- Home

- »

- Biotechnology

- »

-

Optical Genome Mapping Market Size & Share Report, 2030GVR Report cover

![Optical Genome Mapping Market Size, Share & Trends Report]()

Optical Genome Mapping Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Service, By Technique (Structural Variant Detection, Genome Assembly), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-133-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Optical Genome Mapping Market Trends

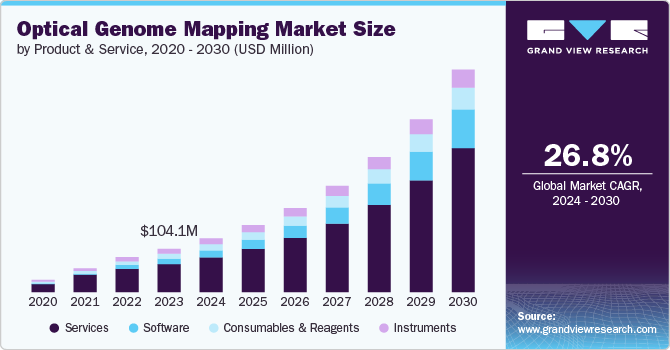

The global optical genome mapping market size was valued at USD 104.1 million in 2023 and is expected to grow at a CAGR of 26.76% from 2024 to 2030. The market has witnessed substantial growth in recent years, primarily driven by the growing demand for advanced genomic analysis techniques & tools. Optical genome mapping provides researchers and clinicians with a powerful tool for examining structural variations in the genome. This helps increase the understanding of genetic diseases and supports the development of personalized medicine.

The COVID-19 pandemic had a positive impact on the market. The market faced disruptions in the early stages of the pandemic as laboratories and research institutions worldwide had to divert their resources and focus toward COVID-19 diagnostics, treatment, and vaccine development. This led to a temporary slowdown in non-COVID-related research activities, including genomics. Additionally, supply chain disruptions and lockdown measures hampered the production and distribution of optical mapping equipment and consumables, causing delays in ongoing projects and new installations.

As the pandemic progressed, optical genomic mapping technology demonstrated its relevance in addressing COVID-19-related challenges. Researchers turned to optical mapping to study the genetic variations of the SARS-CoV-2 virus, understand its transmission dynamics, and track mutations that could impact vaccine efficacy. Optical mapping's capability to deliver rapid, high-resolution genomic data proved essential for detecting and tracking emerging virus variants, aiding the global pandemic response. As genomics remains vital for understanding and managing infectious diseases like COVID-19, the optical genome mapping market is expected to recover and grow in the long term.

The continuous advancements in optical mapping technologies have played a pivotal role in market expansion. Innovations in high-resolution imaging, DNA labeling, and data analysis algorithms have improved the accuracy and efficiency of optical genomic mapping, making it an attractive choice for a wide range of applications, including genome assembly, structural variant detection, and genotyping. For instance, in January 2023, Bionano Genomics announced to launch of several new products and advancements for its optical genome mapping workflow, including improved sample preparation robustness, faster turnaround time for DNA labelling and imaging, and increased throughput and quality metrics. Bionano's new sample prep kits, chips, and instrument software address customer feedback and are designed to enhance performance in high-volume, routine genome analysis applications.

The growing adoption of optical genomic mapping in research institutions and pharmaceutical companies contributed to market growth. For instance, in July 2023, the Centre for Cellular & Molecular Biology (CCMB) in Hyderabad, India, launched a cutting-edge highly high-end, next-generation genetic testing tool called 'Optical Genome Mapping' (OGM) that may discover genomic anomalies that cause a variety of hereditary diseases in humans. As the importance of genomics in drug discovery and development continues to rise, the demand for precise and reliable genomic analysis tools like optical mapping is expected to surge further.

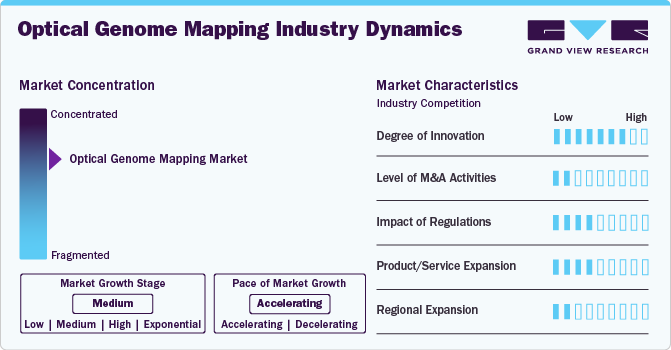

Market Concentration & Characteristics

The degree of innovation in the optical genome mapping industry is moderate. While advancements continue in enhancing resolution and throughput, the industry has not seen groundbreaking changes in its core methodologies.

The market is characterized by the low level of merger and acquisition activities undertaken by various industry players. This is attributed to the high cost and complexity of integrating new technologies and businesses.

Regulatory requirements governing optical genome mapping present significant challenges for market players due to stringent approval processes, the need for extensive validation studies, and compliance with varying standards across different regions. Navigating these complex regulations can be time-consuming and costly, potentially hindering innovation and market entry.

The optical genome mapping industry is experiencing moderate growth and product & service expansion. This is attributed to the growing advancements in technology and increasing demand for genomic analysis.

The optical genome mapping industry is experiencing exponential regional expansion, attributed to the increased demand for custom DNA synthesis in research and therapeutic applications, and growing investments in biotechnology. Moreover, the increasing availability of high-throughput synthesis platforms and the rise of personalized medicine is further expected to propel the growth of the market.

Product & Service Insights

Based on product & service, the services segment dominated the market, with a revenue share of 64.74% in 2023.An increasing number of outsourced service vendors is expected to maintain the demand for services over the forecast period. The market is thriving due to increased demand, ongoing innovation, diverse applications, and its integral role in advancing genomics research and applications. There has been a growing demand for OGM services across various end users for genomics research and clinical applications. As genomics research continues to advance and new challenges emerge, the demand for advanced OGM services is expected to grow over the forecast period.

The software segment is anticipated to grow at the fastest CAGR of 32.86% from 2024 to 2030. This is attributed to the increasing demand for customized and high-quality DNA synthesis solutions. The growing research and therapeutic applications are anticipated to propel the demand for specialized services that offer tailored solutions, technical support, and rapid turnaround times. Moreover, the advancements in technology and the rising complexity of genomic projects are driving the need for more comprehensive and expert service offerings. These factors are anticipated to propel the segmental growth over the forecast period.

Technique Insights

Based on the technique, the structural variant detection segment dominated the market with a revenue share of 44.33% in 2023 and is expected to grow at a lucrative CAGR from 2024-2030. Structural variants (SVs) are large-scale genomic alterations that can have a profound impact on an individual's health, including their susceptibility to genetic diseases and their response to treatments.

Optical genome mapping's high-resolution imaging capabilities and ability to analyze individual DNA molecules make it exceptionally well-suited for the detection of structural variants. According to a study published by Springer Nature Limited in March 2021, the total count of SVs discovered per genome has increased from ~2, 1-2, 5k in the 1000 genomes project to more than 27k in recent multi-platform sequencing efforts. Recent contributions from the Pan-Cancer Analysis of Whole Genomes (PCAWG) Consortium, in particular, offered a substantial supply of matched tumor-normal genomes. The findings from multi-platform analyses also reveal present SV gaps in cancer variant databases such as COSMIC. However, the increasing research on large-scale genome identification is expected to drive the market over the forecast period.

In addition, the genome assembly segment is anticipated to register the fastest CAGR of 31.54% over the forecast period. Genome assembly involves piecing together the entire DNA sequence of an organism, which is a complex and intricate process. Optical genomic mapping has emerged as a transformative technology for genome assembly due to its ability to provide high-resolution, long-range structural information about DNA molecules. This precise structural data helps researchers overcome challenges associated with repetitive and complex genomic regions that often confound traditional sequencing methods. As the genomics field continues to expand, the genome assembly application segment is poised for further growth and innovation.

Application Insights

Based on application, the research segment dominated the market in 2023.This is attributed to the extensive use of optical genome mapping in genomic research and discovery. Researchers rely on advanced technologies for comprehensive genome analysis, structural variant detection, and understanding genetic variations. Moreover, increasing investment activities in research & development to advance genomics knowledge and applications is anticipated to propel the growth of the segment over the forecast period.

The diagnostics segment is anticipated to grow at the fastest CAGR of 30.48% from 2024 to 2030, owing to the increasing adoption of advanced genetic testing for disease diagnosis and personalized medicine. The rising prevalence of genetic disorders, advancements in diagnostic technologies, and the need for precise and early detection of conditions are contributing to the growth of the segment. Additionally, improvements in healthcare infrastructure and increased awareness of genomic diagnostics are further driving the growth of the segment over the forecast period.

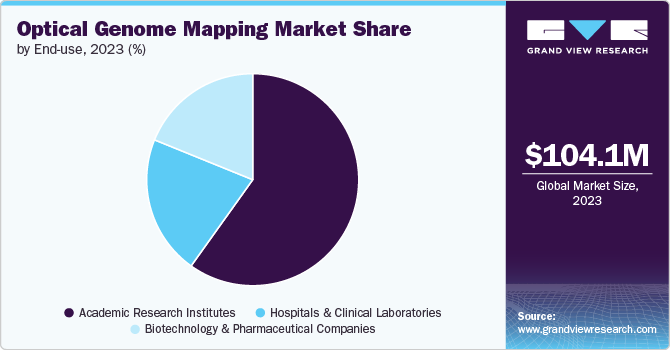

End-use Insights

Based on the end use, the academic research institutes segment dominated the market with a revenue share of 59.87% in 2023. These institutions have increasingly adopted optical genomic mapping technologies to advance their genomics research efforts. Researchers in fields such as genetics, molecular biology, and biotechnology are continually seeking tools and techniques that can provide a more comprehensive understanding of genomes. For instance, in April 2021, in American College of Medical Genetics and Genomics annual clinical genetics meeting at Columbia University Medical Center (CUMC), highlighted the importance of optical genome mapping technology compared to traditional routine methods. The optical genome mapping revealed 100 percent concordance in a study of 100 Acute Myeloid Leukemia (AML) patients. Such factors would likely drive the segment growth over the coming years.

On the other hand, the hospitals & clinical laboratories segment is anticipated to register the fastest CAGR of 30.48% over the forecast period. These hospitals and clinical laboratories have recognized the immense potential of optical mapping technology in advancing drug discovery, research, and precision medicine initiatives. The increasing number of collaborations between instrument manufacturers and these hospitals is expected to drive the segment growth over the forecast period. For instance, in March 2023, Bionano announced that it will be participating in the annual meeting of American College of Medical Genetics and Genomics to showcase applications of OGM for rare genetic disorders and constitutional disorders.

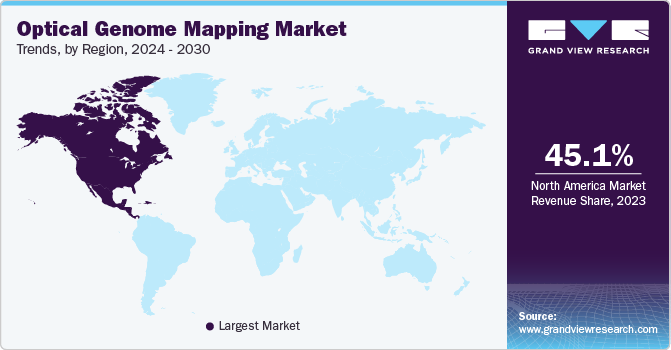

Regional Insights

North America optical genome mapping market dominated the global industry with a share of 45.07% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. This region has been at the forefront of genomics research and biotechnology advancements, and optical genomic mapping has played a pivotal role in this landscape. The market's growth can be attributed to several key factors, including a strong presence of leading biotechnology and pharmaceutical companies, extensive government funding for genomics research, and a robust healthcare infrastructure.

U.S. Optical Genome Mapping Market Trends

The optical genome mapping market in the U.S. is expected to grow over the forecast period. In September 2019, National Institute of Health, granted USD 29.5 million to create and maintain the most comprehensive human genome reference sequence. Additionally, the rising prevalence of genetic diseases and the increasing demand for personalized medicine have fueled the adoption of optical genomic mapping technologies in clinical applications.

Europe Optical Genome Mapping Market Trends

The optical genome mapping market in Europe is expected to grow at the lucrative CAGR over the forecast period. Increasing number of accreditations by hospitals for use of OGM is expected to fuel the segment growth. For instance, in the year 2021, University Hospitals Leuven in Belgium got an accreditation from Belgian Accreditation Body to use optical genome mapping to study Acute Lymphoblastic Leukemia. Such developments are expected to drive regional market growth.

UKoptical genome mapping market is expected to grow over the forecast period. Adopting new rules related to genome domain creates an opportunity for the market, and the UK government is planning to change the rules related to optical genome mapping making R&D easier.

The optical genome mapping market in Germany is anticipated to grow over the forecast period. Collaboration and partnership models among key players strengthen their market presence both locally and globally, driving revenue growth in the country.

Asia Pacific Optical Genome Mapping Market Trends

The optical genome mapping market in Asia Pacific is anticipated to witness significant growth from 2024 to 2030. Increasing investments in genomics research, rising demand for advanced diagnostic tools, expanding healthcare infrastructure, and growing awareness and adoption of personalized medicine across the region are contributing to the growth of the market over the forecast period.

China optical genome mapping market is expected to grow over the forecast period. Government support for biotechnology and expanding applications of optical genome mapping in diagnostics and research are also contributing to the growth of the market.

The optical genome mapping market in Japan is anticipated to grow at a significant CAGR over the forecast period. The rising prevalence of genetic diseases and diabetes, along with expanding genomic research initiatives, is expected to drive market growth in Japan. This trend is likely to significantly boost the market's expansion.

India optical genome mapping market is anticipated to grow at a rapid rate over the forecast. This is attributed to the increasing adoption of advanced genomic technologies, rising investments in biotechnology and healthcare infrastructure, and a growing focus on precision medicine and personalized diagnostics.

Key Optical Genome Mapping Company Insights

Key players operating in the optical genome mapping market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Optical Genome Mapping Companies:

The following are the leading companies in the optical genome mapping market. These companies collectively hold the largest market share and dictate industry trends.

- Bionano Genomics

- Nucleome Informatics Private Limited

- Praxis Genomics, LLC,

- SourceBio International Limited (Source BioScience)

- MedGenome

- INRAE (French Plant Genomic Resources Center (CNRGV))

- PerkinElmer (PerkinElmer Genomics)

- Genohub Inc.

- Hofkens Lab

- Cerba

Recent Developments

-

In August 2024, Hitachi High-Tech Corporation announced the acquisition of a majority stake in Nabsys, a company that makes tools and products for analyzing genomic structural variations. As a result of this acquisition, Nabsys will become a part of the Hitachi High-Tech Group.

-

In July 2024, Bionano Genomics, Inc. announced the release of a study comparing their optical genome mapping (OGM) technology to traditional cytogenetic methods for detecting structural variants (SVs) in multiple myeloma (MM). This study, conducted across multiple sites, is the first of its kind in this area.

-

In March 2023, Bionano Genomics introduced two new OGM-Dx tests: prenatal and postnatal whole genome structural variant tests. These tests enable broad evaluation of structural variants and detection of chromosomal abnormalities to aid in patient diagnosis and management.

-

In November 2022, Bionano Genomics acquired Purigen Biosystems, Inc. to enable improved and enhanced DNA separation for optical genome mapping and identify difficult sample types in new applications with Isotachophoresis (ITP) on the ionic purification system.

Optical Genome Mapping Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 129.3 million

Revenue forecast in 2030

USD 536.4 million

Growth rate

CAGR of 26.76% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, technique, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; South Korea; Singapore; Australia, India; Brazil; South Africa

Key companies profiled

Bionano Genomics, Nucleome Informatics Private Limited, Praxis Genomics, LLC, SourceBio International Limited (Source BioScience), MedGenome, INRAE (French Plant Genomic Resources Center (CNRGV)), PerkinElmer (PerkinElmer Genomics), Genohub Inc., Hofkens Lab, Cerba

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Optical Genome Mapping Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical genome mapping market report on the basis of product & service, technique, application, end-use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables & Reagents

-

Software

-

Services

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Structural Variant Detection

-

Genome Assembly

-

Microbial Strain Typing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Diagnostics

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology & Pharmaceutical Companies

-

Hospitals & Clinical Laboratories

-

Academic Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

South Korea

-

Singapore

-

Australia

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global optical genome mapping market size was estimated at USD 104.1 million in 2023 and is expected to reach USD 129.3 million in 2024.

b. The global optical genome mapping market is expected to grow at a compound annual growth rate of 26.8% from 2024 to 2030 to reach USD 536.4 million by 2030.

b. North America dominated the optical genome mapping market with a share of 45.07% in 2023. This is attributable to the rising number of research studies being done within research institutes and academic institutions

b. Some key players operating in the optical genome mapping market include Bionano Genomics; Nucleome Informatics Private Limited; Praxis Genomics, LLC; SourceBio International Limited (Source BioScience); MedGenome; INRAE (French Plant Genomic Resources Center (CNRGV)); PerkinElmer (PerkinElmer Genomics); Genohub Inc.; Hofkens Lab; Cerba

b. Key factors that are driving the market growth include advancement in genomics research and rising government spending on research grants

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.