in 2025.

- The Asia Pacific online advertising industry is expected to grow at the fastest CAGR of over 15% from 2026 to 2033.

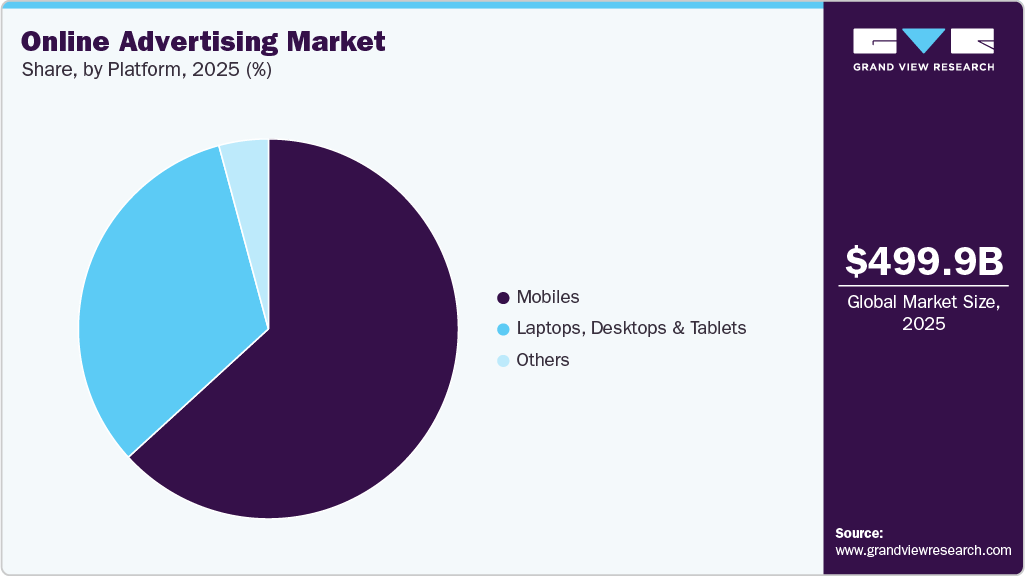

- By platform, mobiles led the market, holding the largest revenue share of 59% in 2025.

- By pricing model, the cost per click pricing model is expected to grow at the fastest CAGR of over 13% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 499.95 Billion

- 2033 Projected Market Size: USD 1,329.88 Billion

- CAGR (2026-2033): 13.0%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

The availability of diverse ad formats and digital channels is significantly influencing the growth of the online advertising industry. Businesses now have access to a wide range of options such as display ads, search engine marketing, social media ads, video ads, and native ads, allowing them to tailor campaigns for maximum effectiveness. This flexibility enables advertisers to experiment and identify the most impactful formats for their specific audiences and objectives, thereby enhancing the overall online advertising industry.

The growing access to user data and advanced analytics tools is propelling the online advertising industry forward. Digital platforms collect vast amounts of behavioral and demographic information, which advertisers can utilize to create highly personalized and targeted campaigns. Real-time performance tracking and analytics capabilities further enable continuous optimization, leading to better returns on investment and higher engagement rates, fueling the online advertising industry.

Furthermore, the rapid rise of mobile devices such as smartphones and tablets is reshaping the online advertising industry. Consumers are spending more time on mobile platforms than on desktops, and advertisers are increasingly focusing on mobile-first strategies. Mobile devices convenience, portability, and constant connectivity allow businesses to reach users across various environments and timeframes, enhancing ad visibility and effectiveness, thereby supporting overall market growth.

Moreover, the integration of mobile apps and browsers into everyday life presents valuable opportunities for brand engagement. Consumers turn to mobile platforms for entertainment, shopping, and services, and advertisers can deliver relevant and timely messages that resonate with their target audience. This growing dependence on mobile technology is contributing to the expansion of the online advertising industry.

Type Insights

The search advertising segment dominated the market with a revenue share of over 33% in 2025, driven by its high-intent user targeting, precise keyword matching, and measurable ROI through click-through and conversion tracking. In addition, AI-powered personalization enhances ad relevance and bidding efficiency on platforms such as Google and Bing, while mobile search dominance and seamless e-commerce integrations such as Google Shopping capture impulse purchases, amid privacy regulations via first-party data strategies.

The video advertising segment is expected to witness the fastest CAGR of 16% from 2026 to 2033. This growth is attributed to the rapid surge in online video consumption across platforms such as YouTube, TikTok, Instagram Reels, and OTT services, as well as the superior engagement and view-through rates that video formats deliver compared to static display ads. Advertisers are increasingly shifting budgets toward short-form and shoppable video ads that support richer storytelling, precise audience targeting, and measurable performance, while improvements in mobile bandwidth, 5G rollout, and programmatic video buying further accelerate adoption globally.

Pricing Model Insights

The cost per mille pricing model (CPM) segment accounted for the largest market share in 2025, owing to the strong brand visibility potential, allowing advertisers to pay for every thousand impressions, making it ideal for awareness-focused campaigns. The rising consumption of online video content, social media, and streaming services provides advertisers with high-traffic platforms to maximize impressions. The integration of advanced targeting technologies, including AI-driven audience segmentation, enhances the effectiveness of CPM. Brands looking to maintain top-of-mind awareness increasingly turn to CPM to ensure consistent exposure, further accelerating demand in this segment.

The cost per click pricing model segment is expected to witness the fastest CAGR from 2026 to 2033. This growth is driven by its performance-based nature, allowing advertisers to pay only when users actively engage with their ads, making it a cost-effective strategy for businesses of all sizes. The rise of programmatic advertising and automation tools has also simplified the deployment and management of CPC campaigns across multiple platforms. Small and medium-sized enterprises (SMEs) increasingly adopt CPC models due to their scalability and budget flexibility, further propelling segment growth.

End Use Insights

The retail and consumer goods segment accounted for the largest market share in 2025, owing to businesses in this industry increasingly turning to advanced online advertising solutions to meet the evolving demands of tech-savvy consumers. The rise of e-commerce and the growing demand for personalized shopping experiences drive companies to invest heavily in digital marketing strategies. The increasing penetration of mobile devices and the growing importance of social media and influencer marketing are also fueling the adoption of online advertising within the retail and consumer goods sector, further propelling segmental growth.

The BFSI segment is expected to witness the fastest CAGR from 2026 to 2033. Financial institutions increasingly adopt digital strategies to engage a tech-savvy customer base. The proliferation of mobile banking apps and digital financial services, video content is being used to simplify user onboarding, highlight service benefits, and personalize customer interactions. Integrating data-driven targeting and real-time analytics allows BFSI advertisers to optimize video campaigns for maximum ROI and customer retention. This strategic use of video advertising enhances brand visibility and credibility, contributing to the rapid expansion of the BFSI segment within the online advertising industry.

Platform Insights

The mobile segment accounted for the largest market share in 2025, owing to the surge in mobile device usage and the increasing preference for accessing content through smartphones and tablets. With the proliferation of high-speed internet and affordable mobile data plans, consumers are spending more time on mobile platforms, leading advertisers to prioritize mobile-optimized campaigns. Mobile advertising allows for precise targeting through location data, real-time engagement, and personalized user experiences, which enhance campaign performance and ROI. These advantages, coupled with rising mobile commerce and app usage, are key drivers contributing to the dominance of the mobile segment in the online advertising industry.

The laptops, desktops & tablets segment is expected to witness a significant CAGR from 2026 to 2033. Businesses increasingly leverage desktop-based digital ad formats such as display banners, pop-ups, and in-stream video ads to target users during work or research-related activities. Enterprises are investing in cross-platform ad strategies that synchronize messages across laptops and desktop devices, enhancing campaign reach and consistency. The growing popularity of hybrid work models and remote learning has further increased time spent on laptops and tablets, providing advertisers with expanded opportunities to reach target audiences through these platforms.

Regional Insights

North America online advertising industry accounted for the largest share of over 34% in 2025, primarily driven by the region’s advanced digital infrastructure, high internet penetration, and widespread adoption of smartphones and connected devices. Businesses across industries are increasingly leveraging data-driven and programmatic advertising solutions to enhance targeting and improve campaign effectiveness. The growing popularity of streaming services, social media, and e-commerce platforms is fueling demand for personalized and interactive ad formats, further supporting the growth of the market.

U.S. Online Advertising Market Trends

The U.S. online advertising industry is expected to grow at a CAGR of over 10% from 2026 to 2033, driven by the country’s highly mature digital infrastructure and leadership in programmatic advertising technologies. The widespread adoption of connected TV (CTV) and over-the-top (OTT) media services is also fueling investment in digital video advertising. Increasing demand from sectors such as retail, entertainment, and political campaigns, especially during national election cycles, contributes to sustained online ad spend, reinforcing the U.S. as a global leader in the online advertising industry.

Europe Online Advertising Market Trends

The Europe online advertising industry is expected to grow at a CAGR of over 12% from 2026 to 2033. The region's growth is primarily driven by increasing digital transformation across industries and the widespread adoption of advanced technologies in marketing strategies. The rising penetration of high-speed internet and mobile devices across the continent has expanded access to digital platforms, enhancing the effectiveness of online campaigns. The growing emphasis on personalized and immersive advertising experiences supported by AI, programmatic advertising, and AR technologies is also reshaping how brands engage with consumers, driving demand for the targeted online advertising industry.

The UK online advertising industry is expected to grow significantly in the coming years. The country benefits from a robust digital infrastructure, high internet penetration, and a mature e-commerce ecosystem. Government initiatives supporting digital innovation and the growing importance of privacy-compliant advertising solutions under GDPR are shaping a resilient and forward-looking online advertising environment in the region.

The Germany online advertising industry is fueled by the country’s advanced digital infrastructure and a tech-savvy population that increasingly consumes content across digital platforms. The growing adoption of programmatic advertising and the rise of mobile and video-based content consumption further support the evolution of the online advertising industry in Germany.

Asia Pacific Online Advertising Market Trends

Asia Pacific online advertising industry is expected to grow at a CAGR of over 15% from 2026 to 2033, driven by the region’s rapid digital transformation and increasing smartphone penetration. India is witnessing a surge in digital ad spending due to the proliferation of affordable smartphones and data plans, and a booming youth population highly engaged with social media. The Region is leveraging advanced technologies such as AI and machine learning to deliver personalized and automated ad experiences. The region's growing startup ecosystem and rising adoption of programmatic advertising further accelerate the expansion of the market across Asia Pacific.

The Japan online advertising industry is gaining traction, driven by the country’s advanced digital infrastructure and strong mobile connectivity. Japan's tech-savvy population and widespread smartphone adoption have accelerated the shift from traditional media to digital platforms. Leading brands and agencies increasingly invest in advertising, influencer marketing, and data-driven campaigns to reach consumers more effectively. Japan’s aging population has prompted brands to develop tailored ad content for older demographics, emphasizing ease of use and accessibility, supporting sustained market growth in the online advertising industry.

The China online advertising industry is rapidly expanding. China's strong emphasis on digital transformation and growing e-commerce ecosystem are key drivers of the market in the region. The proliferation of mobile devices and the dominance of super apps like WeChat and Douyin have created highly integrated ecosystems for targeted advertising and consumer interaction. With increasing investments in data analytics and automation, the Chinese market continues to evolve as a global leader in the online advertising industry.

Key Online Advertising Company Insights

Some of the key players operating in the market include Google LLC (Alphabet) and Facebook, Inc. (Meta Platforms) among others

-

Google LLC (Alphabet) is a global technology company that dominates the market, offering a wide range of advertising services through Google Ads, YouTube, and its vast network of third-party sites. Google’s advanced algorithms, vast data infrastructure, and dominance in search engine and video advertising position it as a key player in the online advertising space. By leveraging its AI-driven solutions and massive user base, Google enables businesses to create highly targeted and effective ad campaigns, driving growth and performance across industries.

-

Facebook, Inc. (Meta Platforms) is a leading social media giant that operates Facebook, Instagram, and WhatsApp, providing highly targeted advertising solutions for businesses worldwide. Through advanced targeting algorithms and its massive user base, Meta delivers precise ad placements, enhancing customer engagement. The company continues to evolve its advertising offerings by integrating emerging technologies such as artificial intelligence (AI) and augmented reality (AR), making it a powerful force in the market, especially in social media and mobile ad spaces.

Adform and Equativ are some of the emerging market participants in the online advertising industry.

-

Adform is a European digital advertising technology company offering a fully integrated Demand-Side Platform, Data Management Platform, and Advertising Server suite. It specializes in identity solutions, omnichannel buying, measurement tools, and real-time audience activation. Adform supports brands with privacy-forward advertising solutions, aligning with strict GDPR requirements. The company is deeply embedded in regional publisher ecosystems, enabling advanced programmatic trading and transparent media buying for European advertisers.

-

Equativ, previously known as Smart AdServer, provides an independent ad monetization and programmatic technology stack, including an SSP, ad server, and data activation tools. The company focuses on empowering direct publishers and conducting transparent ad auctions. Equativ enables publishers to maximize ad revenues through curated marketplaces and privacy-first audience targeting. Its strong regional presence helps media owners access premium demand and maintain control over inventory amid evolving regulatory frameworks.

Key Online Advertising Companies:

The following are the leading companies in the online advertising market. These companies collectively hold the largest market share and dictate industry trends.

- Apple, Inc.

- Google LLC (Alphabet)

- Facebook, Inc. (Meta Platforms, Inc.)

- Microsoft Corporation

- Amazon.com, Inc.

- Twitter, Inc.

- The Trade Desk

- Adobe

- Adform

- Equativ

Recent Developments

-

In May 2025, The Trade Desk. announced the launch of OpenSincera, a new application designed to provide greater visibility into advertising performance and the health of the digital advertising supply chain. OpenSincera, which is free and open to all participants in the advertising industry, leverages Sincera’s rich advertising metadata to deliver deeper insights into advertising quality. The application provides key metrics such as ads-to-content ratio, page weight, average ads-in-view, and ad refresh rate, offering valuable data to optimize ad campaigns across the ecosystem.

-

In May 2025, Meta Platforms, Inc. announced a series of ad updates for its platforms Facebook, Instagram, and Threads at NewFronts 2025. These updates include enhanced tools for creator collaborations, a new method for advertising within trending Reels, updated Partnership Ads, and the introduction of video ads on Threads. Initially, Instagram is testing "Reels trending ads," which will allow brands to showcase their promotions alongside popular Reels content.

-

In March 2025, Adobe announced a strategic collaboration with Amazon Web Services (AWS) and Amazon Ads. The collaboration enhances the Adobe Experience Platform (AEP) with AWS’s generative AI services, Amazon Connect, and Amazon Ads to support the creation of high-impact, data-driven advertising and customer engagement. Adobe Creative Cloud integrations with Amazon Ads will enable streamlined creative workflows, allowing for efficient, compliant ad production.

Online Advertising Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 566.58 billion

Revenue forecast in 2033

USD 1,329.88 billion

Growth rate

CAGR of 13.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, pricing model, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; K.S.A.; UAE; South Africa

Key companies profiled

Apple Inc.; Google LLC (Alphabet); Meta Platforms Inc. (formerly Facebook); Microsoft Corporation; Amazon.com Inc.; Twitter Inc.; The Trade Desk; Adobe; Adform; Equativ

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Online Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the online advertising market report based on type, platform, pricing model, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Native Advertising

-

Video Advertising

-

Search Advertising

-

Display Advertising

-

Full-Screen Interstitials

-

Others

-

-

Platform Outlook (Revenue, USD Billion, 2021 - 2033)

-

Mobiles

-

Laptops, Desktops & Tablets

-

Others

-

-

Pricing Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

Flat Rate Pricing Model

-

Cost Per Mille Pricing Model

-

Cost Per Click Pricing Model

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Media & Entertainment

-

BFSI

-

Education

-

Retail & Consumer Goods

-

IT & Telecom

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

K.S.A

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online advertising market size was estimated at USD 499.95 billion in 2025 and is expected to reach USD 566.58 billion in 2026.

b. The global online advertising market is expected to grow at a compound annual growth rate of 13.0% from 2026 to 2033 to reach USD 1,329.88 billion by 2033.

b. North America accounted for the largest share of over 34% in 2024 primarily driven by the region’s advanced digital infrastructure, high internet penetration, and widespread adoption of smartphones and connected devices. Businesses across industries are increasingly leveraging data-driven and programmatic advertising solutions to enhance targeting and improve campaign effectiveness.

b. Some key players operating in the online advertising market include Apple Inc.; Google LLC (Alphabet); Meta Platforms Inc. (formerly Facebook); Microsoft Corporation; Amazon.com Inc.; Twitter Inc.; The Trade Desk; Adobe; Adform; Equativ

b. The growth of online advertising market is anticipated to grow rapidly in recent years owing to factors including high internet penetration, growth in e-commerce, the emergence of high-speed internet, rise in advertising spends on digital media across various industries, increase in popularity of streaming platforms, and increasing awareness about digital marketing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.