- Home

- »

- Medical Devices

- »

-

Optical Preclinical Imaging Market Size & Share Report, 2030GVR Report cover

![Optical Preclinical Imaging Market Size, Share & Trends Report]()

Optical Preclinical Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Device, Consumables), By End-use (Pharma and Biotech Companies, Research Institutes), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-458-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Optical Preclinical Imaging Market Trends

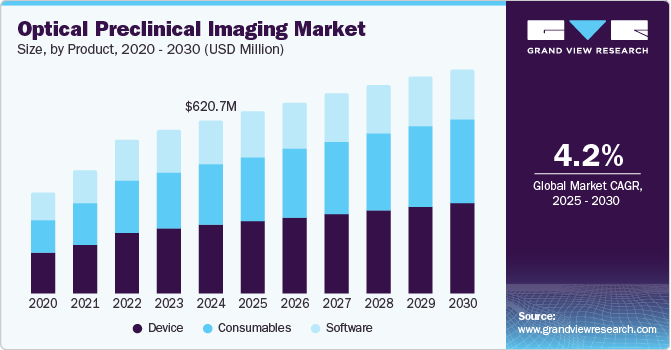

The global optical preclinical imaging market size was estimated at USD 620.7 million in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. The rising prevalence of chronic diseases, particularly cancer and diabetes, underscores the urgent need for advanced imaging techniques for early detection and monitoring. In 2023, nearly 60% of adults in the U.S. were affected by chronic diseases, driving demand for innovative optical preclinical imaging solutions in research settings. Coupled with continuous technological advancements that enhance the sensitivity and specificity of optical imaging modalities, these factors create a robust growth trajectory for the market, addressing the pressing needs of modern biomedical research.

The increased demand for advanced imaging technologies, such as bioluminescence and fluorescence imaging, is a key driver of market growth worldwide. These sophisticated techniques enable non-invasive and high-resolution visualization of biological processes, providing researchers with critical insights into disease mechanisms and treatment efficacy. As there is a significant shift toward non-invasive techniques, understanding biological processes and disease dynamics becomes more effective, facilitating more efficient drug discovery and development.

The growing focus on personalized medicine has escalated the demand for precise imaging solutions tailored to individual patient needs. Optical imaging is pivotal in identifying patient-specific disease characteristics, thus enhancing therapeutic strategies. As the healthcare landscape evolves toward more personalized approaches, the necessity for imaging technologies that can accurately reflect individual patient conditions will only intensify, further propelling the market for optical preclinical imaging solutions.

Lastly, government funding and support are critical factors fostering innovation in preclinical imaging technologies. Substantial investments in healthcare research and development from various governments create a conducive environment for advancements in optical imaging. Initiatives such as the European Union’s Horizon Europe exemplify this backing, encouraging research institutions and industry players to push the boundaries of imaging technology. This financial support not only enhances the capabilities of researchers but also accelerates the development of cutting-edge imaging solutions.

Product Insights

The devices segment dominated the market with a revenue share of 39.7% in 2024. Advanced imaging technologies, including bioluminescence and fluorescence imaging systems, deliver non-invasive, high-resolution visualization of biological processes essential for elucidating disease mechanisms and treatment efficacy. The rising focus on drug discovery and the growing incidence of chronic diseases are driving segment growth further.

The consumables segment is expected to grow at the fastest rate of 5.6% over the forecast period. Consumables, including imaging agents, fluorescent dyes, and reagents, are vital for the optimal performance of optical imaging systems, allowing precise visualization of biological processes. The rise in preclinical studies, clinical trials, and advancements in imaging technologies drives demand for innovative, customized consumables to meet diverse research needs.

End Use Insights

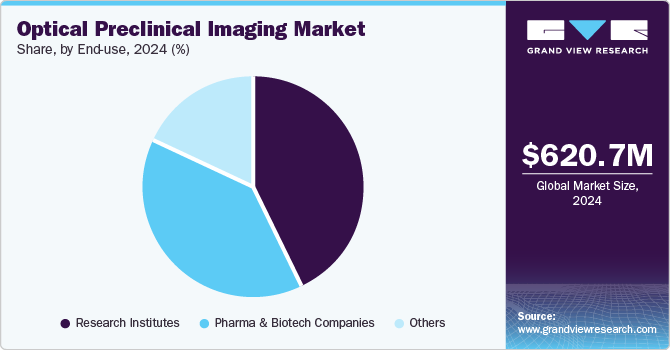

Research institutes led the market with a revenue share of 43.0% in 2024. Research institutes are pivotal in advancing scientific knowledge and innovation, driving the adoption of sophisticated imaging technologies for basic and translational research. The emphasis on drug discovery and collaborative efforts between academia and industry further heightens demand for advanced optical imaging systems, reinforcing their role as key end-users.

Pharma and biotech companies are expected to witness substantial growth over the forecast period. These companies heavily depend on advanced imaging technologies to streamline drug discovery and development, allowing visualization of biological processes at the molecular level. Non-invasive optical imaging techniques, such as bioluminescence and fluorescence, are essential for monitoring drug efficacy and disease progression in animal models, enhancing research efficiency.

Regional Insights

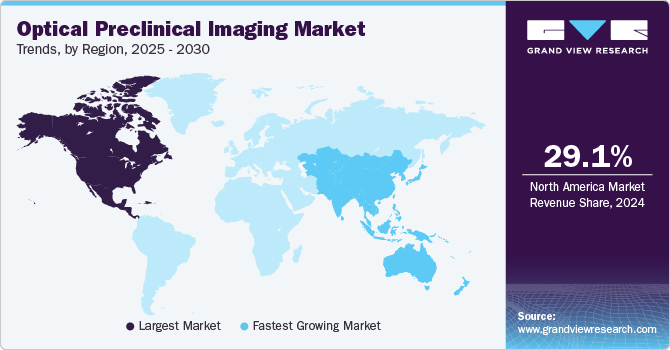

North America optical preclinical imaging market dominated the global market with a revenue share of 29.1% in 2024. The region’s significant emphasis on innovation, bolstered by governmental funding and partnerships between academia and industry, facilitates the advancement of state-of-the-art imaging technologies. Furthermore, the increasing incidence of chronic diseases and the rising demand for non-invasive imaging techniques propel research endeavors.

U.S. Optical Preclinical Imaging Market Trends

The optical preclinical imaging market in U.S. dominated the North America optical preclinical imaging market with a revenue share of 78.6% in 2024. The U.S. Food and Drug Administration (FDA) reports that adverse drug reactions account for over 100,000 human deaths each year, ranking as the fourth leading cause of death in the U.S. Advanced imaging facilities and a commitment to innovation foster the development of sophisticated optical imaging technologies, enhancing drug discovery and development.

Europe Optical Preclinical Imaging Market Trends

Europe optical preclinical imaging market held substantial market share in 2024, driven by substantial investments in healthcare research and advancements in imaging technologies. The region’s focus on innovative drug development solutions, especially in oncology and neurology, is supported by collaborative efforts among academia, industry, and government, further enhancing the demand for precise imaging techniques in personalized medicine.

The optical preclinical imaging market in Germany is expected to grow rapidly in the forecast period, supported by a robust research infrastructure and a strong focus on technological innovation. The presence of leading academic institutions and biotech firms prioritizing advanced imaging techniques enhances drug development and disease research. Government backing for healthcare R&D fosters innovation, aligning with the growing demand for personalized medicine.

Asia Pacific Optical Preclinical Imaging Market Trends

Asia Pacific optical preclinical imaging market is expected to register the fastest CAGR of 5.6% in the forecast period. Several countries in the region are enhancing their research capabilities, resulting in increased adoption of advanced imaging technologies. The growing prevalence of chronic diseases underscores the need for innovative diagnostic solutions, thereby driving demand for non-invasive imaging techniques. Collaborations between local institutions and international partners further facilitate access to state-of-the-art optical imaging systems.

The optical preclinical imaging market in China dominated the Asia Pacific optical preclinical imaging market in 2024. Rapid technological advancements in the country have spurred the increased adoption of innovative optical imaging systems across multiple research domains, especially oncology and neurology. Enhanced collaboration between academic institutions and industry partners facilitates knowledge exchange, while growing awareness of non-invasive diagnostic methods further fuels demand.

Key Optical Preclinical Imaging Company Insights

Some key companies operating in the market include Bruker; PerkinElmer; MR Solutions; BioTek Instruments, Inc.; among others. Key players are prioritizing technological advancements and strategic collaborations, investing in R&D to enhance imaging technologies through partnerships and product launches to foster innovation.

-

BioTek Instruments, Inc. focuses on developing advanced imaging systems and technologies for life science research, offering high-performance solutions for fluorescence and bioluminescence assays, thereby enhancing drug discovery and biological studies for researchers.

-

MILabs B.V. provides cutting-edge optical imaging systems that combine modalities such as bioluminescence, fluorescence, and X-ray imaging. These innovative technologies allow researchers to visualize and quantify in vivo biological processes, enhancing drug development and disease research with exceptional sensitivity and resolution.

Key Optical Preclinical Imaging Companies:

The following are the leading companies in the optical preclinical imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Bruker

- PerkinElmer

- MR Solutions

- BioTek Instruments, Inc.

- MILabs B.V.

- Magnetic Insight, Inc.

- MBF Bioscience

- FUJIFILM Corporation

- Mediso Ltd.

Recent Developments

-

In October 2024, MBF Bioscience unveiled SLICE, an affordable light sheet microscope developed in collaboration with Columbia University, aimed at advancing scientific research and supporting “Big Science in labs of all sizes.”

-

In February 2024, Bruker Corporation acquired Spectral Instruments Imaging, enhancing its preclinical imaging portfolio with advanced in-vivo optical imaging systems, thereby broadening solutions for disease research and complementing existing offerings.

Optical Preclinical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 654.1 million

Revenue forecast in 2030

USD 805.6 million

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Bruker; PerkinElmer; MR Solutions; BioTek Instruments, Inc.; MILabs B.V.; Magnetic Insight, Inc.; MBF Bioscience; FUJIFILM Corporation; Mediso Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Optical Preclinical Imaging Market Report Segmentation

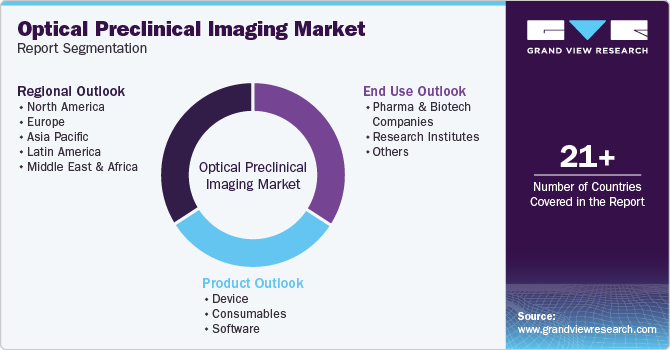

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical preclinical imaging market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Device

-

Fluorescence

-

Bioluminescence

-

-

Consumables

-

Fluorescence

-

Green Fluorescent Proteins

-

Red Fluorescent Proteins

-

Infrared Dyes

-

Others

-

-

Bioluminescence

-

Luciferins

-

Proluciferins

-

Coelenterazine

-

Others

-

-

-

Software

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharma & Biotech Companies

-

Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.