- Home

- »

- Next Generation Technologies

- »

-

Operator Training Simulator Market Size, Share Report, 2030GVR Report cover

![Operator Training Simulator Market Size, Share & Trends Report]()

Operator Training Simulator Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Operator (Console Operator, Field Operator), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-582-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Operator Training Simulator Market Trends

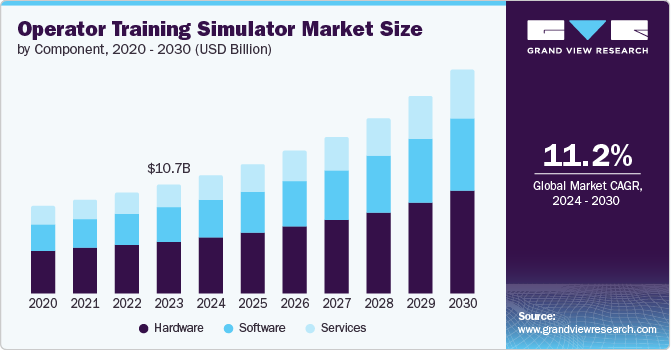

The global operator training simulator market size was valued at USD 10.69 billion in 2023 and is projected to grow at a CAGR of 11.2% from 2024 to 2030. A rising demand across organizations globally for skilled operators, growing concerns and stringent regulations concerning safety measures, and technological advancements in simulation technology are factors driving market growth.

An operator training simulator (OTS) is a computer-based simulation system that mimics the working environment using a dynamic simulation model. The system offers an economical solution for workforce training for various real-life situations and challenges. The integration of virtual and augmented reality, coupled with the adoption of sophisticated simulation software, has helped enhance the realism and effectiveness of training experiences. Technological innovations across industries have compelled organizations to opt for OTS solutions, which are expected to drive steady industry expansion.

Rising industrialization activities worldwide have led to the establishment of various heavy industries in developing and emerging economies, which is an essential driver for this market. Industries such as aviation, oil and gas exploration, petroleum refining, energy, and healthcare are subject to stringent safety protocols from regulatory authorities and local governments. Simulators provide a computer-generated, virtual reality-based controlled environment for operators to practice emergency procedures and comply with regulatory mandates. Furthermore, these simulators offer a cost-effective alternative to real-world training by minimizing equipment damage, reducing downtime, and improving operational efficiency, justifying their adoption among enterprises.

The application of operator training simulators is broadening beyond traditional sectors to encompass industries such as automotive, mining, construction, and medical & healthcare, thus substantially contributing to market advancement. These training simulators enable operators to encounter and manage hazardous situations in a safe and controlled setting, thereby minimizing the risk of accidents and improving safety culture. For instance, simulator systems are programmed with all possible breaking points and risky situations in a particular industry, and operators are trained for worst-case scenarios, thus making them capable of acting effectively in dangerous real-world situations.

Component Insights

Hardware components accounted for the leading market share of 48.3% in 2023. It serves as the fundamental building block upon which operator training simulators are designed. Components such as processors, graphics cards, input/output devices, and specialized peripherals are essential for creating immersive and realistic training environments. Additionally, continuous innovations in hardware technology, in terms of increased processing power, enhanced graphics capabilities, and miniaturization, have directly contributed to this segment's dominance. These advancements enable the development of more sophisticated and complex simulation scenarios, significantly improving operator skills.

The services segment is expected to register the fastest CAGR of 12.0% from 2024 to 2030. As OTS systems become more sophisticated in replicating real-world conditions accurately, the demand for expert services to install, configure, maintain, and upgrade these systems has risen proportionally. Notably, integration & deployment services account for a substantial share of this segment. Moreover, organizations increasingly seek to maximize the value derived from their OTS investments. Service providers offer performance optimization, training, and support services to enhance simulator utilization and effectiveness, leading to faster segment growth.

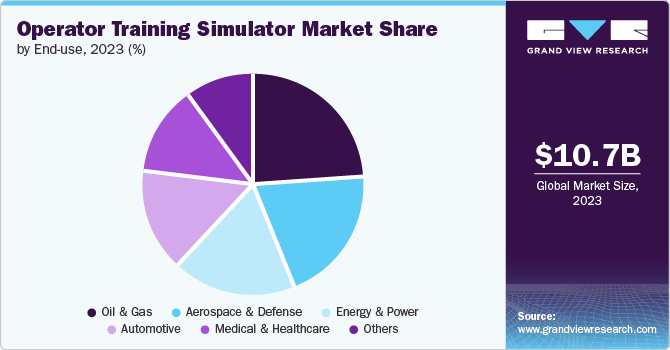

End Use Insights

The oil & gas sector accounted for the highest market share in 2023. The industry's inherently complex and high-risk operational environments compel management to arrange rigorous training sessions for its personnel to ensure worker safety, efficiency, and environmental protection. Operator training simulators provide a controlled environment to replicate real-world challenges, mitigating potential risks and financial losses. Moreover, stringent regulatory frameworks governing safety and environmental standards in the oil and gas industry require comprehensive operator training programs. Simulators offer a structured approach to meet these compliance requirements, accounting for this sector's dominance.

The medical & healthcare sector is expected to register the fastest CAGR during the forecast period. The healthcare industry places an unparalleled emphasis on patient safety. Operator training simulators offer a controlled environment to equip medical professionals with the requisite skills and knowledge to handle complex procedures and emergencies, thereby mitigating risks to patient health. Additionally, advancements in medical technology have led to the emergence of increasingly complex procedures and equipment. Simulators provide a platform for healthcare providers to master them without compromising patient well-being. As innovations in the healthcare sector continue with sophisticated technologies, the demand for OTS systems is expected to increase proportionally.

Operator Insights

The console operator segment held the highest market revenue share in 2023. Console operators are required to manage intricate systems and processes that demand high technical proficiency and decision-making ability. Simulator-based training provides a controlled environment to develop these critical skills effectively, mitigating the risks and high costs associated with on-the-job learning. It mainly applies to energy, aerospace, and manufacturing industries that are subject to stringent safety and operational standards.

The field operator segment is expected to grow at the fastest CAGR over the forecast period. Industries with a significant field operator presence, such as oil & gas, manufacturing, and mining, have increasingly prioritized the implementation of safety protocols to improve working conditions. Operator training simulators offer a controlled environment to simulate hazardous situations, reducing on-the-job accidents and ensuring a safe environment. Furthermore, the complexity of modern machinery and processes demands highly skilled field operators. Simulators provide an affordable and efficient means to bridge the skill gap by offering hands-on experience without the risks encountered in real-world operations.

Regional Insights

North America led the market with a revenue share of 32.6% in 2023. The region possesses a diverse and mature industrial landscape, with critical sectors such as defense, aerospace, energy, manufacturing, and transportation driving advancements. These industries require highly skilled operators, boosting the demand for advanced training solutions. For instance, the airline industry utilizes flight simulators to train their pilots to operate various aircraft types. This option is affordable and environment friendly as there is no use of actual aircraft-grade fuel and subsequent air pollution. Such factors account for a significant demand for OTS systems in the regional market.

U.S. Operator Training Simulator Market Trends

The U.S. held the highest share of the regional market in 2023. The country is a major supplier of defense equipment, such as latest generation fighter jets and helicopters. Actual fighter pilot training on these aircraft may compromise the safety of operators and huge costs related to operational damages. OTS solutions offer a better alternative to industry stakeholders owing to the use of virtual reality simulators, which mimic the actual functional environments. These factors have led to a heightened demand from defense equipment manufacturers for such simulators in the country.

Europe Operator Training Simulator Market Trends

Europe accounted for a notable market share in 2023. The region is known for its industrial innovation across several sectors. The European Union closely monitors regulatory mandates in various sectors such as healthcare, aviation, oil and gas exploration, and automobile. Additionally, advancements in computer-generated graphics and design, such as Virtual Reality (VR), Extended Reality (XR), and Augmented Reality (AR), have caused a surge in the adoption of OTS solutions for comprehensive training programs. These factors are expected to drive steady regional demand growth over the forecast period.

The UK held a substantial share of the European market in 2023. This is owing to the country’s established industrial environment, which obliges stakeholders to employ cutting-edge solutions for enhanced operational efficiency and superior workplace safety. Moreover, the rapid adoption of automation technology in the manufacturing sector has induced a strong demand for skilled workers to remotely operate these machines. These factors have collectively led to promising growth prospects for the OTS market in the UK.

Asia Pacific Operator Training Simulator Market Trends

Asia Pacific is expected to register the fastest growth over the forecast period. The region's expanding industrial landscape, characterized by growing manufacturing, aerospace, energy, and transportation sectors, has highlighted the need for a skilled workforce proficient in complex machinery operations. Operator training simulators offer a competent and economical solution to bridge this skill gap. Furthermore, significant investments in infrastructure across regional economies have stimulated demand for skilled operators in sectors such as power generation, transportation, and construction. Simulator-based training ensures operational efficiency and safety in these rapidly evolving industries.

India's defense, aviation, and energy sectors have experienced a high growth rate for the past three decades. The urgent and constant necessity of highly skilled personnel to operate sophisticated machines such as fighter jets, commercial aircraft, and power generation control systems has led to substantial investments in OTS solutions to avoid risks associated with real-world training. In recent years, the government has prioritized skill development among youth and technological advancement in industries with several policy initiatives. This support for operator training and the adoption of simulation technologies has catalyzed market growth in the economy.

Key Operator Training Simulator Company Insights

Some key companies involved in the operator training simulator market include Yokogawa Electric Corporation, AVEVA Group Limited, and ANDRITZ, among others.

-

Yokogawa Electric Corporation offers industrial automation products and test & measurement software for industrial simulation in several countries worldwide. In its OTS segment, Yokogawa offers OmegaLand OTS solutions with over 200 systems, catering to various industries such as petrochemical, oil and gas, refining, chemical, and power. In addition, the company provides MIRROR PLANT, a simulator system built on OmegaLand technology that uses pre-existing models to optimize plant operations.

-

AVEVA Group Limited is a technology consulting, IT services, and enterprise solutions company. AVEVA offers OTS solutions for chemicals, refining, oil and gas, and power industries. The company’s OTS uses AVEVA Dynamic Simulation for process accuracy. The OTS is equipped with various intuitive instructor tools for better training scenarios. The company has delivered over 1200 OTS and has introduced innovative solutions such as AVEVA Connect, a cloud platform to train operators from remote locations. In addition, AVEVA offers extended reality (XR) 3D training tools for realistic training.

Key Operator Training Simulator Companies:

The following are the leading companies in the operator training simulator market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- ANDRITZ

- Applied Research Associates, Inc.

- Aspen Technology Inc

- AVEVA Group Limited

- CORYS

- DNV GL

- Emerson Electric Co.

- ESI Group

- FLSmidth

- Honeywell International Inc.

- Schneider Electric

- Siemens

- SimGenics, LLC

- Yokogawa Electric Corporation

Recent Developments

-

In June 2024, Campus Veolia announced that its simulator had migrated to INDISS Plus, a dynamic simulation platform developed by CORYS. Other upgrades include creating a hazardous waste furnace model and finalizing Cloud deployment, which is aimed at improving training for waste incineration plant employees. The migration to INDISS Plus has made the instructor viewer console more intuitive and user-friendly while also adding an option to allow designing evaluation scenarios.

-

In January 2023, Schneider Electric announced that it had completed the acquisition of AVEVA, a leading name in industrial software solutions. The acquisition would accelerate AVEVA's transition to becoming a prominent SaaS provider of software and industrial information and moving towards a subscription-based business model. AVEVA has also developed Operator Training Simulators that leverage AVEVA Dynamic Simulation and have catered to industries such as oil and gas, refining, and chemicals.

Operator Training Simulator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.60 billion

Revenue Forecast in 2030

USD 21.90 billion

Growth Rate

CAGR of 11.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, operator, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

ABB; ANDRITZ; Applied Research Associates, Inc.; Aspen Technology Inc; AVEVA Group Limited; CORYS; DNV GL; Emerson Electric Co.; ESI Group; FLSmidth; Honeywell International Inc.; Schneider Electric; Siemens; SimGenics, LLC; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Operator Training Simulator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global operator training simulator market report based on component, operator, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Control Simulation

-

Process Simulation

-

Immersive Simulation

-

-

Services

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

-

-

Operator Outlook (Revenue, USD Million, 2018 - 2030)

-

Console Operator

-

Field Operator

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Energy & Power

-

Oil & Gas

-

Medical & Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."