- Home

- »

- Medical Devices

- »

-

Ophthalmic Devices Market Size, Industry Report, 2033GVR Report cover

![Ophthalmic Devices Market Size, Share & Trends Report]()

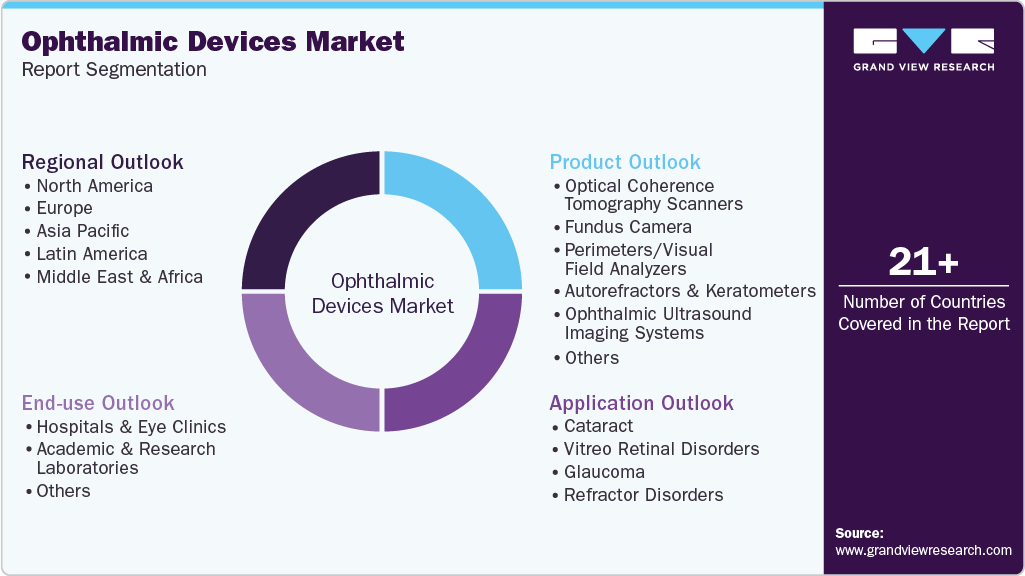

Ophthalmic Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Optical Coherence Tomography, Ophthalmic Ultrasound), By Application (Cataract, Glaucoma), By End-use (Hospitals, Eye Clinics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-901-2

- Number of Report Pages: 175

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Devices Market Summary

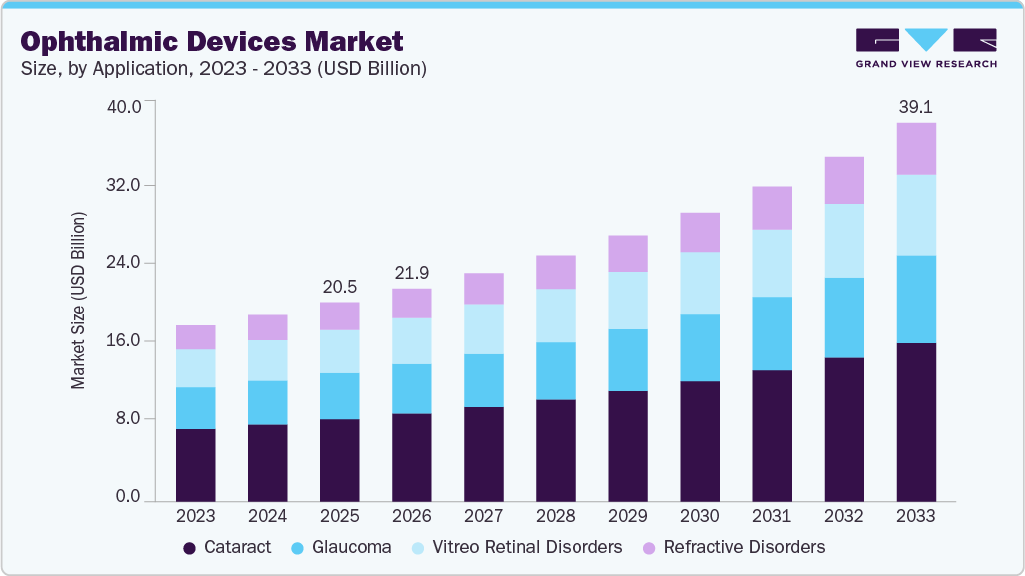

The global ophthalmic devices market size was valued at USD 20.5 billion in 2025 and is projected to reach USD 39.1 billion by 2033, growing at a CAGR of 8.6% from 2026 to 2033. The growth of the market can be attributed to the rising prevalence of optical disorders, such as glaucoma, cataracts, diabetic retinopathy, and vitreoretinal disorders, coupled with technological advancements in ophthalmic surgical as well as diagnostic instruments required for these target applications.

Key Market Trends & Insights

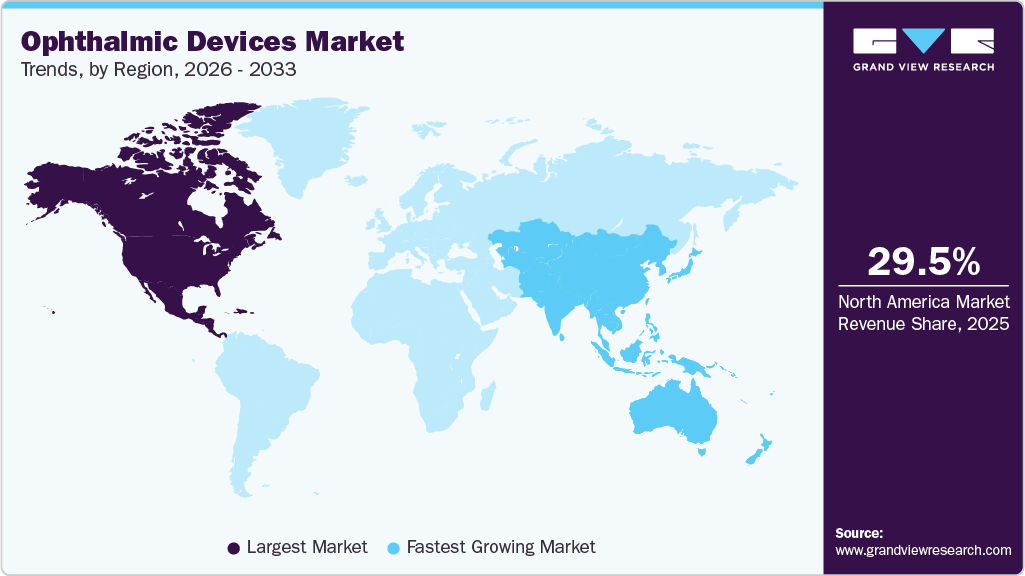

- The North America ophthalmic devices market held the largest share of 29.5% of the global market in 2025.

- The ophthalmic devices industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the optical coherence tomography (OCT) segment held the highest market share of 23.2% in 2025.

- Based on application, the cataract segment held the highest market share in 2025.

- Based on end-use, the hospitals & eye clinics segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 20.5 Billion

- 2033 Projected Market Size: USD 39.1 Billion

- CAGR (2025-2033): 8.6%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Improved government initiatives to increase market base for visual impairment, thereby expanding the market for growth. For instance, in May 2024, the World Health Organization (WHO) initiated the SPECS 2030 program to assist countries in meeting the global eye care goal of a 40% increase in access to appropriate spectacles for people.The growing geriatric population is increasing the demand for ophthalmic devices as they are more susceptible to age-related ophthalmic disorders. According to the National Institute of Aging (NIA), the geriatric population is expected to reach around 72 million by 2030. The increasing prevalence of diabetes and the incidence of diabetes-related blindness are predicted to fuel market growth. According to the World Health Organization (WHO), nearly 422 million people worldwide have diabetes, and the majority live in low and middle-income countries.

Increased screen time, has been associated with the onset and progression of various eye diseases, thus increasing the demand for eye examinations. For instance, in May 2024, Prevent Blindness, a non-profit volunteering organization focused on preventing blindness and preserving sight through public and professional education, community, and patient service programs, launched the “It Started with an Eye Exam” campaign to encourage consumers to provide their stories about how eye care positively impacts their health. This campaign was funded by Vitaris, Inc., a healthcare company that holistically bridges the gap between generic and branded medications to address global healthcare needs.

Technological advancements have enabled accurate diagnosis and improved treatment of ophthalmic disorders. Advancements in medications, diagnostic devices, laser technology, and surgical techniques have improved the handling of cataracts and macular degeneration, glaucoma, and dry eye disease.

Market players are also developing advanced products to meet the demand for these products. For instance, in April 2023, Bausch & Lomb announced the launch of ophthalmic viscosurgical devices in the United States. In March 2023, WaveFront Dynamics Inc. announced the commercial launch of its WaveDyn vision Analyzer. Such initiatives help increase awareness about eye diseases and the availability of diagnostic equipment.

Market Concentration & Characteristics

The market growth is high, and the growth pace is accelerating. Technological advancements, increasing demand from emerging economies, and growing awareness about eye health will likely fuel market expansion. Rising disposable incomes and improving healthcare infrastructure in developing economies like China and India create significant growth opportunities. Government programs promoting eye care and vision correction in regions like North America and Europe contribute to expanding the global market for ophthalmic devices.

Advancements like phacoemulsification for cataracts and laser-assisted procedures for refractive errors have revolutionized eye surgery, leading to faster recovery times, improved outcomes, and wider patient accessibility. Advancements in ophthalmic technology, such as OCT and fundus cameras, have improved early diagnosis and treatment accuracy, driving industry growth. Such technological advancements have enabled early-stage and more accurate diagnosis of eye diseases, improving treatment efficacy and preventing vision loss. Such innovations foster growth in this industry.

Stringent regulations ensure rigorous testing and approval processes for ophthalmic devices, minimizing risks and protecting patient safety. This nurtures trust in the market and encourages widespread acceptance of safe, effective technologies. Regulatory bodies like the FDA in the U.S. and the MHRA in the UK provide transparency in device approval processes and hold manufacturers accountable for product safety and efficacy. This builds trust and promotes ethical practices in the market.

The impact of M&A activities in the ophthalmic devices industry is variable, with a high impact in specific segments like intraocular lenses (IOLs) and surgical devices and a moderate overall impact in other segments due to the market’s diversity. By acquiring competing companies or technologies, businesses can offer various devices, catering to diverse needs and tapping numerous segments simultaneously. Carl Zeiss Meditec AG, in December 2023, acquired 100% stake in the Dutch Ophthalmic Research Center from the investment firm Eurazeo SE. Through this acquisition, ZEISS increased its ophthalmic offerings by seamlessly blending its product range with digitally connected solutions for comprehensive vision care across retinal disorders, cataracts, glaucoma, and refractive errors.

Innovative alternatives like advanced contact lenses, ocular drug delivery systems, and non-invasive imaging technologies can be substitutes for various ophthalmic conditions. For instance, high-definition contact lenses or custom-designed intraocular lenses can deliver better visual outcomes when corrective lenses are required.

Regional expansion holds immense potential for market growth and improved global access to eye care. Focusing on affordability, infrastructure, and access to skilled professionals is crucial to maximize its impact. Due to rapid growth, there is a moderate to high impact in regions like APAC and Latin America. For instance, Europe’s well-developed healthcare infrastructure, coupled with favorable reimbursement policies, facilitates the adoption of advanced ophthalmic technologies. For instance, the European Commission has allocated around USD 5.66 billion (EUR 5.3 billion) through the EU4Health program, marking a significant investment aimed at enhancing healthcare infrastructure from 2021 to 2027.

Product Insights

The optical coherence tomography (OCT) segment dominated the market, accounting for the largest revenue share of 23.2% in 2025. OCT produces high-resolution cross-sectional and three-dimensional images of biological microstructure and has major applications in diagnosing diseases such as glaucoma, age-related macular degeneration (AMD), and diabetic eye disease. Technological advancements such as the integration of OCT with artificial intelligence (AI) are expected to boost the adoption rate of this device amongst healthcare providers. For instance, in October 2024, Carl Zeiss AG expanded its ophthalmic offerings to improve patient care through AI digital tools and innovative solutions. One notable product is the ZEISS VisioGen, which offers a state-of-the-art, AI-driven solution to enhance communication with refractive patients and streamline clinic operations.

The ophthalmoscopes segment is anticipated to witness a significant growth rate of 8.9% over the forecast period. Ophthalmoscopes are used to diagnose diseases such as CMV retinitis, papilledema, glaucoma, AMD, and diabetic retinopathy. In January 2025, Norlase Inc. received FDA 510(k) Clearance and CE Mark approval for the LYNX Pattern Scanning Laser Indirect Ophthalmoscope, a battery-powered device that provides surgeons with an untethered laser solution for treating virtually anywhere. The product’s laser and pattern module has an ergonomic headset, eliminating the need for an external laser source.

Application Insights

The cataract segment dominated the market and accounted for the largest revenue share of 41.4% in 2024. This can be attributed to the high adoption of ophthalmic devices for cataract surgeries. According to the World Health Organization (WHO), cataracts are the leading cause of blindness, as nearly 51% of the total cases of blindness in the world are the result of cataracts.

The refractive disorders segment is anticipated to witness the fastest growth rate over the forecast period. According to the WHO, approximately 2.2 billion people worldwide have near- or far-sighted vision impairment. To treat such disorders and correct refractive errors, ophthalmic devices such as phoropters and retinoscopes are highly preferred. To meet the growing needs of the patient population, major market players are focusing on introducing advanced ophthalmic diagnosis and treatment devices.

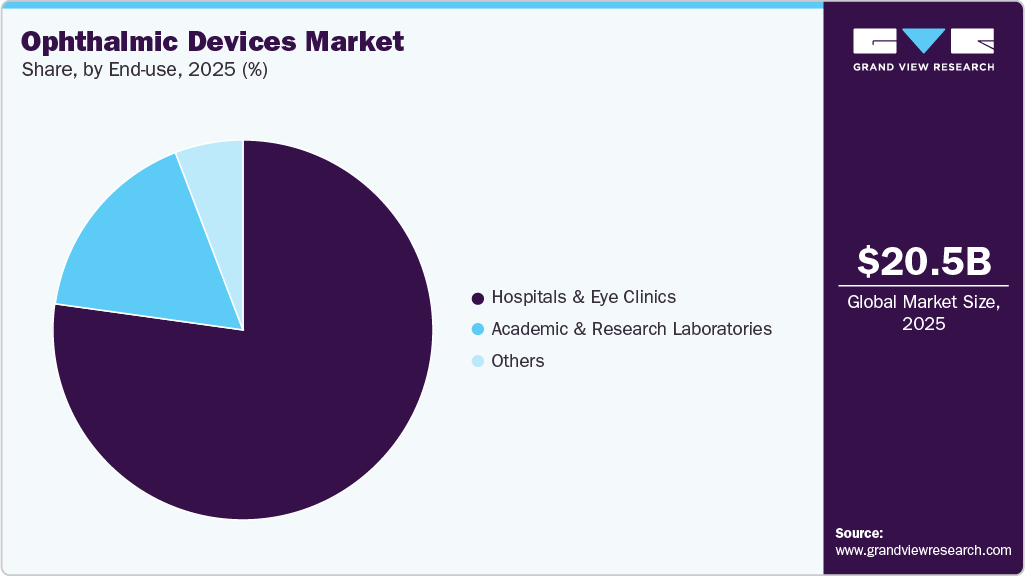

End-use Insights

The hospitals and eye clinics segment held the largest share in the ophthalmic devices market and is expected to continue its dominance over the forecast period. This can be attributed to the increasing adoption of ophthalmic devices in hospitals and the low-cost and effective treatment provided in clinics. The increasing number of mergers and acquisitions between ophthalmic clinics and hospitals is likely to boost demand for new installations in the coming years.

In June 2023, Eye-Q announced the installation of a customized LASIK machine at its Rewari eye-care facility in India. This machine has improved laser vision correction and provided better treatment options for patients. Many eye clinics are now setting up dedicated diagnostic departments, which is increasing the use of ophthalmic devices. The rise in cost-effective treatments offered by more clinics is also expected to drive market growth.

The market for academic & research laboratories is expected to grow significantly during the forecast period. Academic & research laboratories receive funding for ophthalmic care. For instance, John Hopkins Wilmer Eye Institute, U.S., receives large funding from the National Eye Institute to boost ophthalmic research. Similarly, leading institutions across Europe, Asia Pacific, and other regions benefit from both public and private grants aimed at advancing early-stage research in retinal therapies, diagnostic imaging, and surgical device innovation. These laboratories play a critical role in clinical trials, technology validation, and translational research, fostering collaborations with industry players and driving the adoption of next-generation ophthalmic devices. As a result, increased research funding and partnerships are anticipated to continue to faster innovation cycles, enhanced product pipelines, and broader access to cutting-edge ophthalmic solutions globally.

Regional Insights

In 2025, North America ophthalmic devices market held the largest global market share of 29.5% for the ophthalmic devices market. The rapidly growing geriatric population and the rising prevalence of chronic eye conditions caused by high stress and unhealthy lifestyles, such as diabetic retinopathy, are considered high-impact drivers for the industry. Additionally, new reimbursement models for ophthalmologic treatment and a stringent regulatory framework for patients’ safety are expected to drive the demand for ophthalmic devices in this region.

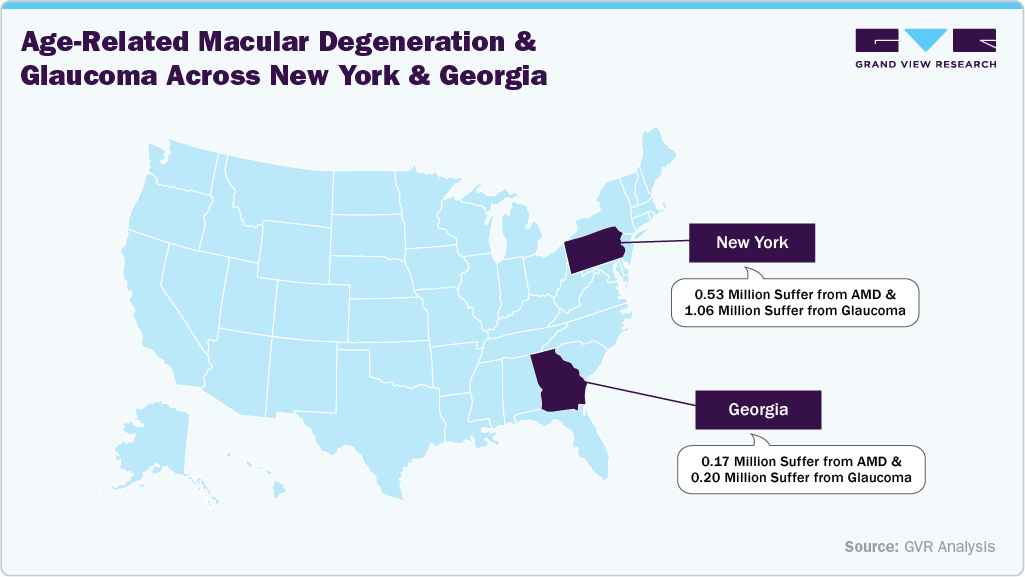

U.S. Ophthalmic Devices Market Trends

The ophthalmic devices market in the U.S. held a significant share of North America's ophthalmic devices market in 2025. The U.S. boasts a well-developed healthcare system with leading academic institutions and research facilities. This fosters innovations in ophthalmic devices, such as minimally invasive surgical techniques, advanced diagnostic instruments, and personalized medicine approaches, propelling the growth of U.S. ophthalmic devices. The prevalence of age-related macular degeneration (AMD) and glaucoma is higher in states with larger elderly populations, with glaucoma also affecting more Black and Hispanic communities. These patterns highlight the need for targeted healthcare strategies to address these growing vision threats and promote early detection.

Europe Ophthalmic Devices Market Trends

The European ophthalmic devices market is experiencing growth driven by the increasing prevalence of various ophthalmic disorders, including glaucoma, cataracts, and diabetic retinopathy. These conditions often necessitating diagnostic interventions and personalized treatment plans, thereby increasing the demand for various ophthalmic devices. Furthermore, the region’s well-developed healthcare infrastructure, coupled with favorable reimbursement policies, has further facilitated the adoption of advanced ophthalmic technologies, which is expected to increase the demand for these devices in the European market.

The ophthalmic devices market in France is expected to grow over the forecast period. France’s rapidly aging population mirrors the trend across Europe, boosting the demand for ophthalmic devices. As people age, they become more susceptible to eye diseases like AMD, cataracts, and diabetic retinopathy. These conditions can lead to severe vision impairment or blindness if not diagnosed and treated promptly. Ophthalmic devices play a crucial role in early detection and ongoing management of these diseases, offering detailed visualization of the retina to help ophthalmologists provide timely and accurate diagnoses.

The ophthalmic devices market in Germany is projected to expand in the forecast period due to Germany’s strong healthcare infrastructure and investment in medical technology, which drive the adoption of innovative solutions-government initiatives and funding support the development and integration of cutting-edge technologies. The market benefits from high R&D activities, with numerous companies focusing on advancing imaging capabilities and incorporating AI to enhance diagnostic precision. For instance, the installation of the RTX1 in February 2024, a retinal imaging device in Halle, highlights a significant advancement in Germany’s ophthalmic devices market.

Asia Pacific Ophthalmic Devices Market Trends

The APAC ophthalmic devices market is experiencing rapid growth, driven by an increasing prevalence of optic diseases, a growing elderly population, and rising awareness of eye health. Conditions such as diabetic retinopathy, AMD, and glaucoma are common, necessitating advanced diagnostic tools. OCT, fundus photography, and scanning laser ophthalmoscopes are crucial technologies providing high-resolution images for accurate diagnosis.

The ophthalmic devices industry in Japanis expected to expand due to several factors, notably the aging population, with over 10% of individuals aged 80 years and above in 2023, as the World Economic Forum reported. Tohoku University’s high-speed, high-resolution retinal imaging system, introduced in November 2023, significantly boosts the market. The increasing demand for precise diagnostic tools, fueled by Japan’s aging demographic, is complemented by government support for enhanced healthcare infrastructure and early detection. The success of this innovation promotes further research and investment, leading to broader adoption and availability of advanced ophthalmic devices across Japan.

The ophthalmic devices market in China is expected to grow significantly in the Asia Pacific region during the forecast period. Increasing product approval is a major factor in boosting market growth by expanding cutting-edge ophthalmic device availability in China. It encourages other healthcare providers to invest in similar advanced systems, leading to broader adoption of innovative diagnostic solutions. For instance, in January 2025, Eyebright Medical Technology (Beijing) Co., Ltd. received the Class III certificate for its Loong Crystal PR, a phakic intraocular lens, from China’s National Medical Products Association. This lens treats myopia in adults, ranging from -3.25D to -18.00D. This product boosts optical performance and enhances overall visual experience and clarity.

The ophthalmic devices market in India is expected to grow over the forecast period. India's healthcare infrastructure is steadily improving. The establishment of more ophthalmic centers, the availability of skilled professionals, and advancements in technologies like telemedicine across India create lucrative growth for several market players. The Indian Government’s National Programme for Prevention and Control of Blindness (NPCB) and other initiatives raise awareness about eye health and prioritize access to essential eye care services. These programs drive demand for affordable and effective ophthalmic diagnostic devices.

Latin America Ophthalmic Devices Trends

The ophthalmic devices market in Latin America is driven by the increasing prevalence of eye disorders, a heightened focus on R&D in medical devices, the rapid adoption of advanced healthcare technologies, and a growing geriatric population. The increasing application of ophthalmic devices for diagnostic and therapeutic purposes, including disease diagnosis, preclinical research, and the visualization of specific molecular & cellular processes, is anticipated to propel market growth.

Middle East & Africa Ophthalmic Devices Trends

The ophthalmic devices market in Saudi Arabia is anticipated to expand in the forecast period. The large-scale AI-based diabetic tele-retinopathy screening project in Saudi Arabia, as detailed in a BMJ blog from March 2024, is expected to significantly enhance the country’s ophthalmic devices market. The initiative leverages AI to screen for diabetic retinopathy, addressing a prevalent issue due to the high diabetes rate. By improving the early detection and management of retinal diseases, this project increases demand for advanced imaging technologies. Integrating AI in retinal screening can promote efficiency and accuracy, leading to greater adoption of such devices in medical practices across Saudi Arabia, ultimately driving market growth.

The ophthalmic devices market in Kuwait is expected to witness moderate growth, driven by higher healthcare spending, growing awareness of women's health, and investments in healthcare infrastructure. Additionally, the increasing number of healthcare professionals, highlighted in a WHO report from January 2023, is anticipated to boost market expansion further.

Key Ophthalmic Devices Company Insights

Success in the ophthalmic devices market relies on adaptability, innovation, and meeting diverse customer needs. Large companies use their resources and brand strength, while smaller players thrive through specialization and innovation. R&D investment-especially in IOLs, laser systems, and diagnostics-along with strong branding and distribution, helps firms grow and maintain market share globally.

Key Ophthalmic Devices Companies:

The following are the leading companies in the ophthalmic devices market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Vision Care

- Alcon Vision LLC

- Carl Zeiss Meditec AG

- Bausch & Lomb Incorporated

- Essilor International S.A

- Ziemer Ophthalmic Systems Ltd

- Nidek Co. Ltd

- TOPCON Corporation

- Haag-Streit Group

- Glaukos Corporation

Recent Developments

-

In July 2024, Alcon Research, LLC. received the U.S. FDA approval for the UNIPURE C3F8 Ophthalmic Gas, a gas injected into the eye to treat uncomplicated retinal detachment. This gas utilizes the company’s UNIFEYE or UNIPEXY Gas Delivery Systems and is expected to be commercially available in 2025.

-

In June 2024, C3 Med-Tech received Rs. 2 crores (USD 0.24 million) from Industrial Metal Powers India Pvt Ltd. to develop AI-enabled portable ophthalmic devices for telemedicine, aimed at enhancing eye checkups and real-time disease detection to prevent blindness.

-

In August 2023, Johnson & Johnson Vision presented its Elita laser correction device in the U.S. launch. This platform is revolutionary for correcting short-sightedness through a minimally invasive laser-assisted lens removal procedure.

-

In June 2023, Bausch + Lomb Corporation launched INFUSE Multifocal silicone hydrogel (SiHy) daily disposable contact lenses across the U.S. These new daily disposable lenses keep patients’ eyes comfortable and dry-free.

Ophthalmic Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 21.9 billion

Revenue Forecast in 2033

USD 39.1 billion

Growth rate

CAGR of 8.6% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Sweden; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Johnson & Johnson Vision Care; Alcon Vision LLC; Carl Zeiss Meditec AG; Bausch & Lomb Incorporated; Essilor International S.A; Ziemer Ophthalmic Systems Ltd; Nidek Co. Ltd; TOPCON Co.; Haag-Streit Group; Glaukos Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Devices Market Report Segmentation

This report forecasts country-level revenue growth and analyzes the latest industry trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global ophthalmic devices market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Optical Coherence Tomography Scanners

-

Fundus Camera

-

Perimeters/Visual Field Analyzers

-

Autorefractors and Keratometers

-

Ophthalmic Ultrasound Imaging Systems

-

Ophthalmic A-Scan Ultrasound

-

Ophthalmic B-Scan Ultrasound

-

Ophthalmic Ultrasound Biomicroscopes

-

Ophthalmic Pachymeters

-

-

Tonometers

-

Slit Lamps

-

Phoropters

-

Wavefront Aberrometers

-

Optical Biometry Systems

-

Ophthalmoscopes

-

Lensmeters

-

Corneal Topography Systems

-

Specular Microscopes

-

Retinoscopes

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cataract

-

Vitreo Retinal Disorders

-

Glaucoma

-

Refractor Disorders

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals and Eye Clinics

-

Academic and Research Laboratories

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the ophthalmic devices market include Abbott Medical Optics, Inc., Carl Zeiss Meditec AG, Alcon, Inc., Bausch & Lomb, Inc., Haag-Streit, Topcon Corporation, Johnson & Johnson, Essilor International S.A., Ziemer Ophthalmic Systems AG, and Nidek Co. Ltd.

b. Key factors that are driving the ophthalmic devices market growth include the rising prevalence of eye diseases, technological advancements in ophthalmic devices, and government initiatives for increasing awareness regarding visual impairment.

b. The global market for ophthalmic devices was estimated at USD 20.5 billion in 2025 and is expected to reach USD 21.9 billion in 2026.

b. The global ophthalmic devices market is expected to grow at a compound annual growth rate of 8.6% from 2026 to 2033 to reach USD 31.9 billion by 2033.

b. North America dominated the ophthalmic devices market with a share of 29.5% in 2025. This is attributable to advancements in ophthalmic devices, which help in the efficient diagnosis and treatment of retinal disorders, glaucoma, and other ophthalmic disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.