- Home

- »

- Next Generation Technologies

- »

-

Online Language Learning Market Size, Industry Report 2030GVR Report cover

![Online Language Learning Market Size, Share & Trends Report]()

Online Language Learning Market (2025 - 2030) Size, Share & Trends Analysis Report By Learning Mode (Self-Learning Apps, Tutoring), By End-use (Individual Source, Educational Institutions), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-585-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Language Learning Market Summary

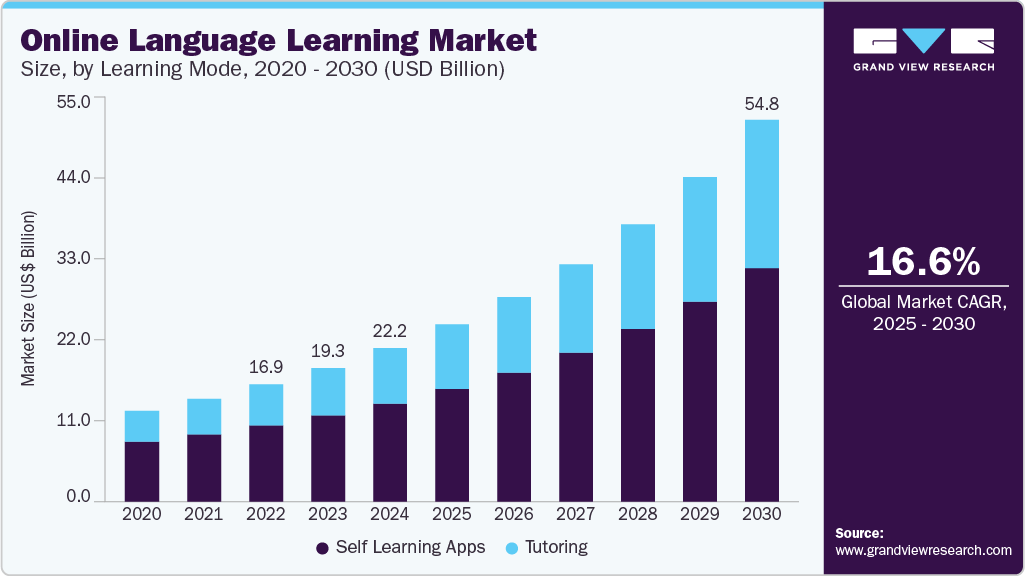

The global online language learning market size was estimated at USD 22115.7 million in 2024 and is projected to reach USD 54833.2 million by 2030, growing at a CAGR of 16.6% from 2025 to 2030. The growth is driven by the expansion of global business operations, international education and travel, and the demand for culturally competent employees.

Key Market Trends & Insights

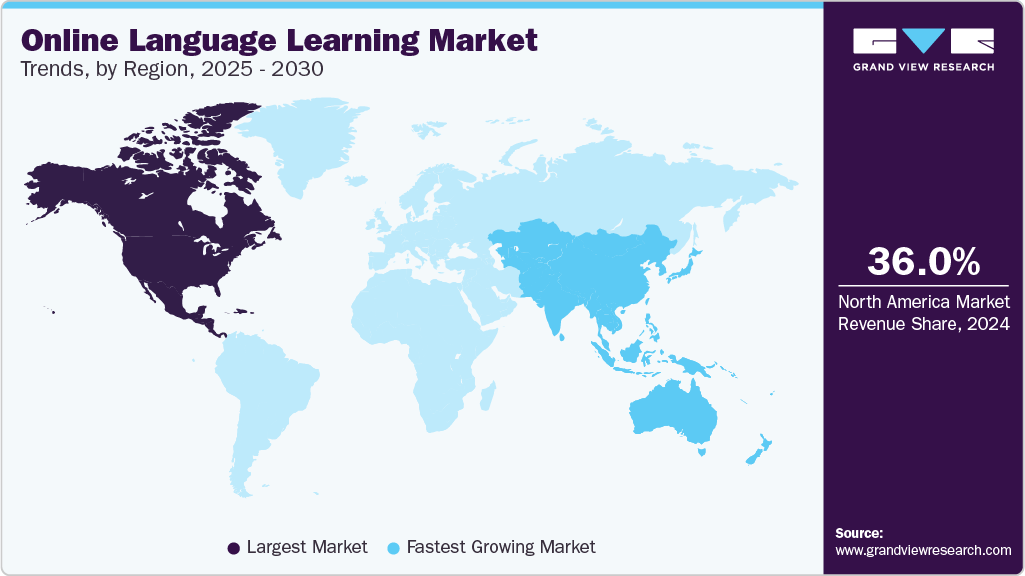

- North America online language learning industry dominated globally with a 36.0% share in 2024.

- The Online Language Learning industry in the U.S. is experiencing rapid growth.

- By learning mode, the self-learning apps segment held the largest revenue share of 64.2% in 2024.

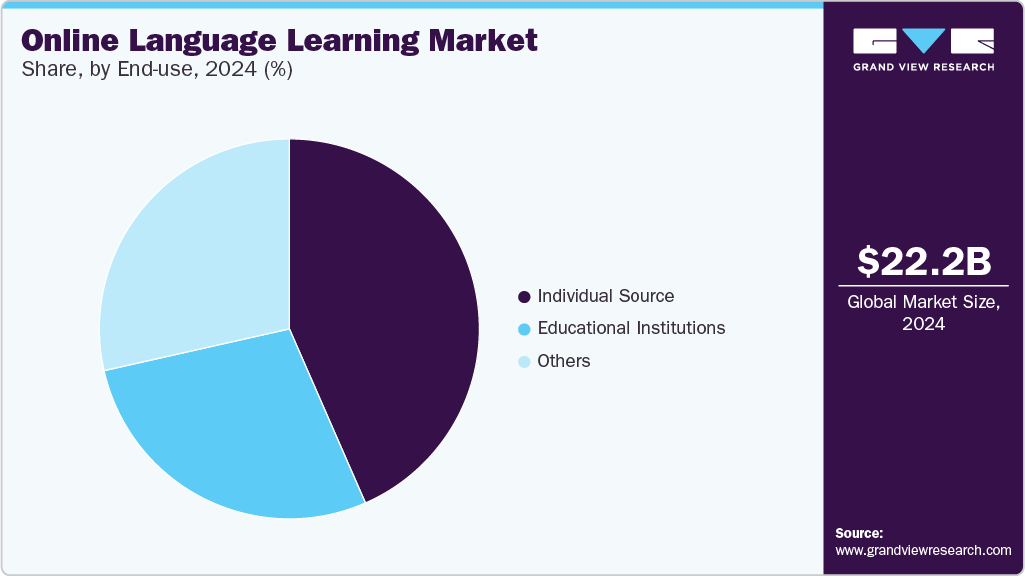

- By end use, the individual source segment held the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22115.7 Million

- 2030 Projected Market Size: USD 54833.2 Million

- CAGR (2025-2030): 16.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological advancements-such as AI-powered language apps, virtual classrooms, and mobile learning platforms-have also made language learning more accessible, flexible, and personalized, thus growing the online language learning industry globally. In addition, the COVID-19 pandemic accelerated digital adoption in education, increasing the popularity of online platforms for self-paced and remote language learning. As a result, individuals and institutions alike are increasingly turning to online tools to develop multilingual capabilities to satisfy the demand of the online language learning industry.

The online language learning industry is observing fast expansion, mainly driven by globalization, the rising need for multilingual capabilities, and the widespread adoption of e-learning platforms. The increasing connection of global trade, migration, international travel, and education has increased the importance of cross-border communication, making language proficiency more important than ever. Multilingualism is becoming an in-demand skill in the global workforce, especially as multinational companies look for employees with diverse language abilities. The expansion of online platforms such as Duolingo, Babbel, and Coursera has made language education more accessible, flexible, and cost-effective.

Technological innovations, including AI, virtual reality (VR) and augmented reality (AR), and mobile learning apps, have significantly improved the user experience by enabling personalized, interactive, and engaging learning environments. Greater internet access and smartphone usage, particularly in developing regions, have further expanded the reach of these platforms. In addition, language learning supports cross-cultural understanding and communication, an essential component of effective global interaction.

Learning Mode Insights

The self-learning apps segment held the largest revenue share of 64.2% in 2024, driven by technological advancements for transforming language learning, with the integration of AI, AR/VR, machine learning, and wearable devices such as Google Glass and HoloLens enabling more personalized, immersive, and adaptable learning experiences. Key initiatives by major players in the market are augmenting the market growth. For instance, in September 2024, Duolingo introduced a suite of new AI-powered features designed to enhance personalized learning and engagement on its platform at Duocon 2024. These innovations include advanced conversational exercises and smarter lesson recommendations, leveraging cutting-edge artificial intelligence to make language learning more effective and enjoyable for users globally.

The tutoring segment registered a CAGR of 18.1% from 2025 to 2030. This growth is primarily driven by the flexibility and accessibility that the tutoring services industry provides. The rise in demand for specialized learning and test preparation is significantly driving the market’s growth. Many students seek additional support for competitive exams such as the SAT, GRE, and GMAT, and online tutoring platforms are well-positioned to cater to this need with on-demand and targeted learning modules. Moreover, parents and guardians increasingly invest in online tutoring services for personalized educational support, seeing it as a valuable supplement to traditional schooling. Advanced technologies such as AI-driven analytics also allow for personalized progress tracking, which improves outcomes and engagement.

End Use Insights

The individual source segment held the largest market revenue share in 2024. This segment is driven by greater internet access and the widespread adoption of mobile technology, which supports convenient, on-demand learning from anywhere and anytime. It also considers strong self-regulation skills such as time management, motivation, goal planning, etc. The growing preference for personalized, AI-driven learning solutions enhances user engagement and improves learning outcomes, such as lifelong learning. The popularity of self-learning apps and the appeal of personalized, on-demand content continue to attract more individual users globally. Factors fueling this trend include the widespread adoption of mobile devices, increased internet accessibility, and the integration of AI-powered, gamified learning experiences. Moreover, the use of gamification, bite-sized content, and unique design is making language learning more attractive and accessible to a wider range of learners across the globe.

The educational institutions segment is projected to grow significantly over the forecast period. This segment is driven by performance expectation, where institutions look at clear benefits in improving teaching habits and learning outcomes through technology. Ease of use is important; flexible and accessible platforms encourage engagement by both educators and students. For instance, the Education University of Hong Kong (EdUHK) launched a free online platform called "Learning English with Little Leaf" to support English learning among primary school students. The platform offers curriculum-aligned resources such as videos, interactive e-books, lesson plans, and quizzes. It aims to enhance students’ English skills through fun and engaging stories and activities that can be used both in classrooms and at home. Social influence from peers, institutional policies, and cultural events shapes positive attitudes toward technology adoption. Providing conditions such as strong infrastructure, technical support, and training is essential for successful implementation.

Regional Insights

North America online language learning industry dominated globally with a 36.0% share in 2024. The significant market share of this segment is mainly due to the growing use of self-learning applications and the integration of information and communication technology (ICT) in educational settings. Major initiatives by key players in this region are driving the market growth. For instance, in December 2024, the AI-powered language learning startup raised $78 million in a series C funding round led by Accel, with participation from the OpenAI Startup Fund, Khosla Ventures, and Y Combinator. The new investment doubles Speak’s valuation to $1 billion and will support the expansion of its innovative English learning app, which leverages OpenAI’s technology for real-time conversation practice.

U.S. Online Language Learning Market Trends

The Online Language Learning industry in the U.S. is experiencing rapid growth driven by flexible and affordable pricing models, such as subscriptions and pay-as-you-go options, which have further broadened access to this market in this region. The integration of AI has greatly enhanced the learning experience, offering personalized lessons, adaptive learning paths, and real-time feedback that boost engagement and effectiveness.

Europe Online Language Learning Market Trends

The online language learning industry in Europe is experiencing prominent growth, mainly driven by Europe’s increasing globalization and the growing need for multilingual professionals. Also, the recent initiatives of the e-learning sector, with language learning playing a key role in its evolution. Technological advancements, particularly the integration of AI in educational platforms along with widespread internet access and the expansion of smartphones, are making online language education more accessible and effective.

Asia Pacific Online Language Learning Market Trends

The Asia Pacific online language learning industry is anticipated to register the fastest CAGR over the forecast period. The Asia-Pacific region presents strong growth opportunities for online language learning due to rising smartphone penetration, increasing demand for English proficiency in globalized job markets, and government initiatives supporting digital education. Expanding internet access in rural areas and the popularity of affordable self-learning apps further fuel market growth. Countries such as China, India, and Southeast Asian nations are key contributors to this expansion.

Key Online Language Learning Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Duolingo, Inc. offers mobile and web-based language learning platforms for individuals, schools, and universities. The company provides interactive, game-like lessons, flashcards, podcasts, and proficiency assessments like the Duolingo English Test. Its product range includes Duolingo for Schools, ABC, Math, Events, and Business, as well as user-generated courses via its incubator platform. Duolingo supports a diverse selection of languages, from widely spoken ones like Spanish and French to niche and fictional languages like High Valyrian and Klingon.

-

Busuu Ltd., now a subsidiary of Chegg, Inc., which offers web and mobile-based language learning courses in 12 languages to over 100 million users worldwide. Its platform provides lessons from beginner to upper-intermediate levels and allows users to practice with native speakers. Premium features include offline access, advanced grammar, quizzes, travel-focused lessons, and adaptive vocabulary tools. Supported languages include English, Spanish, French, German, Chinese, and more.

Key Online Language Learning Companies:

The following are the leading companies in the online language learning market. These companies collectively hold the largest market share and dictate industry trends.

- Duolingo, Inc

- Babbel GmbH

- Busuu Ltd

- Preply Inc.

- Rosetta Stone LLC.

- Berlitz Corporation

- italki HK Limited.

- Lingoda GmbH.

- inlingua International Ltd.

- Enux Education Limited

Recent Developments

-

In April 2025, Duolingo, Inc. significantly expanded its offerings by introducing 148 new language courses, strengthening itself in the online language learning space. This big expansion improves global access to language education and aligns with Duolingo’s mission to provide high-quality learning opportunities to users everywhere and every time. The new courses are available globally on both the Duolingo app and website.

-

In March 2025, Babbel GmbH, an online language learning platform, became the official language learning partner of Major League Soccer’s Inter Miami CF. Through this partnership, the team’s diverse players and staff represent over 15 nationalities who will have access to Babbel’s corporate language tools, including the Babbel App and Babbel Live virtual classes, to support better communication and team unity. Marking Babbel’s first collaboration with an MLS team, this partnership highlights the increasing importance of digital language learning in promoting multicultural collaboration in professional sports.

Online Language Learning Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25464.5 million

Revenue forecast in 2030

USD 54833.2 million

Growth rate

CAGR of 16.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Learning mode, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Duolingo, Inc; Babbel GmbH; Busuu Ltd; Preply Inc; Rosetta Stone LLC.; Berlitz Corporation; italki HK Limited.; Lingoda GmbH.; inlingua International Ltd.; Enux Education Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Language Learning Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online language learning market report based on learning mode, end use, and region:

-

Learning Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-Learning Apps

-

Tutoring

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual Source

-

Educational Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.