- Home

- »

- Medical Devices

- »

-

Oral Irrigator Market Size, Share And Trends Report, 2030GVR Report cover

![Oral Irrigator Market Size, Share & Trends Report]()

Oral Irrigator Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Countertop, Cordless), By Application (Home, Dentistry), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-148-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global oral irrigator market size was valued at USD 999.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. Dental problems are becoming more common as a result of various causes, such as evolving dietary and lifestyle patterns, birth defects, unhealthy eating patterns, and inadequate dental treatment. The rising prevalence of dental caries and tooth decay in the pediatric population has also led to the growth of the market. The prevalence of congenital abnormalities, such as cleft lip, is also on the rise, which has raised the demand for oral irrigators. Numerous drugs such as verapamil and phenytoin can cause tooth conditions, including gingivitis.

As per the World Dental Federation (FDI) 2021 report, periodontal diseases can potentially affect up to 50% of the adult population worldwide. Moreover, more than 530 million children suffer from tooth decay problems in their primary teeth across the globe. Thus, an increase in the occurrence of periodontal disease and tooth decay problems among the global population positively impacts the market for oral irrigators.

The market growth is further fueled by the introduction of innovative features in oral irrigators, such as adjustable water pressure settings, specialized nozzles for specific dental needs, and enhanced portability for travel convenience. These advancements have widened the consumer base and attracted more people to invest in oral irrigators for their oral hygiene routines. In February 2023, Fresh Health launched its new Proclaim Custom-Jet Oral Irrigator. The product is intended for use in daily oral hygiene regimens at home to lessen plaque buildup. Proclaim creates a personalized mouthpiece with up to 60 pressurized jets using intraoral scanning and 3D printing.

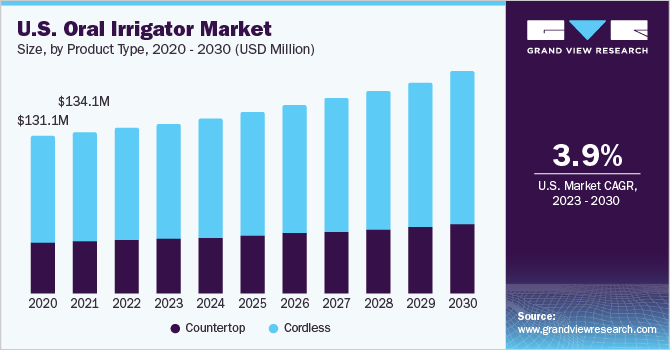

Product Type Insights

The cordless segment accounted for the largest revenue share of 67.2% in the market in 2022. These devices are battery-operated and help in removing debris and bacteria from gums. They are very convenient to use and highly portable, making them very widely used for home care as well as during travel situations. Besides, they are easier to carry and cheaper than their countertop variant. Manufacturers are introducing new products with advanced features to meet consumer demands.

For instance, in August 2020, Panasonic Holdings Corporation launched its new ultrasonic EW1511 portable oral irrigator, which features an in-built active water jet technology with five pressure levels and a unique cordless design. It also boasts a flexible nozzle ultrasonic water jet with tiny bubbles to drive out food particles and clear away germs and floating plaque in periodontal pockets that can cause gum diseases. With roughly 1,600 pulses per minute, it also softly stimulates the gums.

Based on product type, the market is segmented into countertop and cordless. The countertop segment is anticipated to register a CAGR of 4.5% during the forecast period. It is a traditional type of model that has a cord or wire, which must be connected to an outlet in order for it to operate. Compared to their cordless counterparts, these devices typically run longer on a single water tank and do not need to be recharged.

Distribution Channel Insights

Based on distribution channel, the market has been segmented into online and offline. The online segment dominated the market, accounting for the highest revenue share in 2022, and is expected to grow lucratively during the forecast period. Online channels provide convenience and accessibility to consumers, allowing them to browse and purchase oral irrigators from the comfort of their homes. The ease of online shopping, extensive availability of product information, and customer reviews have contributed to the growth of the online distribution channel.

Re-evaluation of consumers’ priorities in their lives as a result of the COVID-19 pandemic has led to the development of new standards for values and expenditure. Consumer behavior is shifting away from conventional buying techniques due to an increased reliance on technology, performance, and online payments. Prior to the pandemic, consumers were shifting their purchase preferences from physical stores to internet retailers. This behavior escalated sooner, though, amid the coronavirus outbreak.

On the other hand, the variety of choices, reduced costs, and visibility of multinational brands that offline retailers provide to clients makes them an ideal platform for all kinds of customers. Offline channels allow consumers to interact with sales representatives or dental professionals who can provide guidance and recommendations on oral irrigators. This personalized assistance enhances consumer confidence and contributes to segment growth. Some consumers prefer immediate availability and hands-on experience on offer while purchasing oral irrigators from physical stores. This enables them to make informed buying decisions, which is an appealing factor for certain sections of consumers.

Application Insights

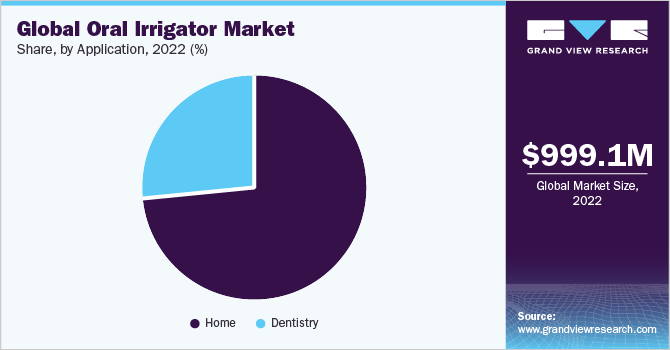

The home application segment dominated the oral irrigator market with a revenue share of 73.3% in 2022 and is anticipated to maintain its dominance during the forecast period, due to the rising product usage in the home setting. The strong segment expansion is being influenced by rising consumer awareness regarding the benefits of high-tech and user-friendly mouth irrigation systems.

Consumers are focusing on purchasing premium dental supplies regardless of their price, aided by improvements in living standards. This trend is anticipated to drive the segment. The development of oral irrigators has significantly altered the buying behaviors of consumers who shop online. They are drawn more and more to products with cutting-edge designs, which has encouraged manufacturers to produce more advanced products while maintaining their competitive advantage.

Based on application, the market is segmented into home and dentistry. The dentistry segment is anticipated to register a CAGR of 4.5% during the forecast period. The steady segment growth can be attributed to the increased frequency of periodontal diseases among a substantial population, especially in developing economies. Oral irrigators are used in various dental procedures, such as periodontal treatments, implant maintenance, and orthodontic care. The versatility and effectiveness of oral irrigators in these clinical applications have led to their increased usage in dental practices.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 40.4% in 2022 and is anticipated to expand at the fastest CAGR during the forecast period. This is due to a rise in the number of people suffering from periodontal diseases owing to poor dietary practices, particularly a large intake of sugary foods. The market is also being driven by an increase in the number of dental clinics and experts in the region.

Adoption of cutting-edge technologies, rising medical tourism in the area, and increased awareness regarding oral hygiene are all contributing to the region’s market expansion. For instance, in 2022, the 4th Chinese National Oral Health Survey revealed that oral health issues were common in Chinese adults: only 13.8% of the people had a complete dentition, 1.8% were edentulous, and 84.4% had dentition abnormalities. Severe tooth loss places a large illness burden on the Chinese population.

Europe was the second-largest market in 2022 in terms of revenue. Increasing penetration and prevalence of oral diseases among the regional population drive the demand for oral irrigators. As per a World Health Organization (WHO) report published in April 2023, the European region had the greatest prevalence of major oral diseases in over half of the adult population in 2019. This has shifted the responsibility on member states to expand access for citizens to necessary oral health care as part of universal health coverage. In addition, the region has the second-highest proportion of tooth loss cases.

Key Companies & Market Share Insights

The market is highly competitive, with several manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are some of the notable business strategies used by market participants to maintain and expand their global reach.

For instance, in August 2022, Oral-B, a brand of Procter & Gamble, entered into a partnership agreement with the International Association of Disability and Oral Health (iADH), as part of its mission to make oral care more accessible, inclusive, and beneficial for people with disabilities. The aim behind the partnership is to jointly develop a training program called "Positive Practices" that will teach dental practitioners how to be more inclusive and self-assured when it comes to their patients. Following are some of the major participants in the global oral irrigator market:

-

Colgate-Palmolive

-

Procter & Gamble

-

Church & Dwight

-

GlaxoSmithKline

-

Johnson & Johnson

-

Lion Corporation

-

Sunstar Suisse S.A.

-

Dr. Fresh

-

Dentaid

Oral Irrigator Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,039.9 million

Revenue forecast in 2030

USD 1,450.1 million

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Colgate-Palmolive; Procter & Gamble; Church & Dwight; GlaxoSmithKline; Johnson & Johnson; Lion Corporation; Sunstar Suisse S.A.; Dr. Fresh; Dentaid

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oral Irrigator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global oral irrigator market report based on product type, application, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Countertop

-

Cordless

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Home

-

Dentistry

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oral irrigator market size was estimated at USD 999.1 million in 2022 and is expected to reach USD 1,039.9 million in 2023

b. The global oral irrigator market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 1,450.1 million by 2030

b. The home application segment dominated the oral irrigator market with a share of 73.3% in 2022. This is attributable to the increasing popularity of technologically advanced products and growing awareness regarding the benefits of regular flossing and good dental hygiene

b. Some key players operating in the oral irrigator market include Church & Dwight Co., Philips, Panasonic, Procter & Gamble, Jetpik, Aquapick, and Conair Corporation.

b. Key factors that are driving the market growth include increasing awareness about dental hygiene and a high prevalence of dental caries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.